Key Takeaways

- Debt settlement is an agreement between a lender and a borrower to pay back a portion of a loan balance, while the remainder of the debt is forgiven.

- You may need a significant amount of cash at one time to settle your debt.

- Be careful of debt professionals who claim to be able to negotiate a better deal than you.

How to negotiate a loan settlement?

To settle a private student loan:

- For private student loans, there is no database to see all of your outstanding loans. ...

- Contact your lender to let them know you would like to settle your student loan.

- Use a polite tone to start the conversation off on a positive note.

- Let your private student loan lender make the initial offer. ...

How to calculate home loan settlement amount?

- Your settlement amount

- Number of days interest included

- Settlement quote valid until (date)

- Date of your next repayment

Can I get a settlement loan?

You can start requesting a loan settlement in delinquency, but only if it’s on its way to default. You can also request a settlement once your loan has passed into default. You might qualify for a student loan debt settlement with your federal loans if:

How to calculate full settlement on your personal loans?

To use it, all you need to do is:

- Enter the original Loan amount (the full amount when the loan was taken out)

- Enter the monthly payment you make

- Enter the annual interest rate

- Enter the current payment number you are at - if you are at month 6, enter 6 etc.

- Click Calculate!

What is settlement loan?

How do settlement loans work?

What are some alternatives to settlement loans?

How much interest do settlement loans cost?

What does a lawsuit advance cover?

How long does it take to get a settlement loan?

Is a lawsuit loan regulated?

See 4 more

About this website

What is the meaning of settlement of a loan?

A One Time Loan settlement is when the lender agrees to accept a lesser amount than the entire amount that is due and agrees to waive off or write off the rest of the amount. The bank may agree to this under certain circumstances and if the reason is genuine, such as job loss or a medical emergency, etc.

What happens if you settle a loan?

Instead of closing the transaction, they term it as settled. When a loan is termed settled, it is viewed as a negative credit behaviour and the borrower's credit score drops by 75-100 points. The CIBIL holds this record for over 7 years.

What is the procedure of loan settlement?

The settlement amount is decided after assessing the borrower's repayment capacity and the severity of the situation. Once the debtor makes the loan settlement payment, the lender writes off the loan, closes the loan account and reports it as “settled” to the credit bureaus.

Is it a good idea to settle debt?

It's a service that's typically offered by third-party companies that claim to reduce your debt by negotiating a settlement with your creditor. Paying off a debt for less than you owe may sound great at first, but debt settlement can be risky, potentially impacting your credit scores or even costing you more money.

How is settlement amount calculated?

Settlement amounts are typically calculated by considering various economic damages such as medical expenses, lost wages, and out of pocket expenses from the injury. However non-economic factors should also play a significant role. Non-economic factors might include pain and suffering and loss of quality of life.

How can I remove settled loan from CIBIL?

How To Remove “Settled” Status from Your CIBIL Report? To clear the “Settled” status from your CIBIL report, you need to pay the outstanding amount on your loan and get a NOC (No Objection Certificate) from the lender.

Does CIBIL improve after settlement?

Change your “Settled” status to “Closed” – One of the easiest ways to improve your CIBIL score is to change “settled” status to “Closed' one with your credit card company. To do this, you have to pay all your dues once and for all.

What is the percentage of loan settlement?

Typical debt settlement offers range from 10% to 50% of what you owe. The longer you allow debt to go unpaid, the greater your risk of being sued. Creditors are under no obligation to reduce your debt, even if you are working with a reputable debt settlement company.

Can I get NOC after loan settlement?

synopsis. A No Objection Certificate (NOC) is a legal document issued by a housing finance company or bank to a customer declaring that he/she has no outstanding dues towards the lender. Sometimes referred to as a “No Dues Certificate”, an NOC can be obtained from the lender once the loan has been paid off completely.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

What are the negative effects of debt settlement?

Debt settlement can cause your credit score to fall by more than 100 points, and it stays on your credit report for seven years. If your creditors close accounts as part of the settlement process, this can cause your credit utilization to increase, which also negatively affects your credit score.

What happens if you pay a settlement offer?

As long as your creditors accept your offer – i.e. agree to sum of money in the settlement offer – they will accept partial settlement of your debt in exchange for writing off the remaining amount you owe. If the settlement offer is big enough, the money will be shared equally among all of your creditors.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

Does it hurt credit to settle debt?

While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative. Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account.

Is settled in full good on credit report?

A settled account is considered a negative entry on your credit report since it indicates the lender agreed to accept less than the full amount owed. A settled account on your credit report tends to lower your credit scores, but its effect will lessen over time.

