Is swift a payment system or settlement system?

SWIFT is neither a payment system nor a settlement system though the SWIFT messaging standard is used in many payment and settlement systems. SWIFT’s customers include banks, market infrastructures, broker-dealers, corporates, custodians, and investment managers. SWIFT is subject to oversight by the central banks of the Group of Ten countries.

What is swift and how does it work?

What is SWIFT? SWIFT, or the Society for Worldwide Interbank Financial Telecommunication, is a secure global messaging network that banks use to make cross-border payments. The network facilitates financial institutions to wire money to each other, helping ensure that global trade carries on smoothly.

What is swift settlement and reconciliation messaging?

SWIFT’s settlement and reconciliation messaging solution uses globally-recognised communication standards to connect you to your counterparties, intermediaries and market infrastructures.

How has the SWIFT system changed the world of Finance?

Before the introduction of a standard, international network for interbank financial transfers was established, the systems that were in place were far more unreliable and insecure. What the SWIFT system has done is make it faster, cheaper and far more reliable for banks to communicate instructions to each other.

What does the SWIFT system do?

The SWIFT messaging network is a component of the global payments system. SWIFT acts as a carrier of the "messages containing the payment instructions between financial institutions involved in a transaction".

Who owns the SWIFT payment system?

SWIFT is a cooperative company under Belgian law and is owned and controlled by its shareholders (financial institutions) representing approximately 2,400 Shareholders from across the world.

What is SWIFT stands for?

the Society for Worldwide Interbank Financial TelecommunicationsSWIFT is an acronym for the Society for Worldwide Interbank Financial Telecommunications and may also be referred to as a CIC code. U.S. Bank's swift code is USBKUS44IMT.

What is the SWIFT international payment system?

The SWIFT payment network allows individuals and businesses to accept/send international money via electronic or credit card payments. This can be done even if the customer or vendor uses a different bank than the payee. The network is a place for secure financial messaging.

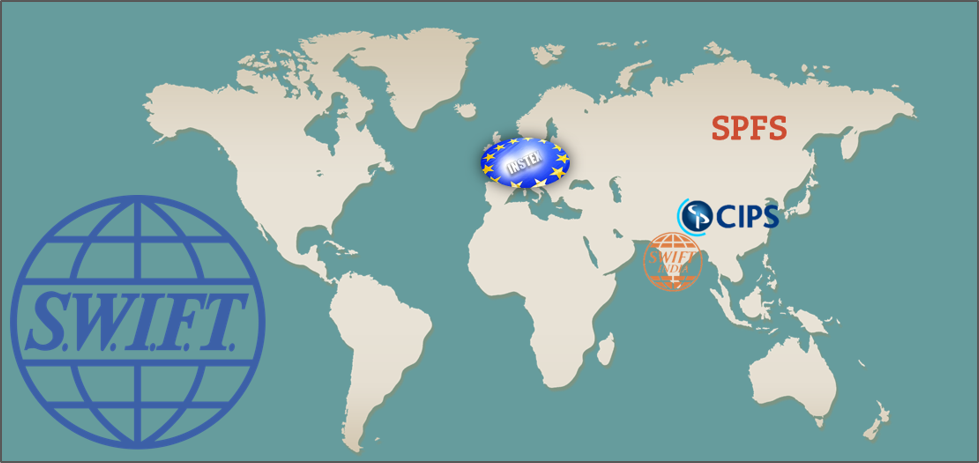

Is Russia in SWIFT?

SWIFT is used by thousands of financial institutions in more than 200 countries, including Russia, and provides a secure messaging system to facilitate cross-border money transfers.

Does China use SWIFT?

China, despite having concern about its reliance on Western financial infrastructure, continues to use SWIFT when messaging payment instructions across borders, even to its own foreign bank branches and subsidiaries.

How many countries use SWIFT?

Having disrupted the manual processes that were the norm of the past, SWIFT is now a global financial infrastructure that spans every continent, 200+ countries and territories, and services more than 11,000 institutions around the world.

