Is there Theta on Vix options?

The VIX is the volatility of something, the volatility of the VIX is another thing. So the way I understand, there is theta and time decay. And options pricing tools are usable on the VIX but dont believe that Back Scholes is the answer. You must need some stochastic model like the SABR and you must calibrate the params that are going to make sense.

Can Vix options be exercised?

VIX options are European style – you can exercise them only on the expiration date, when the exercise settlement value is also determined. VIX options are cash settled (because there is no way of delivering the underlying, which is just an index).

How do Vix options work?

VIX Option Nuances

- VIX options are priced to VIX futures.

- VIX options are settled European style; this means settlement is done in cash and early exercise/assignment is not possible.

- Long-term VIX options are less sensitive to changes in implied volatility than short-term options.

What is the settlement time for options?

The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer. The settlement date for stocks and bonds is usually two business days after the execution date (T+2). For government securities and options, it's the next business day (T+1).

What time does VIX settle?

Trading hours for expiring VX futures contracts end at 8:00 a.m. Chicago time on the final settlement date....Cboe Volatility Index® (VX) Futures.Type of Trading HoursMonday - FridayExtended5:00 p.m. (previous day) to 8:30 a.m.Regular8:30 a.m. to 3:00 p.m.Extended3:00 p.m. to 4:00 p.m.

How do VIX futures settle?

Settlement. CBOE VIX futures are cash-settled and so, unlike futures on commodities, there's no physical delivery. On settlement date, your account will simply be credited or debited the difference between your purchase (or sale) price and the settlement price.

What does VIX stand for?

The Chicago Board Options Exchange Volatility IndexThe Chicago Board Options Exchange Volatility Index, or the 'VIX' as it is better known, is a measure of the expected volatility of the US stock market.

Is buying VIX a good idea?

Investors cannot buy VIX, and even if they could, it would be an investment with a great deal of risk. The Chicago Board Options Exchange Volatility Index® (VIX®) reflects a market estimate of future volatility. VIX is constructed using the implied volatilities of a wide range of S&P 500 index options.

What happens when VIX expires?

VIX Options Exercise-Settlement VIX options are cash settled. The settlement value of VIX is determined by the so called Special Opening Quotation (SOQ), which is calculated based on opening prices of S&P500 options on VIX option expiration. The cash is delivered on the business day following expiration.

What causes the VIX to go up?

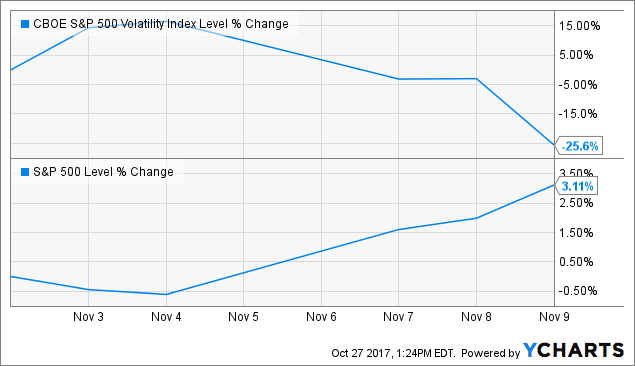

Volatility value, investors' fear, and VIX values all move up when the market is falling. The reverse is true when the market advances—the index values, fear, and volatility decline. The price action of the S&P 500 and the VIX often shows inverse price action: when the S&P falls sharply, the VIX rises—and vice versa.

How is VIX calculated?

The VIX Index is a financial benchmark designed to be an up-to-the-minute market estimate of expected volatility of the S&P 500 Index, and is calculated by using the midpoint of real-time S&P 500® Index (SPX) option bid/ask quotes.

Is VIX free?

ViX+ customers also get access to everything on ViX, the free, AVOD tier that has more than 100 channels, 40,000 hours of video-on-demand and 24/7 news and sports.

Who invented the VIX?

