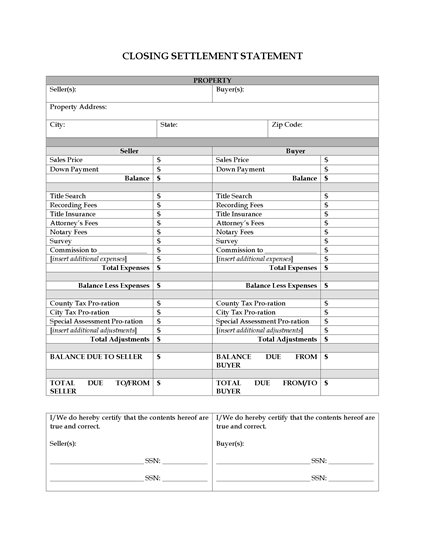

The Settlement Statement is also called the Seller’s Closing Statement.

- Property sale price

- Personal property

- Earnest money

- Loan amount

- Existing loan amount

- Seller credit

- Excess deposit

Full Answer

What in my settlement statement is deductible?

The settlement statement gives both parties a full picture of the expenses attached to the transaction. Some of the more common examples of deductible expenses include loan origination fees, mortgage insurance premiums, and real estate tax payments.

What is settlement and examples of settlement?

Settlement statement defines the document which discloses the summary writing of the transaction between the service provider and the client. For example, a seller sends the buyer a settlement statement containing the summed up costs with regards to the buyer’s purchase. Or a lender sends a settlement statement to a borrower containing all ...

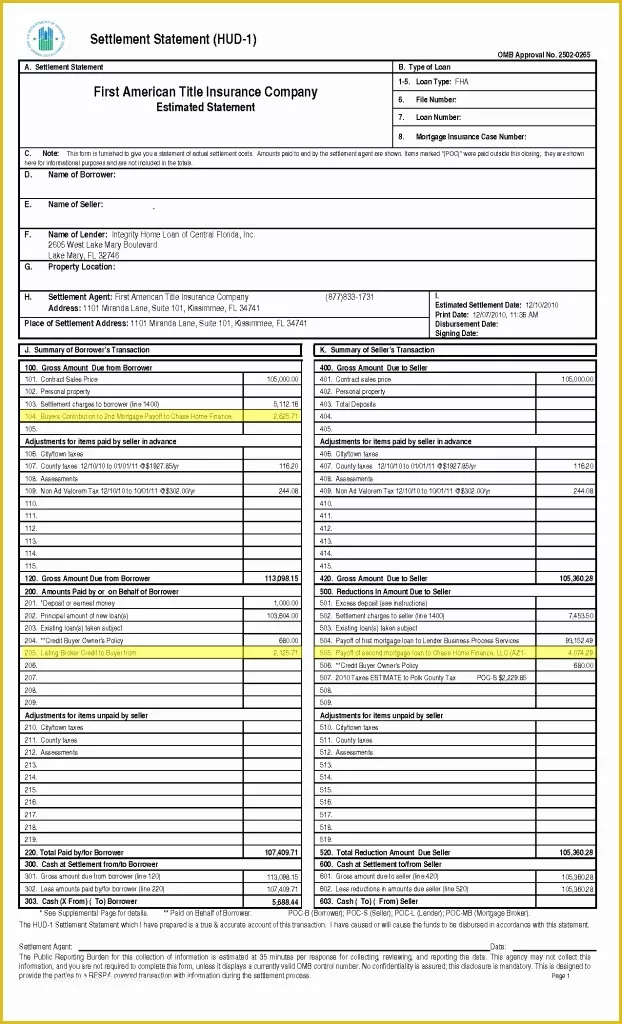

What is a HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

What is a preliminary settlement statement?

Put simply, it’s a form outlining the terms and costs of your mortgage—and one of the most important pieces of paperwork to check before you close on a home.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is a settlement statement used for?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What is settled statement?

A settled statement is a summary of the superior court proceedings approved by the superior court. An appellant may either elect under (b)(1) or move under (b)(2) to use a settled statement as the record of the oral proceedings in the superior court, instead of a reporter's transcript.

What is a settlement statement called now?

What Is a HUD-1 Form? A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

What is loan settlement?

The settlement of a loan is the act of paying back the amount of money owed to the lender. If you've ever been out on the town and had to settle your tab before leaving an establishment, you're familiar with the notion.

What is an example of settlement?

An example of a settlement is when divorcing parties agree on how to split up their assets. An example of a settlement is when you buy a house and you and the sellers sign all the documents to officially transfer the property. An example of settlement is when the colonists came to America.

What happens during settlement?

Settlement, or completion, is the final process in the sale of a property that takes place after the seller and buyer exchange contracts of sale. It all culminates on settlement day when the title is transferred to the buyer and they take physical and legal ownership of the property.

What does closing statement look like?

A mortgage closing statement lists all of the costs and fees associated with the loan, as well as the total amount and payment schedule. A closing statement or credit agreement is provided with any type of loan, often with the application itself.

What is the difference between HUD and CD?