How many banks use SWIFT?

Now, more than 11,000 financial institutions across more than 200 countries and territories use SWIFT.

Why is SWIFT used?

Swift is a general-purpose programming language built using a modern approach to safety, performance, and software design patterns. The goal of the Swift project is to create the best available language for uses ranging from systems programming, to mobile and desktop apps, scaling up to cloud services.

What is replacing SWIFT?

Ripple runs RippleNet, which is a platform that enables anyone to send and exchange digital assets along with conducting cross-border transactions. This gave direct competition to the SWIFT banking system (Society for Worldwide Interbank Financial Telecommunications).

How long does a SWIFT transfer take?

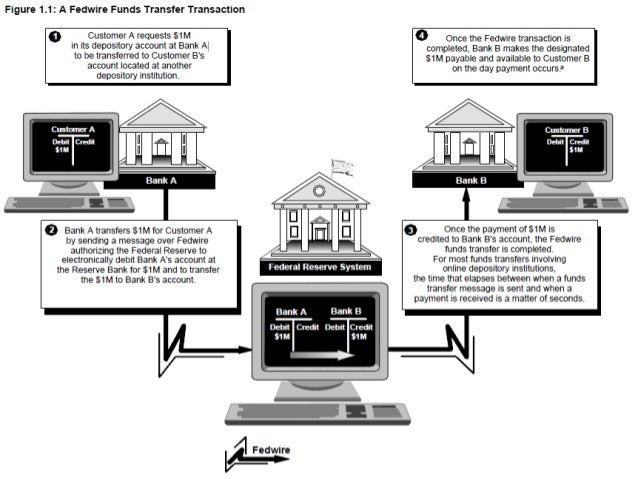

between 1 to 5 working daysOnce the transfer is initiated, a SWIFT payment can take anywhere between 1 to 5 working days to complete. One of the main reasons for the slow transfer of funds via SWIFT are the fraud prevention and anti money laundering (AML) procedures in place by the banks involved in the transaction.

How much money does SWIFT transfer a day?

$5 trillionSWIFT messages direct the transfer of nearly $5 trillion worldwide each day. In contrast to Fedwire and CHIPS, a SWIFT message may travel directly from a U.S. financial institution to a foreign institution or vice versa. In practice, SWIFT is the primary method for international funds transfer messages.

Is SWIFT an American company?

Swift Transportation is a Phoenix, Arizona-based American truckload motor shipping carrier, part of Knight-Swift. With over 23,000 trucks, it is the largest common carrier in the United States.

Who started SWIFT?

IN 1966 Jerry Moyes founded Swift Transportation with his father and one truck, moving imported steel through Los Angeles to Arizona and then Arizona cotton back to California.

Who is SWIFT CEO?

Javier Pérez-Tasso (Jul 1, 2019–)SWIFT / CEOJavier Pérez-Tasso was appointed Chief Executive Officer at SWIFT in July 2019. In this position, he has led the company's new strategy for instant and frictionless payments and securities processing. Prior to this role, he was Chief Executive, Americas & UK region since September 2015.

How many banks use SWIFT?

Now, more than 11,000 financial institutions across more than 200 countries and territories use SWIFT.

Wide variety

The settlement messages include repurchase agreements, portfolio transfers, internal account movements, collateral exchanges and corporate actions distribution.

Automated and standardised reporting

Improve visibility and transparency of your operations through each pre-settlement stage - and for all post-settlement reporting activity.

What is SWIFT in banking?

In Europe, it’s called the Society for Worldwide Interbank Financial Telecommunications, otherwise known as SWIFT.

What is Swift payment network?

The SWIFT payment network allows individuals and businesses to accept/send international money via electronic or credit card payments. This can be done even if the customer or vendor uses a different bank than the payee. The network is a place for secure financial messaging.

What is Swift wire?

SWIFT payments–or international wires–are a type of transaction where the SWIFT international payment network is used to send or receive international electronic payments. The SWIFT network doesn’t actually transfer funds but instead, sends payment orders between banks using SWIFT codes. It’s a means to transfer money overseas quickly, accurately, and securely.

