Do I have to report a settlement on my 1099?

What to Report on Your Form 1099-MISC If you receive a court settlement in a lawsuit, then the IRS requires that the payor send the receiving party an IRS Form 1099-MISC for taxable legal settlements (if more than $600 is sent from the payer to a claimant in a calendar year).

How do I report a lawsuit settlement on my taxes?

Form 1040. If you have a lawsuit settlement that’s taxable, report it on Line 21 of Form 1040, which is labeled “other income.” Taxable settlement monies are taxed at ordinary income tax rates, although it is likely the settlement will put you into a higher tax bracket. Although you don’t owe taxes on a personal injury settlement per se,...

Do you have to pay taxes on a settlement?

Tax Implications of Settlements and Judgments The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code.

How are taxable settlement proceeds reported on Form 1040?

After reporting taxable settlement proceeds on Line 21 (labeled "other income") of Schedule 1 (1040), add Lines 1 through 21 and enter the sum on Line 22 before transferring this sum to Line 6 of Form 1040. Taxable settlement monies are taxed at ordinary income tax rates, although it is likely the settlement will put you into a higher tax bracket.

Do I have to include settlement money on my taxes?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

How do I report a settlement to the IRS?

Attach to your return a statement showing the entire settlement amount less related medical costs not previously deducted and medical costs deducted for which there was no tax benefit. The net taxable amount should be reported as “Other Income” on line 8z of Form 1040, Schedule 1.

Do you get a 1099 for a settlement?

If you receive a taxable court settlement, you might receive Form 1099-MISC. This form is used to report all kinds of miscellaneous income: royalty payments, fishing boat proceeds, and, of course, legal settlements. Your settlement income would be reported in box 3, for "other income."

What part of a settlement is taxable?

You might receive a tax-free settlement or judgment, but pre-judgment or post-judgment interest is always taxable (and can produce attorney fee problems).

How can I avoid paying taxes on a settlement?

How to Avoid Paying Taxes on a Lawsuit SettlementPhysical injury or sickness. ... Emotional distress may be taxable. ... Medical expenses. ... Punitive damages are taxable. ... Contingency fees may be taxable. ... Negotiate the amount of the 1099 income before you finalize the settlement. ... Allocate damages to reduce taxes.More items...•

Can the IRS take my settlement money?

