Settlement fees cover various loan expenses. In real estate, a settlement fee is a charge that covers expenses in excess of the amount a person pays to purchase or sell a property.

What to expect from a settlement?

- For minor injuries, they often settle for 1 to 2 times the medical bills.

- For more serious injuries, your case could settle for 10 times or more of the medical bills.

- But in most cases, it is likely that your case will settle for somewhere between 1 1/2 to 4 times your medical bills.

What is included in settlement?

What Is Included in a Personal Injury Settlement? A personal injury settlement is an amount of money awarded to an injured victim (plaintiff) by an insurance company to make the victim whole again. A victim may achieve a settlement by proving the policyholder’s fault for the accident and injury in question.

Is a debt settlement worth it?

The short answer: Yes, debt settlement is worth it if all of your debt is with a single creditor, and you’re able to offer a lump sum of money to settle your debt. If you’re carrying a high credit card balance or a lot of debt, a settlement offer may be the right option for you. There are numerous debt settlement and credit card companies that promise to help you settle your debt for half or even a small fraction of the total balance you owe, but is debt settlement really a good idea?

What are settlement charges to a seller?

Closing costs for sellers of real estate vary according to where you live, but as the seller you can expect to pay anywhere from 6% to 10% of the home’s sales price in closing costs at settlement.

What is a fee settlement?

Settlement fee means a charge imposed on or paid by an individual in connection with a creditor's assent to accept in full satisfaction of a debt an amount less than the principal amount of the debt.

What does real estate settlement mean?

Settlement involves the simultaneous exchange of documents, and funds required to complete the transaction. You pay the purchase price to the seller with a combination of your down payment, your own funds, and the proceeds of your loan.

What fees can increase at settlement?

Others may change, but only by 10% or less. Some other closing costs can increase without limit....These include:Prepaid interest.Prepaid property taxes.Prepaid homeowners insurance premiums.Initial escrow account deposits.Real estate-related fees.

What's the term for a charge that either party has to pay at closing?

Closing costs are fees due at the closing of a real estate transaction in addition to the property's purchase price. Both buyers and sellers may be subject to closing costs.

What happens at settlement for the seller?

At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged. Your conveyancer or solicitor can check and negotiate the settlement period with the seller.

How does the settlement process work?

A settlement agreement works by the parties coming to terms on a resolution of the case. The parties agree on exactly what the outcome is going to be. They put the agreement in writing, and both parties sign it. Then, the settlement agreement has the same effect as though the jury decided the case with that outcome.

Why are closing costs so high?

Nationwide, home closing costs are now over $1,000 more expensive than before the pandemic. It's largely a consequence of lenders increasing their fees to offset soaring loan production expenses, including commissions and compensation, in addition to making up for the decline in business due to lower sales volume.

Which fees Cannot increase at settlement?

If there is a “change in circumstances,” these costs can change by any amount, but otherwise they cannot change at all: Fees paid to the lender, mortgage broker, or an affiliate of either the lender or mortgage broker for a required service.

Is a settlement statement the same as a closing disclosure?

When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

Who pays expenses and receives income for the day of closing?

If the buyer assumes the seller's existing mortgage or deed of trust, the seller usually owes the buyer an allowance for accrued interest through the date of closing. Unpaid& expenses that are owed by the seller, but not due at the closing are called accrued expenses. These expenses will later be paid by the buyer.

What is negative cash closing?

Put simply, a negative cash to close number means you have extra money you can potentially spend. In other words, you've found a really good deal, because the lender has offered to finance more than you actually need to rehab the property. You've qualified for more financing than you need.

How do you figure closing costs?

To calculate your closing costs, most lenders recommend estimating your closing fees to be between one percent and five percent of the home purchase price. If you're purchasing your house for $300,000, you can estimate your total closing costs to be between $3,000 and $15,000.

Is settlement date the same as closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

How long does it take to get money after house settlement?

