How Are Lawsuit Settlements Paid?

- Signing documents or release forms - these depend on your claim. You are asked if you agree that the settlement amount...

- Once the forms are signed, the check is released by the insurance company

- The legal representative will pay off any liens against the plaintiff (you), such as medical expenses

- The legal representative then pays off an...

How long does it take to settle a lawsuit?

In general, most class actions take between two and three years to resolve, though some may take longer, particularly if a court ruling is appealed. Some companies, however, may choose to settle class actions relatively quickly.

Does a lawsuit settlement get taxed?

The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code.

What to expect in a lawsuit?

- Specifics about your injury (why, how, when and where)

- The circumstances that caused your injury (the why, how, when and where of the exposure)

- The effect that your injury has had on you and your family – physically, financially and emotionally

What is the average payout for a Zantac lawsuit?

The numerical payout amount will be determined during settlement proceedings. Predictions for Zantac lawsuit payouts involve a three-tiered ranking. The first tier of predicted payout ranges from $300,000-$400,000. The second tier of predicted payouts ranges from $80,000 to $120,000.

How is settlement money divided?

The percentage of the settlement or judgment that attorneys charge does vary slightly, usually between 25% to 50%, depending on the type of case being handled.

How does the settlement process work?

A settlement agreement works by the parties coming to terms on a resolution of the case. The parties agree on exactly what the outcome is going to be. They put the agreement in writing, and both parties sign it. Then, the settlement agreement has the same effect as though the jury decided the case with that outcome.

Are lawsuit settlements taxable?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

How do I find out how much my settlement is?

After your attorney clears all your liens, legal fees, and applicable case costs, the firm will write you a check for the remaining amount of your settlement. Your attorney will send you the check and forward it to the address he or she has on file for you.

How long after settlement Do you receive the money?

At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged. Your conveyancer or solicitor can check and negotiate the settlement period with the seller.

How long does it take to get paid after a settlement?

While rough estimates usually put the amount of time to receive settlement money around four to six weeks after a case it settled, the amount of time leading up to settlement will also vary. There are multiple factors to consider when asking how long it takes to get a settlement check.

How do I avoid taxes in a lawsuit settlement?

Spread payments over time to avoid higher taxes: Receiving a large taxable settlement can bump your income into higher tax brackets. By spreading your settlement payments over multiple years, you can reduce the income that is subject to the highest tax rates.

Will I get a 1099 for a lawsuit settlement?

If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too. If all or part of your settlement was for back wages from a W-2 job, then you wouldn't get a 1099-MISC for that portion.

How is money from a lawsuit taxed?

The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code.

Can my lawyer cash my settlement check?

While your lawyer cannot release your settlement check until they resolve liens and bills associated with your case, it's usually best to be patient so you don't end up paying more than necessary.

How is pain and suffering calculated?

The insurance company, or a jury, will determine how many days you are expected to be in ongoing pain or discomfort. They then apply your daily rate of pay to the equation and multiply the days of pain by your rate of pay per day. It can be difficult to decide which method to use to calculate pain and suffering.

How do you calculate emotional pain and suffering?

These types of compensation are called pain and suffering. Generally, pain and suffering awards will be calculated by adding up the economic damages and multiplying them by a number between 1.5 and 5, depending on the severity of the injury.

Why does a judge prefer a settlement over a trial?

Settlements are usually faster and more cost-efficient than trials. They are also less stressful for the accident victim who would not need to testify in front of a judge or hear the defence attempt to minimize their injuries and symptoms.

Can my lawyer cash my settlement check?

While your lawyer cannot release your settlement check until they resolve liens and bills associated with your case, it's usually best to be patient so you don't end up paying more than necessary.

How long do banks hold settlement checks?

Generally, banks hold deposits for 1-7 business days, but large amounts of money could lead to a longer delay. All banks have a funds availability disclosure that they must make accessible to customers.

What should be included in a settlement agreement?

A settlement agreement always includes monetary and/or non-monetary consideration provided to the claimant to settle known claims against the business....Waiver of Certain Claims.Earned wages.Business expense reimbursement.Unemployment insurance.COBRA.Workers' compensation insurance.

How is money distributed when resolving a claim with a structured settlement?

