Face amount, also known as par value, is the amount that the bondholder will receive at maturity date assuming the issuer of the bond does not default. On the other hand, the settlement amount is the amount that the bondholder pays or receives for the face value; it accounts for the accrued interest, taxes and applicable fees.

What is the settlement date of a bond?

Definition of Bond Settlement Date. Bond Settlement Date means the date on which the Bond Investors pay the purchase price for the Bond/s in an aggregate amount at least equal to the Bond Issue Amount; Bond Settlement Date means the first date on which the Bonds are issued.

What is'bond valuation'?

What is 'Bond Valuation'. Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also known as its cash flow, and the bond's value upon maturity, also known as its face value or par value.

What is settlement price in trading?

A settlement price, typically used in the derivatives markets, is the price used for determining profit or loss for the day, as well as margin requirements. The settlement price is the average price at which a contract trades, calculated at both the open and close of each trading day,...

How do I calculate the value of my paper savings bonds?

Calculate the Value of Your Paper Savings Bond (s) Calculate the value of a bond based on the series, denomination and issue date entered. Store savings bond information you enter so you can view it again at a later date. The Savings Bond Calculator WILL NOT: Verify whether or not you own bonds. Create a savings bond based on information...

What is bond valuation?

How are bonds valued?

What Is Duration and How Does That Affect Bond Valuation?

Why Is the Price of My Bond Different From Its Face Value?

How Are Convertible Bonds Valued?

What are the characteristics of a bond?

How to calculate fair value of a bond?

See 4 more

About this website

What does settlement value mean?

The settlement value of a variable payout contract is the amount of contract value remaining, based on whether it was bought or sold. The difference between the price at which the contract was bought or sold, and the settlement value, determines the profit or loss (excluding any applicable exchange fees).

What is minimum settlement amount in bonds?

The minimum settlement amount is the minimum volume of securities at par that is available for sale. This term is closely related to the terms "nominal" and "integral multiple".

What happens if you sell a bond before maturity?

If you sell a bond before it matures, you may not receive the full principal amount of the bond and will not receive any remaining interest payments. This is because a bond's price is not based on the par value of the bond. Instead, the bond's price is established in the secondary market and fluctuates.

What is bond par value?

One of the most important characteristics of a bond is its par value. The par value is the amount of money that bond issuers promise to repay bondholders at the maturity date of the bond. A bond is essentially a written promise that the amount loaned to the issuer will be repaid.

How do I find out how much my settlement is?

After your attorney clears all your liens, legal fees, and applicable case costs, the firm will write you a check for the remaining amount of your settlement. Your attorney will send you the check and forward it to the address he or she has on file for you.

How is settlement amount calculated?

To calculate settlement amounts, you must have a reliable total of expenses incurred as a result of the dispute....Look at your actual damages.Actual damages also may be referred to as economic damages, or as special damages. ... Typically, this amount will represent the lowest number of your settlement range.More items...•

Can you lose money if you hold a bond to maturity?

Treasury bonds are considered risk-free assets, meaning there is no risk that the investor will lose their principal. In other words, investors that hold the bond until maturity are guaranteed their principal or initial investment.

When should you sell bonds?

The most significant sell signal in the bond market is when interest rates are poised to rise significantly. Because the value of bonds on the open market depends largely on the coupon rates of other bonds, an interest rate increase means that current bonds – your bonds – will likely lose value.

Can I sell bonds at any time?

You can sell a bond before its maturity period. However, you cannot sell it at any time. For you to get the chance to cash in your bond at its current value, you must wait until it hits the one-year mark at least. But it would be best if you wait at least five years since you invested in it.

What is the difference between par value and market value of a bond?

The entity that issues a financial instrument assigns a par value to it. When shares of stocks and bonds were printed on paper, their par values were printed on the faces of the shares. Market value, however, is the actual price that a financial instrument is worth at any given time for trade on the stock market.

What does $1 par value mean?