The timeframe in which it takes for mortgage funds to be released does vary between lenders, however, it is common for funds to be released within between 3 and 7 days.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

Is the settlement statement the same as the closing disclosure?

When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

What is title company settlement fee?

What is a Title Company Settlement Fee? The settlement fee is sometimes referred to the closing fee, and it covers costs associated with closing operations.

What are the costs associated with closing a home?

When you are buying a home, there are plenty of costs associated with closing that have nothing to do with the actual cost of the home. These costs are generally associated with insuring, reviewing, and modifying the title of that property. The costs can be broadly called “title fees”.

What is Scott Title?

For over two decades, the Scott Title team has maintained a commitment to delivering the highest quality of service in the title insurance industry . We provide our clients with an attention to detail they won’t find anywhere else when it comes to title insurance services including property title searches, settlement services, and real estate paralegal services. Buying a home is usually the single largest investment most people make in their lifetime, and our experienced team will make sure you are fully prepared for a smooth and successful closing. Contact us today to learn more about our services.

Does Scott Title Services work with real estate?

Settlement experts from Scott Title Services will seamlessly integrate into your real estate team by working with your lender, real estate agent and yourself to guarantee that the transaction is both successful and as stress free as possible. We coordinate everything to ensure that your interests and rights are protected during the entire closing process and beyond.

What is settlement fee?

Definition of Settlement Fee. When you're buying a home with a mortgage, it's important to understand the type of fees you might incur. Most people are familiar with the term closing costs, or the genuine third-party costs that are associated with the closing of a real estate transaction, and expect to pay these expenses when they purchase ...

How Do You Calculate Settlement Costs?

Right at the beginning of your loan application, you'll get a good faith estimate. This document outlines all the fees you should expect to pay for your mortgage such as the loan application fee, appraiser's fees, points, title insurance, mortgage insurance and accrued mortgage interest from the closing date until the end of the month. It's an estimate of the total cost of buying the property and it's provided to help you compare the cost of different mortgage providers.

What are closing costs when buying a home?

Most people are familiar with the term closing costs, or the genuine third-party costs that are associated with the closing of a real estate transaction, and expect to pay these expenses when they purchase a property.

What are closing costs?

Closing costs are the legitimate third-party expenses you incur when you buy a property. These are expenses that you would never get back even if you sold the home a day after you closed on it. Examples include the loan application fee, points, title search fees, appraisal fee, home inspection fees, escrow fees, credit reports, courier fees, ...

What happens when you close a mortgage?

When you close the mortgage loan, on top of the closing costs, you're going to pay interest on the new mortgage from the day you close until the day the first monthly mortgage payment is due. You're also going to pay your share of the property taxes and HOA fees the seller has paid upfront for the property from the closing date to the end of the month. On top of that, the lender will collect escrow reserves upfront on account of future property taxes and homeowner's insurance. And don't forget the down payment. That's required at closing, too, and it goes towards the equity in your home.

What is the HUD-1 settlement statement?

This looks a bit like the good faith estimate, only now it shows the true closing costs, including the final cost of items that could only be estimated before.

What happens when you combine closing costs?

If you combine all these various sums together and add them to the genuine closing costs, you get a complete account of everything you need to purchase the property. This total amount is what real estate professionals are referring to when they talk about "settlement costs," "settlement expenses" or "settlement fees."

Why don't wholesale lenders use fixed dollar fees?

While some retail lenders view fixed-dollar fees as an easy way to generate additional revenue from unwary borrowers, wholesale lenders don't because it would cause them problems with brokers.

What is rate protection?

Protection for a borrower against the danger that rates will rise between the time the borrower applies for a loan and the time the loan closes. Rate protection can take the form of a ...

What is mortgage insurance premium?

A mortgage insurance premium is a policy that insures the lender against loss if the homeowner defaults on a mortgage. ...

What is a foreclosed loan?

An agreement by the lender not to exercise the legal right to foreclose in exchange for an agreement by the borrower to a payment plan that will cure the borrowers delinquency. ...

