- In trading, there is a fixed time period for the settlement of trades as per terms of contract. ...

- For equity trades: Currently all trades are settled on T+2 settlement cycle.

- For derivatives/currency/commodities: Currently all trades are being mark to market at the closing price of contract and mark to market requirement are settled at T+1.

What is average settlement period for trade receivable?

Trade receivables at Equity PLC. were settled in an average period of 117 days in the operational year 20X4. Credit customers are accordingly settling their outstanding balances on an average of 117 days, which is extremely high.

What does trade cycle mean?

Movement in Economic Activity : A trade cycle is a wave-like movement in economic activity showing an upward trend and a downward trend in the economy. Periodical : Trade cycles occur periodically but they do not show the same regularity. Different Phases : Trade cycles have different phases such as Prosperity, Recession, Depression and Recovery.

What is my settlement cycle?

What is my settlement cycle? dashboard. business app. The total payment you have received in one day (24 hours) is transferred to your bank account by the next working day in most cases. Due to bank side issues, the settlement may get delayed sometimes. You can check the status of your transfer in the Paytm for Business app or in the Paytm ...

When do stock trades settle?

When does settlement occur? For most stock trades, settlement occurs two business days after the day the order executes, or T+2 (trade date plus two days). For example, if you were to execute an order on Monday, it would typically settle on Wednesday.

What is the settlement period?

What is the settlement period in securities?

How long is the T+3 settlement period?

Who pays for shares in a security settlement?

Do you have to have a settlement period before buying stock?

See 2 more

About this website

What is trade settlement?

Following a trade of stocks, bonds, futures, or other financial assets, trade settlement is the process of moving securities into a buyer's account and cash into the seller's account. Stocks over here are usually settled in three days.

What is trade settlement in trade life cycle?

What is trade settlement? Trade settlement is a two-way process which comes in the final stage of the transaction. Once the buyer receives the securities and the seller gets the payment for the same, the trade is said to be settled.

What is settlement process?

Settlement can be defined as the process of transferring of funds through a central agency, from payer to payee, through participation of their respective banks or custodians of funds.

Why do trades take 2 days to settle?

The rationale for the delayed settlement is to give time for the seller to get documents to the settlement and for the purchaser to clear the funds required for settlement. T+2 is the standard settlement period for normal trades on a stock exchange, and any other conditions need to be handled on an "off-market" basis.

What are the types of trade settlement?

The important settlement types are as follows:Normal segment (N)Trade for trade Surveillance (W)Retail Debt Market (D)Limited Physical market (O)Non cleared TT deals (Z)Auction normal (A)

What is a settlement period?

Property settlement is the final stage of a property sale wherein the buyer completes payment of the contract price to the vendor and takes legal possession of the property. The 'settlement period' is the amount of time between the exchange of contracts and the property settlement.

How intraday trades are settled?

According to a new regulation by the Securities and Exchange Board of India (Sebi), any profit that you gain from an intraday trade will be unblocked for use only after the markets close on the next working day.

How does settlement system work?

"Gross settlement" means the transaction is settled on one to one basis without bunching or netting with any other transaction. Once processed, payments are final and irrevocable. This was introduced in in 2004 and settles all inter-bank payments and customer transactions above `2 lakh.

What is international trade settlement?

The special rupee vostro account would be opened in the corresponding banks of the partner trading country. For settlement, Indian importers undertaking imports would make payment in Indian rupee. This would be credited into the special account of the corresponding bank against invoices of the oversea supplier.

What is the 3 day rule in stocks?

In short, the 3-day rule dictates that following a substantial drop in a stock's share price — typically high single digits or more in terms of percent change — investors should wait 3 days to buy.

Can I buy and sell a stock the same day?

There are no restrictions on placing multiple buy orders to buy the same stock more than once in a day, and you can place multiple sell orders to sell the same stock in a single day. The FINRA restrictions only apply to buying and selling the same stock within the designated five-trading-day period.

How soon can I sell a stock after buying it?

