Settlement discount is the same as a cash discount and is a discount granted for paying off a debt early. Settlement discount granted is an expense (the opposite of this is settlement discount received, which is an income for your business). Because settlement discount granted is an expense, we record VAT

Value-added tax

A value-added tax, known in some countries as a goods and services tax, is a type of general consumption tax that is collected incrementally, based on the increase in value of a product or service at each stage of production or distribution. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the customer. VATs raise about a fifth of total tax r…

What is an invoice settlement discount?

Settlement discounts are generally offered to credit customers as a means of encouraging them to pay their invoices quickly. It is up to us to decide what the payment terms will be e.g. we could offer a customer a 3% settlement discount if they pay within 14 days, or perhaps a 5% discount if they pay within 7 days, and so on.

What is the difference between cash discount and settlement discount?

Settlement discount is the same as a cash discount and is a discount granted for paying off a debt early. Settlement discount granted is an expense (the opposite of this is settlement discount received , which is an income for your business). Because settlement discount granted is an expense, we record VAT Input on it.

How do you calculate a settlement discount?

You calculate a settlement discount based on the increase in purchases from the customer. You could invoice a customer for making a purchase of X amount, but offer an additional 5% discount if the customer pays that amount within 7 days. These can also get referred to as discount days.

What is a settlement discount under IFRS?

IFRS Answer 033 To make it absolutely clear for everyone: Settlement discount is a discount for prompt payment of invoice by the customer. Let’s say you sell something for 1 000 on 30-day credit and you offer 3% off if a customer pays within 10 days.

What does settlement discount mean?

What Is a Settlement Discount? A settlement discount can often get referred to as cash discounts or prompt payment discounts. They're offered to customers when they purchase something from you to help complete the business transaction. Settlement discounts are often used in business-to-customer (B2C) transactions.

How is settlement discount recorded?

Settlement discount A discount for payment within a certain time period Deduct settlement discounts received from the cost of inventories, such that the inventory and related liability are initially recorded at the net (lower) amount.

Is settlement discount an expense?

Settlement discount is the same as a cash discount and is a discount granted for paying off a debt early. Settlement discount granted is an expense (the opposite of this is settlement discount received , which is an income for your business).

Is settlement discount shown on invoice?

The settlement discount calculation is NOT shown on the invoice – you need to use a bit of scrap paper to work this out. i.e. £400 x 5 / 100 = £20 OR £400 x 0.05 = £20. The £20 is your settlement discount amount.

What is the difference between trade discount and settlement discount?

Trade Discount vs Settlement Discount Trade discounts are allowed to encourage customers to purchase products in larger quantities. Settlement discounts are allowed to ensure that customers settle debts within a short period of time.

What type of account is allowance for settlement discount allowed?

The provision for discounts allowable is likely to be a balance sheet account that serves to reduce the asset account Accounts Receivable.

How do you record discounts in accounting?

Reporting the Discount Report the amount of total sales discounts for an accounting period on a line called “Less: Sales Discounts” below your sales revenue line on your income statement. For example, if your small business had $200 in discounts during the period, report “Less: Sales discounts $200.”

Is discount a liability or an asset?

When the buyer receives a discount, this is recorded as a reduction in the expense (or asset) associated with the purchase, or in a separate account that tracks discounts.

How do you record an allowance for settlement discount granted?

0:313:22How to record Discounts (Discounts allowed and received) - YouTubeYouTubeStart of suggested clipEnd of suggested clipFrom a business's point of view it is treated as an expense. Let's have a look at how I discountMoreFrom a business's point of view it is treated as an expense. Let's have a look at how I discount allowed is treated in their accounts Peter's pen shop gave 20 pounds discount to G meal a customer.

What is the journal entry for cash discount?

Cash discount is an expense for the seller and income for the buyer. It is, therefore, debited in the books of the seller and credited in the books of the buyer.

What is the journal entry for discount received?

Discount Received: When at the time of purchase or paying cash, any concession is received from the seller, it is called discount received. Journal Entry: Example: Goods purchased for cash ₹20,000, discount received @ 20%.

How are discounts treated in financial statements?

Cash discounts will go under Debit in the Profit and Loss account. Trade discounts are not recorded in the financial statement. The discount allowed journal entry will be treated as an expense, and it's not accounted for as a deduction from total sales revenue.

