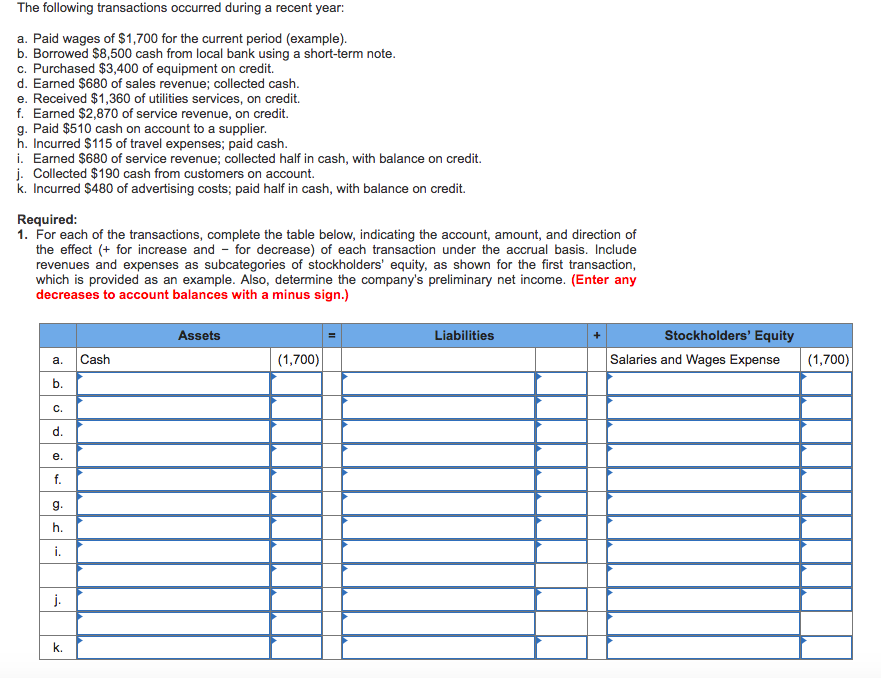

When trade date accounting is used, an entity entering into a financial transaction records it on the date when the entity entered into the transaction. When settlement date accounting is used, the entity waits until the date when the security has been delivered before recording the transaction.

What exactly happens on settlement date?

What happens on settlement day?

- Bank withdraws funds On settlement day, you will need to provide the funds to purchase the new property. ...

- Seller is notified Once the transfer of the balance of the purchase price of the property has been made, the seller will be notified and confirm receipt of the ...

- Documents are signed and exchanged

When do stock trades settle?

When does settlement occur? For most stock trades, settlement occurs two business days after the day the order executes, or T+2 (trade date plus two days). For example, if you were to execute an order on Monday, it would typically settle on Wednesday.

What is settlement date method?

Settlement date accounting is an accounting method that accountants may use when recording financial exchange transactions in the company's general ledger. Under this method, a transaction is ...

What is the definition of settlement date?

The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer. The settlement date for stocks and bonds is usually two business days after the execution date (T+2).

Is settlement date the same as trade date?

The first is the trade date, which marks the day an investor places the buy order in the market or on an exchange. The second is the settlement date, which marks the date and time the legal transfer of shares is actually executed between the buyer and seller.

What does settlement date mean in accounting?

Under settlement date accounting, a transaction is recorded in the general ledger when it is "fulfilled" or "settled." This is contrasted with trade date accounting, where transactions are recorded in the general ledger at the initiation date rather than at completion.

What is trade settlement date?

What Is a Settlement Date? The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer. The settlement date for stocks and bonds is usually two business days after the execution date (T+2).

What comes first trade date or settlement date?

For most stock trades, settlement occurs two business days after the day the order executes, or T+2 (trade date plus two days). For example, if you were to execute an order on Monday, it would typically settle on Wednesday.

What is meant by trade settlement?

Following a trade of stocks, bonds, futures, or other financial assets, trade settlement is the process of moving securities into a buyer's account and cash into the seller's account. Stocks over here are usually settled in three days.

Can I trade before settlement date?

Can you sell a stock before the settlement date? The key is knowing if you bought the stock using settled or unsettled cash. If you bought the stock (or other type of security) using settled cash, you can sell it at any time.

Is trade date or settlement date used for tax purposes?