You can sell a stock right after you buy it, but there are limitations. In a regular retail brokerage account, you can not execute more than three same-day trades within five business days. Once you cross that threshold, you are considered a pattern day trader and must maintain a $25,000 balance in a margin account.

What is international trade settlement?

The special rupee vostro account would be opened in the corresponding banks of the partner trading country. For settlement, Indian importers undertaking imports would make payment in Indian rupee. This would be credited into the special account of the corresponding bank against invoices of the oversea supplier.

What is DTCC settlement?

The Depository Trust and Clearing Corporation (DTCC) is a financial services company that provides clearing and settlement services for the financial markets. The DTCC settles most securities transactions in the U.S. Settlement is integral to securities transactions.

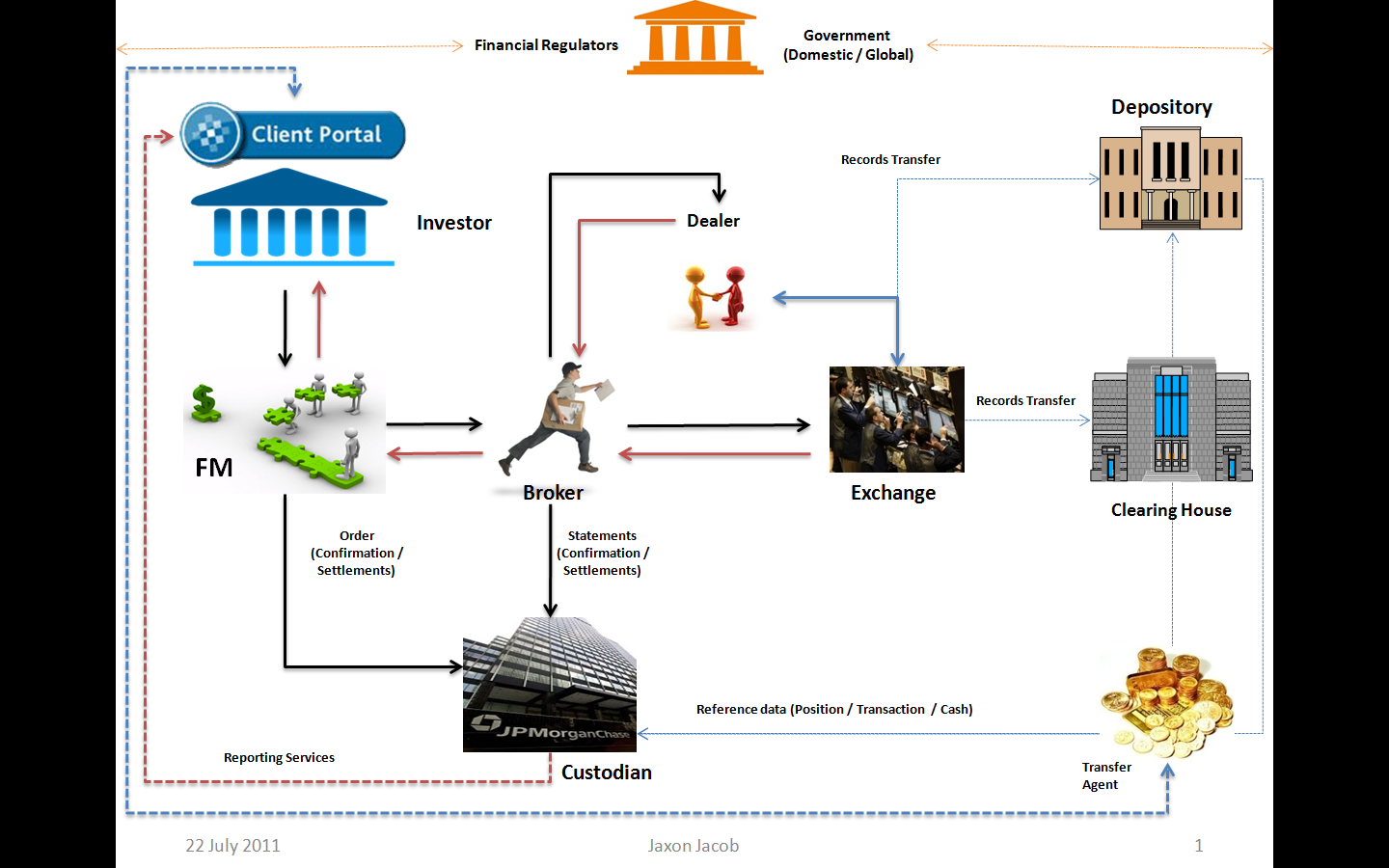

How many types of trade life cycles are there?

