Can I be taxed on my personal injury settlement?

In general, the proceeds from a personal injury settlement or jury verdict will not be subject to state or federal tax. The general exclusion from taxation applies to the damages an individual receives as a result of the expenses incurred due to their bodily injuries or physical illness.

What are the tax consequences of personal injury settlement?

Taxability of Personal Injury Settlements. Receiving money in a personal injury settlement or judgment may have tax consequences. In fact, depending on the type of settlement or judgement, you could have multiple tax payment structures tied to the types of damages you recover. For example, if your settlement has elements of back pay, emotional ...

Does the IRS tax personal injury settlements?

Personal injury settlements are generally not considered to be income that is subject to taxation. Rather, a settlement is intended to reimburse an injured party for costs and expenses that are paid to reimburse economic losses. Certain categories of damages are not within the definition of economic losses:

Do you have to pay taxes on your injury settlement?

Whether your settlement came from out-of-court negotiations or the verdict of a lawsuit, it’s all the same when it comes to taxes. Generally, personal injury settlements are not taxable.

Do I have to report personal injury settlement to IRS?

The compensation you receive for your physical pain and suffering arising from your physical injuries is not considered to be taxable and does not need to be reported to the IRS or the State of California.

Can the IRS take money from a personal injury settlement?

In some cases, the IRS can take a part of personal injury settlements if you have back taxes. Perhaps the IRS has a lien on your property already, and if so, you could find yourself losing part of your settlement in lieu of unpaid taxes. This can happen when you deposit settlement funds into your personal bank account.

How can I avoid paying taxes on a settlement?

How to Avoid Paying Taxes on a Lawsuit SettlementPhysical injury or sickness. ... Emotional distress may be taxable. ... Medical expenses. ... Punitive damages are taxable. ... Contingency fees may be taxable. ... Negotiate the amount of the 1099 income before you finalize the settlement. ... Allocate damages to reduce taxes.More items...•

What type of settlement is not taxable?

personal injury settlementsSettlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Will I get a 1099 for a lawsuit settlement?

If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too. If all or part of your settlement was for back wages from a W-2 job, then you wouldn't get a 1099-MISC for that portion.

Are 1099 required for settlement payments?

Forms 1099 are issued for most legal settlements, except payments for personal physical injuries and for capital recoveries.

What do I do if I have a large settlement?

– What do I do with a large settlement check?Pay off any debt: If you have any debt, this can be a great way to pay off all or as much of your debt as you want.Create an emergency fund: If you don't have an emergency fund, using some of your settlement money to create one is a great idea.More items...•

Do you have to pay taxes on insurance payouts?

Answer: Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received.

How can you avoid paying taxes on a large sum of money?

Research the taxes you might owe to the IRS on any sum you receive as a windfall. You can lower a sizeable amount of your taxable income in a number of different ways. Fund an IRA or an HSA to help lower your annual tax bill. Consider selling your stocks at a loss to lower your tax liability.

Can the IRS take my personal injury settlement in Florida?

The law states that any payment you revive because of sickness or personal injury is exempt from taxable income. If the IRS questions your tax liabilities, then they will consider the totality of your circumstances to judge what the settlement is for.

Do you pay income tax on insurance settlement?

If you receive money in a personal injury settlement due to injuries you suffered or because your loved one was killed in an accident, this money is usually exempt from taxes.

Do insurance claims count as income?

No. Insurance claim payments restore you to how you were before and are not income. However, insurance claim payments reduce deductions for medical expenses, casualty and theft losses.

Is money received from insurance claim taxable?

Answer: Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received.

What is the first form of personal injury compensation?

Personal injury compensation takes on two primary forms. The first is economic damages.

Why would a tax liability impact negotiations with insurance companies?

In addition, this would impact negotiations with the insurance company, because a tax liability may require that they negotiate more in their injury settlements.

What is the purpose of settlement agreement?

Parties may try to structure their settlement agreement to maximize line items that are not treated as taxable income to keep as much money in their pocket as possible.

What are non-economic damages?

Then, you are also entitled to non-economic damages for your accident injuries. These are damages that relate to your physical injury or sickness.

