Does the rebate appear on the hud-1/settlement statement?

Does the rebate appear on the HUD-1 Settlement Statement? Yes, we work with the closing attorney and your lender from the beginning of the transaction to make sure that your rebate is accounted for properly.

How to properly record a HUD settlement?

- Deposit made by the buyer

- The loan amounts

- The amount owed by the seller to the buying party is a credit entry and must record. ...

- Property tax and assessment pro-ration credits from seller to the buyer of the HUD Settlement Statement

- Lastly, any additional credits to the buyer will be entered here from any source, if not from the seller

What is an Alta/Closing Disclosure/HUD-1 statement?

ALTA Settlement Statements are used in conjunction with the HUD-1 settlement statement. Under the new CFPB regulations, most real estate transactions require the use of the new Closing Disclosure Form. However, the HUD-1 settlement statement is still used in certain cases such as: Home equity revolving lines of credit.

Is the settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry. What’s the difference between a Closing Disclosure and settlement statement?

Is a HUD-1 the same as a closing statement?

The HUD-1 form, often also referred to as a “Settlement Statement”, a “Closing Statement”, “Settlement Sheet”, combination of the terms or even just “HUD” is a document used when a borrower is lent funds to purchase real estate.

What is the purpose of a HUD-1 statement?

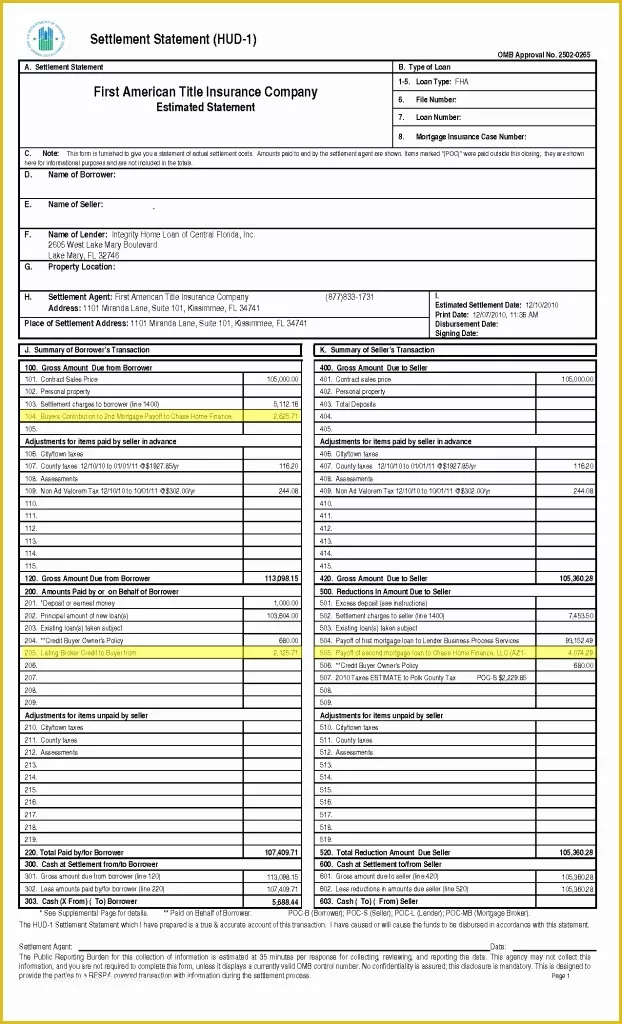

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

Is a HUD-1 a settlement statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance. If you applied for a mortgage on or before October 3, 2015, or if you are applying for a reverse mortgage, you receive a HUD-1.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What replaced the HUD-1 settlement?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

What happened to the HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

Where can I find my HUD-1?

HUD-1 Forms | HUD.gov / U.S. Department of Housing and Urban Development (HUD)

How do I get my HUD payoff statement?

Requests for payoff statements, subordinations, releases, and other documentation specific to these programs can be submitted to:Payoff Requests: [email protected] Requests: [email protected] Requests: [email protected] Partial Claim document submittal: [email protected] items...

Who prepares the HUD settlement statement?

A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts the closing on the creditor's behalf.

What is a settlement statement for taxes?

