If you had already made your choice and now want to change it, you can do so by reaching out to the settlement administrator through the site's contact form. Getting the most value from the Equifax settlement

Full Answer

Where can I find out more about the Equifax settlement?

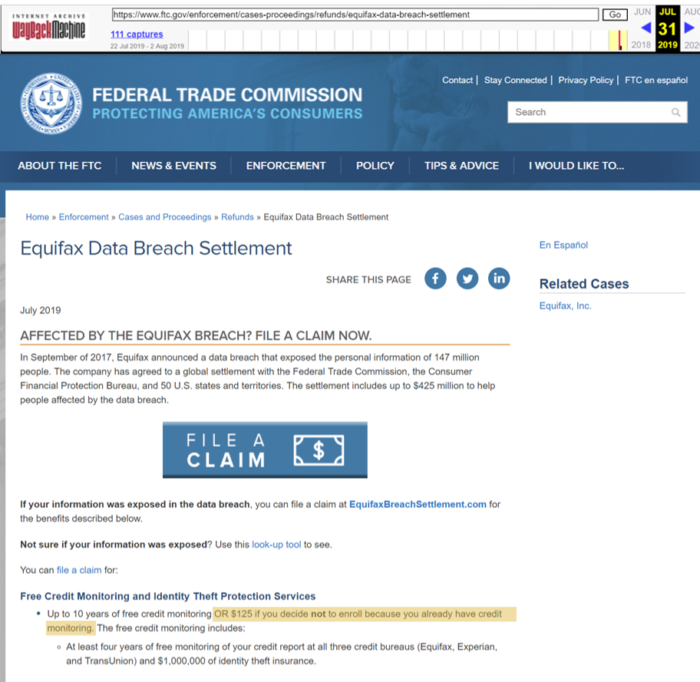

Learn more at the FTC’s official site for information: ftc.gov/Equifax. Remember that you don’t have to pay for credit monitoring as part of this settlement, and nobody will call, text, or email out of the blue to ask you for your credit card or bank account numbers, or to “help” you get your free credit monitoring.

How much did you pay for the Equifax breach?

As a result, consumers who were affected by the breach had the option of signing up for either up to $125 or free credit monitoring at all three of the largest credit reporting firms: Equifax, Experian and TransUnion. (Consumers who sought cash payments should visit the settlement claims administrator’s website for updates, Equifax told CNBC.)

Did you get an email about free credit monitoring through Equifax?

Lots of people recently got an email or letter about free credit monitoring through the Equifax settlement. That’s because the settlement with Equifax was just approved by a court. So now, if you signed up for credit monitoring as part of that settlement, you can take a few steps to switch it on. The email or letter tells you how.

Do I have to pay for credit monitoring with the settlement?

Remember that you don’t have to pay for credit monitoring as part of this settlement, and nobody will call, text, or email out of the blue to ask you for your credit card or bank account numbers, or to “help” you get your free credit monitoring. Anyone who does is a scammer, so please tell the FTC at ReportFraud.ftc.gov.

See more

How much can you get from Equifax settlement?

If you asked for money If you requested compensation of up to $125 or reimbursement for time spent recovering from fraud or ID theft, a check or debit card will be mailed to the address you used when submitting your claim. Be prepared for compensation that is much less than you requested.

What happened to Equifax data breach settlement?

Equifax data breach settlement. In 2017, Equifax announced a breach that exposed the personal data of approximately 147 million people. The legal settlement is now final. Here's how you can use the services provided through the settlement to protect and monitor your credit.

Who qualifies for the Equifax settlement?

You are a Settlement Class Member if you are among the approximately 147 million U.S. consumers identified by Equifax whose personal information was impacted by the Equifax Data Breach.

How do I check my Equifax settlement status?

You can also log into your myEquifax account and view your status by clicking the “check status of a dispute” button. If you are checking your status by mail or phone, please make sure you have the confirmation number that was provided to you when you submitted your dispute.

How much can you get from a data breach settlement?

You can get compensation for up to 20 hours at $25 per hour for the time you spent taking measures to prevent identity theft or dealing with identity theft. Ten hours can be self-certified, requiring no documentation.

How long does a data breach claim take?

In reality, how long a data breach claim takes simply comes down to the circumstances of the case. Some cases could be resolved in a few months, whereas others may end up being pursued for several years.

