The Seller’s Closing Statement, or Settlement Statement, is an itemized list of fees and credits that shows your net profits as the seller, and sums up the finances of the entire transaction. This is one of many closing documents for seller.

What is a seller’s settlement statement?

At the time of closing you’ll also receive a separate — and more official — document called the seller’s closing statement (aka seller’s settlement statement), which is an itemized list of fees and credits that shows your net profits as the seller. We’ve introduced over 1 million buyers and sellers (and counting) to top local real estate agents.

How do you list purchase price on a settlement sheet?

Purchase price: This amount is usually listed as the “selling price” or “consideration” and represents the amount negotiated with the seller less any “seller assist” or price reduction (s) associated with the transaction. Each adjustment should be listed on the settlement sheet as separate lines.

What is a buyer’s settlement statement (BSS)?

The Buyer’s Settlement Statement will list the purchase price of the property as well as a few other items like loan costs, prorated taxes, title and escrow fees, homeowner’s insurance, seller credits, and anything else associated with the buyer’s purchase.

How do you read a settlement statement for a mortgage?

At the end of the settlement statement you’ll find a summary of the money that you owe (“Due from Seller”) and money that’s coming your way (“Due to Seller.”) The “Totals” row represents your credit minus your debit column — and hopefully you’re well in the black!

What is a settlement statement?

What is a seller's net sheet?

Is a settlement statement the same as a closing statement?

What is an ‘excess deposit’ at closing?

What information is needed to complete a closing document?

How long before closing do you have to give closing disclosure?

How much does it cost to sell a house in 2021?

See 4 more

About this website

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What is a settlement sheet in business?

The purpose of this form is to document and verify that loan proceeds have been disbursed in accordance with the Authorization and to document that the Borrower's contribution has been injected into the business prior to the Lender disbursing any loan proceeds.

What is the purpose of the seller net sheet?

The seller's net sheet is the sum of all the expenses incurred by selling a home. It's typically a document that breaks down all the additional fees that often come with selling a rental property or a home. The seller's net sheet is also known as the net sheet, seller's net proceeds, or the remaining balance.

Is a closing statement the same as a closing disclosure?

The closing statement or closing disclosure is intended to share the details of a loan right before closing so both the buyer and lender are on the same page. You can receive a closing statement for various types of loans issued, but a mortgage closing statement is the most recognizable and commonly discussed.

Is settlement date same as closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

How do you write a settlement statement?

A settlement agreement should be in writing....Those requirements include:An offer. This is what one party proposes to do, pay, etc.Acceptance. ... Valid consideration. ... Mutual assent. ... A legal purpose.A settlement agreement must also not be "unconscionable." This means that it cannot be illegal, fraudulent, or criminal.

What is a settlement letter?

A settlement letter is a letter that provides a quote for the amount you need to pay in order to settle your vehicle finance account in full.

Is a net sheet same as settlement statement?

Settlement statements summarize all transactions on an individual's bank statement while a seller's net sheet summarizes the income and expenses of all property transactions.

Who is most likely to use a seller net sheet?

Real estate agents are more familiar with seller net sheets, can predict any hidden fees, and give you more accurate numbers. It is standard to fill out a seller's net sheet at more than one point during the home sales process, so you are always on top of your finances.

What determines net to seller real estate?

The formula for calculating the net proceeds is the total cost of selling a good or service minus the cost of selling the goods or services at the final purchase price.

What is a settlement statement quizlet?

Uniform Settlement Statement. Under RESPA, a lender must use HUD's Form 1 Uniform Settlement Statement to disclose settlement costs to the buyer. This form covers all costs that the buyer will have to pay at closing, whether to the lender or to other parties.

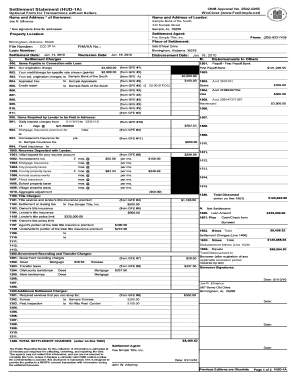

What is the purpose of the HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

What is a settlement statement NZ?

Settlement statement – Your lawyer will check that the rates and any other utilities have been paid by the seller and are up to date. They will then send a settlement statement to your lender, showing the amount required to 'settle' the transaction.

