What is the claim settlement ratio of Aegon life insurance?

The claim settlement ratio of 98.01% is the indicator of the number of death claims settled by Aegon Life Insurance against the total claims of 351 reported for FY 2019-20.

What does the claim settlement ratio (CSR) rank signify?

The Claim Settlement Ratio (CSR) rank signifies the position, Where Aegon Life Insurance Company lies. With respect to other life insurers in the industry from the financial year 2015-16 to 2019-20. The claim settlement percentage attained by Aegon Life Insurance Co. Is the basis of the rank identified in the respective financial years?

Why choose Aegon life insurance?

Aegon Life Insurance ensures complete transparency ensures that there are no problems caused during the claim settlement process. The policyholder/claimant can intimate the claim online at the Aegon Life Insurance website. Aegon Life has a 3 step hassle-free claim settlement process. The process is as follows:

What is claim settlement ratio of Aegon Life Insurance?

^As per the latest annual audited figures, Individual Death Claim Settlement ratio for FY 2021-22 is 99.03%.

Which company has highest claim settlement ratio?

The highest claim settlement ratio is of the public insurance company LIC at 98.31%.

What is the claim settlement ratio of Religare health insurance?

When it comes to health insurance, Religare Health had a claims settlement ratio of 92.58 percent for FY19.

Is Aegon good for life insurance?

0.5 4.0/5 "Great!" AEGON LIFE is the insurance provider where I have taken the life insurance and the premium is of 5K approx and they provide the sum assured as 55Lakh. It is the TERM PLAN taken with this and I am using it from 2006. Overall service and the customer service is good.

Which insurance is easy to claim?

Insurance CompaniesClaim Settlement RatioIncurred Claim Ratio ( 2019-2020)Reliance Health Insurance100%89.36%Star Health Insurance90%65.91%SBI Health InsuranceN/A50.54%Tata AIG Health Insurance96%66.61%20 more rows

Which is the No 1 general insurance company in India?

General Insurance Corporation of IndiaTop General Insurance Companies in India 2020NoCompanies NameSecurity Code1General Insurance Corporation of India5407162ICICI Lombard General Insurance Company Ltd5407553The New India Assurance Company Ltd540769Apr 18, 2022

What is a good claim settlement ratio?