Is lost wages taxable income?

As a result, the IRS will use the “origin of the claim” test. If you file for lost wages because of employment discrimination, that would be considered taxable income.

Is lost wages considered gross income?

26 USC 104 excludes from the definition of “gross income” any payment that was awarded on the basis of a physical injury.

Is punitive damages rare?

In addition, there are also possible punitive damages (very rare), and these have their own special rules.

What is compensatory damages?

What are compensatory damages exactly? Compensatory damages are money awarded to a plaintiff in a personal injury case to compensate for damages, injury, or another loss that happened due to the negligence or unlawful conduct of another party. (This party may be one or more individuals, or an entity such as a business, community organization, or even a church or other religious institution.) In order to receive compensatory damages, the plaintiff needs to demonstrate that the loss is real and that it was caused by the defendant.

What is punitive damages?

What are punitive damages? These are meant not just to compensate the plaintiff, but to also provide a harsher punishment for the defendant in situations where the defendant is found to be wildly or grossly negligent in some way. Essentially, punitive damages are meant to be an extra punishment, on top of compensatory and lost wage damages, for recklessness, intentional misconduct, or complete disregard for the safety of others.

Do you have to think about taxes when accepting a settlement?

Questions about taxes and personal injury settlements are very common. This is understandable. You have to think about how much money you’ll actually get if you accept a settlement, and that includes figuring out the tax situation. You may know someone who received a personal injury settlement, then unexpectedly received a large tax bill because of it. However, it’s important to know that this isn’t always the case.

Is compensatory damages taxable?

So are compensatory damages taxable? In most cases, no. Usually settlements for losses involved with physical injuries or illnesses, like broken bones, head injuries, brain damage, traumatic brain injury (TBI), paralysis or spinal cord injuries, loss of vision or hearing, loss of limbs, etc., are tax-exempt.

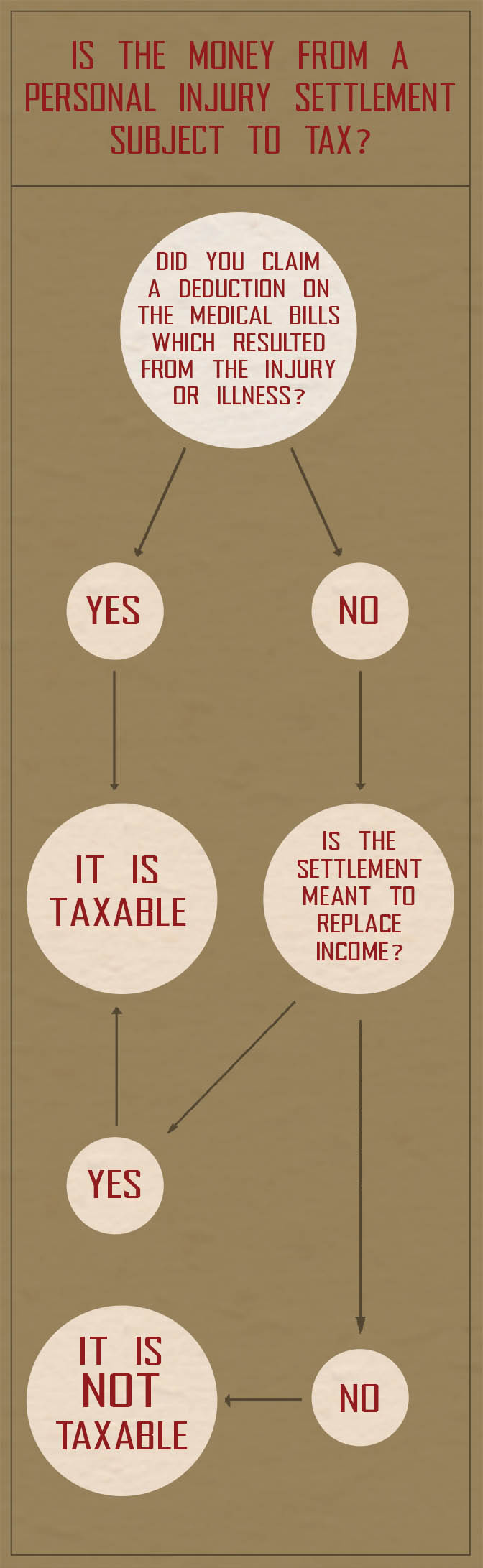

Can you deduct medical bills on taxes?