How do you read a settlement statement?

0:217:31How To Read A Settlement Statement From Your Real Estate ClosingYouTubeStart of suggested clipEnd of suggested clipSo on page one of the closing disclosure you're going to see the parties identified at the top soMoreSo on page one of the closing disclosure you're going to see the parties identified at the top so seller and buyer the property. Address and the loan. Amount.

Sample Real Estate Closing Statements

Sample Real Estate Closing Statements Here are sample real estate closing statements for a buyer under various scenarios. These are actual real estate closing statements for transactions over the last couple of years with the address, names, etc. removed.

Understanding Credits & Debits in a Real Estate Closing Statement

A real estate closing statement outlines all costs associated with a house purchase. For buyers, it will include any earnest money paid down, credits for work the seller has agreed to and remaining costs owed at closing. For sellers, it will include anything that needs to be paid to close the deal.

What is the Seller’s Closing Statement: A Breakdown of ... - UpNest

Wondering About The Seller’s Closing Statement? Hooray! You’ve got a buyer for your home.You’ve signed the purchase agreement and received the earnest money deposit. Now all that’s left is to close the deal. It’s also the moment — when you can’t stand the thought of even seeing another piece of paper — that the Seller’s Closing Statement drops into your hands.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

How long before closing do you have to give closing disclosure?

In the wake of the subprime crisis, the Consumer Financial Protection Bureau requires that buyers receive the Closing Disclosure, outlining loan costs among other fees and information pertinent to the borrower, no later than 3 days before closing for review.

How much does it cost to sell a house in 2021?

A 2021 study we conducted found that it costs $31,000 on average to sell a home. But ideally your sale price covers the costs of all the transaction fees, your mortgage payoff, and then some, leaving you with a tidy sum to add to your bank account.

When will you receive the seller’s net sheet in the home sale process?

Customarily, a real estate agent who uses seller’s net sheets will supply one to you at different points during the transaction. These stages include:

Who prepares the seller’s net sheet?

Typically, the listing agent prepares the seller’s net sheet, Black says.

Why does Grove ask for each seller to initial and date the seller's net sheet?

Grove asks each seller to initial and date the seller’s net sheet so that they grasp how much money they stand to pocket from the deal.

What does a net sheet do for a seller?

The projections in the seller’s net sheet can guide you, in collaboration with your agent, toward one key decision about your home—whether to raise or lower the sale price.

What percentage of the final sale price is paid to sellers?

Sellers can expect to pay between 6-10% of the final sale price in commissions and closing costs, so it’s nice to see exactly where that money is going.

Why is Taylor uncomfortable preparing net sheets?

Taylor says some agents have confided in him that they’re uncomfortable preparing seller’s net sheets out of fear that their numbers will be incorrect.

Does a title company have a net sheet?

Indeed, some title companies do offer seller’s net sheets.

What Is a Settlement Statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest. Different types of loans can have varying requirements for settlement statement documentation. Generally, loan settlement statements can also be referred to as closing statements .

What is a settlement statement in stock trading?

Trading: In financial market trading, settlement statements provide proof of a security’s ownership transfer. Typically, stocks are transferred with a T+2 settlement date meaning ownership is achieved two days after the transaction is made.

What is included in HUD-1?

These forms also include comprehensive information about the borrower’s loan, detailing the principal and interest as well as all of the upfront costs, commission charges, service costs, and any deductions associated with the loan. Loan terms are also included, such as details on principal, interest, variable rates, prepayment penalties, and any special clauses associated with a loan such as escrow requirements.

What is debt settlement?

Debt settlement: A debt settlement statement can provide a summary of debts written off, reduced, or otherwise amended after a debt settlement has completed. Lawyers and debt settlement companies work on behalf of borrowers with overwhelming amounts of debt, in order to help them reduce some or all of their obligations.

What is insurance settlement?

Insurance settlement: An insurance settlement is most commonly documentation of the amount an insurer agrees to pay after reviewing an insurance claim. Banking: In the banking industry, settlement statements are produced on a regular basis for internal banking operations.

When are settlement statements created?

Beyond just loans, settlement statements can also be created whenever a large settlement has taken place, such as with a large business transaction or potentially in the legal, insurance, banking, and trading industries.

Does a reverse mortgage require a HUD-1 settlement statement?

