The first is the trade date, which marks the day an investor places the buy order in the market or on an exchange. The second is the settlement date, which marks the date and time the legal transfer of shares is actually executed between the buyer and seller.

Full Answer

What is the settlement date and when is it?

The settlement date is the actual day when your property passes into the ownership of the buyer. The date, referred to as settlement day, is specified by the you in the contract of sale after consultation with the buyer. This is also the day you, as the seller, receive the balance of the sale price for your property from the buyer.

What is the difference between a trade and settlement date?

With stocks and exchange-traded funds, the settlement date is three business days after the trade date. Mutual funds and options settle more quickly, with a settlement date that's the next business day after the trade date. Why trade and settlement dates matter. The trade date is the key date for one very important aspect of investing: tax rules.

What is the difference between settlement and closing date?

Settlement versus Closing. "Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed. The settlement meeting may occur in the office...

What is an auction date?

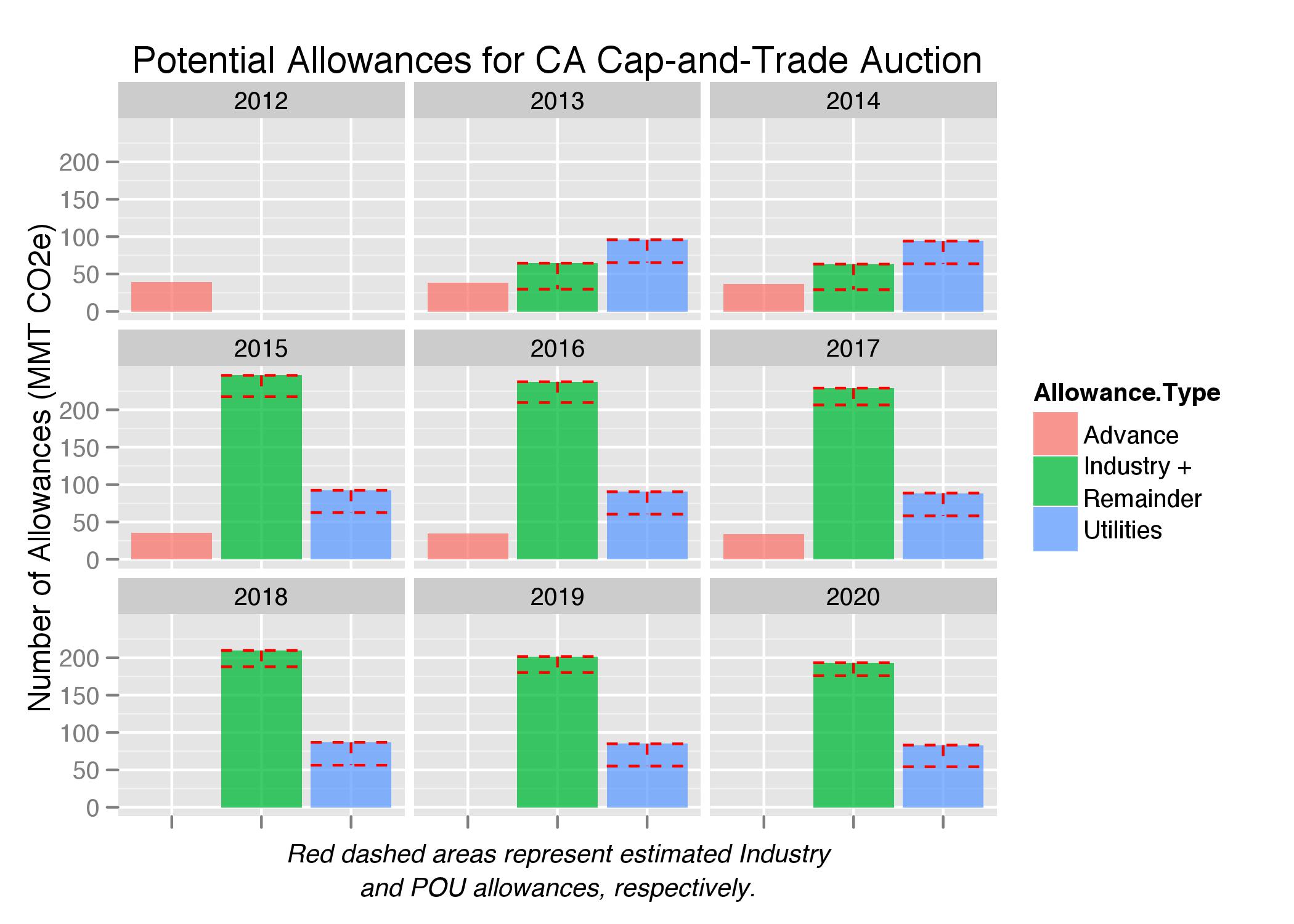

This is the date when notification of an auction is made to the public. This notification states the terms and conditions of the securities to be auctioned, including the auction date, offering amount, and auction format. This is the date on which the auction for a specific Treasury security is held. Type of auction method used.