Trade Life Cycle Activities: There are mainly two types of Trading Life Cycle activities: Trading Activity: The trading activity covers all the processes and procedures to capture trade from the client through the front office and enrich that trade so that it can be sent to operational activity.

Q1. What is meant by trade settlement date?

The settlement date is when a transaction is complete, and the buyer must pay the seller while the seller will transfer the assets to the buyer.

Q2. Can I sell my stock before the date of settlement?

Settled funds are defined as cash or the sale proceeds of fully paid for securities. Since no effort was made to deposit extra cash into the accoun...

Q3. Who are the participants that are involved in the process of settlement?

The participants are involved in clearing corporations, clearing members, custodians, depositors, clearing banks, and professional clearing members.

Q4. What constitutes a poor delivery?

A poor delivery occurs when a share transfer is not completed due to a violation of the exchange's rules.

Q5. What are the terms "pay-in" and "pay-out"?

The buyer provides money to the stock exchange, and the seller sends the securities on the pay-in day. The stock exchange delivers the money to the...

Settlement Period - Overview, History, How It Works

Settlement date is used in the securities industry to refer to the period between the transaction date when an order is executed to the settlement date.

Trade Settlement Date: TD Ameritrade, Etrade, Ally Invest

How long is settlement time period (T+2) for stock trade funds at Ally Invest, Charles Schwab, Robinhood, Merrill Edge, and Vanguard. Have you ever noticed that when you place a trade for a stock or mutual fund, there’s something called the settlement date that appears on your confirmation?

Settlement Date - Overview, How It Works, Associated Risks

Understanding Settlement Dates. When an investor buys a stock, bond, derivative contract, or other financial instruments, there are two important dates to remember, i.e., transaction date and settlement date.Transaction date is the actual date when the trade was initiated. On the other hand, settlement date is the final date when the transaction is completed.

Stock Settlement: Why You Need to Understand the T+2 Timeline

Stock settlement violations occur when new trades to buy are not properly covered by settled funds. Although settlement violations generally occur in cash accounts, they can also occur in margin accounts, particularly when trading non-marginable securities.

Trade Settlement

Following a trade of stocks, bonds, futures, or other financial assets, trade settlement is the process of moving securities into a buyer's account and cash into the seller's account. Stocks over here are usually settled in three days.

What is the Settlement Date?

When a security is purchased or sold, two important dates are involved: the transaction date (also known as the trade date) and the settlement date.

What is Settlement in Stock Market and the Different Types?

There are two types of stock investment settlements that you will encounter:

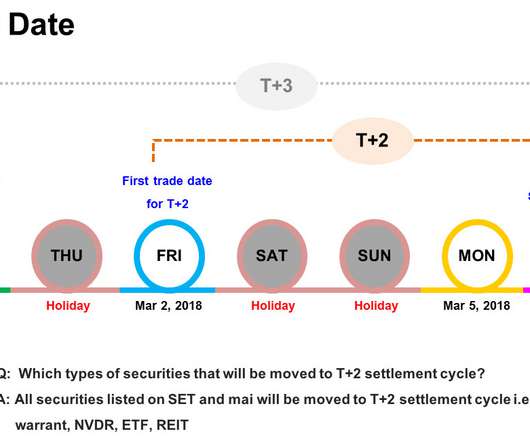

Meaning of Rolling Settlement

The trade is settled in the days after the trade-in a rolling settlement. With this type of settlement, trades are finalized in T+2 days, meaning that deals are closed after the second working day. This time range excludes Sundays, Saturdays, Bank Holidays, and Exchange Holidays.