The VIX traces its origin to the financial economics research of Menachem Brenner and Dan Galai.

Should I buy when VIX is high or low?

When the VIX is low, volatility is low. When the VIX is high volatility is high, which is usually accompanied by market fear. Buying when the VIX is high and selling when it is low is a strategy, but one that needs to be considered against other factors and indicators.

How do you make money on the VIX?

The primary way to trade on VIX is to buy exchange-traded funds (ETFs), and exchange-traded notes (ETNs) tied to VIX itself. ETFs and ETNs related to the VIX include the iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX) and the ProShares Short VIX Short-Term Futures ETF (SVXY).

Can you hold VIX long-term?

It's also likely a good choice to see investments in inverse VIX ETFs as an opportunity for short-term gains, rather than for long-term buy-and-hold strategies. The volatility of these ETFs is too extreme to make them a suitable long-term investment option.

How does VIX short Term futures work?

The S&P 500 VIX Short-Term Futures Index measures the returns of a portfolio of monthly VIX futures contracts that rolls positions from first-month contracts into second-month contracts on a daily basis. The index maintains a weighted average of one month to expiration.

What time do VIX futures expire?

The expiration date for VIX futures and VIX options is usually 30 days before the Third Friday of the next month. Expiring futures contracts cease trading at 8:00 am Chicago time / 9:00 am New York time on the final settlement day.

How do you read VIX futures?

0:3212:53Trading VIX Futures | Volatility Trading - YouTubeYouTubeStart of suggested clipEnd of suggested clipBut VIX futures were introduced in 2004 as a means to gaining exposure to changes in the VIX index.MoreBut VIX futures were introduced in 2004 as a means to gaining exposure to changes in the VIX index. So VIX futures are just a vehicle that traders use to trade. Changes in implied volatility.

How do you trade VIX profit from volatility?

Since the Cboe Volatility Index (VIX) was introduced, investors have traded this measure of investor sentiment about future volatility. The primary way to trade on VIX is to buy exchange-traded funds (ETFs), and exchange-traded notes (ETNs) tied to VIX itself.

What is VIX settlement?

The VIX Index settlement process is patterned after the process used to settle A.M.-settled S&P 500 Index options. The final settlement value for Volatility Derivatives is determined on the morning of their expiration date (usually a Wednesday) through a Special Opening Quotation ("SOQ") of the VIX Index. By providing market participants with a mechanism to buy and sell SPX options at the prices that are used to calculate the final settlement value for Volatility Derivatives, the VIX Index settlement process is "tradable."

How is the VIX settlement process determined?

The final settlement value for Volatility Derivatives is determined on the morning of their expiration date (usually a Wednesday) through a Special Opening Quotation ("SOQ") of the VIX Index. By providing market participants with a mechanism to buy and sell SPX options at the prices that are used to calculate the final settlement value for Volatility Derivatives, the VIX Index settlement process is "tradable."

How many weekly expirations are there for VIX?

CFE may list up to six consecutive weekly expirations for VIX futures. VIX Weekly futures generally have the same contract specifications as monthly expiring VIX contracts. See Contract Specifications for VIX Futures for more information.

When did VIX begin trading?

VIX Weeklys futures began trading on CFE in 2015 and provide market participants with additional opportunities to establish short-term VIX positions and to fine-tune the timing of their hedging and trading activities.

When did VIX come out?

Introduced in 2004 on Cboe Futures Exchange ℠ (CFE ® ), VIX futures provide market participants with the ability to trade a liquid volatility product based on the VIX Index methodology. VIX futures reflect the market's estimate of the value of the VIX Index on various expiration dates in the future. VIX futures provide market participants with a variety of opportunities to implement their view using volatility trading strategies, including risk management, alpha generation and portfolio diversification.

When do VIX futures expire?

Weekly expirations for VIX futures are generally listed on Thursdays (excluding holidays) and expire on Wednesdays. CFE may list up to six consecutive weekly expirations for VIX futures. VIX Weekly futures generally have the same contract specifications as monthly expiring VIX contracts. See Contract Specifications for VIX Futures for more information.