What is considered a settlement date?

The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer. The settlement date for stocks and bonds is usually two business days after the execution date (T+2).

What is the difference between purchase date and settlement date?

Key Takeaways Purchasing a security involves a trade date, which signifies the day an investor places the buy order, and a settlement date, which marks the date and time the legal transfer of shares is actually executed between the buyer and the seller.

Is the settlement date the date of sale?

There are two related and important dates when you buy or sell stock. The trade date is the date when you place an order to buy or sell. The settlement date is the date that the cash or shares are transferred to or from your account.

What is the difference between settlement date and maturity date?

The settlement date is the date a buyer purchases a coupon, such as a bond. The maturity date is the date when a coupon expires. For example, suppose a 30-year bond is issued on January 1, 2008, and is purchased by a buyer six months later.

Can you sell before settlement date?

Can you sell a stock before the settlement date? The key is knowing if you bought the stock using settled or unsettled cash. If you bought the stock (or other type of security) using settled cash, you can sell it at any time.

Why does settlement date matter?

Settlement dates matter because of funding requirements from your broker. Some brokers will let you buy stock even if you don't have enough money currently in your account to pay for the shares, relying on you to deposit cash at some point between the trade date and the settlement date to cover the cost of the stock.

Is a settlement date the same as a closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

What happens on settlement date?

What happens on settlement day? On settlement day, at an agreed time and place, your settlement agent (solicitor or conveyancer) meets with your lender and the seller's representatives to exchange documents. They organise for the balance of the purchase price to be paid to the seller.

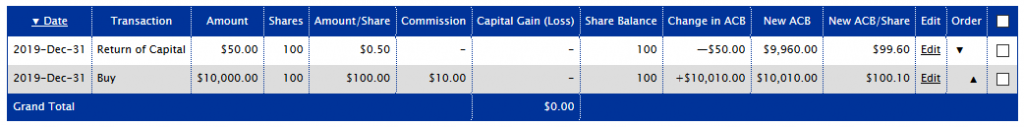

What date is used for capital gains?

Answer: For capital gains tax (CGT) purposes, the relevant taxing point for the sale of a property is generally the date of the contract. Therefore, as the contract for the sale of your investment property was dated 5 June 2018, for CGT purposes the sale is treated to have taken place in the year ended 30 June 2018.

Why does it take 2 days to settle a trade?

The rationale for the delayed settlement is to give time for the seller to get documents to the settlement and for the purchaser to clear the funds required for settlement. T+2 is the standard settlement period for normal trades on a stock exchange, and any other conditions need to be handled on an "off-market" basis.

What time do funds settle on settlement date?

9:00 AM ET on the settlement date.

Is closing date and settlement date the same?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

Is settlement date same as possession date?

Settlement day is the last milestone before you take possession of your new home. The purchase price is paid to the seller and the title of the home transfers to you. Your lawyer will handle most of the requirements on your behalf and guide you through the process.

When buying a house what does settlement date mean?

It's when ownership passes from the seller to you, and you pay the balance of the sale price. The seller sets the settlement date in the contract of sale. As a general rule, property settlement periods are usually 30 to 90 days, but they can be longer or shorter.

Is settlement date the day you move in?

Settlement day is the day you assume legal ownership of your new home. Picture: iStock.

Trade vs. Settlement Date: What’s the Difference?

There are two dates that are important for investors to know when making an investment: the trade date versus the settlement date. When a buy or se...

Why the Difference Between Trade and Settlement Date?

Given the state of modern technology, it seems reasonable to assume that everything should happen instantaneously. But the current rules go back de...

What is the T+2 Rule

The T+2 rule refers to the fact that it now takes two days beyond a trade date for a trade to settle. For example, if a trade is executed on Tuesda...

Why Is There a Delay Between Trade and Settlement Dates?

Given modern technology, it seems reasonable to assume that everything should happen instantaneously.

How long does it take for a trade to settle?

The T+2 rule refers to the fact that it takes two days beyond a trade date for a trade to settle. For example, if a trade is executed on Tuesday, the settlement date will be Thursday, which is the trade date plus two business days. Note that weekends and holidays are excluded from the T+2 rule.

Why did Sally not have the cash to buy ABC stock?

Because the sale of XYZ stock hadn’t settled yet and Sally didn’t have the cash to cover the buy for ABC stock, a cash liquidation violation occurred. Investors who face this kind of violation three times in one year can have their accounts restricted for up to 90 days.

How long after a trade is a T+2?

For many securities in financial markets, the T+2 rule applies, meaning the settlement date is usually two days after the trade date. An investor therefore will not legally own the security until the settlement date.

What is a trade date?

