The final settlement statement will include the total settlement amount and a detailed breakdown showing how your proceeds will be disbursed. The settlement statement should account for every dollar received and every dollar disbursed in your settlement. View our Final Settlement Statement Example.

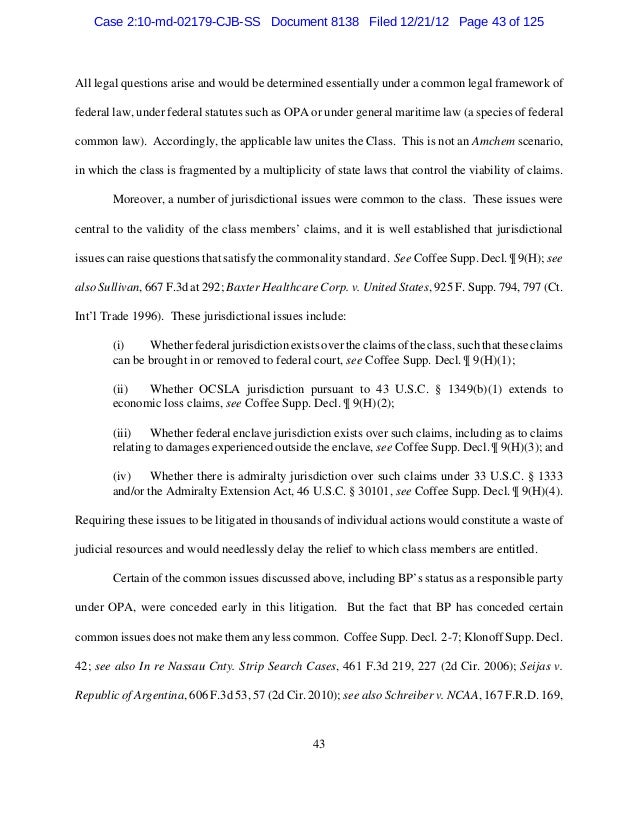

What is a final settlement statement for closing?

The final settlement statement breaks down all the numbers for the transaction. For more information on closing disclosures, see the Consumer Financial Protection Bureau. A lot of numbers go into the closing process. The closing settlement statement is your document of truth for all the charges related to your closing.

What is a settlement statement in real estate?

The statement also has a good faith estimate. The settlement statement lists all charges and credits to both the buyer and the seller in a property or real estate settlement. Some of these costs include loan origination fees, closing costs, and appraisal fees. Here’s Investopedia’s definition of a Settlement Statement .