How do Settlement discounts work?

A settlement discount is where a business offers another business a discount when an invoice is paid early. This is usually a percentage discount if an invoice is paid within a specified number of days, for example, a 5% discount for invoices paid within 15 days.

How do you record discounts in accounting?

Reporting the Discount Report the amount of total sales discounts for an accounting period on a line called “Less: Sales Discounts” below your sales revenue line on your income statement. For example, if your small business had $200 in discounts during the period, report “Less: Sales discounts $200.”

What is early settlement discount?

An early payment discount – also known as a prompt payment discount or early settlement discount – is a discount that buyers can receive in exchange for paying invoices early. It's typically calculated as a percentage of the value of the goods and services purchased.

How do you calculate discount in accounting?

The discount rate may be expressed as either a percentage or a decimal number. For example, the discount rate can be expressed as either 2% or . 02. The formula can be expressed algebraically as CD = P*R where CD = the cash discount, P = the price, and R = the discount rate expressed as a decimal.

What is settlement discount?

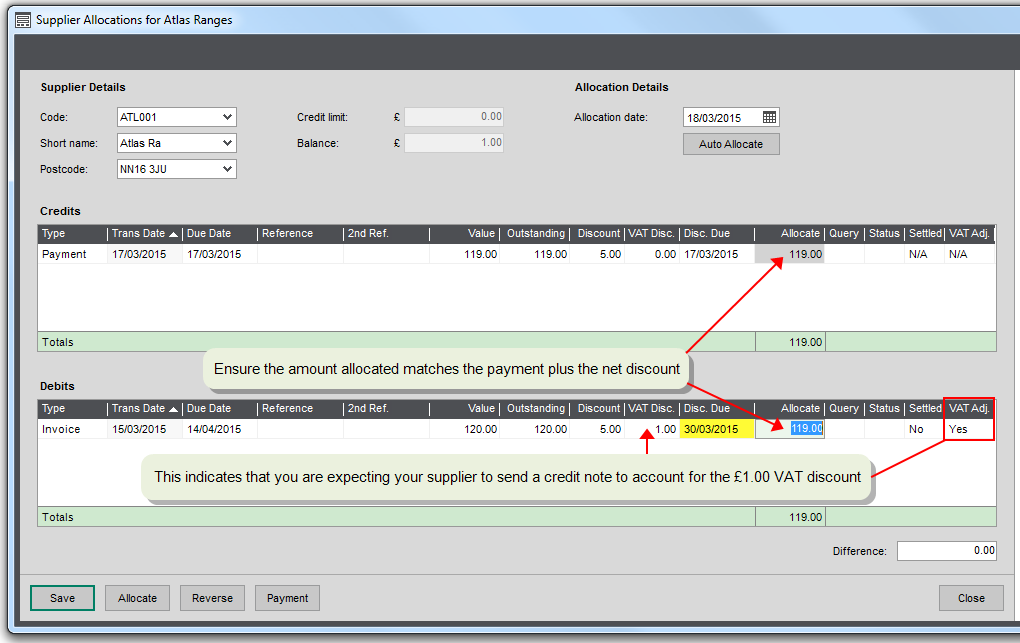

A settlement discount is where a business offers another business a discount when an invoice is paid early. This is usually a percentage discount if an invoice is paid within a specified number of days, for example, a 5% discount for invoices paid within 15 days. Settlement discounts can be recorded for both sales and purchase transactions - ...

When an invoice is paid immediately, is the settlement discount automatically taken?

When an invoice is paid immediately, the settlement discount is automatically taken. The VAT is discounted on the invoice and no subsequent VAT adjustment is necessary.

How to make sure that the correct discounts are always entered?

To help make sure that the correct discounts are always entered, you can store the discount settings on your customer and supplier accounts. Each time an order or invoice is entered, the discount details are automatically entered on the transaction.

How to notify customers of VAT discount?

Businesses must: Notify their customers of the VAT discount available and the amounts the customer is due to pay. This can be done in one of two ways: Issue an invoice detailing the full net and VAT payable. If the invoice is paid within the discount period, issue a VAT only credit note to account for the VAT discount.

When an invoice contains settlement discount is paid within the discount period, is the VAT charged?