RESPA requires a HUD-1 settlement statement for borrowers involved in a reverse mortgage. For all other types of mortgage loans, RESPA requires the mortgage closing disclosure. Both the HUD-1 and mortgage closing disclosure are standardized forms.

What is a Seller Net Sheet?

A net sheet is a document that lists the expenses paid for by you and your lender, as well as any gains/losses incurred on the sale of the property. It shows how much money you will receive from the sale to use towards paying off debts (e.g., mortgage payoff), closing costs, or reinvesting in another property.

What is the importance of a seller's net sheet?

The main reason you need a seller’s net sheet is to record all real estate transactions you will be taking part in. The importance of a seller net sheet include:

Who prepares the net sheet?

A reliable professional advisor should be hired to prepare a seller’s net sheet. This is because the calculations are complicated and mistakes could lead to errors in interpretation.

What is settlement statement cash?

Settlement Statement Cash – This version is used for liquid cash transactions for property sales.

Who prepares settlement statements?

Depending on what state you’re in, the settlement statement – a separate document – will be prepared by either an attorney, a title company, or an escrow firm, and the actual closing will be held at one of these three offices.

What fees would a seller pay?

Another cost that buyers and sellers may both have to pay is their portion of the commission for the real estate agents. This would be listed in your seller’s disclosure statement. You might also pay your prorated portion of the property taxes, or homeowners insurance for the period you’re still living in the home.

What happens if you offer to pay buyer fees?

If you as the seller offer to pay any of the buyer’s fees for obtaining a loan, you’ll probably receive a version of the Closing Disclosure , which outlines the lender’s charges.

How long does it take to get a closing disclosure?

Since the subprime lending crisis of the 2000s, the Consumer Financial Protection Bureau requires that buyers receive the Closing Disclosure no later than 3 days before closing. It outlines loan costs among other fees and information pertinent to the borrower,

What is the net sheet of a home sale?

A net sheet is a document that can be provided throughout the sale process to give the seller an estimate on what they can expect to make.

What is a closing statement?

The Seller’s Closing Statement, or Settlement Statement, is an itemized list of fees and credits that shows your net profits as the seller, and sums up the finances of the entire transaction. Everything from the sale price, loan amounts, school taxes, and other important information is contained in this document. Sellers can expect to pay between 6-10% of the final sale price in commissions and closing costs. So, it’s good to see exactly where that money is going.

Who provides settlement services?

The decision about who provides settlement (also known as closing or escrow) services varies from one market to another. In many places, the buyer chooses the settlement company, but in others the seller chooses. When closing on a house, the buyer will provide funds to buy your home and the settlement agent will review the sales agreement to determine what payments you’ll receive. The title to the property is transferred to the buyers and arrangements are made to record that title transfer with the appropriate local records office.

What are adjustments at closing?

At a typical closing, adjustments are made to the final amounts owed by the buyer and you as the seller. For example, if you’ve been paying your property taxes through an escrow account, you may be credited extra for prepaid taxes or you may receive less money at settlement if the property taxes haven’t been paid properly.

What do you need to do before closing on a house?

Before closing on a house, you need to get to the settlement table. You’re near the end of the process of selling your home, but don’t breathe a sigh of relief just yet. While it’s certainly true that you can lighten up on the perfectionism required to show your home at any moment, as a seller you still need to cooperate with your buyer, ...

Can you move onto your next home after a settlement?

Once the settlement papers are signed and the house keys are transferred, you’re free to move onto your next home.

Can you negotiate a settlement date with a buyer?

Buyers and sellers typically negotiate a settlement date that is mutually agreeable. If you have sold your home and are not yet ready to move into your next residence, you can sometimes negotiate a “rent-back” with the buyer that allows you to stay in the home after the settlement by paying rent to the buyer.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

How long before closing do you have to give closing disclosure?

In the wake of the subprime crisis, the Consumer Financial Protection Bureau requires that buyers receive the Closing Disclosure, outlining loan costs among other fees and information pertinent to the borrower, no later than 3 days before closing for review.

How much does it cost to sell a house in 2021?

A 2021 study we conducted found that it costs $31,000 on average to sell a home. But ideally your sale price covers the costs of all the transaction fees, your mortgage payoff, and then some, leaving you with a tidy sum to add to your bank account.