What is VIX in insurance?

The VIX is a way to measure that premium, as well as the perception of risk in the market.

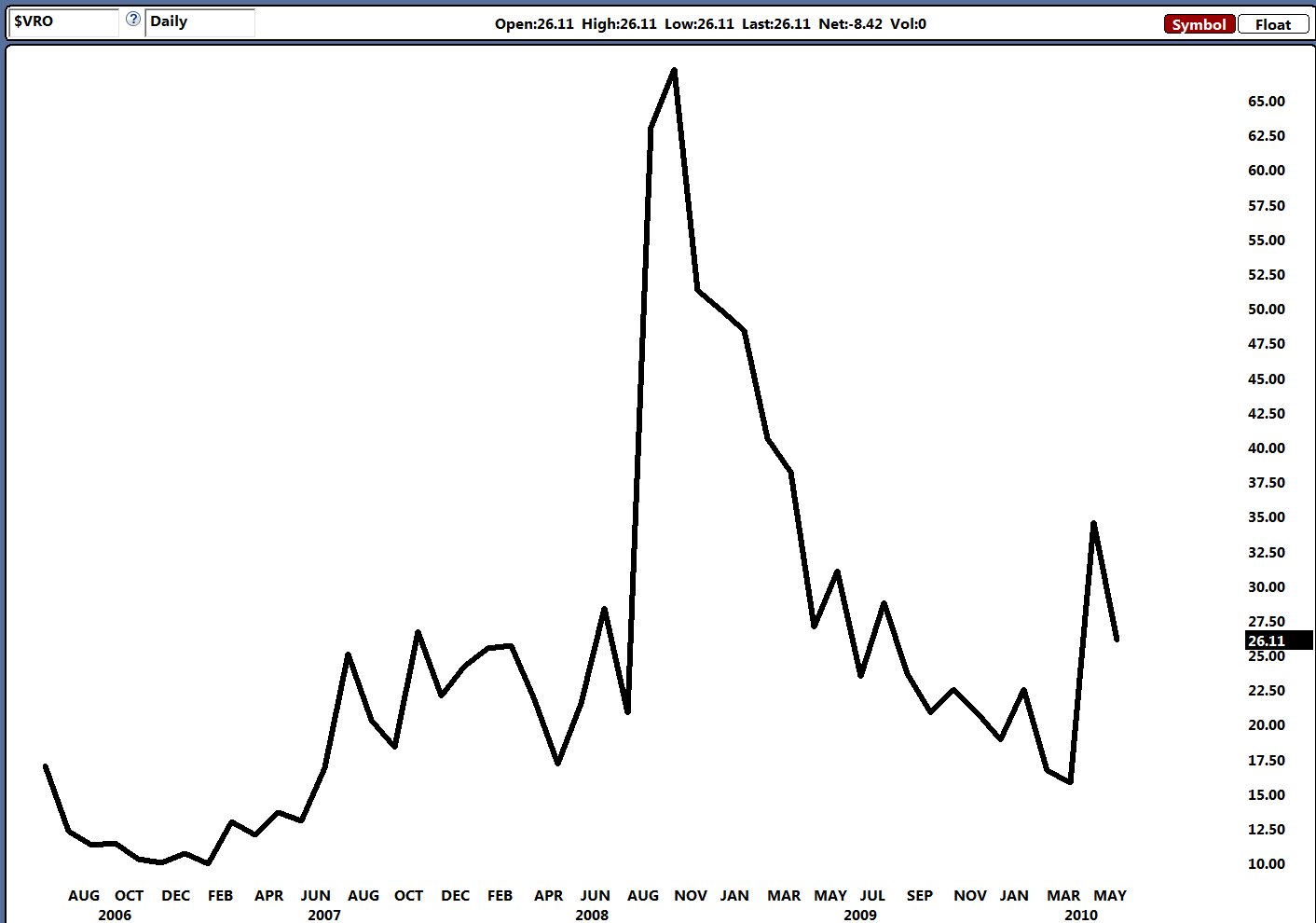

What is contango in VIX futures?