How long does debt settlement affect credit?

Debt settlement affects your credit for up to 7 years, lowering your credit score by as much as 100 points initially and then having less of an effect as time goes on. The events that typically lead up to debt settlement will affect your credit score, too.

Loans for Settlement: How Do They Work?

Legal-Bay Lawsuit Funding 60 Roseland Ave. Suite 101 Caldwell, NJ, 07006

Structured Settlement Loans | Getting Cash in Advance - Annuity.org

There are ads around the internet for something called “structured settlement loans.” The idea might be appealing if you have a structured settlement and have a financial need that exceeds the payments you’re getting.

Best Lawsuit Loans Pre Settlement Funding Company

About Our Services. Best Lawsuit Loans LLC specializes in providing affordable and fast legal loans to all clients within the United States. We are one of the only lawsuit funding companies to be available 24 hours a day and 7 days a week to provide you with affordable funding.

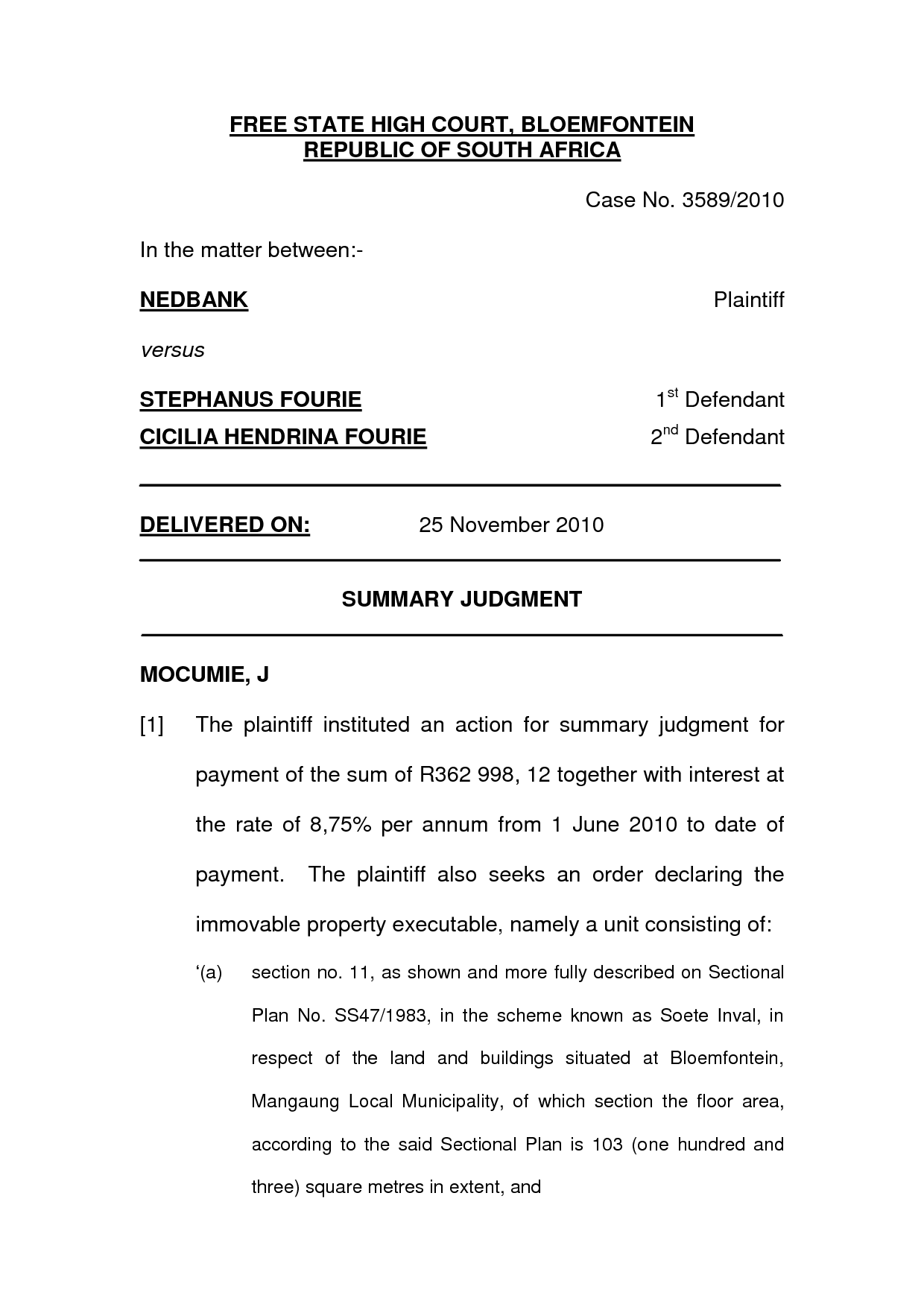

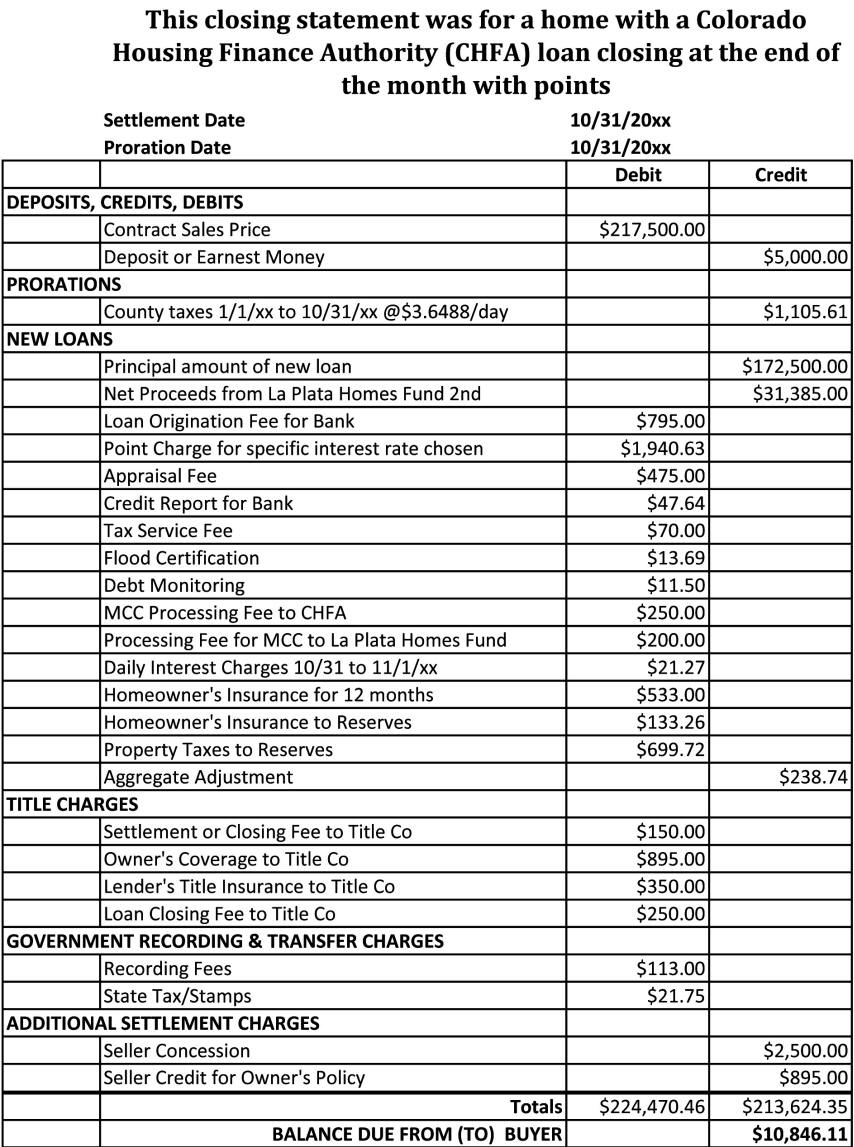

What is a loan settlement statement?

A loan settlement statement is the document that describes the amount of a loan, typically for a mortgage, given to the borrower once the loan has been settled. In addition to the amount, the settlement statement will also contain the frequency of installments expected from the lender in regards to repayment.

Is there any downside to settling a loan early?

On the surface, paying off your loan before the terms agreed to seems like an obvious decision. If you're looking at a mortgage, it's likely that this is going to be the largest debt that you encounter in your lifetime, and the faster you settle your debt, the less interest you'll pay. Seems like a clear-cut decision, right?

Is a loan settlement statement different from a normal settlement statement?

Quick answer: yes. It's not uncommon to mix the two up, though, because a "settlement statement" is another document that's involved in buying a home. So how do you keep track of which one is which?

What is personal loan settlement?

Personal loan settlement process, also known as personal loan defaulter settlement refers to an agreement between a lender and a borrower wherein the loan is ‘settled’ by repaying only a part of the loan. The lender may forgive a part of the debt in order to help the borrower repay the loan at least partially.

What happens if you settle a personal loan?

