What is a settlement fee?

The settlement fee is sometimes referred to the closing fee, and it covers costs associated with closing operations. Some title companies list out each cost, and some bucket them all in one place, so be sure you know exactly what you’re paying for. Costs bundled under the Settlement Fee may include the cost of:

Who pays escrow fees when buying a house?

Who pays escrow fees? Escrow fees are typically split 50-50 between buyer and seller. Escrow fees cover the services of an independent third party to conduct the closing and manage funds during the transaction. Cost: Usually 1% of the purchase price.

What are title fees and how do they work?

Title fees are a group of fees associated with closing costs. These fees pay a title company to review, adjust and insure the title of the property. The title company will perform a title search to find any potential issues with the title, such as encumbrances or liens.

Who pays for title insurance – buyer or seller?

Both the buyer and seller pay for title insurance, but each type is slightly different. The seller pays for the title insurance coverage for the buyer, and the buyer pays for the title insurance policy for their lender.

What are settlement expenses?

Settlement costs (also known as closing costs) are the fees that the buyer and/or seller have to pay to complete the sale of the property. Depending on the lender, these may include origination fees, credit report fees, and appraisal fees, as well as property taxes and recording fees.

Who actually paid the costs of settlement?

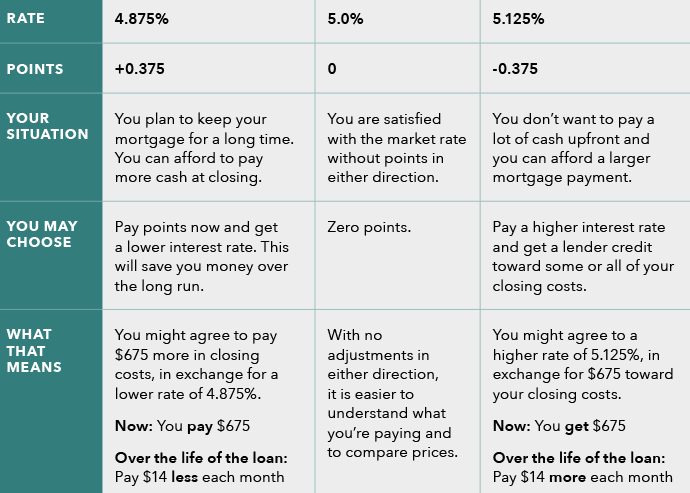

Generally' the buyer pays the fee' unless otherwise negotiated. 802. Loan Discount: Also often called "points" or "discount points'" a loan discount is a one-time charge imposed by the lender or broker to lower the rate at which the lender or broker would otherwise offer the loan to you.

Who pays closing costs in Iowa?

In Iowa, you'll pay about 0.8% of your home's final sale price in closing costs, not including realtor fees. Keep in mind that this is only an estimate. While closing costs will always have to be paid, your real estate agent can often negotiate who pays them — you or the buyer.

Who pays closing costs in Kentucky?

Closing costs cover all the fees homebuyers must pay on closing day when they purchase a new home, including loan- and service-related fees. They generally amount to 2 percent to 5 percent of the home's purchase price.

Does the seller pay closing costs?

Closing costs are paid according to the terms of the purchase contract made between the buyer and seller. Usually the buyer pays for most of the closing costs, but there are instances when the seller may have to pay some fees at closing too.

What if I can't afford closing costs?

Consider asking a family member or friend to lend or give you some cash you can use to cover the closing costs. Reduce the down payment. If your lender is willing to accept a lower down payment on the loan, it could allow you to put more cash toward closing costs.

What is the average closing cost in Iowa?

According to data from ClosingCorp, the average closing cost in Iowa is $2,272.18 after taxes, or approximately 1.14% to 2.27% of the final home sale price.

What is included in closing costs in Iowa?

According to data from Bankrate, the average closing costs for a $200,000 home in Iowa is around $2,100. However, that doesn't include variable costs, including title insurance, title search, taxes, other government fees, escrow fees, and discount points.

What do closing costs include?

Closing costs are the expenses over and above the property's price that buyers and sellers usually incur to complete a real estate transaction. Those costs may include loan origination fees, discount points, appraisal fees, title searches, title insurance, surveys, taxes, deed recording fees, and credit report charges.

Who pays for deed preparation in KY?

Kentucky seller closing cost overviewClosing costPercentage of sale or flat priceSeller responsibilityDeed Preparation$500RequiredReal estate transfer tax0.1%RequiredReal estate agent commission5-6%NegotiableTitle Fee Doc Prep Fee Loan Payoff Fee$250 $250 $50Required3 more rows•Nov 1, 2021

Who pays the transfer fees when selling a house?