What is trade settlement process on BSE?

Mentioned below are the steps of settlement by the Bombay Stock Exchange:

What is the trade settlement in NSE?

The National Stock Exchange's (NSE) rolling equity settlement cycle is as follows:

Settlement Violations

Settlement violations occur when purchases are completed, but there is insufficient settled cash in the investor's account on settlement day to cover the trade. If the investor fails to submit funds by the settlement date, the brokerage business is responsible for settling the contract.

What is the settlement period?

The settlement period is the time between the trade date and the settlement date. The SEC created rules to govern the trading process, which includes outlines for the settlement date. In March 2017, the SEC issued a new mandate that shortened the trade settlement period.

What is the settlement period in securities?

In the securities industry, the trade settlement period refers to the time between the trade date —month, day, and year that an order is executed in the market— and the settlement date —when a trade is considered final. When shares of stock, or other securities, are bought or sold, both buyer and seller must fulfill their obligations to complete ...

How long is the T+3 settlement period?

Then in 1993, the SEC changed the settlement period for most securities transactions from five to three business days —which is known as T+3.

Who pays for shares in a security settlement?

During the settlement period, the buyer must pay for the shares, and the seller must deliver the shares. On the last day of the settlement period, the buyer becomes the holder of record of the security.

Do you have to have a settlement period before buying stock?

Now, most online brokers require traders to have sufficient funds in their accounts before buying stock. Also, the industry no longer issues paper stock certificates to represent ownership. Although some stock certificates still exist from the past, securities transactions today are recorded almost exclusively electronically using a process known as book-entry; and electronic trades are backed up by account statements.

Settlement in stock markets

When buying through exchanges, the term ‘Settlement’ refers to the conclusion of the trade after securities have been credited to the Demat Account of the buyer. And at the same time, the consideration amount is credited to the seller.

Rolling Settlement

The Rolling Settlement refers to the mechanism of settling trades on consecutive days after the trade has been executed. This means that if a market follows a T+2 settlement on a rolling basis, then the settlement will be completed on the second working day after the trade day. (Weekends and Holidays are not counted)

Why is it important to know the settlement date of a stock?

Knowing the settlement date of a stock is also important for investors or strategic traders who are interested in dividend-paying companies because the settlement date can determine which party receives the dividend. That is, the trade must settle before the record date for the dividend in order for the stock buyer to receive the dividend.

Why is the settlement date a little trickier?

However, the settlement date is a little trickier because it represents the time at which ownership is transferred . It's important to understand that this doesn't always occur on the transaction date and varies depending on the type of security.

When Do You Actually Own the Stock or Get the Money?

If you buy (or sell) a security with a T+2 settlement on Monday, and we assume there are no holidays during the week, the settlement date will be Wednesday, not Tuesday. The 'T' or transaction date is counted as a separate day. 2

What does the transaction date mean?

As its name implies, the transaction date represents the date on which the actual trade occurs. For instance, if you buy 100 shares of a stock today, then today is the transaction date. This date doesn't change whatsoever, as it will always be the date on which you made the transaction.

Do all mutual funds have the same settlement period?

Not every security will have the same settlement periods. All stocks and most mutual funds are currently T+2. 3 However, bonds and some money market funds will vary between T+1, T+2, and T+3.

What Is the Trade Life Cycle Process?

In the capital market, the trade process is the set of events and actions that occur once there is a purchase or sale of any financial asset. The first step in this process is the order.

What is the life cycle of a forex trade?

The trade life cycle is the sum of all of the steps from the initial trade order to the eventual settlement which make up the active life of a capital market trade. Beginning with order and ending with trade confirmation and validation, the journey of a forex trade from conception to realization may not take long timewise, ...

How to determine if a trade is safe?

In determining whether the trade is safe to make, one of the things they look at is whether or not the investor placing the order has sufficient capital in the forex market to cover the security and limits.

What happens when a broker accepts a trade?