Why is Swift used?

Particularly in relation to processing international payments. The word “communicate” is always used because SWIFT is simply a messenger between banks. It channels the message enclosing payment instructions from the issuing bank (i.e. the payor) to the remitting bank (i.e. the beneficiary/receiver).

How many countries does Swift serve?

Currently, SWIFT provides messaging services to over 10,000 financial institutions in 212 different countries worldwide and helps facilitate global business.

Why is Swift so successful?

The attributed success is due to how continually the network adds new message codes to transmit different kinds of financial transactions. In other words, it’s constantly adapting to new financial needs and fintech processes. This makes it the most reliable, flexible, and functional system for international wire transfers on the planet.

How many characters are in a Swift code?

A unique SWIFT code is comprised of 8 or 11 characters. Other names for this same code include:

What does Swift do?

What the SWIFT system has done is make it faster, cheaper and far more reliable for banks to communicate instructions to each other. That ultimately means less expensive transfers for customers and less chance of something going wrong. Member banks are known and trusted quantities.

What was the system used before Swift?

Before SWIFT codes were instituted, most banks used a system called TELEX. TELEX is something that will be familiar to most people who were in an office environment before the Internet was a regular part of daily life.

What is a Swift code?

SWIFT codes are used by member banks to send instructions to each other that relate to funds transfers. Each bank has a unique code made up of letters and numbers. Once the instruction is loaded into the SWIFT system, it is conveyed to the other institution.

What does it mean when you get a wrong Swift code?

Getting a SWIFT code wrong can mean delays in your funds transfer, or even your money not being sent or received at all.

Does orbitremit have a money transfer system?

We hope you’ve enjoyed this look inside the SWIFT system. If you’re interested in making an international money transfer you may be pleasantly surprised to find that OrbitRemit’s money transfer system can offer better rates and lower fees than your bank – check out our calculator on this page to see how much a funds transfer with us can help you save.

What is SWIFT a member of?

The Society for Worldwide Interbank Financial Telecommunication, Societe Cooperative a Responsabilite Limitee (limited co-operative society) (“SWIFT”) is a member-owned co-operative. SWIFT provides a telecommunication platform for the exchange of standardized financial messages between financial institutions and corporations. SWIFT is neither a payment system nor a settlement system though the SWIFT messaging standard is used in many payment and settlement systems. SWIFT’s customers include banks, market infrastructures, broker-dealers, corporates, custodians, and investment managers. SWIFT is subject to oversight by the central banks of the Group of Ten countries.

What is SIA in banking?

The Italian Interbank Company for Automation (SIA), established in 1977 by CIPA (Convenzione Interbancaria per i Problemi dell’Automazione), has the objective of providing operational support for the Italian banking system’s automation projects. It manages the national interbank network (RNI) and is responsible for the development and operation of an integrated system of services and procedures which constitute the technological platform supporting the payment system and the financial market. Recently, a project to integrate the RNI in SWIFT was launched given the convergence of network systems towards internet protocols. At the beginning of 2000 the Bank of Italy completed the disposal of its stake in the SIA, which in 1999 had merged with CED-Borsa (a software company which manages stock exchange trading systems), thereby integrating the management of IT systems in market and settlement systems.

Is Swift a payment system?

SWIFT is neither a payment system nor a settlement system though the SWIFT messaging standard is used in many payment and settlement systems. SWIFT’s customers include banks, market infrastructures, broker-dealers, corporates, custodians, and investment managers. SWIFT is subject to oversight by the central banks of the Group of Ten countries.

Is CLS Bank regulated?

As an Edge Act corporation, CLS Bank is regulated and supervised in the US by the Federal Reserve. In the United Kingdom, HM Treasury has specified CLS Bank as a recognized payment system, and it is subject to regulation by the BoE. CLS is a “user-owned” financial market utility used to mitigate settlement.