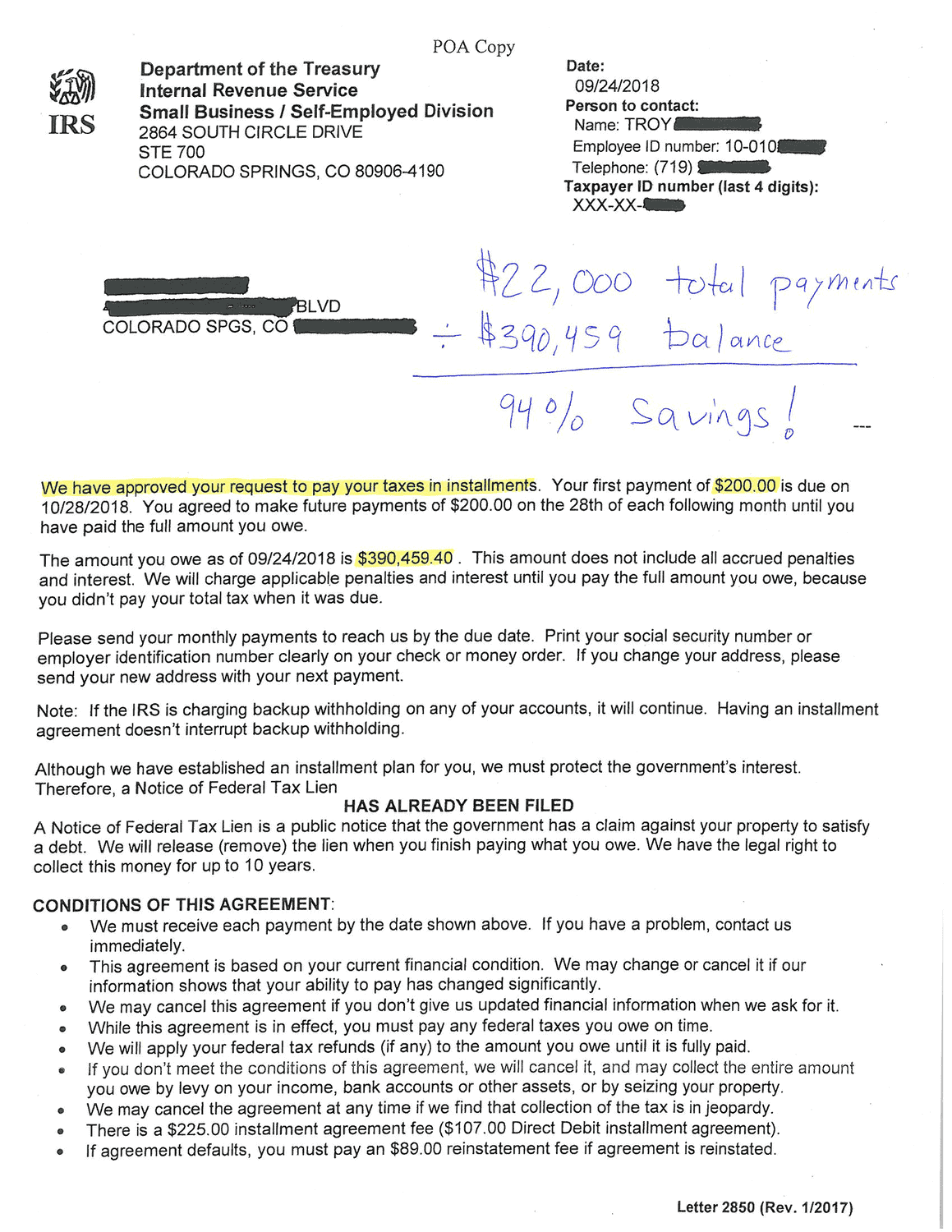

If you have back taxes, yes—the IRS MIGHT take a portion of your personal injury settlement. If the IRS already has a lien on your personal property, it could potentially take your settlement as payment for your unpaid taxes behind that federal tax lien if you deposit the compensation into your bank account.

Do you get a w2 for a settlement?

REPORTING REQUIREMENTS The settlement agreement should also explicitly provide for how the settlement will be reported as well. The two primary methods to report the settlement to the IRS are either on a Form W-2 or a Form 1099-MISC.

Why is a W 9 required for settlement?

The Form W-9 is a means to ensure that the payee of the settlement is reporting its full income. Attorneys are frequently asked to supply their own Taxpayer Identification Numbers and other information to the liability carrier paying a settlement.

Is a lump sum payment in a divorce settlement taxable?

Generally, lump-sum divorce settlements are not taxable for the recipient. If the lump-sum payment is an alimony payment, it is not deductible for the person who makes the payment and is not considered income for the recipient.

Why is a W 9 required for settlement?

The Form W-9 is a means to ensure that the payee of the settlement is reporting its full income. Attorneys are frequently asked to supply their own Taxpayer Identification Numbers and other information to the liability carrier paying a settlement.

How do you account for legal settlements?

How to Account for a Record Estimated Loss From a LawsuitRead the documents from the company's attorney. ... Write a journal entry to record the estimated loss. ... Enter the dollar amount in the general ledger to increase the "Lawsuit Expense" account.More items...

What if the lawyer is beyond merely receiving the money and dividing the lawyer’s and client’s shares?

What if the lawyer is beyond merely receiving the money and dividing the lawyer’s and client’s shares? Under IRS regulations, if lawyers take on too big a role and exercise management and oversight of client monies, they become “payors” and as such are required to issue Forms 1099 when they disburse funds.

