When does the settlement date of a real estate transaction occur?

June 23, 2011. The culmination of a real estate transaction is the settlement or closing, the date on which ownership of the property officially changes hands. At this time, the home seller receives the proceeds resulting from the sale and the buyer pays any associated costs required to complete the transaction.

What is a settlement statement?

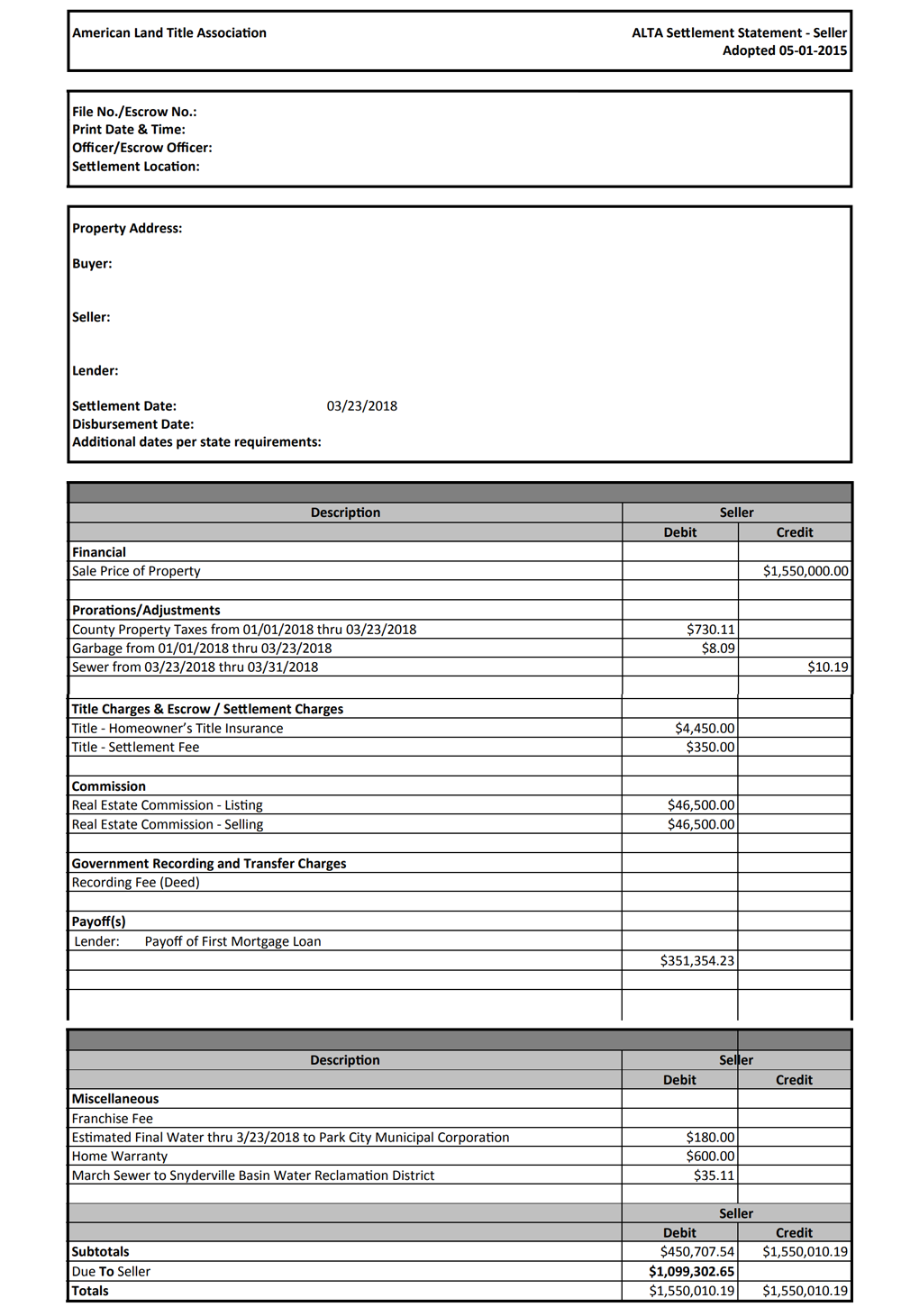

What is a settlement statement? A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

What is the real estate settlement procedures act?

What Is the Real Estate Settlement Procedures Act (RESPA)? The Real Estate Settlement Procedures Act (RESPA) was enacted by Congress in 1975 to provide homebuyers and sellers with complete settlement cost disclosures.

What does a settlement attorney do?

A: The settlement attorney is the one who distributes all money involved in a Real Estate transaction, so this will happen when you close on the sale of your house, normally the bank gets paid first and then the Realtors and so forth..., before the bank gets it's money no one can gets paid.

What does real estate settlement mean?

Settlement involves the simultaneous exchange of documents, and funds required to complete the transaction. You pay the purchase price to the seller with a combination of your down payment, your own funds, and the proceeds of your loan.

What is the difference between settlement and closing?