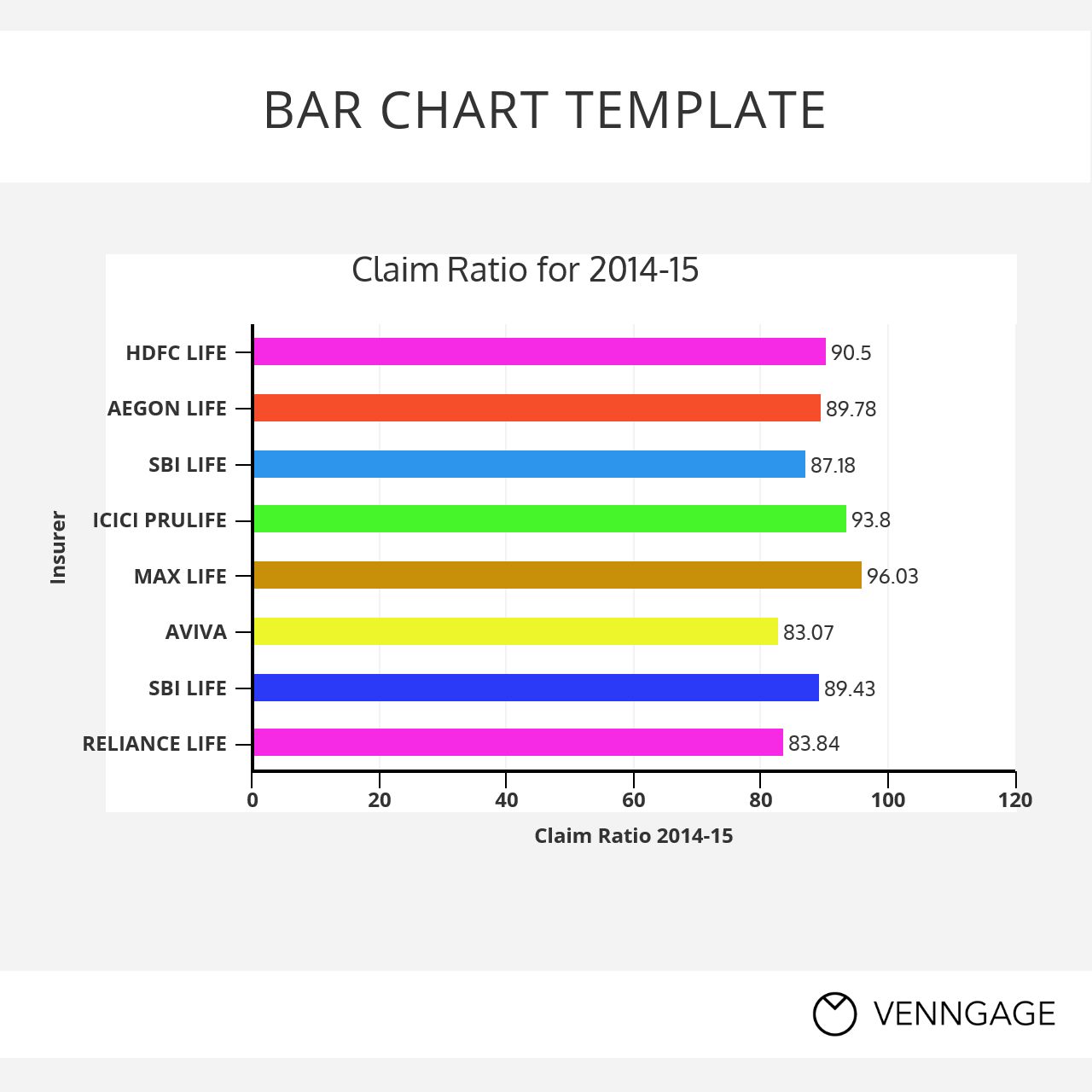

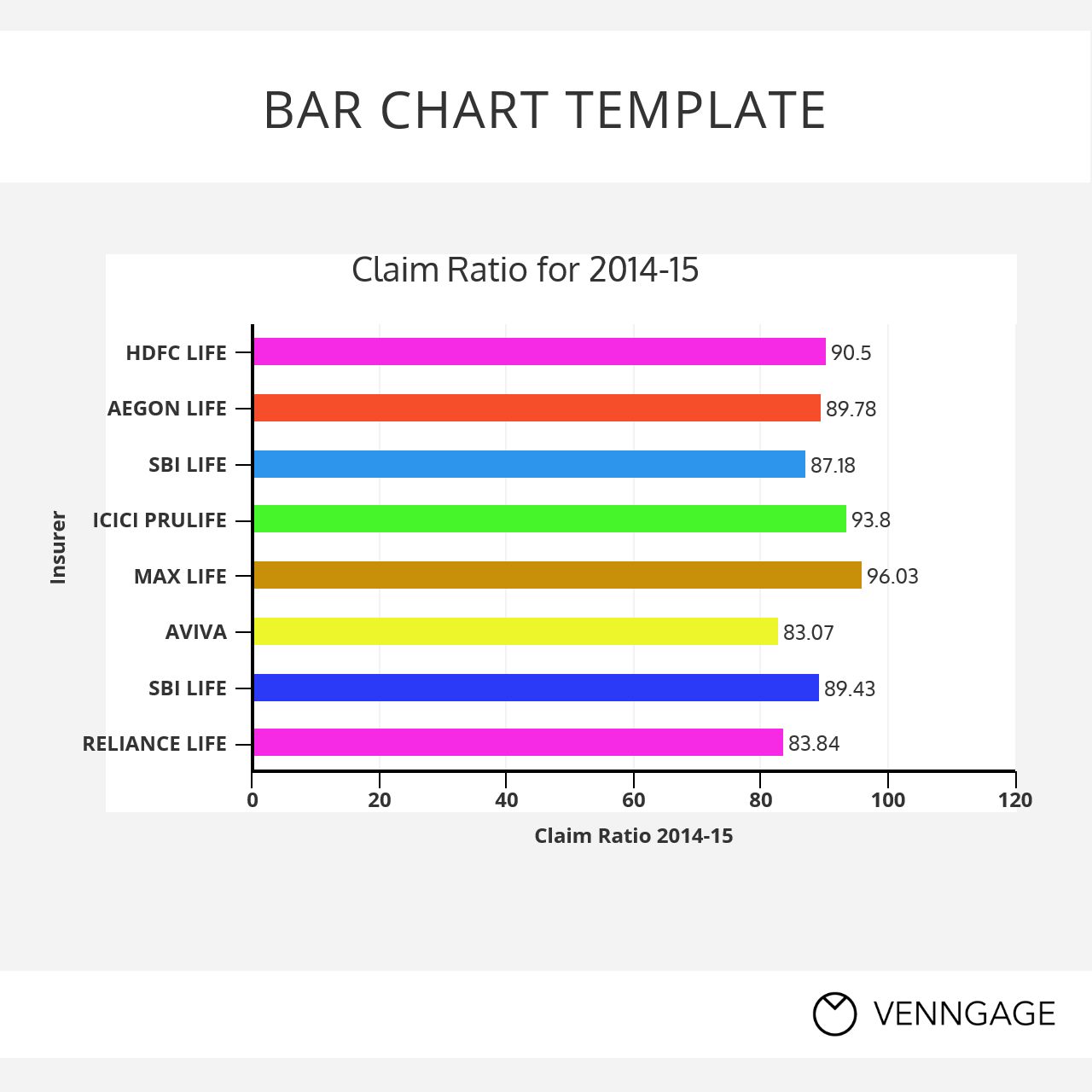

The CSR higher than 80% is a good claim settlement ratio. If a company of more than 90% CSR is offering a great value product, it is more than welcome. Also look at the average claim settlement time taken but the company. This is a great indicator of the process efficiency of the company.