Once all the specifics have been accepted by their clients, the brokers will pass the trade to their back office teams and pave the way for the clearing house portion of the newly confirmed trade.

What does T+2 mean in trading?

At this phase, trades are given a letter and number in order to quickly reference them. The most common way to trade is T+2, in which T stands for the transaction date and 2 represents the number of days after the transaction date in which the settlement will take place. In the case of T+2, it means the settlement will take place 2 days after the transaction is made.

How long does it take for a currency exchange to settle?

Usually two days after the transaction date, the settlement date finally comes . This is the day in which the currency pairs are officially exchanged between the two parties. However, the transfer does not occur directly between the two traders. The clearing house will receive the securities or money and move them into accounts they have set up for their respective clients.

How long does it take for a T+2 to settle?

In the case of T+2, it means the settlement will take place 2 days after the transaction is made. Moving its way through the clearing house, now it’s time for a trade to experience the final stage in this journey, the settlement phase.

When is a trade executed?

Once the order is placed and it gets matched, the trade is said to be executed.

What is trade in business?

What exactly is Trade?Trade is the exchange of items between two or more parties backed up by purchasing power. In … Continue reading

What is trade validation and enrichment?

Trade Validation and Enrichment – The reference data team set up the static and dynamic details which help middle office teams to validate the trade, before releasing instructions into the market.

What is a trade?

What is trade?#N#Trade is a process of buying and selling any financial instrument.#N#Just like any other product even trade has its life cycle involving several steps, as those with a career in Capital Markets know.

When are trade details and SSIs agreed with the counterparty?

Trade details and SSIs are agreed with the counterparty at least a day prior to the settlement date.

What is the settlement period?

The settlement period is the time between the trade date and the settlement date. The SEC created rules to govern the trading process, which includes outlines for the settlement date. In March 2017, the SEC issued a new mandate that shortened the trade settlement period.

What is the settlement period in securities?

In the securities industry, the trade settlement period refers to the time between the trade date —month, day, and year that an order is executed in the market— and the settlement date —when a trade is considered final. When shares of stock, or other securities, are bought or sold, both buyer and seller must fulfill their obligations to complete ...

How long is the T+3 settlement period?

Then in 1993, the SEC changed the settlement period for most securities transactions from five to three business days —which is known as T+3.

Who pays for shares in a security settlement?

During the settlement period, the buyer must pay for the shares, and the seller must deliver the shares. On the last day of the settlement period, the buyer becomes the holder of record of the security.

Do you have to have a settlement period before buying stock?

Now, most online brokers require traders to have sufficient funds in their accounts before buying stock. Also, the industry no longer issues paper stock certificates to represent ownership. Although some stock certificates still exist from the past, securities transactions today are recorded almost exclusively electronically using a process known as book-entry; and electronic trades are backed up by account statements.

What Is The Settlement period?

Understanding Settlement Periods

- In 1975, Congress enacted Section 17A of the Securities Exchange Act of 1934, which directed the Securities and Exchange Commission (SEC) to establish a national clearance and settlement system to facilitate securities transactions. Thus, the SEC created rules to govern the process of trading securities, which included the concept of a trade settlement cycle. The SEC also determi…

Settlement Period—The Details

- The specific length of the settlement period has changed over time. For many years, the trade settlement period was five days. Then in 1993, the SEC changed the settlement period for most securities transactions from five to three business days—which is known as T+3. Under the T+3 regulation, if you sold shares of stock Monday, the transaction would settle Thursday. The three …

New Sec Settlement Mandate—T+2

- In the digital age, however, that three-day period seems unnecessarily long. In March 2017, the SEC shortened the settlement period from T+3 to T+2 days. The SEC's new rule amendment reflects improvements in technology, increased trading volumes and changes in investment products and the trading landscape. Now, most securities transactions settle within …

Real World Example of Representative Settlement Dates

- Listed below as a representative sample are the SEC's T+2 settlement dates for a number of securities. Consult your broker if you have questions about whether the T+2 settlement cycle covers a particular transaction. If you have a margin accountyou also should consult your broker to see how the new settlement cycle might affect your margin agreement.