Why do lawyers send 1099s?

Copies go to state tax authorities, which are useful in collecting state tax revenues. Lawyers receive and send more Forms 1099 than most people, in part due to tax laws that single them out. Lawyers make good audit subjects because they often handle client funds. They also tend to have significant income.

What is the exception to the IRS 1099 rule?

Payments made to a corporation for services are generally exempt; however, an exception applies to payments for legal services. Put another way, the rule that payments to lawyers must be the subject of a Form 1099 trumps the rule that payments to corporation need not be. Thus, any payment for services of $600 or more to a lawyer or law firm must be the subject of a Form 1099, and it does not matter if the law firm is a corporation, LLC, LLP, or general partnership, nor does it matter how large or small the law firm may be. A lawyer or law firm paying fees to co-counsel or a referral fee to a lawyer must issue a Form 1099 regardless of how the lawyer or law firm is organized. Plus, any client paying a law firm more than $600 in a year as part of the client’s business must issue a Form 1099. Forms 1099 are generally issued in January of the year after payment. In general, they must be dispatched to the taxpayer and IRS by the last day of January.

How does Larry Lawyer earn a contingent fee?

Example 1: Larry Lawyer earns a contingent fee by helping Cathy Client sue her bank. The settlement check is payable jointly to Larry and Cathy. If the bank doesn’t know the Larry/Cathy split, it must issue two Forms 1099 to both Larry and Cathy, each for the full amount. When Larry cuts Cathy a check for her share, he need not issue a form.

What percentage of 1099 does Larry get?

The bank will issue Larry a Form 1099 for his 40 percent. It will issue Cathy a Form 1099 for 100 percent, including the payment to Larry, even though the bank paid Larry directly. Cathy must find a way to deduct the legal fee.

When do you get a 1099 from a law firm?

Forms 1099 are generally issued in January of the year after payment. In general, they must be dispatched to the taxpayer and IRS by the last day of January.

How much is the penalty for not filing 1099?

Most penalties for nonintentional failures to file are modest—as small as $270 per form . This penalty for failure to file Forms 1099 is aimed primarily at large-scale failures, such as where a bank fails to issue thousands of the forms to account holders; however, law firms should be careful about these rules, too.

Why should settlement agreements be taxed?

Because different types of settlements are taxed differently, your settlement agreement should designate how the proceeds should be taxed—whether as amounts paid as wages, other damages, or attorney fees.

How much money did the IRS settle in 2019?

In 2019, the average legal settlement was $27.4 million, according to the National Law Review, with 57% of all lawsuits settling for between $5 million and $25 million. However, many plaintiffs are surprised after they win or settle a case that their proceeds may be reportable for taxes. The Internal Revenue Service (IRS) simply won't let you collect a large amount of money without sharing that information (and proceeds to a degree) with the agency.

What to report on 1099-MISC?

What to Report on Your Form 1099-MISC. If you receive a court settlement in a lawsuit, then the IRS requires that the payor send the receiving party an IRS Form 1099-MISC for taxable legal settlements (if more than $600 is sent from the payer to a claimant in a calendar year). Box 3 of Form 1099-MISC identifies "other income," which includes ...

How much is a 1099 settlement?

What You Need to Know. Are Legal Settlements 1099 Reportable? What You Need to Know. In 2019, the average legal settlement was $27.4 million, according to the National Law Review, with 57% of all lawsuits settling for between $5 million and $25 million.

What form do you report lost wages on?

In this example, you'll report lost wages on a Form W-2, the emotional distress damages on a Form 1099-MISC (since they are taxable), and attorney fees on a Form 1099-NEC. As Benjamin Franklin said after the U.S. Constitution was signed, "in this world nothing can be said to be certain, except death and taxes.".

What happens if you get paid with contingent fee?