In most cases, tax law considers the trade date as the date on which a gain or loss is recognized. If you sell a stock at a gain on December 31, you are responsible for any capital gains tax in the current tax year, even though the trade won't settle until the next year.

What does settlement day mean?

On settlement day, at an agreed time and place, your settlement agent (solicitor or conveyancer) meets with your lender and the seller's representatives to exchange documents. They organise for the balance of the purchase price to be paid to the seller.

Who determines settlement date?

The seller sets the date of settlement in the contract of sale. The settlement period is usually 30 to 90 days. Settlement is the date when you: pay the balance of the purchase price to the seller.

What does settlement mean in accounting?

An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero. It can also refer to the completion of an offset process between two or more parties in an agreement, whether a positive balance remains in any of the accounts.

What does settlement mean in finance?

Settlement involves the delivery of securities or cash from one party to another following a trade. Payments are final and irrevocable once the settlement process is complete. Physically settled derivatives, such as some equity derivatives, require securities to be delivered to central securities depositories.

What happens on settlement date?

What happens on settlement day? On settlement day, at an agreed time and place, your settlement agent (solicitor or conveyancer) meets with your lender and the seller's representatives to exchange documents. They organise for the balance of the purchase price to be paid to the seller.

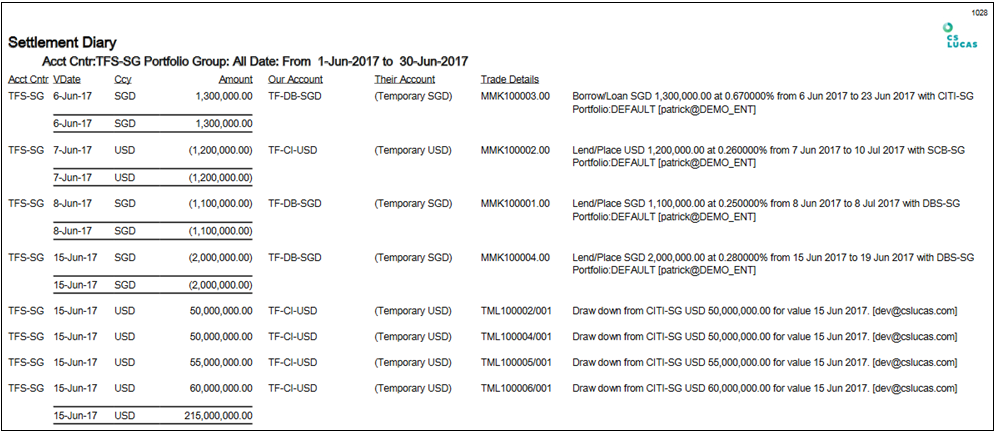

What is a settlement report in accounting?

Settlement reports provide a list of sales transactions, refunds, disputes, and fee adjustments over a daily, weekly, or monthly period. There is one settlement report for each deposit settled to your bank account. In some cases, there may be more than one settlement report per day.

Trade vs. Settlement Date: What’s the Difference?

There are two dates that are important for investors to know when making an investment: the trade date versus the settlement date. When a buy or se...

Why the Difference Between Trade and Settlement Date?

Given the state of modern technology, it seems reasonable to assume that everything should happen instantaneously. But the current rules go back de...

What is the T+2 Rule

The T+2 rule refers to the fact that it now takes two days beyond a trade date for a trade to settle. For example, if a trade is executed on Tuesda...

What is the difference between settlement date and trade date?

The difference between trade date and settlement date accounting. When trade date accounting is used, an entity entering into a financial transaction records it on the date when the entity entered into the transaction. When settlement date accounting is used, the entity waits until the date when the security has been delivered before recording ...

What does settlement date mean?

Further, use of the settlement date means that the actual cash position of a business is more accurately portrayed in the financial statements.

What is trade date accounting?

Trade date accounting gives the users of an organization's financial statements the most up-to-date knowledge of financial transactions, which can be used for financial planning purposes.

Why Is There a Delay Between Trade and Settlement Dates?

Given modern technology, it seems reasonable to assume that everything should happen instantaneously.

What is a trade date?

The trade date is the day an investor or trader books an order to buy or sell a security. But it’s important for market participants to also be aware of the settlement date, which is when the trade actually gets executed.

What is margin trading?