Although different people use different terms, the "closing" or the "settlement" refers to the same finalization of your home purchase. At the closing or settlement date, the seller receives the sale proceeds, and the buyer pays any required expenses to close the transaction, known as closing costs.

What is the purpose of a settlement statement in real estate?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What happens during settlement?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

What happens after house settlement?

After the settlement meeting, your settlement agent will notify you the settlement has been finalised and the money has been received. After the meeting, your lender will draw down your loan, debiting the amount they've paid at settlement from your loan account.

What is the seller's main issue at settlement?

What is the seller's closing/settlement statement? The Seller's Closing Statement, or Settlement Statement, is an itemized list of fees and credits that shows your net profits as the seller, and sums up the finances of the entire transaction. This is one of many closing documents for seller.

Is a closing statement the same as a closing disclosure?

The closing statement or closing disclosure is intended to share the details of a loan right before closing so both the buyer and lender are on the same page. You can receive a closing statement for various types of loans issued, but a mortgage closing statement is the most recognizable and commonly discussed.

Who prepares the closing statement?

In real estate transactions, a closing agent prepares the closing statement which reflects the cost of the property for both the buyer and the seller. It is important that closing statements reflect the agreement of both buyers and sellers of properties, as well as a mortgage loan that backed up the home purchase.

What is home loan settlement?

Loan settlement is the process of negotiating with your lender to pay off your loan for a lesser amount than what you originally borrowed. This can be done for various reasons, such as financial hardship or wanting to get out of debt quicker.

How many days before the closing must the closing disclosure be delivered?

three business daysYour lender is required to send you a Closing Disclosure that you must receive at least three business days before your closing. It's important that you carefully review the Closing Disclosure to make sure that the terms of your loan are what you are expecting.

Where does the purchase price appear on a settlement statement?

Where does the purchase price appear on the settlement statement? debit for the buyer credit for the seller. Where does the buyers new loan appear on the settlement statement? Credit buyer- The buyers debit column lists all the charges to the buyer; the credit column shows how the buyer is going to pay the charges.

Is closing date and settlement date the same?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

How long does house take to settle?

Generally, it might take around two years internally before the building stabilizes. In most cases, a house should finish “settling” after a year. Usually, it goes through seasons of different humidity: hot weather, cold weather, wet weather, etc.

What not to do after closing on a house?

What Not To Do While Closing On a HouseAvoid Big Charges on a Credit Card. Do not rack up credit card debt. ... Be Careful with Trends. ... Do Not Neglect Your Neighbors. ... Don't Miss Tax Breaks. ... Keep Your Real Estate Agent Close. ... Save That Mail. ... Celebrate!

What does settlement date mean when buying a house?

It's when ownership passes from the seller to you, and you pay the balance of the sale price. The seller sets the settlement date in the contract of sale. As a general rule, property settlement periods are usually 30 to 90 days, but they can be longer or shorter.

What is a settlement agent?

Not only is a settlement agent responsible for prepping appropriate closing documents for the buyer and seller and working with the lender to execute any loan documents, but the agent is also responsible for maintaining an escrow account and keeping impeccable records.

What is a wet settlement?

That all parties have executed appropriate closing documents and the settlement agent is in possession of all funds. At this point, the settlement agent is able to record the applicable deed and/or deed of trust.

What is the fiduciary duty of a settlement agent?

Settlement agents act as stewards of millions of dollars of funds on a daily basis and that’s not to be taken lightly.

What is a closing in real estate?

What is a real estate closing? A real estate closing occurs when the seller has signed the deed conveying the property to the buyer, all parties have signed the final settlement statement, and the settlement company is in possession of all closing funds. If one of these items is missing, the deal is not closed.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

How much does it cost to sell a house in 2021?

A 2021 study we conducted found that it costs $31,000 on average to sell a home. But ideally your sale price covers the costs of all the transaction fees, your mortgage payoff, and then some, leaving you with a tidy sum to add to your bank account.

What Is the Real Estate Settlement Procedures Act (RESPA)?

The Real Estate Settlement Procedures Act (RESPA) was enacted by Congress in 1975 to provide homebuyers and sellers with complete settlement cost disclosures. RESPA was also introduced to eliminate abusive practices in the real estate settlement process, prohibit kickbacks, and limit the use of escrow accounts. RESPA is a federal statute now regulated by the Consumer Financial Protection Bureau (CFPB).

How long does it take to respond to a borrower's complaint?

The servicer is required to respond to the borrower’s complaint in writing within 20 business days of receipt of the complaint. The servicer has 60 business days to correct the issue or give its reasons for the validity of the account's current status.

What is a RESPA loan?

The types of loans covered by RESPA include the majority of purchase loans, assumptions, refinances, property improvement loans, and equity lines of credit. 1. RESPA requires lenders, mortgage brokers, or servicers of home loans to disclose to borrowers any information about the real estate transaction. The information disclosure should include ...

What is a RESPA lawsuit?

A plaintiff has up to one year to bring a lawsuit to enforce violations where kickbacks or other improper behavior occurred during the settlement process.

How long does it take to file a complaint against a loan servicer?