The trade date is the day an investor or trader books an order to buy or sell a security. But it’s important for market participants to also be aware of the settlement date, which is when the trade actually gets executed.

What time does the stock market open?

Note that weekends and holidays are excluded from the T+2 rule. That’s because in the U.S., the stock market is open from 9:30 a.m. to 4:00 p.m. Eastern time Monday through Friday.

What are the dates of an investment?

There are two important dates to know when making an investment: the trade date and the settlement date.

What is the difference between settlement date and trade date?

The distinction between trade date and settlement date is an important one, as the initial recognition of a security is different under trade date accounting versus settlement date accounting.

What is the trade date of a security?

The trade date of a security is the date the agreement is entered into where elements of the transaction including the security description, quantity, price, and delivery terms are set . The date the securities must be delivered and payment received is referred to as the settlement date.

What is the difference between ASC 321 and ASC 320?

There are two main FASB codification topics that cover accounting for investment securities. ASC 320 covers accounting for investments in debt securities while ASC 321 covers the accounting for investments in equity securities. Investments can fall outside of the scope of these two topics, in which case other GAAP should be applied, but in this blog, we will focus our attention on the initial recognition of investment securities within the scope of ASC 320 and ASC 321.

What is ASC 942-325-25-2?

For depository and lending institutions, ASC 942-325-25-2 indicates that, “Regular-way purchases and sales of securities shall be recorded on the trade date. Gains and losses from regular-way security sales or disposals shall be recognized as of the trade date in the statement of operations for the period in which securities are sold or otherwise disposed of.”

What is ASC 320?

Both ASC 320 and 321 provide clear guidance on the subsequent measurement and accounting for debt and equity securities but are generally silent regarding initial recognition. This is where the issue of trade date and settlement date comes in.

When accounting for the initial recognition of investment securities, there are two critical dates to consider?

When accounting for the initial recognition of investment securities, there are two critical dates to consider: the trade date and the settlement date. What is the difference? And why are these dates important? In this blog post, let’s take a closer look at trade date versus settlement date accounting.

Does GAAP require a trade date?

Well, for general industries, U.S. GA AP does not specify whether trade date or settlement date is required. As such, an entity should elect an accounting policy to account for purchases and sales of securities on a trade date or settlement date basis.

What is the settlement date?

The settlement date is the actual day when your property passes into the ownership of the buyer. The date, referred to as settlement day, is specified by the you in the contract of sale after consultation with the buyer. This is also the day you, as the seller, receive the balance of the sale price for your property from the buyer.

When does a settlement occur?

Settlement then occurs on the specified date, when both parties legal representatives meet to exchange documents and cheques. Sellers and buyers are rarely attend, and are typically informed by their conveyancer or solicitor when it is complete.

Who does what during settlement?

If you are using a conveyancer or solicitor, they will handle all the relevant paperwork and legal documentation associated with settlement. They will also liaise with your real estate agent as well as the buyer’s legal team to ensure all the conditions of the contract have been met, and that all legal documents are signed, submitted and in order.

How long does settlement take?

Depending on where you live, settlement can take anywhere from 30 days to 90 days. This allows time for the paperwork to be finalised, and for you to prepare to vacate the property, including scheduling movers, packing and having the property cleaned. Buyers use the time preparing to occupy your property.

What is the day of settlement?

Settlement day is the actual day when your property passes into the ownership of the buyer

How long does it take to settle a sale?

This is the primary reason why a sale often requires a settlement period of weeks or even months.

Why are settlement delays not uncommon?

Delays are not uncommon for a settlement as there are so many variables to coordinate.

What is the closing date of a real estate transaction?

Closing Date. The settlement date is the date completing a real estate transaction. The culmination of a real estate transaction is the settlement or closing, the date on which ownership of the property officially changes hands. At this time, the home seller receives the proceeds resulting from the sale and the buyer pays any associated costs ...

What is the closing date of a deed?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed. The settlement meeting may occur in the office of a title company, lender or attorney. Any costs associated with the settlement must also be paid at this time.

What is the escrow period?

During the period from the offer to the settlement date, which is referred to as the "escrow" period, the property buyer will incur a number of closing costs.

How long does it take to settle a mortgage?

A normal settlement time frame is 30 days from the offer to the closing date although it can be shorter or longer. Advertisement.

What are the closing costs of a home?

The total amount of closing costs can vary but a rule of thumb is 3 to 5 percent of the home's purchase price. In some cases, a motivated property seller may offer to pay some or all of the closing costs to facilitate the transaction.

How long does it take to settle a sale?

Usually, the settlement process takes as little as a few hours. If it is a complicated transaction or there is a disagreement over the final paperwork, it could take several days.

What is the most realistic expectation you can have of closing and settlement?