For example, if you set the par value for your corporation's shares at $1, all purchasers of the stock must pay at least this amount for every share they purchase. If you purchase 10,000 shares, you'll have to pay at least $10,000 for them. If you pay only $5,000, you'll owe your corporation another $5,000.

Is par value same as face value?

Key Takeaways Par value refers to the "face value" of a security, and the terms are interchangeable. Par value and face value are most important with bonds, as they represent how much a bond will be worth at the time of the bond's maturity.

What is minimum settlement mean?

Definition. Minimum Settlement Unit (MSU) Defines the minimum quantity or nominal of a security for settlement. The value could be zero.

What is indicative settlement amount?

The “indicative settlement amount” is usually higher because it will include any accrued interest on the bond. What is accrued interest? If a bond pays interest in July and January and you bid in December, you will get a six-monthly interest in January, but you would have held the bond only for one month.

What are bond cancellation costs?

If your bond is relatively new, and you want to cancel it within the first two years of the loan agreement, you will also be liable for penalty interest of approximately 1% of the amount owing. This penalty will be applied once the house is sold and deducted from the proceeds of the sale.

How to calculate the present value of a bond — AccountingTools

A bond is a fixed obligation to pay that is issued by a corporation or government entity to investors. The issuer may have an interest in paying off the bond early, so that it can refinance at a lower interest rate.If so, it can be useful to calculate the present value of the bond. The steps to follow in this process are listed below. First, we need to use several assumptions as we work ...

Bond Valuation Calculator | Calculate Bond Valuation

Bond Valuation Definition. Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond. To use our free Bond Valuation Calculator just enter in the bond face value, months until the bonds maturity date, the bond coupon rate percentage, the current market rate percentage (discount rate), and then press the calculate button.

When is the settlement price determined?

The settlement price will be determined on the settlement date of a particular contract.

What Is the Settlement Price?

The settlement price, typically used in the mutual fund and derivatives markets, is the price used for determining a position's daily profit or loss as well as the related margin requirements for the position.

What happens if you own a call option with a strike price of $100?

If you own a call option with a strike price of $100 and the settlement price of the underlying asset at its expiration is $120, then the owner of the call is able to purchase shares for $100, which could then be sold for a $20 profit since it is ITM. If, however, the settlement price was $90, then the options would expire worthless since they are OTM.

How are settlement prices calculated?

Settlement prices are typically based on price averages within a specific time period. These prices may be calculated based on activity across an entire trading day—using the opening and closing prices as part of the calculation—or on activity that takes place during a specific window of time within a trading day.

Is the settlement price the same as the opening price?

While the opening and closing prices are generally handled the same way from one exchange to the next, there is no standard on how settlement prices must be determined in different exchanges, causing variances across the global markets.

How to calculate savings bond value?

The Savings Bond Calculator WILL: 1 Calculate the value of a paper bond based on the series, denomination, and issue date entered. (To calculate a value, you don't need to enter a serial number. However, if you plan to save an inventory of bonds, you may want to enter serial numbers.) 2 Store savings bond information you enter so you can view or update it later. HOW TO SAVE YOUR INVENTORY

Can a bond be cashed?

Guarantee a bond is eligible to be cashed.

What is settlement bond?

Settlement Bond means a bond issued to ASTC at the request of a Participant in accordance with Rule 4.9.1.

What happens if a company loses a settlement bond?

In the event of a loss of securities covered under this Settlement Bond, the COMPANY may, at its sole discretion, purchase replacement securities, tender the value of the securities in money, or issue its indemnity to effect replacement securities.

What is the amount of money deposited into the Tobacco Settlement Bond Proceeds Account?

Moneys All earnings on Fund investments shall be deposited into the Tobacco Settlement Bond Proceeds Account and the Tobacco Settlement Residual Account as provided by the terms of the Railsplitter Tobacco Settlement Authority Act, provided that an annual amount not less than $2,500,000, subject to appropriation, shall be deposited into the Tobacco Settlement Residual Account for use by the Attorney General for enforcement of the Master Settlement Agreement.