One characteristic about VIX futures is that the near term tends to have a lower value than the next term. This is called " contango " in the futures curve.

How to protect against financial loss?

To protect against financial loss you talk with your local insurance office to protect your assets in exchange for a monthly premium.

What happens when a trader buys an option?

If a trader buys an option, the market maker has to take the other side of the trade.

Does Vix futures have a settlement?

VIX futures have a cash settlement, since it's impossible to take delivery of a statistic. The settlement is based off the

Is VIX an averaging?

2. The VIX technically isn't an averaging. It's a standard deviation measurement similar to how we calculate implied volatility, but instead of looking at the extrinsic value of a single option, we're taking a weighted average of the total premium in the market and then finding the standard deviation of that.

Do VIX futures track spot VIX?

VIX futures don't track the spot VIX on a 1:1 basis.

How do VIX options settle?

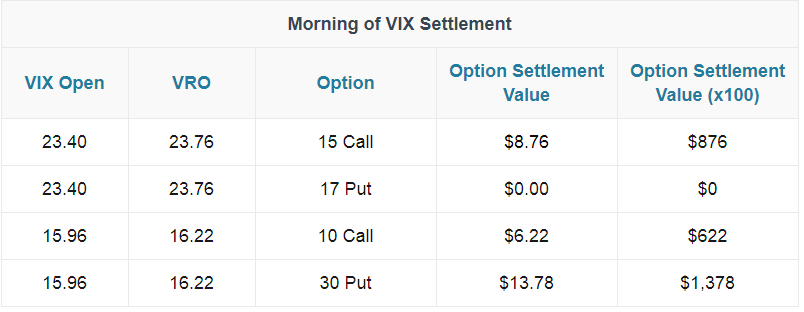

VIX options settle in cash and trade in the European style. European style options cannot be exercised until expiration. The options can be opened or closed anytime before expiration. You don’t need to worry about ending up with an unwanted position in VIX after expiration. If your VIX options expire In-The-Money (ITM), you get a cash payout. The payout is the difference between the strike price and the VRO quotation on the expiration day (basically the amount the option is ITM). For example, the payout would be $2.50 if the strike price of your call option strike was $15 and the VRO was $17.50.

What is VIX option?

VIX options were the first exchange-traded options that allowed investors to trade the market volatility. VIX options can be used as a hedge against sudden market decline, but also as speculation on future moves in volatility. Here are 10 important things about VIX options. VIX options settle in cash and trade in the European style.

How many weekly expirations are there in Vix?

Contract Expirations : Up to six 6 weekly expirations and up to 12 standard (monthly) expirations in VIX options may be listed. The 6 weekly expirations shall be for the nearest weekly expirations from the actual listing date and standard (monthly) expirations in VIX options are not counted as part of the maximum six weekly expirations permitted for VIX options. Like the VIX monthlys, VIX weeklys usually expire on Wednesdays.

What time does VIX trading start?

VIX Options Trading Hours are 8:30 a.m. to 3:15 p.m. Central time (Chicago time). Extended hours are 2:00 a.m. to 8:15 a.m. Central time (Chicago time). CBOE extended trading hours for VIX options in 2015. The ability to trade popular VIX options after the close of the market provides traders with a useful alternative, especially from overseas market participants looking to gain exposure to the U.S. market and equity market volatility. VIX options are among of the most actively traded contracts the options market has to offer.

When do VIX options expire?

On the expiration Wednesday the only SPX options used in the VIX calculation are the ones that expire in 30 days. Last Trading Day for VIX options is the business day prior to the Expiration Date of each contract expiration.

Which is more sensitive, VIX or VIX futures?