Another big distinction between the Closing Disclosure and the HUD-1 is where the HUD-1 listed all terms, charges and credits for both the buyer and the seller, the Closing Disclosure has a separate form for the buyer as it does for the seller. This provides for more consumer protection at the closing table.

Who provides the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

What does HUD mean in real estate?

U.S. Department of Housing and Urban DevelopmentHUD Homes | HUD.gov / U.S. Department of Housing and Urban Development (HUD)

Who provides the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

What is a settlement statement quizlet?

Uniform Settlement Statement. Under RESPA, a lender must use HUD's Form 1 Uniform Settlement Statement to disclose settlement costs to the buyer. This form covers all costs that the buyer will have to pay at closing, whether to the lender or to other parties.

Who should review the settlement statement before closing quizlet?

-gives buyer the right to review the completed settlement statement one business day prior to closing. -specifically prohibits any payment or receiving of fees or kickbacks when a service has not been rendered.

What is a settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

How does a settlement statement work?

Every real estate transaction requires a settlement statement of some kind. It is used in home purchases and refinances, as well as all-cash transactions, reverse mortgages and commercial and investment property sales.

What can I expect to see on my settlement statement?

Several items are listed and organized within a settlement statement, including:

Next steps

Upon receipt of a closing disclosure or HUD-1 settlement statement, “it’s safe to say that you are at the tail end of the process,” Moreira says. It’s crucial to review this document carefully to ensure all costs are accurate.

What is a Settlement Statement?

The settlement statement, also known as the closing statement, is a legal document that outlines what a buyer needs to pay to the seller or vendor on settlement. The statement also has a good faith estimate. The settlement statement lists all charges and credits to both the buyer and the seller in a property or real estate settlement.

Meet some of our Real Estate Lawyers

Possesses extensive experience in the areas of civil and transactional law, as well as commercial litigation and have been in practice since 1998. I addition I have done numerous blue sky and SEC exempt stock sales, mergers, conversions from corporations to limited liability company, and asset purchases.

What is a Settlement Statement?

The Settlement Statement or closing statement is a document that outlines what the buyer has to pay to the vendor on settlement day. It includes all payments and receipts that are related to the settlement. This may include stamp duty, the First Home Owner Grant and the Statement of Adjustments. It also includes the total purchase price less any deposit paid. The Settlement Statement is usually put together by your conveyancer or property lawyer when they are getting ready to settle the property purchase.

What is a settlement?

Real estate settlement happens when the land is transferred over to the buyer. Settlement day usually marks the end of the transaction. Aside from handing over keys, there are several things that happen on settlement day. A settlement day checklist includes:

What is included in a statement of adjustment?

Some of the most common include: Municipal Rates: The seller is liable to pay for the rates up to settlement day.

How is a statement of adjustments calculated?

The Statement of Adjustments will be calculated assuming that all of the expenses have been paid. If they haven’t then they will be paid out of the total money that is to be paid to the seller. This means that the seller will effectively pay them up to settlement date. Sometimes this involves having a bank cheque for settlement drawn up so that these expenses can be paid.

Why do you need to adjust settlement dates?

Because settlements rarely occur at the end of the year or month, adjustments need to be done to make sure both the buyer and the seller only pay (and receive) their fair share. If for some reason the settlement date is delayed, then the adjustments will need to be recalculated.

Why are settlement statements included in the Statement of Adjustments?

Settlement Statements are usually incorporated into the Statement of Adjustments because the income and expenses related to the property also need to be settled between the parties. These expenses may include things like municipal rates, land tax and other periodic expenses related to the property.

What does settlement adjuster include?

The income may include things like rent if the property has tenants. Generally, the settlement adjuster will include income or expenses that are paid periodically. That means they are paid or received weekly, monthly or annually. The seller must pay these expenses and can receive the income up to and including on the settlement day.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

Does the seller get a closing statement?

Buyers tend to sign the bulk of the paperwork at closing, making some sellers wonder if they will even receive a settlement statement.

What is settlement statement?

A settlement statement is the statement that summarizes all the fees and charges that both the home-buyer and seller face during the settlement process of a housing transaction. The table below gives further explanation as to what these fees and charges are for both buyer and seller.

When are sellers charged for taxes?

Seller is charged their portion of the current year taxes from January 1st to the closing date. Based on either prior year taxes or most recent mill levy and assessed value. This determines pursuant to the contact.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

Who studied the statement of sale?

Most buyers and sellers studied the statement on their own, with the assistance of their real estate agent and the settlement agent. The idea was that the more people who reviewed it, the more likely it became that errors would be detected.

What is the 701 and 702 section?

This section deals with the commissions paid to real estate agencies. Lines 701 and 702 show how the commissions are split between two participating agencies. 6

What is tabulated before being brought forward to page 1 in Section L or page 2?

Many entries are tabulated before being brought forward to page 1 in Section L or page 2. Columns contain charges that are paid from either the borrower's or the seller's funds. Your closing statement probably won't have entries in all these lines.

When did the closing disclosure change?

Borrowers began receiving a form called the Closing Disclosure instead of a HUD-1 for most kinds of mortgage loans after October 2015. The change was in response to the TILA RESPA Integrated Disclosures, or simply TRID, which overhauled the way mortgages are processed and disclosed. 3.