Settlement funding, also known as pre-settlement funding, is a cash advance against an anticipated settlement or award. This form of financing helps many people avoid financial hardship while recovering from accident injuries and waiting for a compensation claim to settle. What Is Settlement Funding?

How long until funds comes after settlement?

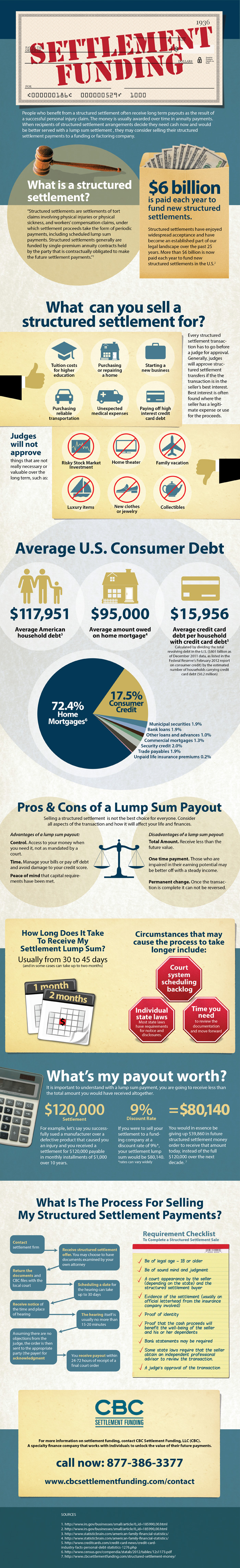

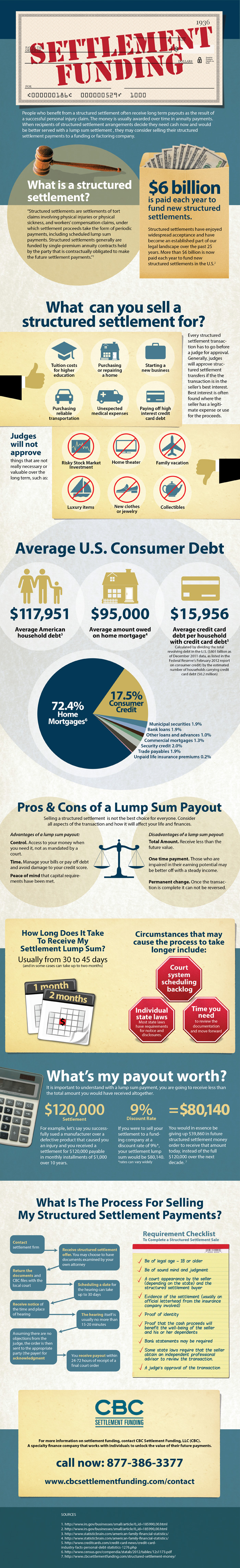

Depending on your case, it can take from 1 – 6 weeks to receive your money after your case has been settled. This is due to many factors but below outlines the basic process. If you have been awarded a large sum, it may come in the form of periodic payments. These periodic payments are called a structured settlement.

What to do with settlement money?

What to Do With Money from a Lawsuit Settlement

- Pay Your Bills. If you have a lawsuit settlement due to a personal injury, you may have medical bills to pay as well as living expenses from not being able ...

- Pay Your Attorney. Following a settlement, you will also need to pay attorney's fees. ...

- Set Aside for Taxes. ...

- Sell It. ...

- Invest it. ...

What is settlement finance?

Settlement is the "final step in the transfer of ownership involving the physical exchange of securities or payment". After settlement, the obligations of all the parties have been discharged and the transaction is considered complete. In the context of securities, settlement involves their delivery to the beneficiary, usually against (in simultaneous exchange for) payment of money, to fulfill ...

Is pre-settlement funding taxable?

Pre-settlement legal funding, however, is usually tax-free. You don't have to pay taxes on that funding. This is because pre-settlement legal funding is considered an advance on your lawsuit settlement or jury award, not a form of wages or income. There are some exceptions to this generality, however, so it is worth going over the details.