Did anyone get money from Equifax?

Court Approves Equifax Breach Settlement: Money for Some, Free Credit Monitoring for All. Equifax will pay up to $425 million in restitution to those directly impacted by the massive data breach of the credit bureau in 2017. A federal court gave final approval to the class-action lawsuit settlement in mid-January.

Is Equifax being sued?

Equifax sued over glitch sending inaccurate credit scores to lenders. Consumer credit reporting agency Equifax is being sued for a three-week glitch earlier this year that may have sent incorrect credit scores for potentially millions of Americans to lending agencies and banks across the country.

How do I know if I was affected by the Equifax breach?

If you want to check whether your data was exposed, the FTC and official settlement site have an online tool you can use to check if you were part of the Equifax breach. You'll need to enter your last name and last six digits of your Social Security number to see if your data was part of the hack.

Is my Equifax the same as Equifax?

Highlights: With a free myEquifax account, you can receive free Equifax credit reports, place a security freeze, fraud alert or submit a dispute. A myEquifax account is FREE, and for anyone to easily view and monitor their Equifax credit report and needs credit report assistance.

Are Experian and Equifax the same?

Experian provides monthly data for each account including the minimum payment due, payment amounts, and balances. Equifax lists accounts in groupings of “open” or “closed,” which makes it easy to view current versus old credit data.

Does Equifax sell your information?

We use and sell personal data to nonaffiliated third parties for the following commercial purposes: Consumer credit reporting. Some of our affiliates collect, use, and sell personal data when acting as a consumer reporting agency, as this activity is regulated by the FCRA.

Did anyone get money from Equifax?

Court Approves Equifax Breach Settlement: Money for Some, Free Credit Monitoring for All. Equifax will pay up to $425 million in restitution to those directly impacted by the massive data breach of the credit bureau in 2017. A federal court gave final approval to the class-action lawsuit settlement in mid-January.

Where is my Yahoo settlement check?

If you are still not sure whether you are a Settlement Class Member, you may go to the Contact page of this Settlement Website or call the Settlement Administrator toll free number at 844-702-2788, to see if you are a Settlement Class Member.

How much did the Equifax breach cost the company?

The hackers had access to the data for almost three months before the company realized it. Under the terms of the settlement revealed Monday, the company will pay a $175 million fine to the states and $100 million to the CFPB.

Who was responsible for the Equifax data breach?

The U.S. Department of Justice announced that a federal grand jury in Atlanta delivered a nine-count indictment accusing four hackers and members of China's People's Liberation Army – Wu Zhiyong, Wang Qian, Xu Ke and Liu Lei – of serving as masterminds of the hack.

Settlement deadline and claim verification

Don’t miss this deadline if you incurred provable out-of-pocket losses or if you want free credit monitoring — these are probably the two actual benefits you can expect. The earliest you will receive them will be January 23, 2020.

Settlement option to opt-out

This section of the email explains how to opt-out but not why to opt-out. Opt-out if you may want to file your own lawsuit against Equifax at some point — you can’t be part of the class-action suit and also file another suit.

The Equifax settlement options

The Equifax settlement provides two compensation options for everyone affected: 10 years of free credit monitoring or a cash payout of up to $125.

Should you choose cash or credit monitoring?

Here's the problem with taking the cash -- the fund for this alternative reimbursement only has $31 million available. That money will be divided between everyone who chooses the cash payout, which means if too many people choose this option, the payout amounts will be reduced.

Additional compensation

Whether you take the cash or credit monitoring, the settlement also allows you to claim compensation for time spent or unreimbursed out-of-pocket losses you suffered that can be traced back to the data breach.

How to file a claim

The settlement administrator has created an Equifax data breach settlement site where you can read more about it and file your claim.

Getting the most value from the Equifax settlement

When news of the Equifax settlement first broke, it wasn't clear that the cash settlements could be reduced, so there was plenty of talk about "claiming your $125". Based on the number of people who have already filed, the cash payout won't amount to much.

Top credit card wipes out interest into 2023

If you have credit card debt, transferring it to this top balance transfer card secures you a 0% intro APR into 2023! Plus, you’ll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt. Read The Ascent's full review for free and apply in just 2 minutes.

About the Author

Lyle is a writer specializing in credit cards, travel rewards programs, and banking. His work has also appeared on MSN Money, USA Today, and Yahoo! Finance.