The HUD-1 Settlement Statement is a breakdown of the expenses home sellers and homebuyers incur in a real estate sale. The settlement statement gives both parties a full picture of the expenses attached to the transaction.

How do you read a HUD statement?

Look at the first page of the HUD statement. Look over the basic details in Part B, such as your name, the seller's name and the property address. Read sections J and K, which give a summary of the total amounts owed from or due to the borrower or seller.

What is a HUD-1 settlement statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement , details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

How long do you have to give a closing disclosure?

In contrast, lenders must give you a closing disclosure three days before closing. Everyone taking out a HELOC, reverse mortgage or manufactured home loan should ask their lender for the HUD-1 document at least a day before closing to allow time to review the contents, fix errors and raise questions with the lender.

What is section 300?

No. 5 (Section 300): Cash at settlement from/to borrower. This section explains if you need to bring cash to the settlement. In most cases, the closing costs for a reverse mortgage refinance or HELOC will be subtracted from the loan, so you don’t need to bring funds to the closing.

What is a HELOC loan?

A HELOC is a mortgage-based line of credit that works much like a credit card. It allows you to pull from your home’s existing equity (or the value of the home that you own, compared to what you still owe to your lender) on a revolving basis.

How long does it take to pay down a HELOC?

You can borrow as much as you need up to your maximum loan amount, then pay it down to zero as many times as necessary during a set draw period that usually ends after 10 years.

How long does a HELOC loan last?

This revolving product has a set draw period that usually ends after 10 years. After the draw period is over, you pay the remaining balance in fixed payments until it is paid in full.

What is HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

What is a HUD-1?

The HUD-1 (or a similar variant called the HUD-1A) is used primarily for reverse mortgages and mortgage refinance transactions. The reference to 'HUD' in the form's name refers to the Department of Housing and Urban Development . Federal regulations require that unless its use is specifically exempted, either the HUD-1 or the HUD-1A, ...

What is the HUD-1A used for?

Federal regulations require that unless its use is specifically exempted, either the HUD-1 or the HUD-1A, as appropriate, must be used for all mortgage transactions that are subject to the Real Estate Settlement Procedures Act.

When do you need to inspect a HUD-1?

The settlement agent must permit the borrower to inspect the HUD-1 or HUD-1A settlement statement, completed to set forth those items that are known to the settlement agent at the time of inspection, during the business day immediately preceding settlement. Items related only to the seller's transaction may be omitted from the HUD-1.

Is a HUD-1 exempt from the Truth in Lending Act?

The TRID rule mandates the use of a Closing Disclosure form instead. The use of the HUD-1 or HUD-1A is also exempted for open-end lines of credit (home -equity plans) covered by the Truth in Lending Act and Regulation Z. A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts ...

What information is provided on a HUD-1 Settlement Statement?

Aside from the basic details of the involved parties, consisting of the buyer and seller , the lender , property details and settlement agent details, unsurprisingly the majority of the settlement statement consists of figures. Lots of figures.

What is HUD-1 form?