VIX options time sensitivity : VIX Index is the most sensitive to volatility changes, while VIX futures with further settlement dates are less sensitive. As a result, longer-term options on the VIX are less sensitive to changes implied volatility.

Is VIX based on a spot index?

VIX options are based on a VIX futures, not the spot index ($VIX) quote. Therefore VIX options prices are based on the VIX futures prices rather than the current cash VIX index. To understand the price action in VIX options, look at VIX futures. This can lead to unusual pricing of some VIX strategies.

What is VIX in stock market?

The Cboe Volatility Index (VIX) is a real-time index that represents the market's expectations for the relative strength of near-term price changes of the S&P 500 index (SPX). Because it is derived from the prices of SPX index options with near-term expiration dates, it generates a 30-day forward projection of volatility. Volatility, or how fast prices change, is often seen as a way to gauge market sentiment, and in particular the degree of fear among market participants.

Why do investors use the VIX?

Investors use the VIX to measure the level of risk, fear, or stress in the market when making investment decisions.

How Does the VIX Work?

For financial instruments like stocks, volatility is a statistical measure of the degree of variation in their trading price observed over a period of time. On September 27, 2018, shares of Texas Instruments Inc. ( TXN) and Eli Lilly & Co. ( LLY) closed around similar price levels of $107.29 and $106.89 per share, respectively.

How long does the VIX expire?

Only those SPX options are considered whose expiry period lies within 23 days and 37 days. 1

Why is VIX important?

It is an important index in the world of trading and investment because it provides a quantifiable measure of market risk and investors' sentiments.

Which has more volatility, TXN or LLY?

However, a look at their price movements over the past one month (September) indicates that TXN (Blue Graph) had much wider price swings compared to that of LLY (Orange Graph). TXN had higher volatility compared to LLY over the one-month period.

Why is volatility a quantitative measure?

Having a standard quantitative measure for volatility makes it easy to compare the possible price moves and the risk associated with different securities, sectors, and markets.

What is VIX in stock market?

VIX is a consistent measure of near term volatility determined using S&P 500® (SPX) option pricing . There are two different expiring sets of SPX options feeding into the VIX calculation with the two series being time weighted to determine a consistent 30-day measure of implied volatility. When the S&P 500 comes under pressure the demand for SPX put options increases which often pushes VIX higher. VIX was given the nickname, “The Fear Index” because of this increased demand for portfolio protection at times when the market is under pressure.

When did VIX start trading?

Financial futures trading based on the CBOE Volatility Index® (VIX®) was introduced in 2004. This milestone was the first instance of a listed derivative available for trading that gave investors direct exposure to expected market volatility. If you are considering adding volatility to your toolbox of trading and portfolio management methods, there are a few things you should know as you get started.

What is VIX futures?

VIX Futures are AM settled contracts. The final settlement value for VIX Futures is a Special Opening Quotation (SOQ) of the VIX Index. The SOQ is calculated using opening prices of constituent SPX or SPX Weeklys options that expire 30 days after the relevant VIX expiration date. The final settlement value for VIX futures is disseminated using the ticker VRO. The last trading day for VIX Futures is the day before settlement so a contract that is due to expire on Wednesday morning will cease trading at 3:15 pm Chicago time the day before settlement. This means a contract set to expire will not trade during non-US hours the day of settlement.

What is VIX Q6?

VIX/Q6 is the standard August VIX contract. The quotes that begin with numbers are VIX Weeklys Futures and the numbers actually represent which week of the year these contracts expire. 1. The VIX Settlement Process.

How often do VIX futures expire?

In addition, there are standard VIX Futures contracts that expire each month.

Is VIX futures a premium?

VIX Futures contracts may trade at a premium or discount to spot VIX and other VIX futures. The majority of trading days VIX Futures are at a premium to spot VIX as well as at a premium to the futures contracts that expire before the expiration date for the individual contract. Figure 3 shows spot VIX and the standard VIX futures contract pricing ...