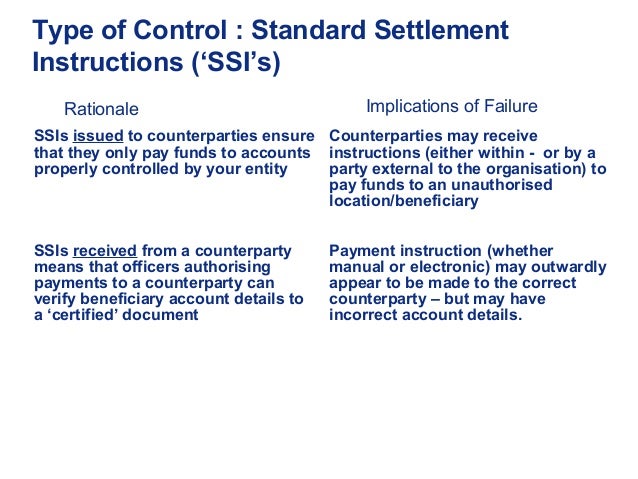

Standard settlement instructions (or SSIs) are one of the most important reference data sets in the financial industry. For a given trade or cash movement, they identify the accounts that assets and money should be credited to, the market or place of settlement and through which custodians/intermediaries the communication should flow.

What is a standard settlement instruction (SSI)?

Standard Settlement Instructions (SSI’s), refer to a Legal Entities Settlement Instruction for which key information remains the same from one cash settlement to another (i.e., bank, account number and account name), with only the amount and value date modified.

What does SSI stand for in finance?

Definition of term standing settlement instructions (SSI) Definition of term. standing settlement instructions (SSI) Standing settlement instructions are a market participant’s default instructions for the payment and delivery of securities. They often differ depending on the type and denomination currency of the securities.

When should the customer send the settlement instruction?

The Customer should send separate settlement instruction two business day s prior to the settlement date if the Transaction needs to be settled through accounts other than that specified in the Standard Settlement Instruction.

What are HSBC's Standard Settlement Instructions?

HSBC's Standard Settlement Instructions documents allow you to have correct payment/delivery whenever you transact with HSBC. Commercial Bank About HSBCnet Online security Customer support Getting started Troubleshooting 从中国登录 Select your country HSBC Global Business websites Americas Argentina Bermuda Canada

What is a settlement instruction?

The term settlement instruction is a generic term used to describe the (only) mechanism by which trade settlement (the exchange of securities and cash) is initiated between seller and buyer.

What is standing settlement instruction?

Standing settlement instructions are instructions that have been agreed in advance, and that are to be used every time a trade is made. For recurring transfer of funds or securities, you may enter standing settlement instructions that can be used each time a transfer request is made.

What is SSI in trade life cycle?

Standing Settlement Instructions (SSIs) play a crucial role in the trade-processing life cycle since it includes all the details a trade needs before it can settle, including account numbers, identification codes and place of settlement.

What is SSI in finance?

Supplemental Security Income (SSI) is a Federal income supplement program funded by general tax revenues (not Social Security taxes): It is designed to help aged, blind, and disabled people, who have little or no income; and. It provides cash to meet basic needs for food, clothing, and shelter. Recently Updated.

What is SSI share transfer?

4) Share you new broker SSI means account details where you will receive `portfolio or share & bond. 5) Pay transfer out fees to your old broker.

What is SSI enrichment?

With standard ALERT enrichment the user manually provides the appropriate ALERT keys (Country, Method, Security) in CTM. When a trade is submitted to the CTM service for matching, both broker/dealers and investment managers can provide a set of fields, or keys, that activate the enrichment process.

What is SSI database?

SSI is a synchronous, point-to-point, serial communication channel for digital data transmission. Synchronous data transmission is one in which the data is transmitted by synchronizing the transmission at the receiving and sending ends using a common clock signal.

What are trade instructions?

Trade Instruction or "Trade Instructions" means trade instruction(s) for trading in Securities listed on 4AX pursuant to a Client Mandate and communicated or conveyed to A-Trade in accordance with the Client Mandate; Sample 1Sample 2. Trade Instruction has the meaning set out in Part A of Schedule 2.

How often does SSI review your case?

If improvement is possible, but can't be predicted, we'll review your case about every three years. If improvement is not expected, we'll review your case every seven years. Your initial award notice will tell you when you can expect your first medical review.

Can SSI see your bank account?

For those receiving Supplemental Security Income (SSI), the short answer is yes, the Social Security Administration (SSA) can check your bank accounts because you have to give them permission to do so.

How often does SSI check your bank account?

As we explain in this blog post, SSI can check your bank accounts anywhere from every one year to six years, or when you experience certain life-changing experiences. The 2022 maximum amount of available financial resources for SSI eligibility remains at $2,000 for individuals and $3,000 for couples.

What is Omgeo Alert?

Omgeo ALERT is the industry's largest and most compliant web-based global database for the maintenance and communication of standing settlement and account instructions (SSI).

What are 4 types of financial institutions?

The most common types of financial institutions are commercial banks, investment banks, insurance companies, and brokerage firms.

Is SSI static data?

The Static Single Information (SSI) form is a compiler intermediate representation that allows efficient sparse implementations of predicated analysis and backward dataflow algorithms. It possesses several attractive graph-theoretic properties which aid in program analysis.

What is Post trade Processing?

Post-trade processing occurs after a trade is complete. At this point, the buyer and the seller compare trade details, approve the transaction, change records of ownership, and arrange for the transfer of securities and cash. Post-trade processing will usually include a settlement period and involve a clearing process.

What is SSI in securities?

Definition of term. standing settlement instructions (SSI) Standing settlement instructions are a market participant’s default instructions for the payment and delivery of securities. They often differ depending on the type and denomination currency of the securities.

What is a standing settlement?

Synonym: settlement instructions. Standing settlement instructions are a market participant’s default instructions for the payment and delivery of securities. They often differ depending on the type and denomination currency of the securities.

About

The ALERT platform is the industry’s largest and most compliant online global database for the maintenance and communication of account and standing settlement instructions (SSIs). ALERT enables a community of investment managers, brokers-dealers, custodian banks and prime brokers to share accurate account and SSI automatically worldwide.

Benefits

Ensure complete automated communication of account and settlement instructions by connecting to the world’s largest community of SSI database subscribers

Who Can Use the Service

ALERT allows our buy-side clients to set up or edit accounts and maintain the SSIs associated with those accounts. To maintain your SSIs, you can either link your accounts to a set of existing instructions via the “model” process, or SSI maintenance can be handled by Global Custodian (GC) Direct enabled global custodians and prime brokers.