Meanwhile, margin trading accounts allow investors to trade using borrowed money or trade “on margin.”. An investor may notice two different numbers describing the cash balance in his or her brokerage account: the “settled” balance and the “unsettled” balance. Settled cash refers to cash that currently sits in an account.

How long after a trade is a T+2?

For many securities in financial markets, the T+2 rule applies, meaning the settlement date is usually two days after the trade date. An investor therefore will not legally own the security until the settlement date.

What time does the stock market open?

Note that weekends and holidays are excluded from the T+2 rule. That’s because in the U.S., the stock market is open from 9:30 a.m. to 4:00 p.m. Eastern time Monday through Friday.

How long does it take for a trade to settle?

The T+2 rule refers to the fact that it takes two days beyond a trade date for a trade to settle. For example, if a trade is executed on Tuesday, the settlement date will be Thursday, which is the trade date plus two business days. Note that weekends and holidays are excluded from the T+2 rule.

What are the dates of an investment?

There are two important dates to know when making an investment: the trade date and the settlement date.

What is the difference between settlement date and trade date?

A company can use either option but must stick to whichever one is chosen. The major difference between trade date and settlement date accounting is timing, which also affects financial statements. The distinction between trade date and settlement date accounting is an important one, as it affects the company's financial statements.

What is trade date accounting?

Key Takeaways. Trade date accounting is a method of accounting used to record transactions. A company using trade date accounting would recognize a transaction when the transaction or deal is entered into. Trade date accounting is in contrast to settlement date accounting, which uses the delivery date as the transaction date.

When can interest be recorded on the books?

If interest is involved in the transaction, it cannot be recorded on the books until the settlement date.

What is the difference between settlement date and transaction date?

Transaction date is the actual date when the trade was initiated. On the other hand, settlement date is the final date when the transaction is completed. That is, the date when the ownership of the security is transferred from the seller to the buyer, and the buyer makes the payment for the security to the seller.

What is the date on which a trade is deemed settled?

The settlement date is the date on which a trade is deemed settled when the seller transfers ownership of a financial asset to the buyer against payment by the buyer to the seller.

When Does Settlement Occur?

The settlement date is the number of days that have elapsed after the date when the buyer and seller initiated the trade. The abbreviations T+1, T+2, and T+3 are used to denote the settlement date. T+1 means the trade was settled on “transaction date plus one business day,” T+2 means the trade was settled on “transaction date plus two business days,” and T+3 means the trade was settled on “transaction date plus three business days.”

What are the risks of a lag between a transaction date and a settlement date?

The lag between the transaction date and the settlement date exposes the buyer and the seller to the following two risks: 1. Credit risk . Credit risk refers to the risk of loss resulting from the buyer’s failure to meet the contractual obligations of the trade. It occurs due to the elapsed time between the two dates and the volatility of the market.

What is settlement date?

Settlement date is an industry term that refers to the date when a trade or derivative contract is deemed final, and the seller must transfer the ownership of the security to the buyer against the appropriate payment for the asset. It is the actual date when the seller completes the transfer of assets, and the payment is made to the seller.

Why does a buyer fail to make the agreed payment?

The buyer may fail to make the agreed payment by the settlement date, which causes an interruption of cash flows. 2. Settlement risk.

How long does it take for a bond to settle?

Bonds and stocks are settled within two business days, whereas Treasury bills and bonds are settled within the next business day. Where the period between the transaction date and the settlement date falls on a holiday or weekend, the waiting period can increase substantially.

What is Settlement Date Accounting?

Settlement date accounting is an accounting method that accountants may use when recording financial exchange transactions in the company's general ledger. Under this method, a transaction is recorded on the "books" at the point in time when the given transaction has been fulfilled.

When is a settlement date recorded?

Under settlement date accounting, a transaction is recorded in the general ledger when it is "fulfilled" or "settled."

When did XYZ enter into a loan agreement?

Assume XYZ Company, which has a December 31 year end, entered into a loan agreement with a bank on December 27. The loan was not delivered until January 15 of the following year. Under the settlement date method, the financial statements dated on December 31 will not include the loan amount.

Does pending transactions go through the general ledger?

Under this method, any pending transactions that have not been finalized by the balance sheet date will not be recorded in the company's general ledger. Any transaction not recorded in the general ledger will also not flow through to the company's financial statements for that period. This causes issues when a large financial transaction occurs ...