What is lawsuit settlement funding?

Pre-settlement funding is a cash advance for individuals that have a pending personal injury lawsuit (automobile accident, workers comp case or slip and fall, etc.) that are in need of money now.

How does a settlement loan work?

A lawsuit settlement loan provides cash in advance for pending settlement award or lawsuit judgment. The borrower can pay back the loan once the funds from the settlement are disbursed. Interest will accrue while the loan is outstanding, sometimes at high rates.

How does pre-settlement funding work?

Pre-settlement funding is when a company provides you with money upfront in exchange for a portion of your expected future settlement proceeds. Then, once your case is settled, the company receives the portion they purchased. Simply put, they are giving you money now in exchange for a payment after you settle.

What is post settlement funding?

Post-settlement funding is a financial product available to both plaintiffs and attorneys after litigation reaches a resolution, and it is entirely risk-free. Post-settlement funding is often referred to as a lawsuit loan or a settled case lawsuit loan, but post-settlement loans are not loans at all.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

Is it worth it to settle debt?

In general, paying off the total amount of debt you owe is a better option for your credit. An account that appears as "paid in full" on your credit report shows potential lenders that you have fulfilled your obligations as agreed, and that you paid the creditor the full amount due.

How many loans can you get from settlement?

There is no set limit to the number of lawsuit loans you can take out. In fact, plaintiffs frequently take out a second or third loan on their case. This is normal and understandable: it is very difficult to predict exactly how much pre-settlement funding you and your family will need.

How long does pre-settlement funding take?

If you qualify, you can usually expect to have money within 24-48 hours.

Can my lawyer deny me from getting a pre-settlement loan?

Your attorney isn't required to approve any pre-settlement funding options. It's best to talk to them before starting the application process. Discuss with them your need for money to cover living expenses and other financial assistance until you can receive your settlement to help ensure your attorney's consent.

How can I get a loan while waiting for a settlement?

How do pre-settlement loans work?Hire a Lawyer and File a Lawsuit. To secure a pre-settlement advance, you must first file a lawsuit. ... Apply for a Lawsuit Loan from a Reputable Funding Company. ... Review the Proposed Funding Agreement with Your Attorney. ... Decide Whether a Pre-Settlement Advance is Right for You.

What does post settlement mean?

What happens after settlement? After settlement, your lender will draw down on your loan. This means that they'll debit the amount they've paid at settlement from your loan account. You're then responsible for paying land transfer duty or stamp duty. It's usually paid on the settlement date.

What is pre and post settlement?

Pre-settlement funding is an advance against a pending litigation and tends to be more expensive because of the increased risk on the part of the funding company. Post-settlement funding is also a cash advance, but against the forthcoming award money from a case that has already settled.

Can I get a loan to pay off a settlement?

To take out a settlement loan, you apply for a loan after filing an eligible lawsuit. The lawsuit loan company evaluates your case's merit, weighs your chances of winning the suit or the case being settled, and estimates how much you can expect to receive. Based on that information, it may offer you an advance.

What percentage should I offer to settle a debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

What is the interest rate on pre-settlement loans?

When you get an offer for pre-settlement funding, a lender should tell you upfront what your interest rate is before you sign paperwork. The best lawsuit funding companies will usually give you an interest rate between 1-3% monthly.

Can my lawyer deny me from getting a pre-settlement loan?

Your attorney isn't required to approve any pre-settlement funding options. It's best to talk to them before starting the application process. Discuss with them your need for money to cover living expenses and other financial assistance until you can receive your settlement to help ensure your attorney's consent.

What Does Post Settlement Funding Mean?

If you are a plaintiff involved in a lawsuit, the defendant in your case will typically pay you some of the total settlement amount after the case is resolved and settlement agreed upon. This will not normally be the total settlement amount. The law does not hold someone to make full payment by a given deadline. Resultantly, wait times can vary from weeks to years.

How Can I Qualify for Post Settlement Funding?