The most realistic expectation you can have of closing and settlement is paperwork, lots and lots of paperwork. The attorney you used for your purchase will have already reviewed the documents, but ask for explanations of any fees or documents that you don’t understand. Your attorney is there to answer your questions and guide you through the process. Closing and settlement is the last time to ask these questions before you legally own the home.

What is the last step in the home purchase process?

The very last step in the process is the closing or settlement date. Although different people use different terms, the "closing" or the "settlement" refers to the same finalization of your home purchase. At the closing or settlement date, the seller receives the sale proceeds, and the buyer pays any required expenses to close the transaction, ...

What to do after closing and settlement?

After the Closing and Settlement. After closing and settlement, make sure to get copies of every single document. When you leave, be sure to take all of your closing documents and immediately place them in your safe deposit box.

Does safety inspection affect selling price?

Further, any results of safety inspections or walk-throughs may affect the final selling price . For example, you may see additional costs you will have to bear for needed repairs where the seller has agreed to reduce the selling price rather than make the repair.

What does settlement date mean on a stock?

The settlement date, on the other hand, reflects the date on which your broker actually "settles" the trade. Technically, even though your online brokerage account will typically list the shares you've just bought among your holdings, your broker doesn't actually take the money out of your account and put the shares in until a later date.

Why do settlement dates matter?

Settlement dates matter because of funding requirements from your broker. Some brokers will let you buy stock even if you don't have enough money currently in your account to pay for the shares, relying on you to deposit cash at some point between the trade date and the settlement date to cover the cost of the stock.

How long after a trade date do you settle?

With stocks and exchange-traded funds, the settlement date is three business days after the trade date. Mutual funds and options settle more quickly, with a settlement date that's the next business day after the trade date. Why trade and settlement dates matter. The trade date is the key date for one very important aspect of investing: tax rules.

What is the trade date?

Of these two terms, the trade date makes more sense intuitively. It's the date on which you actually entered and executed the trade. Most investors think of the trade date as the only one that truly matters, as it's the one that you have the most control over.

Does it matter if the settlement date comes later?

So as long as you get that trade executed before the market closes on the last day of the year, it doesn't matter that the settlement date comes later. Also, when measuring how long you've owned a stock to determine whether a gain is short-term or long-term, you'll use the trade date to measure your holding period.

Is settlement date lag good?

Having the settlement-date lag can actually be helpful from a liquidity standpoint. But the Securities and Exchange Commission also pays attention to settlement dates, and it has rules that can trip up investors who aren't mindful of those dates.

Do people think twice about trade dates?

Most people never think twice about those two dates , but there are a couple of situations in which it makes a huge difference knowing how trade dates and settlement dates differ. Let's take a look at the various uses of both dates and what you need to know to avoid some nasty surprises. An archaic distinction.

What is an auction notification?

This is the date when notification of an auction is made to the public. This notification states the terms and conditions of the securities to be auctioned, including the auction date, offering amount, and auction format.

What is a dated date?

The date from which interest accrues for notes and bonds. The dated date and issue date are usually the same. In those cases where interest begins accruing prior to the issue date, however, the dated date will be prior to the issue date. An example is when the dated date is a Saturday and the issue date is the following Monday.

What is the equivalent yield in a price based auction?

In a price-based auction, it is the equivalent yield associated with the lowest price accepted.

When are coupons due for callable bearer security?

Coupons associated with a noncallable bearer security or coupons associated with a callable bearer security that are due on or before the date on which the callable bearer security is subject to call.

What is competitive bid?

A competitive bid is one in which the bidder, at a U.S. Treasury auction, specifies the discount rate, yield, or discount margin they wish to receive. Awards to a single customer may not exceed 35 percent of the total offering.

What is the average in a multiple price auction?

In a multiple-price auction, the average is the weighted average of all accepted competitive rates. In a price-based auction, it is the rate associated with the weighted average of all accepted competitive prices.

When did the strip bearer coupon conversion end?

With the call of the last bond eligible for conversion to CUBES on November 15, 2006, the conversion program has ended.

Understanding Settlement Dates

- The financial market specifies the number of business days after a transaction that a security or financial instrument must be paid and delivered. This lag between transaction and settlement datesfollows how settlements were previously confirmed, by physical delivery. In the past, securi…

Settlement Date Risks

- The elapsed time between the transaction and settlement dates exposes transacting parties to credit risk. Credit risk is especially significant in forward foreign exchange transactions, due to the length of time that can pass and the volatility in the market. There is also settlement riskbecause the currencies are not paid and received simultaneously. Furthermore, time zone differences inc…

Life Insurance Settlement Date

- Life insurance is paid following the death of the insured unless the policy has already been surrendered or cashed out. If there is a single beneficiary, payment is usually within two weeks from the date the insurer receives a death certificate. Payment to multiple beneficiaries can take longer due to delays in contact and general processing. Most states require the insurer pay inter…