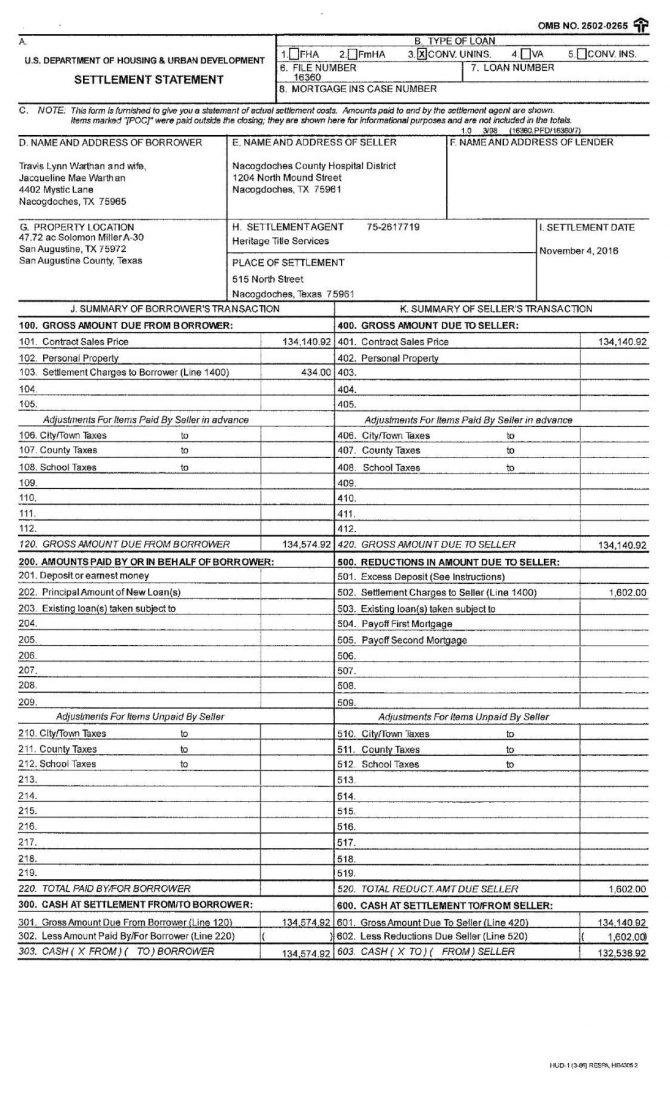

What is a HUD settlement statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What should I do if I have a question about settlement statements?

If you have a question about your settlement statement, HomeLight always encourages you to reach out to your own advisor. It’s the moment when you can’t bear to see another piece of paper related to your home sale that you’ll receive the settlement statement — also known as a closing statement in real estate.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is a final closing statement?

DEFINITION. A closing statement is a written record of the terms of a loan or other financial transaction, disclosing the final terms of an agreement.

Is a closing statement the same as a closing disclosure?

A closing statement or credit agreement is provided with any type of loan, often with the application itself. A seller's Closing Disclosure is prepared by a settlement agent and lists all commissions and costs in addition to the net total to be paid to the seller.

What is a settlement statement used for?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What happens at settlement for the seller?

At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged. Your conveyancer or solicitor can check and negotiate the settlement period with the seller.

Why do you do a final walk through when buying a house?

The final walkthrough is typically completed after the seller has moved out and allows the buyer to confirm that agreed-upon repairs have been made, and that there are no new issues. Essentially, the final walkthrough allows home buyers to do one last check.

Who typically prepares the closing statement?

Typically, closing agents are real estate attorneys, title companies or escrow officers. Unlike the HUD-1, which closing agents generally provided to buyers and sellers on the day of a real estate closing, closing statements must be issued at least three business days before closing.

How many days before the closing must the closing disclosure be delivered?

three business daysYour lender is required to send you a Closing Disclosure that you must receive at least three business days before your closing. It's important that you carefully review the Closing Disclosure to make sure that the terms of your loan are what you are expecting.

Is a settlement date the same as a closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

What form contains a settlement statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance. If you applied for a mortgage on or before October 3, 2015, or if you are applying for a reverse mortgage, you receive a HUD-1.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

How do you write a settlement statement?

A settlement agreement should be in writing....Those requirements include:An offer. This is what one party proposes to do, pay, etc.Acceptance. ... Valid consideration. ... Mutual assent. ... A legal purpose.A settlement agreement must also not be "unconscionable." This means that it cannot be illegal, fraudulent, or criminal.

What is a closing statement example?

An example of a closing argument is the lawyer opening with a statement, "How can my client be in two places at once?". The lawyer could then incorporate the theme of an alibi, arguing that the defendant could not have possibly committed a crime because they weren't even in the country when the crime took place.

What should a closing statement contain?

A closing statement is a form used in a real estate transaction that includes an itemized list of all the buying or selling costs associated with that transaction. It's a standard element of home sales, especially those that involve mortgages, and refinancings.

What is a closing statement in court?

At the end of the trial, you and the prosecution will each get the opportunity to make closing submissions. Closing submissions allow both parties to summarise the evidence presented in court in order to persuade the judge to decide the case in their favour.

What is a closing statement in a disciplinary hearing?

Closing arguments are crucial to confirm your version and at the same time refute the version of your opponent. The main purpose of closing arguments is to sensibly summarise your matter by focusing on all the facts that were proven in your favour during the hearing/arbitration by confirming the facts.

What is a Final Settlement Statement?

Before you can actually receive any money, however, you will meet with your attorney or insurance adjuster to discuss the settlement agreement and how the proceeds will be disbursed. Generally speaking, your attorney will have a final settlement statement prepared that will explain where each and every dollar and cent came from and where it will be going.

What is the recovery section of a personal injury settlement?