When an invoice that contains settlement discount is paid within the discount period, the VAT is only charged on the discounted invoice amount. VAT must be calculated and shown on the invoice at the full rate. If the customer pays within the settlement discount period, the VAT is discounted and a VAT adjustment must be processed. Businesses must:

When can you record a discount?

When the payment is received from a customer , you can record the discount amount. This is then posted to the Discounts Allowed nominal account. When the payment is paid to a supplier, you can record the discount amount. This then posted to the Discounts taken nominal account.

Can you enter discounts for each supplier account?

Enter discounts for each supplier account if they are different to the default.

When is a settlement discount recorded?

Settlement discounts are accounted for when the customer pays us. We will know at this point, whether or not the customer took advantage of the settlement discount. When posting the cash book (see cash book blog here ), the settlement discount should be recorded as a DEBIT entry in the Discounts Allowed Account and a CREDIT entry in the Sales Ledger Control Account (SLCA)

Where to record settlement discount?

Something that is regularly forgotten is to remember to record the settlement discount in the customer’s Sales Ledger account. This should be recorded (along with the receipt) to the CREDIT side of the Sales Ledger Account.

What is a common error that can arise when students are given an invoice extract and are asked what the settlement discount amount?

A common error that can arise is when students are given an invoice extract and are asked what the settlement discount amount will be . Mistakenly, some students will calculate the settlement discount from the invoice total amount rather than calculating it based on the invoice net amount, so watch out for this one!

Do you record settlement discounts in sales day book?

Settlement discounts are NEVER recorded in the Sales Day Book where we record all the sales invoices sent to our credit customers. When the invoices are entered in the Sales Day Book, we don’t know at this stage whether or not the customer will in fact take advantage of a settlement discount. So, simply record the Net, VAT and Total amounts as shown on the invoice.

What is settlement discount?

To make it absolutely clear for everyone: Settlement discount is a discount for prompt payment of invoice by the customer. Let’s say you sell something for 1 000 on 30-day credit and you offer 3% off if a customer pays within 10 days. Those 3% – or 30 in this case – is a settlement discount.

How long does it take to get 10% settlement discount?

Let’s say that an entity that sells goods on credit for 100 and offers 10% settlement discount if the customer pays within 10 days. Otherwise, the full amount is to be paid after 30 days.

Does a seller have to pay promptly?

Seller assumes that customer WILL pay promptly. If past evidence or other information indicate that yes, a customer will pay promptly, then the seller should recognize the revenue net of settlement discount at the time of sale. As an example, let’s say you make a sale of 1 000 to customer John on credit for 30 days.

Why do companies offer settlement discounts?

Therefore, the main purpose of offering settlement discount is to encourage customers to settle debts early.

Why are settlement discounts allowed?

Settlement discounts are allowed to ensure that customers settle debts within a short period of time.

What is the difference between Trade Discount and Settlement Discount?

Settlement discounts are allowed to ensure that customers settle debts within a short period of time.

Why do companies give discounts?

Companies grant discounts for customers in order to provide incentives for them to purchase more products. This is a widely utilized sales technique in all types of organizations and, trade discount and settlement discount are two main types of discounts granted.

What is a trade discount?

A trade discount is a discount given by the seller to the buyer at the time of making a sale. This discount is a reduction in the list prices of the quantity sold. The main objective of trade discount is to encourage customers to purchase company’s products in more quantities.

What is Company X discount?

E.g. Company X is a clothing retailer, and it grants a 15% discount for customers who buy clothing items within a selected date range in festive season.

What Is an Account Settlement?

An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero. It can also refer to the completion of an offset process between two or more parties in an agreement, whether a positive balance remains in any of the accounts. In a legal agreement, an account settlement results in the conclusion of a business dispute over money.

When does account settlement take place?

In cases of two or more parties, related or unrelated, account settlement would take place when one set of agreed-upon goods is exchanged for another, even if a zero balance is not required.

What is offset in insurance?

Amounts receivable and payable to reinsurers are offset for account settlement purposes for contracts where the right of offset exists, with net insurance receivables included in other assets and net insurance payables included in other liabilities. 1.

What is the account receivable department?

The accounts receivable department of a company is charged with the account settlement process of collecting money owed to the firm for providing goods or services. The ages of the receivables are broken down into intervals such as 1–30 days, 31–60 days, etc. Individual accounts will have amounts and days outstanding on record, and when the invoices are paid, the accounts are settled in the company's books.