If your attorney or law firm was paid with a contingent fee in pursuing your legal settlement check or performing legal services, you will be treated as receiving the total amount of the proceeds, even if a portion of the settlement is paid to your attorney.

Do you have to pay taxes on a 1099 settlement?

Where many plaintiff's 1099 attorneys now take up to 40% of the settlement in legal fees, the full amount of the settlement may need to be reported to the IRS on your income tax. And in some cases, you'll need to pay taxes on those proceeds as well. Let's look at the reporting and taxability rules regarding legal settlements in more detail as ...

What line do you add settlement proceeds to on a 1040?

After reporting taxable settlement proceeds on Line 21 (labeled "other income") of Schedule 1 (1040), add Lines 1 through 21 and enter the sum on Line 22 before transferring this sum to Line 6 of Form 1040.

When are compensatory damages taxable?

Compensatory damages are those awarded to a plaintiff to replace something lost. Compensatory damages are taxable when they do not pertain to any sort of injury.

Is lost wages a punitive or compensatory damages?

Often, the compensatory damages in a personal injury settlement, such as lost wages or medical expenses, are listed separately from any punitive damages, so it is easy to figure out the correct amounts.

Is personal injury settlement taxable?

Personal Injury Settlement Not Taxable. Most personal injury settlements are not taxable, and that’s true at the state as well as at the federal level. You don’t have to report such monies on your Form 1040.

Do settlements have to be taxed?

Taxable settlement monies are taxed at ordinary income tax rates, although it is likely the settlement will put you into a higher tax bracket.

Do you report insurance settlements on 1040?

How to Report Insurance Settlement Proceeds on IRS Form 1040. Before you report taxes on an insurance settlement on your Form 1040, you must know which settlement proceed s are considered taxable by the Internal Revenue Service and which are not . The answer depends on the nature of the lawsuit and the settlement.

Is a car accident settlement taxable?

A Car Accident Settlement May Be Taxable. If your car accident settlement involved personal injury, that part of the lawsuit settlement isn’t taxable. However, if you received monies for emotional distress and the emotional distress wasn’t directly related to your injuries, you must pay tax on that amount.

When is my settlement considered taxable?

In general, the Internal Revenue Service (IRS) will only seek to tax personal injury settlements if the settlement is meant to replace your own income.

Is a personal injury settlement taxable?

In general, the money that is received from a personal injury settlement is not taxable as long as it was received due to a physical injury or physical sickness. The IRS states that: If you receive a settlement for personal physical injuries or physical sickness and did not take an itemized deduction for medical expenses related to ...

Do you have to include medical expenses in a settlement?

The exact wording from the IRS website is as follows: If you receive a settlement for personal physical injuries or physical sickness, you must include in income that portion of the settlement that is for medical expenses you deducted in any prior year (s) to the extent the deduction (s) provided a tax benefit.

Is medical expenses taxable if you claim medical expenses?

According to Tax Attorney John Claudell: “if you itemize deductions and you claimed medical expenses in previous years as an itemized deduction that were later reimbursed by the settlement then that amount would be taxable.”. Essentially what the IRS is saying here is that if you have claimed the money as a deduction from your taxes previously then ...

Is a settlement taxable?

In the event that your settlement is meant to replace income (e.g. employment discrimination or a lost profits claim from business) then the claim can be taxed. There are a few other instances that may be considered income replacement, so if this is something that you are worried about, it is important to consult a tax attorney to determine whether your settlement is taxable based on the unique circumstances of your case.

Christian K. Lassen II

Some do and some don't. If you receive a Form 1099-MISC, that means they reported it. Regardless of whether it is reported by the company to the IRS or not, you need to report it on your tax return. Proceeds of an insurance claim aren't taxable income per se.

Peter N Munsing

I do not believe that this is taxable income, and I don't think there is any reason to report it, but I would confirm that with a tax lawyer or an accountant.