Do you have to settle a workers compensation claim?

Note: Workers comp settlements are entirely voluntary. You don’t have to agree to a settlement offer proposed by your employer or its insurance company, nor do you have the ability to force the employer or insurer to settle your claim. How Is a Settlement Calculated for Workers Compensation?

How long do I have to report a workers’ comp claim?

Most typically require a report within 30 days to start the workers’ comp claims process. As the employer, you should follow these steps once you’re told an employee was hurt: Get the employee medical attention.

Do I have to report workers comp income on my taxes?

You do not have to report workers comp income on your tax returns. If you received workers comp for the entire year, you would have no income to report on your taxes, IF it’s the only income you receive. Now, there are exceptions.

Should I report a compensation settlement to the welfare office?

As a general rule, you should always report a compensation settlement to the welfare office in order to ensure that you do not violate the law. What Is Welfare? Welfare is a broad term used to describe several different programs that help low- or no-income citizens.

Should workers compensation be reported on w2?

No, your employer didn't make an error if you don't see your workers' compensation reflected on 2020's W-2. That's because workers' compensation is not considered taxable income. As a result, it is not reported on your W-2 form.

Where do I put workers comp on TurboTax?

@aman2020 You should receive a form 1099-G reporting your workmen's compensation income and you will enter that in the Unemployment section of TurboTax, which is in the federal Wages and Income section.

How do workers comp settlements work in California?

Settlement of claims for California workers' compensation benefits takes two primary forms: by agreeing to have the insurance company provide future medical care for the injury for life, or. by taking a lump sum of the cash value of future medical treatment.

Is workers Comp taxable in Kentucky?

In short, the answer is “no”. Workers compensation benefits are not considered taxable income.

Does compensation count as income?

Any interest you receive after you've invested your compensation might be taxable, and you'll need to declare it on any tax return. In some cases, the tax will have already been paid 'at source' - this means the tax has already been paid before the interest is given to you, but you'll need to declare it either way.

Is workers Comp taxable on Turbotax?

Workers' compensation benefits are not taxable and are not claimed on yearly tax statements. These are fully exempt from state and federal taxes, regardless if paid on a scheduled basis (like weekly or biweekly) or in a lump sum.

What is the average work comp settlement in California?

between $2,000 and $20,000In California, the average workers' compensation settlement is two-thirds of your pre-tax wages. Research shows that the typical amount is between $2,000 and $20,000.

What is the average workers comp shoulder injury settlement in California?

between $25,000.00 and $175,000.00In my experience, the average workers compensation settlement amount for a shoulder injury is between $25,000.00 and $175,000.00.

What is the biggest workers comp settlement?

a $10 millionTo date, the largest settlement payment in a workers' comp case came in March of 2017, with a $10 million settlement agreement.

Are workers comp benefits taxable IRS?

The quick answer is that, generally, workers' compensation benefits are not taxable. It doesn't matter if they're receiving benefits for a slip and fall accident, muscle strain, back injury, tendinitis or carpal tunnel. In most cases, they won't pay taxes on workers' comp benefits.

Are workers compensation weekly payments taxable income?

Any weekly WorkCover payments you receive are treated as your income and therefore taxable.

Can a company fire you while on workers comp in Kentucky?

Employers cannot lay employees off or fire them simply for pursuing or receiving workers' compensation benefits. Those actions are considered retaliatory measures and are a violation of the law.

How long do most workers comp settlements take?

around 12-18 monthsHow Long Does It Take to Reach a Settlement for Workers' Comp? The entire settlement process—from filing your claim to having the money in your hands—can take around 12-18 months depending on the details of your case and whether or not you have legal representation.

What is the maximum workers compensation in California?

For 2020, the maximum is $1,299.43 per week, while the minimum is $194.91. However, these amounts will be different for people who were injured before 2020; for two years after the injury, you're locked into the maximum TD payment that applied to your injury date.

What is the maximum permanent disability benefit in California?

Permanent Disability Payments: How Much and How Long For injuries between 2014 and 2018, the minimum is $160 per week, and the maximum is $290 per week. While the amount of partial PD payments may be similar to the weekly amount of total PD, the big difference is how long you receive those payments.

How long can you stay on workers comp in California?

104 weeksIn the typical workers' compensation claim filed in California, benefits can be provided for 104 weeks or 2 years' worth. The 104 weeks of benefits can be parceled out across 5 years, though, if you do not need to use all 104 weeks consecutively.

How Is a Settlement Calculated for Workers Compensation?

The formula for calculating a workers compensation settlement package involves four major factors:

What is workers compensation settlement?