In some cases, plaintiffs who have extensive medical bills will have taken these as deductions on their taxes , because in most cases you are allowed to deduct medicare expenses. If you then receive this money back in the form of compensation for your injuries, then you will need to pay the taxes you didn’t pay when taking this money as a deduction. Essentially, the IRS doesn’t permit anyone to get a tax deduction twice—if you already deducted the sum of your medical bills from your taxes last year, you’ll need to pay income tax when you receive that sum back as a settlement.

Can you file a lawsuit for emotional injuries?

Physical or emotional injuries are not the only situations where one can file a lawsuit and receive damages. You may receive damages in a lawsuit over wrongful termination, a breach of contract, or other business disputes, for example. In some situations, plaintiffs may point out that the stress of being fired may have caused a chronic condition to flare up or triggered a migraine. However, if your lawsuit is not about your physical ailment, than you will have to pay taxes on the award.

Do you have to pay taxes on a settlement?

You also shouldn’t have to pay taxes on portions of a settlement that are supposed to pay for things like medical care, repairs to your car or other property, legal fees, loss of quality of life, emotional distress, loss of consortium, or wrongful death. So, for example, if you are awarded an amount of money for loss of consortium and wrongful death after your spouse died in an accident caused by someone else’s negligence, you would not have to pay taxes on that award.

What is medical expense?

Medical expenses include bills to diagnose, cure, treat, mitigate or prevent a medical condition.

Do you pay taxes on personal injury settlements?

In most cases, there are no taxes owed on personal injury settlements as the Internal Revenue Service (IRS) does not consider this type of income to be a wage or salary. However, there are important exceptions.

Is emotional distress taxable?

However, if you claim that the damages were due to emotional distress, your award is taxable. If the emotional distress causes you to suffer some physical symptoms, the physical symptoms do not elevate your claim to tax-free status. However, if you are physically injured or ill and suffer emotional distress, then the emotional distress damages should be tax-free.

Is compensation tax free?

Generally, the way that it works is if you claim that the defendant caused you to be injured or become physically sick, and you receive compensation for damages based on this claim, then this compensation is tax-free.

Is it fair to deduct medical expenses?

The IRS reasons that it is not fair for you to have received a tax deduction for medical expenses that were paid off by money from your settlement. Additionally, whether you receive wages from your employer or those wages are included as part of a settlement award, you are required to pay income taxes on that portion.

Do you have to include damages on your taxes?

However, if you did not deduct these expense items previously, you do not have to include them on your taxable income. If your damages are the result of a breach of contract, they will be taxable if the breach of contract is the basis of your lawsuit. Additionally, punitive damages and interest on a judgment are taxable.

Is personal injury insurance taxable?

The general rule is that proceeds from a personal injury claim are not taxable under federal or state law. This rule applies to insurance proceeds, as well as to awards that are given by a judge or jury.

What is a settlement agreement?

A settlement occurs in a legal case when the parties resolve the case outside of court. In a Final Settlement Agreement, the parties will typically waive their rights to pursue any further legal action or monetary recovery from one another in that case.

What is punitive damages?

An injured person may be awarded money that goes beyond ordinary compensation for injuries and is intended to punish the wrongdoer. This monetary award is called punitive damages . Punitive damages are generally taxable. Subject to limited exceptions, it does not matter if there are physical injuries or physical sickness.

How much did Bob get paid for leg surgery?

Bob again settles with the lawn mower company for $90,000. He received $60,000 for his medical expenses due to extensive leg surgery. Bob also receives $30,000 in compensation for mental anguish for having to live in a cast for over six months and for dealing with daily pain.

Is a lawn mower injury taxable?