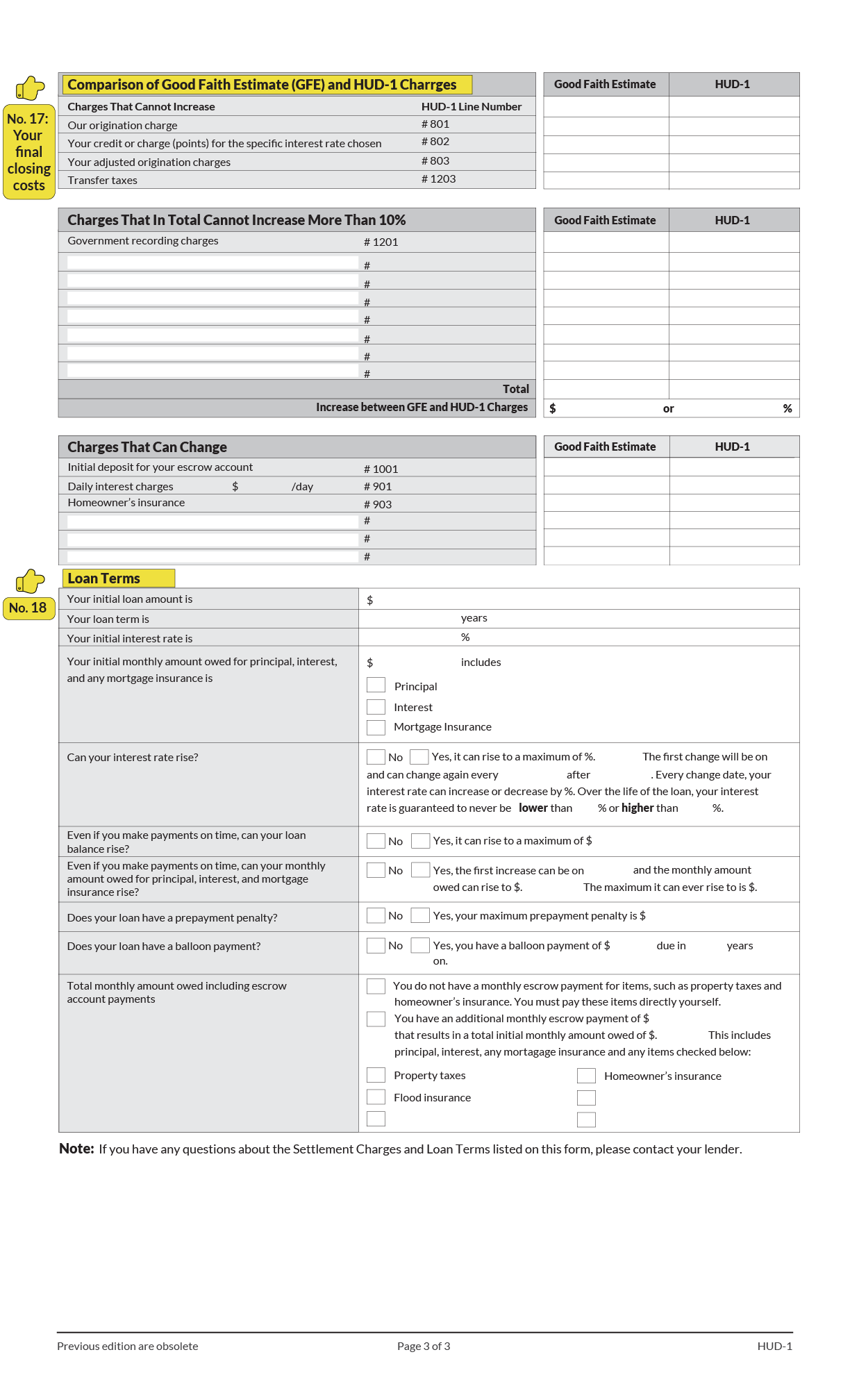

The HUD-1 form, often also referred to as a “ Settlement Statement ”, a “ Closing Statement ”, “ Settlement Sheet ”, combination of the terms or even just “ HUD ” is a document used when a borrower is lent funds to purchase real estate. Another acronym used in relation to the HUD form is GFE, which means ‘ Good Faith Estimate ’.

When will be my first mortgage payment?

An example is if the closing is September 15, the first mortgage payment will not be until November 1. The November 1st payment will represent the principal and interest for October. The interest from Sept 15-Sept 30 will be prepaid on the closing date.

Why are the values between the GFE and final HUD figures different?

Many times the GFE and the final HUD figures do indeed differ from each other. The GFE figures are presented by a lender within 3 days of applying for ta loan. In many instances, these figures may increase or decrease. Many of these GFE disclosures cannot exceed a 10% tolerance given by the bank. Unless they are figures that can be shopped for, any tolerance of over 10% must be reduced by the Lender to adhere to the 10% tolerance level.

What is a RESPA?

Another term linked with the HUD is RESPA. RESPA is an acronym for Real Estate Settlement Procedures Act and represents a set of legislative statutes relating to real estate transactions put in place by the government to enforce disclosure of charges and fees to the consumer.

What is HUD 1?

HUD is an acronym for Housing and Urban Development, and represents the arm of the U.S. government department responsible for legislation relating to home ownership and property development within the United States of America. The HUD-1 form, often also referred to as a “ Settlement Statement ”, a “ Closing Statement ”, “ Settlement Sheet ”, ...