Generally, this will consist of the amount paid by the at-fault party’s insurance and any medical payment coverage (MedPay) your attorney has received on your behalf. Section 1 also includes a Total Recovery section. The total recovery amount is the final amount that has been received for your personal injury settlement in lump sum. Also, please note that no reductions have been taken yet. The Total Recovery section reflects the Gross Recovery. In other words, attorney’s fees, liens and advanced costs have not been subtracted from this amount.

What is the second section of Medpay?

The second section, identified as “Medical Payments (Flat Fee),” under Section 2 is the flat fee amount the attorney charged for the collection of each available MedPay. In North Carolina, an attorney may only charge a reasonable flat fee for the collection of each available MedPay. Here, the attorney charged a flat fee of $200. That amount will be deducted from the total recovery amount found in Section 1.

What is a Settlement Statement?

The settlement statement, also known as the closing statement, is a legal document that outlines what a buyer needs to pay to the seller or vendor on settlement. The statement also has a good faith estimate. The settlement statement lists all charges and credits to both the buyer and the seller in a property or real estate settlement.

Meet some of our Real Estate Lawyers

Possesses extensive experience in the areas of civil and transactional law, as well as commercial litigation and have been in practice since 1998. I addition I have done numerous blue sky and SEC exempt stock sales, mergers, conversions from corporations to limited liability company, and asset purchases.

What is a settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

How does a settlement statement work?

Every real estate transaction requires a settlement statement of some kind. It is used in home purchases and refinances, as well as all-cash transactions, reverse mortgages and commercial and investment property sales.

What can I expect to see on my settlement statement?

Several items are listed and organized within a settlement statement, including:

Next steps

Upon receipt of a closing disclosure or HUD-1 settlement statement, “it’s safe to say that you are at the tail end of the process,” Moreira says. It’s crucial to review this document carefully to ensure all costs are accurate.

Does the seller get a closing statement?

Buyers tend to sign the bulk of the paperwork at closing, making some sellers wonder if they will even receive a settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

How many pages are in a settlement statement?

The settlement statement consists of two pages and is read from the second page to the first page, which shows the final amounts. It is divided into two columns, one for the buyer and one for the seller. Fees are grouped together according to what they cover and who is charging the fee. The statement’s final numbers must balance; the buyer’s credits and debits have to equal the seller’s total amount, according to the California Land Title Association.

What is HUD-1 Settlement Statement?

The Real Estate Settlement and Procedures Act, or RESPA, mandates that the HUD-1 settlement statement is used for all real estate closings, according to the U.S. Department of Housing and Urban Development. The HUD-1 shows an itemized list of charges for both the buyer and the seller.

What is the first section of fees?

At the top of the second page, the first section of fees contains the commissions paid to the real estate companies, as well as how the commissions are split. The next three sections include all charges related to the buyer’s loan, and even include fees that have already been paid by the buyer prior to closing.

What is settlement statement?

A settlement statement is the statement that summarizes all the fees and charges that both the home-buyer and seller face during the settlement process of a housing transaction. The table below gives further explanation as to what these fees and charges are for both buyer and seller.

What is a mortgage payoff?

Mortgage Payoff. The payoff amount is sent to the existing mortgage company and includes additional interest a few days beyond closing. Title Insurance (Owner’s Policy) Typically paid for by the seller, however the contract gives the option for either buyer or seller to pay.

When Is a HUD-1 Used in 2020?

The HUD-1 settlement statement is still used in 2020 for reverse mortgages. These types of mortgages are very popular with sellers over the age of 62 who want to pull equity out of their homes. 4

When Is the HUD-1 Distributed?

Before October 3, 2015, RESPA stated that borrowers should be given a copy of the HUD-1 at least one day prior to settlement. 5 However, entries could easily still be coming in, right up until a few hours before closing.

What is line 902 on a mortgage?

Line 902 shows mortgage insurance premiums that are due at settlement. Escrow reserves for mortgage insurance are recorded later. It should be noted here if your mortgage insurance is a lump sum payment that's good for the life of the loan.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What is line 903 used for?

Line 903 is used to record hazard insurance premiums that must be paid at settlement to have immediate insurance coverage on the property. It's not used for insurance reserves that will go into escrow.

What is HUD-1 form?

The statutes of the Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federally related mortgage loans. 2.

When did the closing disclosure change?