Where are the net proceeds of tobacco bonds deposited?

The net proceeds of bonds shall be deposited by the State in the Tobacco Settlement Bond Proceed s Account, and shall be used by the State (either directly or by reimbursement) for the payment of outstanding obligations of the General Revenue Fund or to supplement the Tobacco Settlement Residual Account to pay for appropriated obligations of the Tobacco Settlement Recovery Fund for State fiscal year 2011 through 2013.

Is the new UAL ORD settlement bond acceptable?

Pursuant to the Chicago Municipal Bond Settlement Order and the Chicago Municipal Bond Settlement Agreement, the New UAL ORD Settlement Bond documents shall be reasonably acceptable to Stark Investment LP.

How to calculate the value of a bond?

To calculate the value of a bond, add the present value of the interest payments plus the present value of the principal you receive at maturity. To calculate the present value of your interest payments, you calculate the value of a series of equal payments each over time.

What is the present value of a bond?

The present value of your bond is (present value of all interest payments) + (present value of principal repayment at maturity).

How to calculate discount rate?

Determine discount rate. Divide the discount rate required by the number of periods per year to arrive at the required rate of return per period, k. For example, if you require a 5% annual rate of return for a bond paying interest semiannually, k = (5% / 2) = 2.5%.

How long does IBM bond maturity?

IBM (the issuer) must repay the $1,000,000 to the investors at the end of 10 years. The bond matures in 10 years. The bond pays interest of ($1,000,000 multiplied by 6%), or $60,000 per year. Since the bond pays interest semiannually, the issuer must make two payments of $30,000 each.

What is an annuity?

An annuity is a specific dollar amount paid to an investor for a stated period of time. The interest payments on your bond are considered a type of annuity.

How to calculate the number of periods interest is paid over the life of a bond?

Calculate the number of periods interest is paid over the life of the bond, or variable n. Multiply the number of years until maturity by the number of times per year interest is paid. For example, assume that the bond matures in 10 years and pays interest semi-annually.

How to find the present bond value?

Add the present value of interest to the present value of principal to arrive at the present bond value. For our example, the bond value = ($467.67 + $781.20), or $1,248.87.

Why would a bond be sold at a higher price?

A bond could be sold at a higher price if the intended yield (market interest rate) is lower than the coupon rate. This is because the bondholder will receive coupon payments that are higher than the market interest rate, and will, therefore, pay a premium for the difference.

Why are bonds priced?

Bonds are priced to yield a certain return to investors. A bond that sells at a premium (where price is above par value) will have a yield to maturity that is lower than the coupon rate. Alternatively, the causality of the relationship between yield to maturity.

What happens when a bond is higher?

A bond with a higher yield to maturity or market rates will be priced lower. An easier way to remember this is that bonds will be priced higher for all characteristics, except for yield to maturity. A higher yield to maturity results in lower bond pricing.

What are the characteristics of bond pricing?

Bond Pricing: Main Characteristics. Ceteris paribus, all else held equal: A bond with a higher coupon rate will be priced higher. A bond with a higher par value will be priced higher. A bond with a higher number of periods to maturity will be priced higher.

How do zero coupon bonds earn interest?

Purchasers of zero-coupon bonds earn interest by the bond being sold at a discount to its par value. A coupon-bearing bond pays coupons each period, and a coupon plus principal at maturity. The price of a bond comprises all these payments discounted at the yield to maturity.

What is par value bond?

Each bond must come with a par value. Par Value Par Value is the nominal or face value of a bond, or stock, or coupon as indicated on a bond or stock certificate. It is a static value. that is repaid at maturity. Without the principal value, a bond would have no use. The principal value is to be repaid to the lender (the bond purchaser) ...

How does time to the next coupon payment affect the actual price of a bond?

Finally, time to the next coupon payment affects the “actual” price of a bond. This is a more complex bond pricing theory, known as ‘dirty’ pricing. Dirty pricing takes into account the interest that accrues between coupon payments . As the payments get closer , a bondholder has to wait less time before receiving his next payment. This drives prices steadily higher before it drops again right after coupon payment.