What is an adjustment for items paid in advance?

Adjustments for items paid in advance by the seller primarily calculated from taxes paid. Amounts paid for by or in behalf of the borrow, and reductions in the amount due to the seller. Adjustments for items unpaid by the seller. Cash at settlement due from or to the buyer and seller.

What is HUD-1 statement?

The settlement agent shall use the HUD-1 settlement statement in every settlement involving a federally related mortgage loan in which there is a borrower and a seller. For transactions in which there is a borrower and no seller, such as refinancing loans or subordinate lien loans, the HUD-1 may be utilized by using the borrower's side of the HUD-1 statement. Alternatively, the form HUD-1A may be used for these transactions. The HUD-1 or HUD-1A may be modified as permitted under this part. Either the HUD-1 or the HUD-1A, as appropriate, shall be used for every RESPA-covered transaction, unless its use is specifically exempted. The use of the HUD-1 or HUD-1A is exempted for open-end lines of credit (home-equity plans) covered by the Truth in Lending Act and Regulation Z.

Who completes HUD-1?

The settlement agent shall complete the HUD-1 or HUD-1A, in accordance with the instructions set forth in appendix A to this part. The loan originator must transmit to the settlement agent all information necessary to complete the HUD-1 or HUD-1A. (1) In general. The settlement agent shall state the actual charges paid by ...

Who must state the actual charges paid by the borrower and seller on the HUD-1?

The settlement agent shall state the actual charges paid by the borrower and seller on the HUD-1, or by the borrower on the HUD-1A. The settlement agent must separately itemize each third party charge paid by the borrower and seller.

Can HUD-1 be modified?

The HUD-1 or HUD-1A may be modified as permitted under this part. Either the HUD-1 or the HUD-1A, as appropriate, shall be used for every RESPA-covered transaction, unless its use is specifically exempted.

Why was the HUD-1 Settlement Statement required in 2010?

The reason behind all of these amendments and changes was to create more transparency and progress in consumer protection, which leads us into the 1986 HUD-1 Form.

What is HUD-1 form?

1986-2015: Prior to October 2015, the Settlement Statement was known as the HUD-1, which is a standard government form issued by the Closing Agent that lists all credits, charges and home loan terms for both the buyer and the seller in all real estate transactions that required a mortgage. The charges for both the borrower and seller were listed on the same form, with borrower charges on one side of the form and seller charges on the other.

What is RESPA disclosure?

RESPA requires different disclosures during different parts of the home closing process and also offers protection to consumers in areas including: Limiting the amount put into escrow for real estate charges. Allowing buyers to use their own title company and title insurance.

What is the real estate settlement procedure act?

1974: The Real Estate Settlement Procedures Act (RESPA) was created to help protect consumers from foul practices, forcing lending institutions to disclose settlement costs upfront. This act is enforced by the Consumer Financial Protection Bureau (CFPB) and includes all types of mortgages. RESPA requires different disclosures during different parts of the home closing process and also offers protection to consumers in areas including: 1 Limiting the amount put into escrow for real estate charges 2 Allowing buyers to use their own title company and title insurance 3 Prohibiting lenders from receiving a fee in exchange for a referral

What is the difference between HUD-1 and HUD-1?

Another big distinction between the Closing Disclosure and the HUD-1 is where the HUD-1 listed all terms, charges and credits for both the buyer and the seller, the Closing Disclosure has a separate form for the buyer as it does for the seller. This provides for more consumer protection at the closing table. Another change that came up ...

How long does a loan estimate need to be in the hands of the buyer before closing?

These two documents must be in the hands of the buyer at least 3 days prior to the closing date in order to find any errors or issues before closing. If certain changes are made to the disclosure, the 3-day waiting period starts over. This is one big change with the new TRID rules.

When did the HUD-1 change to the closing disclosure?

The Consumer Financial Protection Bureau (CFPB) took over administration from HUD and replaced the HUD-1 with the Closing Disclosure in October of 2015. It is similar to the HUD-1 in that it details the loan terms and costs, including the interest rates, closing costs, taxes, monthly payments, and more.