Can you see the impact of planned transactions that have not yet been finalized?

However, it does not allow financial statement users to see the impact of planned transactions that have not yet been finalized.

Is settlement date accounting conservative?

It is a conservative accounting method, which means that it errs on the side of caution when recording journal entries in the general ledger.

What are the dates of a securities transaction?

Whether you’re buying or selling securities, two important dates are part of every transaction: the trade date and the settlement date. These two dates are important whether you’re trading stocks, municipal bonds, mutual funds or exchange-traded funds. For commercial paper and certificates of deposit, trade date and settlement date are the same.

What day does a security settlement date in T+2 count?

Weekends and holidays are excepted. So, if you purchase a security on a Friday, your settlement date will be the following Monday. And if one of the two days in T +2 lands on a holiday, that day doesn’t count.

What happens when a trade fails?

Most of the time when a trade fails, it’s for legitimate reasons and the matter is quickly resolved. However, when unethical brokerage practices lead to repeated and egregious failed trades, the SEC may impose fines.

Is closing date the same as settlement date?

It’s the same as settlement date, no difference.

Is the settlement date the same as the trade date?

However, unlike Amazon, which offers choices of how quickly you can receive your item, settlement dates are strictly set and governed by the Securities Exchange Commission. As far as trade date vs. settlement date price goes, they’re the same. The price is set the moment you make the trade. It won’t change between then and settlement date.

Do you have to pay for securities when you buy them?

When you initiate the purchase of securities (the trade date), you have a legal obligation to pay for them. On the other side of the deal, also as of trade date, the seller has a legal obligation to provide the securities that you purchased. But you don’t legally own the securities you’ve bought until settlement date.

What does settlement date mean on a stock?

The settlement date, on the other hand, reflects the date on which your broker actually "settles" the trade. Technically, even though your online brokerage account will typically list the shares you've just bought among your holdings, your broker doesn't actually take the money out of your account and put the shares in until a later date.

How long after a trade date do you settle?

With stocks and exchange-traded funds, the settlement date is three business days after the trade date. Mutual funds and options settle more quickly, with a settlement date that's the next business day after the trade date. Why trade and settlement dates matter. The trade date is the key date for one very important aspect of investing: tax rules.

Why do settlement dates matter?

Settlement dates matter because of funding requirements from your broker. Some brokers will let you buy stock even if you don't have enough money currently in your account to pay for the shares, relying on you to deposit cash at some point between the trade date and the settlement date to cover the cost of the stock.

What is the trade date?

Of these two terms, the trade date makes more sense intuitively. It's the date on which you actually entered and executed the trade. Most investors think of the trade date as the only one that truly matters, as it's the one that you have the most control over.

Does it matter if the settlement date comes later?

So as long as you get that trade executed before the market closes on the last day of the year, it doesn't matter that the settlement date comes later. Also, when measuring how long you've owned a stock to determine whether a gain is short-term or long-term, you'll use the trade date to measure your holding period.

Is settlement date lag good?

Having the settlement-date lag can actually be helpful from a liquidity standpoint. But the Securities and Exchange Commission also pays attention to settlement dates, and it has rules that can trip up investors who aren't mindful of those dates.

Do people think twice about trade dates?

Most people never think twice about those two dates , but there are a couple of situations in which it makes a huge difference knowing how trade dates and settlement dates differ. Let's take a look at the various uses of both dates and what you need to know to avoid some nasty surprises. An archaic distinction.

Understanding Settlement Dates

When Does Settlement occur?

- The settlement date is the number of days that have elapsed after the date when the buyer and seller initiated the trade. The abbreviations T+1, T+2, and T+3 are used to denote the settlement date. T+1 means the trade was settled on “transaction date plus one business day,” T+2 means the trade was settled on “transaction date plus two business days...

Settlement Date Risks

- The lag between the transaction date and the settlement date exposes the buyer and the seller to the following two risks:

Additional Resources

- CFI is the official provider of the Commercial Banking & Credit Analyst (CBCA)®certification program, designed to transform anyone into a world-class financial analyst. In order to help you become a world-class financial analyst and advance your career to your fullest potential, these additional resources will be very helpful: 1. Commodities: Cash Settlement vs Physical Delivery …