When you opt for a personal loan defaulter settlement, it negates the original credit agreement between you and your lender. Also, when your lender reports the same to credit rating agencies as ‘ settled’ instead of ‘paid as agreed’ or ‘paid in full’- it will have a negative impact on your credit score, and discourage other lenders ...

What is loan closure?

Loan closure is a term that refers to the closing of an existing loan account after the borrower repays the loan fully on time. This will have a positive impact on one’s credit score.

How does a loan settlement affect your credit score?

Loan settlement process can negatively affect your credit history and reduce your credit score drastically thereby limiting your chances of receiving credit in the future. When you opt for a loan settlement, even if it is for a genuine reason, the amount paid will be lesser than the original amount which reduces your creditworthiness.

What to do if you can't repay a loan?

In case you are unable to repay your loan due to unavoidable circumstances, then one of the options available is loan settlement. However, this is not a recommended option due to various reasons, one of which includes the adverse impact on your credit score.

How to opt for a mortgage loan?

Opt for a mortgage loan or secured loan by pledging financial assets like gold, properties, etc., and pay off the current debt

How long does it take to get a credit score back?

For a borrower, it takes nearly seven years or so to reestablish a positive score and improve his/her credit history.

What is a settlement ?

With reference to a credit facility, a settlement is an official agreement between creditor and debtor to resolve over dues. This status signifies that there was a mutual agreement between the borrower and lending institution. As part of this arrangement, a part of the outstanding on a loan is waived to close the account

Disadvantages of a settlement

Credit bureau gets updated with a settlement flag (‘S’), which makes lenders wary of lending to such borrowers

What is pre settlement funding?

Before you’ve settled your case, you may find yourself in need of money to pay bills. In that case, some people seek lawsuit loans, also known as pre-settlement funding.

What happens if a bank finds the need to seize a structured settlement payment?

That’s partly because if a bank found the need to seize the structured settlement payments if the loan wasn’t repaid, the bank would require court approval. Banks generally have no desire to participate in that process.

Why do you need to document your income to get a mortgage?

Documenting this income could be a way to prove to the mortgage lender that you will be able to make your mortgage payments. So in this sense, your structured settlement could help you get a loan.

What happens if you file a lawsuit and the opposing side agrees to settle?

If you file a lawsuit and the opposing side agrees to settle, you may receive a lump sum or a structured settlement. With a lump-sum settlement, you receive all your money at once, concluding the case. With a structured settlement, you receive a series of payments, typically stretching out over years.

Can you sell a structured settlement loan?

Some people inaccurately use the term “structured settlement loan” when they are actually talking about a different transaction: You can sell future structured settlement payments to a company that purchases them.

Do structured settlements require cash?

Sometimes, people with structured settlements find themselves in need of an infusion of a greater amount of cash than the immediate settlement payments will provide. They may want an advance on their future payments.

Can I Use My Settlement to Get a Loan?

Possibly. Even though your structured settlement can’t be used as collateral, you may use it to show you have income to repay a loan. So if you needed to get a mortgage, for example, you may get documentation from your structured settlement administrator to show the income you will be receiving from your structured settlement. You could also show bank statements where your structured settlement payments are deposited.

What is settlement loan?

Settlement loans give you a cash advance against an expected legal settlement. While you can get the cash you need to pay for necessary expenses right away, there are significant drawbacks to keep in mind.

How do settlement loans work?

To take out a settlement loan, you apply for a loan after filing an eligible lawsuit. The lawsuit loan company evaluates your case’s merit, weighs your chances of winning the suit or the case being settled, and estimates how much you can expect to receive. Based on that information, it may offer you an advance.

What are some alternatives to settlement loans?

If you need cash, there may be other ways to get the money without resorting to a lawsuit advance. Consider a personal loan. If you have good credit, taking out a traditional personal loan can be a smart option.

How much interest do settlement loans cost?

Most notably, they can come with very high costs. Settlement loans typically have high interest rates. Interest rates commonly range from 20% to 60% a year. A study by University of Texas School of Law researchers found the average interest rate for settlement loans is 44%. Lawsuits can take years to settle.

What does a lawsuit advance cover?

You’ll get money for living expenses. With a lawsuit advance, you’ll get cash to cover your necessary expenses, which can help you keep up with your bills.

How long does it take to get a settlement loan?

You can generally get the loan quickly. Some settlement lenders may be able to approve and fund your advance within hours or days.

Is a lawsuit loan regulated?

Lawsuit loans are not heavily regulated. Many types of loan products are heavily regulated, but settlement loans are primarily regulated at the state level, meaning each state has its own rules regarding settlement loans. If you have issues with your settlement loan, you should contact the attorney general in your state.