Fixed Income Valuation Example (Hills Inc.)

Consider Hills Inc., which is evaluating a bond that’s offering 5% coupons with a $1,000 par value and a five-year maturity.

Fixed Income Valuation (Alternative Example: Watson Plc)

Let’s move on now, and look at Watson Plc, which wants to issue 10,000 10 year 6% £100 bonds.

What Is a Settlement Date?

The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer. The settlement date for stocks and bonds is usually two business days after the execution date (T+2). For government securities and options, it's the next business day (T+1). In spot foreign exchange (FX), the date is two business days after the transaction date. Options contracts and other derivatives also have settlement dates for trades in addition to a contract's expiration dates .

What causes the time between transaction and settlement dates to increase substantially?

Weekends and holidays can cause the time between transaction and settlement dates to increase substantially, especially during holiday seasons (e.g., Christmas, Easter, etc.). Foreign exchange market practice requires that the settlement date be a valid business day in both countries.

How long does it take for a stock to settle?

Most stocks and bonds settle within two business days after the transaction date . This two-day window is called the T+2. Government bills, bonds, and options settle the next business day. Spot foreign exchange transactions usually settle two business days after the execution date.

How long does it take to settle a stock trade?

Historically, a stock trade could take as many as five business days (T+5) to settle a trade. With the advent of technology, this has been reduced first to T=3 and now to just T+2.

How far back can a forward exchange settle?

Forward foreign exchange transactions settle on any business day that is beyond the spot value date. There is no absolute limit in the market to restrict how far in the future a forward exchange transaction can settle, but credit lines are often limited to one year.

What is the settlement date of a bond?

Bond Settlement Date means the date on which the Bond Investors pay the purchase price for the Bond/s in an aggregate amount at least equal to the Bond Issue Amount;

What is standard settlement period?

Standard Settlement Period means the standard settlement period, expressed in a number of Trading Days, on the Company’s primary Trading Market with respect to the Common Stock as in effect on the date of delivery of a certificate representing Warrant Shares issued with a restrictive legend.

When will PRC bonds be redeemed?

If the purchase of the relevant PRC Bonds is not completed in accordance with the provisions of the relevant PRC Bond Purchase Instruction, the Issuer will redeem the Notes (in whole) on or before the date which falls 14 Business Days after such Bond Settlement Date (as defined in the relevant PRC Bond Purchase Instruction) at the relevant Early Redemption Amount on such date, to the extent of funds available therefor in accordance with the applicable Series Priority of Payments on such date.

What is a settlement date for a termination?

Termination Settlement Date means, for any Terminated Obligation, the date customary for settlement, substantially in accordance with the then-current market practice in the principal market for such Terminated Obligation (as determined by the Calculation Agent), of the sale of such Terminated Obliga tion with the trade date for such sale occurring on the related Termination Trade Date.

What is a cash settlement date?

Cash Settlement Date means, for each Financially Settled Futures Transaction, the Business Day determined by Exchange from time to time in accordance with industry practice for such Transaction, as posted on Exchange’s Website not less than one month prior to the occurrence of such date, other than Invoices issued as a result of a Contracting Party’s Default or under the Close- out Procedure which amounts require payment immediately;

How many days after the scheduled maturity date is a physical settlement?

Physical Settlement Date means the date (which may occur after the Scheduled Maturity Date) specified as such in the Intended Physical Settlement Notice falling 10 Business Days after the date of the Intended Physical Settlement Notice.

When was the master settlement agreement signed?

Master Settlement Agreement means the settlement agreement and related documents entered into on November 23, 1998, by the state and leading United States tobacco product manufacturers.

What is bond valuation?

Bond valuation is a way to determine the theoretical fair value (or par value) of a particular bond. It involves calculating the present value of a bond's expected future coupon payments, or cash flow, and the bond's value upon maturity, or face value. As a bond's par value and interest payments are set, bond valuation helps investors figure out ...

