RMB cross-border settlement allows cross-border transactions to be settled in China’s currency. Historically, cross-border trade settlement with an entity in China was primarily conducted through USD.

What is RMB cross-border settlement?

What is RMB cross-border settlement? RMB cross-border settlement allows cross-border transactions to be settled in China’s currency. Historically, cross-border trade settlement with an entity in China was primarily conducted through USD.

How are cross-border RMB payments cleared in China?

Cross-border RMB payments are cleared through either CNAPS or CIPS: 1. China National Advanced Payment Systems (CNAPS) When China launched the RMB cross-border settlement program in 2009, settlements were cleared through CNAPS, which is the primary domestic electronic payment system in China, similar to Fedwire in the United States.

How is cross-border trade settlement conducted in China?

Historically, cross-border trade settlement with an entity in China was primarily conducted through USD.

What types of transactions can be settled in RMB?

Therefore, various transactions, including but not limited to goods or services trade, cross-border lending/borrowing, profit repatriation or registered capital injection, can be settled in RMB. What are the benefits of using RMB for settlement?

What is RMB settlement?

What transactions can be settled in RMB?

What is RCPMIS in China?

Which branch of a bank in China has its own CNAPS code?

What is the Foreign Investment Law of the PRC?

Who owns CNAPS?

Do you need a payment purpose code for RMB?

See 4 more

About this website

What is cross border RMB?

Cross-border RMB business, such as RMB cross-border settlement, financing, investment and trading businesses, are performed by the Bank for enterprises to meet their needs for true and compliant cross-border business in accordance with Chinese cross-border RMB policies aiming to serve the real economy and promote trade ...

What is cross border trade settlement?

A cross-border settlement is defined as a securities settlement that takes place in a country other than the country in which one or both counterparties are located. Under these definitions every cross-border trade results in a cross-border settlement, but cross-border settlements can also result from domestic trades.

What is RMB clearing?

The clearing bank maintains RMB -denominated accounts for German and European banks and enterprises. These accounts are used to settle RMB payments between the clearing bank's RMB account holders, as well as cross-border RMB payments with the People's Republic of China, Hong Kong or other offshore centres.

What does cross border transaction means?

Cross-border payments are financial transactions where the payer and the recipient are based in separate countries. They cover both wholesale and retail payments, including remittances.

What are the two payments covered under cross border payments?

Cross-border payments can be made in several different ways. Bank transfers, credit card payments and Alternative Payment Methods (APMs) are the most prevalent ways of transferring funds across borders.

What is an example of a cross border investment?

Real World Example of Cross-Border Financing 2017, Japanese conglomerate Toshiba agreed to sell its roughly $18 billion memory chip unit to a consortium led by Bain Capital Private Equity. The group of investors included American companies, Apple, Inc. and Dell, Inc., among others.

Why does China want to internationalize the RMB?

Internationalization of the renminbi (RMB) is China's long-term strategy aimed at creating a stable international monetary environment for its own economic development. Its goal is for Chinese and non-Chinese alike to use the RMB for trade, lending, borrowing, and investing internationally.

Are CNY and RMB the same currency?

The Chinese Yuan (CNY) and Renminbi (RMB) are interchangeable terms for China's currency. The Renminbi(RMB) is the official name of China's currency. The principal unit of RMB is called the Chinese Yuan (CNY). CNY is the official ISO 4217 abbreviation for China's currency.

What do clearing banks do?

Whether it's in banking or finance, clearing serves an important role. Clearing houses protect both parties in a financial transaction by ensuring that funds are verified, and everything goes according to plan. If any disputes arise, the clearing house steps in to act as a mediator before it's sent to arbitration.

How long does a cross border payment take?

between two to five business daysInternational payments normally take between two to five business days to clear. The timeframe is dependent on where the funds are being sent to and the number of intermediary banks in between. The more financial institutions that the payment has to pass through, the longer the transaction will take to clear.

What is the most important part of cross border transaction?

One of the most critical decisions that the parties to a cross-border transaction will make is the choice of governing law applicable to the deal. Most courts in most countries will respect the parties' right to decide which country's law to apply.

What is a cross border transaction fee?

A cross border fee is an assessment fee merchants pay when customers use cards from international banks at their business. The cardmember associations first introduced the cross border fee in 2005. eCommerce had finally cemented into the worldwide economy, and assessment fees were rising across the board.

What is SWIFT cross border payments?

SWIFT, or Society for Worldwide Interbank Financial Telecommunications, is a financial messaging service based in Belgium. It facilitates rapid and highly secure payments between two countries via a SWIFT code, enabling seamless international trade.

Cross-border RMB Trade Settlement - The Global Treasurer

The mainland Chinese government’s preliminary announcement in late 2008 that it would be permitting the limited use of renminbi (RMB) as a trade currency between China and Hong Kong/Macau was not entirely unexpected. A limited range of retail RMB transactions has been possible for some time in Hong Kong and these have now been extended […]

RMB Cross-border Trade Settlement - Bank of China

RMB Cross-border Trade Settlement。 Product Name. RMB Cross-border Trade Settlement. Product Description. Bank of China Ltd London Branch provides various types of cross-border RMB products and RMB trade finance products, such as Letters of Credit, Documentary Collection, Telegraphic Transfer, Letter of Guarantee and so on.