Transfer costs are paid by the buyer of the property, to a conveyancing attorney who is appointed by the seller of the property. This is one of the additional costs incurred by the buyer, which also includes bond registration costs, rates and levies, and insurance.

Can my lawyer cash my settlement check?

While your lawyer cannot release your settlement check until they resolve liens and bills associated with your case, it's usually best to be patient so you don't end up paying more than necessary.

How are personal injury settlements paid?

When a settlement amount is agreed upon, you will then pay your lawyer a portion of your entire settlement funds for compensation. Additional Expenses are the other fees and costs that often accrue when filing a personal injury case. These may consist of postages, court filing fees, and/or certified copy fees.

How does the settlement process work?

A settlement agreement works by the parties coming to terms on a resolution of the case. The parties agree on exactly what the outcome is going to be. They put the agreement in writing, and both parties sign it. Then, the settlement agreement has the same effect as though the jury decided the case with that outcome.

How do you handle settlement money?

Here is a list of steps to take once you receive a settlement.Take a Deep Breath and Wait. ... Understand and Address the Tax Implications. ... Create a Plan. ... Take Care of Your Financial Musts. ... Consider Income-Producing Assets. ... Pay Off Debts. ... Life Insurance. ... Education.More items...

Who pays title insurance?

Title search and title insurance (paid by either the seller or the buyer).

What is broker commission?

Brokerage commission (the sum or percentage of the sale price, previously agreed upon by the seller and real estate agent).

What is title company settlement fee?

What is a Title Company Settlement Fee? The settlement fee is sometimes referred to the closing fee, and it covers costs associated with closing operations.

What are the costs associated with closing a home?

When you are buying a home, there are plenty of costs associated with closing that have nothing to do with the actual cost of the home. These costs are generally associated with insuring, reviewing, and modifying the title of that property. The costs can be broadly called “title fees”.

What is Scott Title?

For over two decades, the Scott Title team has maintained a commitment to delivering the highest quality of service in the title insurance industry . We provide our clients with an attention to detail they won’t find anywhere else when it comes to title insurance services including property title searches, settlement services, and real estate paralegal services. Buying a home is usually the single largest investment most people make in their lifetime, and our experienced team will make sure you are fully prepared for a smooth and successful closing. Contact us today to learn more about our services.

Does Scott Title Services work with real estate?

Settlement experts from Scott Title Services will seamlessly integrate into your real estate team by working with your lender, real estate agent and yourself to guarantee that the transaction is both successful and as stress free as possible. We coordinate everything to ensure that your interests and rights are protected during the entire closing process and beyond.

Costs usually covered by the seller

Some of the major costs in the seller’s camp include any pre-listing work done to the home, the real estate agent commission, and in some states — transfer taxes. Let’s review what’s commonly on your tab.

Costs usually covered by the buyer

On the flip side, the buyer will generally be in charge of paying for any inspections they order to evaluate the home, the fees related to their mortgage, and the lender-ordered appraisal among other purchase expenses. Let’s review!

Costs that can be split or may go either way

Sometimes real estate transaction fees don’t fall squarely on the buyer or seller. Some expenses may be split, while others can be negotiated one way or another.

Who pays closing costs?

Typically, buyers and sellers each pay their own closing costs.

What are the closing costs for a home?

Here are the most common and expensive closing costs home buyers have to pay: Origination fee — This is the lender’s charge for its services, including the cost to verify your documents, process your application, and get the loan set up. The origination fee is often around 1% of the loan amount.

What is the upfront fee for USDA home loan?

Like the FHA loan, the USDA home loan program requires both an upfront mortgage insurance fee and an annual one. USDA’s upfront fee is equal to 1% of the loan amount and can be added to the mortgage balance to reduce closing costs.

What is loan estimate?

The Loan Estimate lets you easily compare fees and understand which lenders are less expensive overall – which may be different from the ones simply offering the lowest mortgage rates.

How to avoid closing costs as a seller?

If you’re looking to avoid closing costs as a seller, be sure to explore alternatives: selling your home yourself; finding a discount broker, or using a different agent. Checking all your options will give you a basis for negotiation. If you want a full service, you’re going to have to pay for it.

How much is the VA funding fee?

For first-time home buyers, the VA funding fee is usually equal to 2.3% of the loan amount. Buyers who’ve used a VA loan before will pay 3.6% of their loan amount. If you make a down payment of 5% or more, the VA funding fee is reduced.

How much does a home appraisal cost?

Appraisal fee — A home appraisal typically costs around $500, but could be as much as $1,000. The home appraisal usually follows an inspection of the property. Title search and title insurance — A title search makes sure your new home’s title is clear, meaning no one else can claim rights to the home or property.

What is title settlement fee?

The title settlement fee, or closing fee, is a charge from the title company to cover the administrative costs of closing. Title companies may or may not list out the individual costs of the fee.