Workers Compensation Settlements. Workers compensation insurance provides a safety net for medical expenses and lost wages of those who get hurt on the job. But that doesn’t mean such workers have to accept whatever the insurance company offers. A workers compensation settlement is a way you can negotiate the immediate payment ...

What happens if you dispute a workers comp claim?

If your claim is disputed, a trial or workers comp hearing is time-consuming and risky. The judge or hearing officer may award you less money than the insurance company offered to settle your workers comp claim. Note: Workers comp settlements are entirely voluntary. You don’t have to agree to a settlement offer proposed by your employer ...

How long does it take to settle a workers comp case?

Short answer: It varies greatly. The Martindale-Nolo survey of readers turned up an average of 15.7 months to resolve a case, and less than 20% of cases are resolved in less than six months. Obviously, those who try to negotiate a better workers comp settlement may hire legal assistance to negotiate the best terms for a settlement or to bring a hearing if there is a disputed issued. This can be time consuming. However, a shorter time frame is not always better. Those actions that lengthen the process can also bring higher settlements.

Why do you settle a lump sum claim?

If you settle the claim, you can choose or change your physicians. However, if you have severe and complicated work-related injuries, you may not want to settle the medical portion of the claim because you can be entitled to medical benefits for your accident for the rest of your life. Some injuries are too complicated to take the risk that you will not have enough money through a settlement to meet your medical needs.

How long does it take for a settlement to be approved?

Those actions that lengthen the process can also bring higher settlements. Once an agreement is reached, it can take four-to-eight weeks for money to arrive while settlement contracts are drafted, signed and approved.

Do you have to agree to a workers comp settlement?

You don’t have to agree to a settlement offer proposed by your employer or its insurance company, nor do you have the ability to force the employer or insurer to settle your claim. Talk with an attorney for free today, and find out how much money you could receive in a workers comp settlement.

What is workers compensation?

In the event of on-the-job injury or illness, workers' compensation covers all associated medical treatment. Medical claims can be made for emergency care or regular treatment for less urgent work-related health problems. Based upon the situation, coverage may activate immediately upon injury or require pre-approval from the insurance company.

What is workers comp?

In employment-related deaths, workers' comp provides funeral and burial expenses for all covered employees. For workers with spouses or dependents, it also distributes cash benefits, typically equivalent to what the deceased would have received for total permanent disability. Benefits stop if/when the spouse remarries or dependent recipients reach adulthood.

What does a workman's comp judge do?

In most cases, a workman's comp judge must review and certify a settlement before it becomes final. If the injured worker has not retained a workers compensation attorney to negotiate on their behalf, the judge will attempt to ensure the amount of money and duration of benefits are fair.

Can you file a lump sum claim for workers compensation?

In this case, the injured party does not give up their right to claim future benefits for the same work-related health problem. If unexpected medical bills crop up later, the injured worker may still be able to file a claim for them.

Can you get a bulk disability payment?

In lieu of continued weekly or bi-weekly disability payments, the insurance company may offer one bulk payment . Ideally, the amount offered will cover the employee's medical bills and a portion of lost wages for the expected duration of disability.

Is Workman's comp taxable?

The Federal Government does not count workman's comp disability benefits as taxable, but some states may.

Can an employer cover emergency care?

Emergency Care Claims: In most cases, employees are free to seek immediate emergency services, and the workers' compensation insurer will cover them without prior clam approval. The employer may tell them to obtain such care from a specific healthcare provider. Regardless, the employee should inform emergency healthcare providers that the injury or illness is work-related (if they are able). If the claim is later denied, the employee may or may not have to cover the cost.

What happens if a workers compensation claim is approved?

If the workers’ compensation claim is approved, the insurance company will pay for any medical expenses related to the injury.

Who is responsible for filing a workers comp claim?

File a claim. You’re usually responsible for filing a workers’ comp claim with your insurance provider. Rules vary, but you may also need to submit documentation to the state workers’ comp board.

What is a return to work program?

Your goal should be to get your injured worker healthy and back on the job as quickly as possible. A return-to-work program can help.

What is lump sum compensation?

A work injury settlement can be either a lump sum or a structured payment plan: Lump sum payment: The employee receives a one-time payment for all medical costs and benefits under the claim.

How many nonfatal workplace injuries are there in 2019?

And an expensive one. The U.S. Bureau of Labor Statistics reported 2.8 million nonfatal workplace illnesses or injuries by private employers in 2019. And each year, U.S. companies spend nearly $62 billion on lost-time workplace injuries. To protect employers and workers from the financial risks of workplace injuries, ...