Which are the top 5 health insurance companies on the basis of claim settlement ratio?

Best Health Insurance Companies In 2021 Based On Claim Settlement RatioIFFCO Tokio General Insurance. 96.33% ... Care Health Insurance. 95.47% ... Magma HDI Health Insurance. 95.17% ... The Oriental Insurance Company. 93.96% ... New India General Insurance. ... Bajaj Allianz General Insurance. ... Max Bupa Health Insurance. ... Navi General Insurance.More items...•

What is the claim settlement ratio of Tata AIG?

Tata AIG has a claim settlement ratio of 96.43% for FY 2020-21. Tata AIG offers a variety of health insurance plans: Individual health insurance plans. Family health insurance plans.

How big is Aegon?

Aegon N.V. is a Dutch multinational life insurance, pensions and asset management company headquartered in The Hague, Netherlands. As of July 21, 2020, the company had 26,000 employees.

What companies does Aegon own?

Aegon has businesses in Europe, Asia and the Americas. Our main brands are Aegon and Transamerica. Aegon offers products and services in the life insurance, pension, retirement and asset management fields. We innovate on a continual basis, following trends and customer needs in the markets in which we operate.

How is Aegon term plan?

Aegon Life Term Insurance Plan There are two death benefit options in the plan. Under the first option, the Sum Assured is paid. Under the second option, 50% of the Sum Assured is paid immediately on death while the remaining Sum Assured is paid at 3% every month for the next 5 years.

Who is the top five insurance company?

The five largest homeowners insurance companies in the U.S. are State Farm, Allstate, USAA, Liberty Mutual, and Farmers.

Who is the biggest insurance company?

Prudential Financial was the largest insurance company in the United States in 2019, with total assets amounting to just over 940 billion U.S. dollars. Berkshire Hathaway and Metlife secured second and third place, respectively.

What insurance company makes the most money?

Top 10 Most Profitable Insurance Companies in 2020Berkshire Hathaway. $81.4B.MetLife. $5.9B.State Farm. $5.6B.Allstate. $4.8B.Prudential. $4.2B.USAA. $4B.Progressive. $4B.MassMutual. $3.7B.More items...•

Which is the biggest insurance company in India?

January 2022RankCompanyGross Premiums Written1Life Insurance Corporation of India55,068,7792SBI Life Insurance Company Ltd.6,862,2073General Insurance Corporation of India6,419,8144HDFC Life Insurance Co. Ltd.5,268,5765 more rows

What happens after Aegon Life settles a claim?

After the documents have been submitted and assessed for the claim to be settled a claim decision is made by Aegon Life and the claim amount is released in the favour of the beneficiary through mentioned payment mode.

What happens after Aegon Life Insurance is assessed?

After the required documents and forms have been assessed by the claims department at Aegon Life Insurance the claim decision has been made the sum assured and any other rider/benefit amount is released to the claimant/beneficiary.

Does Aegon Life Insurance have a claim settlement process?

Aegon Life Insurance provides an easy and quick claim settlement process. The insurance company allows you to settle a claim both online as well as offline. The insurer featured a high claim settlement ratio of 98.01% in the FY 2019-2020. Aegon Life Insurance ensures complete transparency ensures that there are no problems caused during the claim settlement process.

What is the importance of a detailed study of the claim settlement ratio?

Making a detailed study of the claim settlement ratio of a company is a must. It is also necessary to ensure that the increase in the ratio is subtle and not drastic.

What is claims ratio?

The claims ratio of any company is always calculated as a percentage. The higher the percentage, the better is the reputation of the company for settling the claims of the customers.

How to calculate number of claims denied?

The number of claims denied will be calculated by subtracting the ratio from 100.

How to calculate claims ratio?

The claims ratio is a percentage calculated by dividing the number of claims closed in a company in a year by the total number of claims that the company receives.

How long does it take to process a claim?

Ans: It usually takes seven business days to process a claim if all the documentation is in order.

Is it good to check the claim settlement ratio of an insurance company before planning and investing in it?

It is always good to check the claim settlement ratio of an insurance company before planning and investing in it. A customer may use the above formula to calculate the same or check the list issued by IRDAI.

Is it safer to invest in insurance companies with a higher claim settlement ratio?

At the end of each financial year, the Insurance Regulatory and Development Authority releases a list of the claims settlement ratios of various insurance companies. It is always safer to invest in companies that have a higher claim settlement ratio.