Who pays title search fees?

The buyer also typically pays recording and title search fees. In others, it is the reverse. Regardless of where in the county you are, who pays these fees can be negotiated and reflected in the purchase agreement.

What Are Title Fees?

Title is the right to own and use the property. Title fees are a group of fees associated with closing costs. These fees pay a title company to review, adjust and insure the title of the property.

How to find closing costs?

You can find title fees and overall closing costs on a couple documents: 1 Closing disclosure: Your closing disclosure will break down total closing costs, including title fees, in an itemized list. 2 Loan estimate: The loan estimate will list your total closing costs, along with title service fees, and tell you the cash you need to bring to close.

How much does a home buyer pay for closing costs?

Home buyers can typically expect to pay 2% – 5% of the loan amount in closing costs. One of the main costs is a title fee. Here we’ll cover what title fees are, who pays them and how much they cost.

How much does title fee vary?

Title fees change from company to company and from location to location. They can also change depending on what’s included. In general, closing costs, which title fees are a large part of, cost from 2% – 5% of the total loan amount.

How much does it cost to record a deed?

The national average for this charge is around $125.

Who pays escrow fees?

Escrow fees are typically split 50-50 between buyer and seller. Escrow fees cover the services of an independent third party to conduct the closing and manage funds during the transaction.

Who pays closing costs?

While some aspects of closing costs can be negotiated into the contract between buyer and seller, certain things are typically paid by one party or the other. Read on to learn which big bills you, the seller, should be budgeting for and which will be the buyer’s responsibility.

Who pays for the home inspection?

The buyer pays for a home inspection if they choose to conduct one. Inspections are meant to protect the buyer from any hidden defects in the home that could impact the home’s value, cost a lot of money to repair or make the home unsafe to live in.

Who pays for the appraisal?

Buyers cover the cost of the home appraisal, which is usually required by their lender if they will be taking out a mortgage to buy the home. Even if it isn’t required, buyers sometimes complete appraisals for peace of mind that they’re making a smart investment and not overpaying.

Who pays for a land survey — buyer or seller?

The home buyer pays for a land survey, if they request one. Considered due diligence (much like a home inspection), a land survey lets the buyer know the details of the exact property they’re purchasing, including property boundaries, fencing, easements and encroachments.

Who pays for title insurance?

Both the buyer and seller pay for title insurance, but each type is slightly different. The seller pays for the title insurance coverage for the buyer, and the buyer pays for the title insurance policy for their lender. In general, title insurance ensures the home is “free and clear” and that no third party has an unknown claim to the property.

Who pays real estate transfer taxes?

The seller is responsible for paying any real estate transfer taxes, which are charged when the title for the home is transferred from the old owner to the new owner. Transfer taxes can be levied by a city, county, state or a combination.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

Does gross income include damages?

IRC Section 104 explains that gross income does not include damages received on account of personal physical injuries and physical injuries.

Is dismissal pay a federal tax?

As a general rule, dismissal pay, severance pay, or other payments for involuntary termination of employment are wages for federal employment tax purposes.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

Who pays for owner’s title insurance or closing costs?

In the case of the home buyer’s title insurance policy, it’s customary for the seller to pay the costs of the policy issued to the new homeowner. Mortgage lenders also require a title insurance policy. It’s customary for the lender’s policy to be paid by the home buyer.

What is closing cost?

Closing costs are the fees associated with the purchase of the home and are paid at closing. Title insurance is a wise investment as it protects home buyers and mortgage lenders against defects or problems with a title when there is a transfer of property ownership.

What happens if you have a lien on your home after you sell it?

When a lien is placed on your home, it can prevent you from refinancing or selling your home unless you pay the outstanding amount.

Is title insurance confusing?

Title insurance is confusing for anyone who’s a first-time home buyer. What type of title insurance policy is required to own a home and who is responsible for paying the closing costs and title insurance? It’s important to understand the intricacies that go into the home buying process. First, you need to understand what closing is ...

Does title insurance cover a house?

Keep in mind, title insurance only covers issues that date from before you took ownership of the home. If the government decides it wants to tear down your house and build a highway, or you don’t pay your property taxes, you’re out of luck. Title insurance won’t cover you.

Can you lose your home if you trust the seller?

Rightful owners with legitimate claims can result in you losing your home altogether. Even if you believe you can trust the seller, the home itself could come with unknown problems that cause issues later down the road. It’s a good idea to be safe and invest in a title insurance policy.

Can closing costs be negotiable?

Fees can be negotiable, and it’s important to keep in mind that you can shop lenders until you find one that offers you a loan with lower fees. Closing costs may vary depending on where you live, the type of property you buy, as well as the type of loan you choose.