Physical injuries and physical sickness are generally non-taxable. For example, Bob Smith is injured by a defective lawn mower and has $90,000 in medical expenses. The lawn mower company settles with Bob for $90,000. The personal injury settlement will be tax-free and Bob does not need to report it on a tax return.

Is a settlement award with compensation for lost wages or loss of income taxable?

Lost Wages or Loss of Income. Similar to wrongful discrimination and defamation, a settlement award with compensation for lost wages or loss of income is taxable and must be reported on a tax return.

Is Bob's $30,000 taxable?

Bob's $30,000 for mental anguish would likely be non-taxable because it is directly related to his physical injury. Attorney's fees associated with a monetary award for physical injuries and physical sickness may be non-taxable as well.

Is a settlement amount taxable?

However, where there is no relation between the emotional distress or mental anguish and a physical injury or physical sickness , the settlement amount is taxable. In this example, Bob is not injured by a lawn mower. Instead, Bob's neighbor tells several people that Bob steals money from the local church.

How do I Protect my Personal Injury Settlement From the IRS?

Another way that some people choose to deal with the tax is to receive payment through a structured annuity over time, and not all at once. This can reduce the amount due to the IRS.

What is punitive damages?

This is also true in cases in which punitive damages were awarded. Punitive damages are amounts awarded as punishment for the other party’s bad behavior. These types of awards are different from monies received for injuries and corresponding medical bills, emotional distress, and pain and suffering related to the injury. Awards for pain and suffering etc., are given to make the person whole or to attempt to undo the wrongs committed and are compensation for your injuries. Punitive damages are not designed to make you whole. Instead, they are awards intended to simply punish the other party.

Do you have to pay taxes in New Jersey?

All New Jersey residents have to pay taxes to New Jersey and the Federal Government via the IRS. Taxes are due and owing on earned income. Earned income commonly includes money derived from your employment or self-employment.

Is personal injury settlement taxable?

Generally, personal injury settlements are not considered income and, in many cases, are not taxable unless there is a portion allotted for lost wages. More specifically, awards for pain and suffering related to an injury, emotional distress for such injury, as well as medical bills, and amounts paid out for attorney’s fees are not taxed. This does not mean that taxes are never owed on money derived from such cases or that the amount received does not have to be reported.

Is emotional suffering taxed?

Similarly, there are times when emotional suffering not based on an injury is taxed. In other words, things that you may be going through as a result of the emotional distress would not be tax-free unless it is related to an actual physical injury sustained.

Do you have to report PI to IRS?

As a general rule, you should always rely on your accountant for tax advice. However, as PI attorneys, we had clients who have had to report their award to the IRS. As you know, there are exceptions to every rule, and the IRS is no different. Taxes are determined on a case-by-case basis and are fact-sensitive. There are instances in which the IRS will require you to report the amount and pay tax.

Rule of Thumb

Non-Taxable Personal Injury Compensation: What Is Included

- If you receive compensation for the kinds of damages listed below, it is typically non-taxable: 1. Medical bills 2. Pain and suffering 3. Loss of consortium 4. Attorney fees Medical expenses include bills to diagnose, cure, treat, mitigate or prevent a medical condition.

Exceptions For Non-Taxable Compensation

- There are exceptions to when personal injury compensation is taxable. For example, if you include the medical expenses related to the injury for a tax deduction on your prior year’s tax return, the portion of your award that went to reimburse you for these expenses may be taxable. The IRS reasons that it is not fair for you to have received a tax deduction for medical expenses …

Confusion Due to 2017 Law

- In 2017, the Trump Administration signed a tax law that said compensation from a personal injury settlementor award is only tax-free if the injuries are physical. Emotional distress does not qualify as physical. Other by-products of emotional distress, such as insomnia, headaches and stomachaches also do not qualify to receive the tax-free treatmen...

Contact A Knowledgeable Lawyer For Help

- A knowledgeable attorney, like those at Pfeifer, Morgan & Stesiak, is well-versed in complex legal issues, such as taxes on injury settlements. We can work tirelessly on your behalf to maximize the non-taxable portion of your award. Contact our office in South Bend for a free no-obligation review of your case. We work on a contingency basis, so there is never any fee for you unless we win …