Cross-border Interbank Payments and Settlements - Monetary Authority of ...

Cross-Border Interbank Payments and Settlements: Emerging opportunities for digital transformation | 1 LEGAL DISCLAIMER

Cross-border RMB Business-Home-ICBC China

I. Business Overview Cross-border RMB business, such as RMB cross-border settlement, financing, investment and trading businesses, are performed by the Bank for enterprises to meet their needs for true and compliant cross-border business in accordance with Chinese cross-border RMB policies aiming to serve the real economy and promote trade and investment.

The Use of RMB in International Transactions - University of California ...

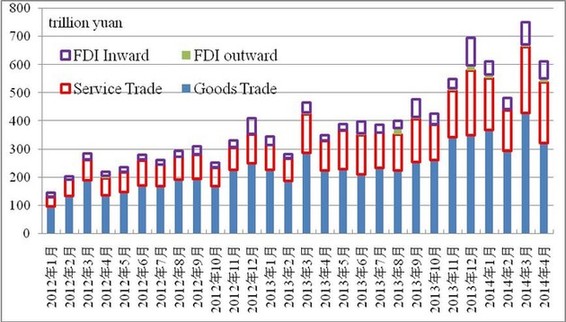

The early stage of cross-border RMB usage RMB as settlement currency for border trade has long existed In 1980s, RMB has been widely used to settle the border trade between China with Vietnam, Myanmar, Mongolia and Russia. Since 1993, China signed a number of Bilateral Currency Border-trade Settlement Agreements with neighboring

What is RMB settlement?

RMB cross-border settlement allows cross-border transactions to be settled in China’s currency. Historically, cross-border trade settlement with an entity in China was primarily conducted through USD. As part of the effort by the Chinese government to promote the use of the RMB as a trade currency, asset currency and reserve currency, in 2009, ...

What transactions can be settled in RMB?

Therefore, various transactions, including but not limited to goods or services trade, cross-border lending/borrowing, profit repatriation or registered capital injection, can be settled in RMB.

What is RCPMIS in China?

RCPMIS was established by the PBOC to collect cross-border RMB transaction information. Banks in mainland China providing RMB cross-border settlement services are required to report their RMB transactions to PBOC via RCPMIS.

Which branch of a bank in China has its own CNAPS code?

As the provincial branch, city branch and even sub-branch of each bank in mainland China may have its own CNAPS code, the CNAPS code may allow the payment to be more efficiently routed to the correct branch.

What is the Foreign Investment Law of the PRC?

Meanwhile, according to the Foreign Investment Law of the PRC approved by The National People’s Congress on March 15, 2019, article 21: “Foreign investors may exercise discretion in accordance with applicable law to remit into or out of China, in renminbi or any other currency, their contributions, profits, capital gains, income from disposition of assets, intellectual property royalties, lawfully acquired compensation, indemnification proceeds, proceeds of liquidation, etc.”

Who owns CNAPS?

CNAPS is owned and operated by PBOC.

Do you need a payment purpose code for RMB?

Cross-border RMB payments to a beneficiary in mainland China do need to include a payment purpose code. See “What information is required for an RMB payment that a USD payment does not have?”

Possible Outcomes

Related Initiative

- The pilot scheme to allow the RMB to be used as a trade settlement currency is part of a broader context of currency/trade deals that China has been agreeing with major trading partners since December 2008. By the end of the first quarter of 2009, China had agreed currency swap deals in various formats with Malaysia, South Korea, Hong Kong, Belarus...

Immediate Outcomes

- These currency swap initiatives and the pilot for Hong Kong/Macau have one key feature in common – they will allow the further internationalisation of the RMB, but in an orderly manner. With most of the former, any currency exchanges are defined in advance and typically involve another sovereign government as the counterparty. With the Hong Kong/Macau pilot scheme, th…

Further Growth

- While the short-term effects of the RMB trade pilot scheme seem likely to be relatively low key, the medium- to long-term picture is a different matter. If there is further extension of the pilot, it is likely that domestically focused Chinese companies will be inclined to rethink their business strategy. They may previously have been deterred from international trade by the prospect of ha…

from The Bank Side

- While many of the fundamentals for greater trade adoption of RMB are positive, a critical factor will be the pricing and availability of suitable bank products. This in turn will be heavily dependent on the efficiency of the methods available to banks to hedge and raise funds in RMB. On this point there has been some talk of allowing China-based subsidiaries of Hong Kong banks to raise RM…

Conclusion

- It is clear that greater levels of RMB-denominated trade could in the mid- to long-term prove highly positive for global trade volumes. While it may be premature to predict a significant decline in US dollar-denominated trade, it is certainly safe to assume that many trade participants will see the recent moves by the Chinese government and the PBOC as highly positive. The key will be at wh…