If the borrower has a grievance against their loan servicer, there are specific steps they must follow before any suit can be filed. The borrower must contact their loan servicer in writing, detailing the nature of their issue. The servicer is required to respond to the borrower’s complaint in writing within 20 business days of receipt of the complaint. The servicer has 60 business days to correct the issue or give its reasons for the validity of the account's current status. Borrowers should continue to make the required payments until the issue is resolved.

What is RESPA in real estate?

What Is the Real Estate Settlement Procedures Act (RESPA)? The Real Estate Settlement Procedures Act (RESPA) was enacted by Congress in 1975 to provide homebuyers and sellers with complete settlement cost disclosures. RESPA was also introduced to eliminate abusive practices in the real estate settlement process, prohibit kickbacks, ...

How long does a plaintiff have to file a lawsuit?

A plaintiff has up to one year to bring a lawsuit to enforce violations where kickbacks or other improper behavior occurred during the settlement process.

Who divvies up the proceeds from a sale?

The closing agent (escrow) will divvy up the proceeds from the sale. Of which, if there is a mortgage, that bank will get what is needed to pay the loan in full, the agents commissions, any service providers that are being paid from closing proceeds, as well as the seller to get whats left over. This is all spelled out in ...

What does escrow pay after closing?

Immediately after the transaction closes, escrow pays the seller the full purchase price in the form of a cashier’s check or wire transfer—minu s any fees, taxes, or real estate commissions, which the seller is required to pay. (See more on wire transfers below.)

What is escrow in real estate?

Escrow provides the third party mechanism by which all monies in a real estate transaction are handled fairly and according to the purchase agreement. Escrow provides for all parties to pay or be paid on a specific date (the closing date).

What happens if you cancel a sale for no reason?

However, if the buyers flake, cancel the sale for no legitimate reason, or miss key dates in the contract, the seller may have the right to keep the money.

What happens to HUD-1 at closing?

A: It all happens on the HUD-1 at closing. There is income (sales price) and then there are expenses (closing costs which include bank payoff, REALTOR fees and loan payoff). In the event of a Short Sale the bank agrees to take less than is owed to them. Sometimes, the bank will insist the REALTOR also agree to take less.

How long does it take to close a home loan?

The entire closing process can take anywhere from 30 days to three months, but the average time is 50 days. Closing occurs when all of these steps have been completed and the loan is approved.

How long does it take to settle a mortgage?

A normal settlement time frame is 30 days from the offer to the closing date although it can be shorter or longer. Advertisement.

What is the closing date of a real estate transaction?

Closing Date. The settlement date is the date completing a real estate transaction. The culmination of a real estate transaction is the settlement or closing, the date on which ownership of the property officially changes hands. At this time, the home seller receives the proceeds resulting from the sale and the buyer pays any associated costs ...

What are the closing costs of a home?

The total amount of closing costs can vary but a rule of thumb is 3 to 5 percent of the home's purchase price. In some cases, a motivated property seller may offer to pay some or all of the closing costs to facilitate the transaction.

What is the escrow period?

During the period from the offer to the settlement date, which is referred to as the "escrow" period, the property buyer will incur a number of closing costs.

What is the closing date of a deed?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed. The settlement meeting may occur in the office of a title company, lender or attorney. Any costs associated with the settlement must also be paid at this time.

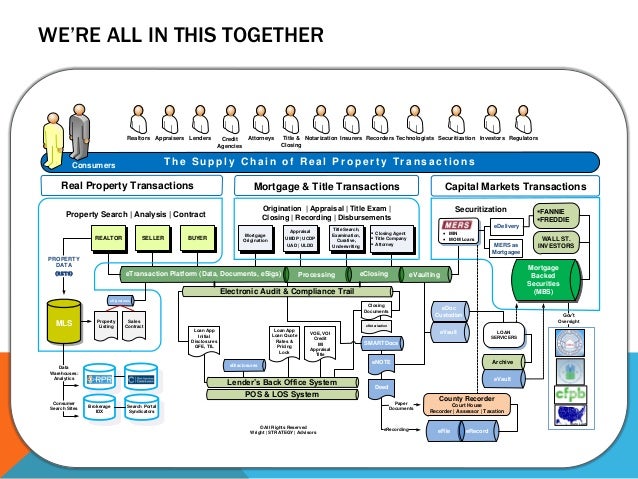

What is a Split Settlement Closing and How does it Work?

This is going to sound like Real Estate 101, but a split settlement closing is when the purchase contract is ratified the buyer picks where they want to obtain their Title Insurance for the transaction and close their side of the deal. Legally, per RESPA they have the right to do this.

What to do Next Time

The next time you receive an offer for your client’s listing…think of your client. This doesn’t necessarily mean you have to like or want to use the suggested Title Company on the contract…there are options.

Looking for a Good Northern Virginia Title Company?

Need a good Title partner that is going to help you get more business? Would you also want a Title Sales Rep that knows how to help you become more valuable to your clients…teach you HOW to get found online and use technology in your real estate business? All you have to do is fill out the form below and tell me how I can help you!