Borrowers began receiving a form called the Closing Disclosure instead of a HUD-1 for most kinds of mortgage loans after October 2015. The change was in response to the TILA RESPA Integrated Disclosures, or simply TRID, which overhauled the way mortgages are processed and disclosed. 3.

What information is provided on a HUD-1 Settlement Statement?

Aside from the basic details of the involved parties, consisting of the buyer and seller , the lender , property details and settlement agent details, unsurprisingly the majority of the settlement statement consists of figures. Lots of figures.

Where is my closing credit?

Usually this credit will be given on the first page of the respa, buyers side, indicating that the amount being credited is being added to the amount the Buyer has to use, therefore, a check will not be given to the Buyer at the time of the closing.

What is title insurance?

A title insurance policy is a mandatory insurance policy taken out when you are taking out a mortgage. The philosophy behind it is that there are issues that can arise relating to the title ownership of the land. Be it, problems with the past deeds, i.e. missing signatures or invalid information or more extreme issues like the detection of fraud relating to the title ownership of land. The title insurance is there to protect you up to the value of the policy when something does go wrong. And bear in mind, since humans are involved – things do go wrong.

Why are the values between the GFE and final HUD figures different?

Many times the GFE and the final HUD figures do indeed differ from each other. The GFE figures are presented by a lender within 3 days of applying for ta loan. In many instances, these figures may increase or decrease. Many of these GFE disclosures cannot exceed a 10% tolerance given by the bank. Unless they are figures that can be shopped for, any tolerance of over 10% must be reduced by the Lender to adhere to the 10% tolerance level.

What is HUD-1 form?

The HUD-1 form, often also referred to as a “ Settlement Statement ”, a “ Closing Statement ”, “ Settlement Sheet ”, combination of the terms or even just “ HUD ” is a document used when a borrower is lent funds to purchase real estate. Another acronym used in relation to the HUD form is GFE, which means ‘ Good Faith Estimate ’.

What is a RESPA?

Another term linked with the HUD is RESPA. RESPA is an acronym for Real Estate Settlement Procedures Act and represents a set of legislative statutes relating to real estate transactions put in place by the government to enforce disclosure of charges and fees to the consumer.

What is an adjustment for items paid in advance?

Adjustments for items paid in advance by the seller primarily calculated from taxes paid. Amounts paid for by or in behalf of the borrow, and reductions in the amount due to the seller. Adjustments for items unpaid by the seller. Cash at settlement due from or to the buyer and seller.

What Is A Final Settlement Statement?

Section 1 – Recovery

- Section 1, labeled “Recovery,” on the final settlement statement covers the total recovery amount received from the various sources, if applicable. This section will include all the money received for your accident claim. Generally, this will consist of the amount paid by the at-fault party’s insurance and any medical payment coverage (MedPay) your attorney has received on your be…

Section 2 – Less Attorney’s Fees

- Section 2, labeled “Less Attorneys Fees,” on the final settlement statement includes the amount that will be deducted for attorney’s fees as agreed upon by you and your attorney in your retainer agreement. This amount, the attorney’s fees, will be deducted from total recovery identified in Section 1. Under Section 2, you will see two separate amounts for attorney’s fees in this exampl…

Section 3 – Deductions For Bill and Liens

- Section 3, labeled as “Deducted and Retained to Pay Others,” on the final settlement statement covers the amount that will be deducted for any bills, liens or assignments attached to your personal injury recovery. Generally, medical providers and certain health insurance plans such as Medicare and Medicaid will have a lien on your settlement. These liens must be paid with the pr…

Section 4 – Costs Advanced

- Section 4, labeled as “Costs Advanced,” on the final settlement statement covers the amount that will be deducted for any advancement costs your attorney may have had to pay for your personal injury case. Generally, these costs are relatively low and usually include costs of postage and records. These cost are deducted from your portion of the settlement amount. Thus, here the $9…

Section 5 – Client Recovery

- Section 5, labeled as “Net Recovery to Client,” on the final settlement statement covers your share of the settlement proceeds. This section is most important to you because it is the actual amount you will take home. In other words, your attorney will hand you a check for this amount at the conclusion of your meeting. Here, the client will receive a check for $15,988.05 from his attor…