What to do when you are told your employee is hurt?

As the employer, you should follow these steps once you’re told an employee was hurt: Get the employee medical attention. If you learn of an injury right away, help the employee receive the proper care. Investigate the accident. You have a duty to document what happened and identify possible safety issues.

Why is it important to get an employee back to work?

Reduced employment costs: Getting an employee back to work helps avoid the costs of hiring and training temporary replacements.

What is worker comp?

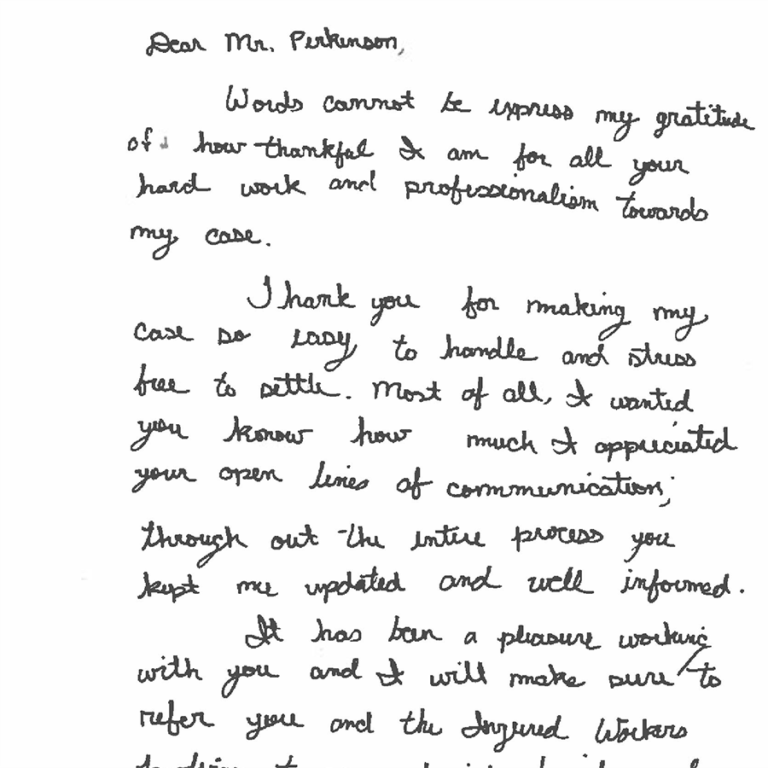

Worker's compensation, or "worker's comp", is a payment made when a person is injured while working. Whether it will affect a household's welfare benefits depends on several factors, but regardless, the settlement must be reported.

Does worker compensation have to be reported?

A worker's compensation settlement could increase a household's income, and therefore the settlement may need to be reported.

Is not reporting changes in income considered fraud?

Not reporting changes in income is considered benefit fraud. In essence, by not reporting that you have additional income from a worker's comp settlement while you continue to receive benefits is illegal. Penalties can range from fines to legal action and the repayment of any benefits you received after the settlement.

What expenses can you deduct from your workers comp?

The expenses include lawyer fees, medical expenses, and even dependent costs.

How much of your pre-injury income can you receive from SSDI?

By law, you can only receive up to 80% of your pre-injury earnings between SSDI and workers comp benefits. If your SSDI and workmen’s comp add up to over 80% of your pre-injury income, the Social Security Administration will offset your SSDI (reduce it) by the exact amount you’re over the threshold.

Is workers comp taxable?

Generally speaking, no workers comp settlements are not taxable at the federal or state level. If you’re injured at work and receive payments to cover your medical expenses, loss of wages, and pain/suffering, they aren’t taxable in most cases.

Do you have to work on light duty to get workers comp?

Many people on workmen’s comp end up going back to work on ‘light duty.’ Since you’ll earn income working but still get some workers comp, you’ll owe taxes on the earned income that isn’t the workmen’s comp income if it exceeds the threshold for taxable income for the year.

Do you have to report workers comp on taxes?

You do not have to report workers comp income on your tax returns. If you received workers comp for the entire year, you would have no income to report on your taxes, IF it’s the only income you receive.

Can you ask for lump sum settlement?

If you receive a lump sum settlement, you can ask for it to be prorated over your lifetime. You still receive the settlement in one payment, but for tax purposes, it’s amortized over your expected lifetime.

Is SS taxable for workers comp?

The amount the SS Admin decreases your SSDI and your workers comp covers it, is taxable. If your SSDI is decreased by $300 a month and replaced with $300 in workers compensation income, $300 of your workmen’s comp is taxable.