How are bonds valued?

Not exactly. Both stocks and bonds are generally valued using discounted cash flow analysis— which takes the net present value of future cash flows that are owed by a security. Unlike stocks, bonds are composed of an interest (coupon) component and a principal component that is returned when the bond matures. Bond valuation takes the present value of each component and adds them together.

What Is Duration and How Does That Affect Bond Valuation?

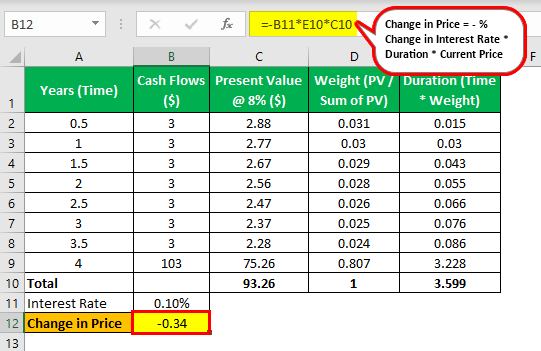

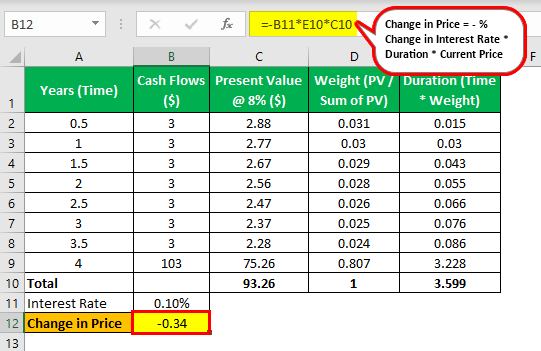

Bond valuation looks at discounted cash flows at their net present value if held to maturity. Duration instead measures a bond's price sensitivity to a 1% change in interest rates. Longer-term bonds have a higher duration, all else equal. Longer-term bonds will also have a larger number of future cash flows to discount, and so a change to the discount rate will have a greater impact on the NPV of longer-maturity bonds as well.

Why Is the Price of My Bond Different From Its Face Value?

This has to do with several factors including changes to interest rates, a company's credit rating, time to maturity, whether there are any call provisions or other embedded options, and if the bond is secured or unsecured. A bond will always mature at its face value when the principal originally loaned is returned.

How Are Convertible Bonds Valued?

At its most basic, the convertible is priced as the sum of the straight bond and the value of the embedded option to convert.

What are the characteristics of a bond?

A bond is a debt instrument that provides a steady income stream to the investor in the form of coupon payments. At the maturity date, the full face value of the bond is repaid to the bondholder. The characteristics of a regular bond include: 1 Coupon rate: Some bonds have an interest rate, also known as the coupon rate, which is paid to bondholders semi-annually. The coupon rate is the fixed return that an investor earns periodically until it matures. 2 Maturity date: All bonds have maturity dates, some short-term, others long-term. When a bond matures, the bond issuer repays the investor the full face value of the bond. For corporate bonds, the face value of a bond is usually $1,000 and for government bonds, the face value is $10,000. The face value is not necessarily the invested principal or purchase price of the bond. 3 Current price: Depending on the level of interest rate in the environment, the investor may purchase a bond at par, below par, or above par. For example, if interest rates increase, the value of a bond will decrease since the coupon rate will be lower than the interest rate in the economy. When this occurs, the bond will trade at a discount, that is, below par. However, the bondholder will be paid the full face value of the bond at maturity even though he purchased it for less than the par value.

How to calculate fair value of a bond?

The theoretical fair value of a bond is calculated by discounting the future value of its coupon payments by an appropriate discount rate. The discount rate used is the yield to maturity, which is the rate of return that an investor will get if they reinvested every coupon payment from the bond at a fixed interest rate until the bond matures. It takes into account the price of a bond, par value, coupon rate, and time to maturity.