What is lease purchase mortgage?

Wondering what is the best lease purchase mortgage definition?A lease purchase mortgage is a financing option that allows potential homebuyers to lease a property with the option to ...

Is streamlined refinancing cheaper?

Refinancing that omits some of the standard risk control measures and is therefore quicker and less costly. The rationale for streamlined refinancing is that, while it is an entirely new ...

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

How much does it cost to sell a house in 2021?

A 2021 study we conducted found that it costs $31,000 on average to sell a home. But ideally your sale price covers the costs of all the transaction fees, your mortgage payoff, and then some, leaving you with a tidy sum to add to your bank account.

When are property taxes prorated?

For instance, say you get billed for property taxes in February to cover the previous year. If you’re closing on a sale on April 30, the yearly property tax is “prorated” or calculated for the first four months of the year, and it’s reflected in this section.

How much does a seller pay for closing costs?

Closing costs for sellers of real estate vary according to where you live, but as the seller you can expect to pay anywhere from 6% to 10% of the home’s sales price in closing costs at settlement. This won’t be cash out of the seller’s pocket; rather it will be deducted from the profit on your home—unless you are selling with very low equity on your mortgage. In this case, sellers may need to bring a little cash to the table to satisfy your lender—and some closing costs may be held in escrow.

What are closing costs for sellers?

Additional closing costs for sellers of real estate include liens or judgments against the property; unpaid homeowners association dues; prorated property taxes; escrow fees; and homeowners association dues included up to the settlement date.

What are the taxes that are included in closing costs?

Transfer taxes, recording fees, and property taxes are key parts of a seller’s closing costs. Transfer taxes are the taxes imposed by your state or local government to transfer the title from the seller to the buyer. Transfer taxes are part of the closing costs for sellers.

What is title insurance?

Title insurance fees are another fee to keep in mind when you sell real estate. As part of closing costs, sellers typically pay the buyer’s title insurance premium. Title insurance protects buyers and lenders in case there are problems with the title in a real estate deal.

How much commission does a real estate agent get for a $350,000 purchase?

For a $350,000 purchase price, the real estate agent’s commission would come to $21,000. Buyers have the advantage of relying on sellers to pay real estate agent commissions. 2. Loan payoff costs. Most home sellers often seek out a sales price for their home that will pay off their mortgage and satisfy their lenders.

Do you have to include closing costs when selling a house?

Also, don’t forget to estimate some of the closing costs associated with preparing to sell, such as cosmetic repairs or improvements to make your home more attractive to buyers. Those closing costs may be returned with a higher sales price, but you should still include them in your calculations.

Do you have to pay attorney fees for a real estate sale?

If you have your own attorney represent you at the settlement of your real estate sale, the seller may have to pay attorney fees as part of closing costs. Market traditions vary, so while in some areas both the buyers and sellers have their own attorneys, in others it’s more common to have one settlement attorney for the real estate transaction.

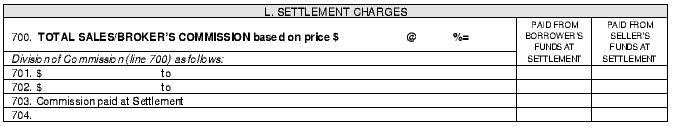

What is settlement statement?

A settlement statement is the statement that summarizes all the fees and charges that both the home-buyer and seller face during the settlement process of a housing transaction. The table below gives further explanation as to what these fees and charges are for both buyer and seller.

When are sellers charged for taxes?

Seller is charged their portion of the current year taxes from January 1st to the closing date. Based on either prior year taxes or most recent mill levy and assessed value. This determines pursuant to the contact.

What is a mortgage payoff?

Mortgage Payoff. The payoff amount is sent to the existing mortgage company and includes additional interest a few days beyond closing. Title Insurance (Owner’s Policy) Typically paid for by the seller, however the contract gives the option for either buyer or seller to pay.