To qualify for post-settlement funding, you must be the plaintiff in the case and not the defendant.

What Is Pre-Settlement Funding?

A lawsuit advance or pre-settlement funding occurs when plaintiffs are advanced money from a court award before the final decision is made.

What are the options for litigation financing?

There are options to fill this gap that go by several names: lawsuit advances, lawsuit loans, structured settlement loans, third-party consumer litigation financing, non-recourse advances, non-recourse loans and alternative litigation financing.

What is the most common criticism of lawsuit loans or advances?

The most common criticism of these kinds of lawsuit loans or advances is that the fees and interest can be excessive. In some cases, they have even been called usurious.

What percentage of fees do companies charge for referral fees?

Companies may also charge broker fees. One company charges 25 percent for what it calls a referral fee. In some instances, critics say, litigation funders may take over or interfere with the consumer’s lawsuit.

How long does a consumer have to rescise a sale?

Requires that the consumer has the right of rescission for five days after receiving funds from the sale. Requires consumer to inform his or her attorney of any contracts with funding providers and requires attorney to acknowledge having been informed.

Why did Ohio Supreme Court voide a loan?

In 2003, the Ohio Supreme Court voided one of these contracts because the court considered it a loan that violated that state’s usury laws.

What is a prohibition on commissions?

Prohibits the payment of commissions, referral fees, rebates, etc., to attorneys, law firms, medical providers, chiropractors, or physical therapist or any of their employees. Prohibits attorneys from having any financial interest in a funding provider that transacts with their clients.

What is pre settlement funding?

Pre-settlement funding is a cash advance for individuals that have a pending personal injury lawsuit (automobile accident, workers comp case or slip and fall, etc.) that are in need of money now.

How to contact Bridgeway for a pre settlement advance?

So if you have been involved in an accident and need a pre-settlement advance (a.k.a "lawsuit loan") now please call Bridgeway at (516) 787-8000 or complete a quick application here and we will do our best to help you. Bridgeway Legal Funding’s goal is help clients get to the other side....

Is a pre settlement loan a non-recourse loan?

Pre-settlement funding is often referred to as a “lawsuit loan”, but it’s actually not a loan rather a non-recourse advance. Non-recourse means that if your case is unsuccessful, you would not have to re-pay Bridgeway anything. If there is not a settlement or award, the pre-settlement advance is yours to keep.

Does Bridgeway pay off a loan?

Yes, in many cases Bridgeway can still help. Assuming the math works, Bridgeway would payoff or buyout what you owe the previous funding company and then provide an additional advance on top of that. For more information on buyouts please click here.

What is pre-settlement funding?

The funding is structured as an advance against the anticipated settlement or judgment awarded after trial.

What happens if I lose my case?

Review it with your lawyer to make certain that you owe nothing in the event that you lose the case or the settlement or award is not enough to repay the entire amount of money that you received through an advance along with the interest charge and fees on it.

How long does it take to get a settlement loan?

The length of time from your lawsuit loan application to approval varies from company to company and case to case. A few key factors determine how long the process takes:

How many loans can I take out on a settlement?

Fortunately, there is no limit to the number of times you can apply for a pre-settlement loan.

What to look for when considering lawsuit settlement funding?

The best way to find one is by shopping the marketplace and getting a quote from several companies. Our How to Compare Lawsuit Loans guide gives you step-by-step instructions on how to do this.

What is a lawsuit settlement loan?

The company you apply to for a lawsuit settlement loan evaluates the case to determine the potential value of a settlement or judgment. You may take a portion of that potential value regardless of whether you take it in one advance or in multiple advances.

How much do you get for a lawsuit loan?

The amount that you get is usually somewhere in the range of 10% to 20% of the value the lawsuit loan company places on the case. What percentage a company agrees to advance depends entirely on its evaluation of the lawsuit, but it takes into consideration the costs of the lawsuit, including court fees and other litigation expenses as well as the fees charged by your lawyer that must be paid first from a settlement or award.