Depending on the terms of your contract, your payments may be distributed on a monthly, yearly or quarterly schedule. Payouts may be in fixed amoun...

How much will I pay in taxes on my settlement money?

Section 104(a)(2) of the federal Internal Revenue Code excludes damages paid for physical injuries or wrongful death. Punitive damages, however, ar...

How do I sell my structured settlement?

The process for selling your structured settlement involves researching structured settlement purchasing companies, shopping around for the best qu...

What is structured settlement?

A structured settlement can include a large lump-sum payment upon termination of the contract. A child recipient may receive regular payments while they are a minor and then one large lump sum to pay for their college tuition when they graduate from high school.

How often can a structured settlement recipient receive payments?

A structured settlement recipient can receive payments at any reasonable regular interval, such as monthly, quarterly, annual ly or even some combination of schedules.

What is extra payment in a structured settlement?

Extra payments that occur in the form of periodic lump sums may be included in the terms of a structured settlement contract . For example, a structured settlement holder on a monthly payment schedule may receive an additional payment every five years to pay for the cost of replacing and upgrading medical devices.

Why do structured settlement contracts yield more than lump sum payouts?

In total, a structured settlement contract often yields more than a lump-sum payout would because of the interest earned over time.

Why is structured settlement important?

One of the greatest strengths of a structured settlement is its ability to earn interest, which can allow the payments to be adjusted upward over time to keep up with inflation. In addition, payments can be set to rise according to a schedule. This may be necessary if the costs of the recipient’s health care are expected to increase over time.

When do child support payments decrease?

For example, if a minor receives a structured settlement in a wrongful death lawsuit, the payments may be structured to decrease when the child reaches the age of majority.

Can a personal injury claim go to trial?

Some personal injury claims never make it to trial. Instead, plaintiffs and defendants negotiate compensation as a lump sum or a structured settlement, in which the plaintiff receives monthly payments for a specified period of time. Before you agree to a structured settlement, discuss your payout options and the full terms of the contract with an attorney or financial advisor.

How Is a Settlement Paid Out?

If you have pursued a claim for personal injury and a settlement has been reached, you may be wondering how the settlement is paid out.

Steps in the Payout Process

If the defendant has settled before a lawsuit is filed, your attorney will receive a check and then make sure you receive the money. The majority of personal injury claims are settled out of court. Usually, legal fees and costs are contingent upon winning a settlement, so an amount of up to 50% can be deducted by your lawyer from the settlement.

Cases Can Be Appealed

Bear in mind that court verdicts can be appealed by either side. If an appeal takes place, any verdict award will not be paid out until the appeal process is complete. Appeals can be lengthy, and an appeal that loses can be appealed again.

If You Need Funds Now

You can see that the actual payout of funds may take a long time. If you have been injured, you may have difficulty paying bills for medical care. If your injury rendered you unable to work, you could face rising bills from almost every area of life: rent or mortgage, food, utilities, and more. What happens then?

A Legal Loan Can Help

It is possible to obtain a loan to tide you over while your case is pending. Legal loans are nonrecourse, which means they are more like cash advances than standard bank loans. If your case is successful, you will need to pay the legal loan back, at a reasonable rate of interest.

How Are Lawsuit Settlements Paid?

There are several steps you will need to follow in order to get your money. Read all the paperwork carefully.

What Types of Lawsuits are Taxed?

In general, lawsuits that deal with wages are treated as wages. A lawsuit that deals with injuries or damages are not. However, this is not cut and dried, so always speak with a professional to determine how your lawsuit is laid out and how the damages are allocated.

How Is a Structured Settlement Paid Out?

A structured settlement is a stream of payments paid to someone who won or settled a civil lawsuit. The defendant in the case funds the settlement, and the plaintiff (or victim of a personal injury lawsuit) is paid these funds over time.

What is personal injury settlement?

Personal injury settlements are designed to put you back where you would have been if the accident had not happened. That means that if you suffered serious losses and damage, you should be paid more compared to someone who had very few losses or damages.

How is a lump sum distributed after a settlement?

When you settle a personal injury case, you will use the settlement amount to cover expenses incurred during the process before you spend the lump sum as you specified in court.

What is settlement money used for?

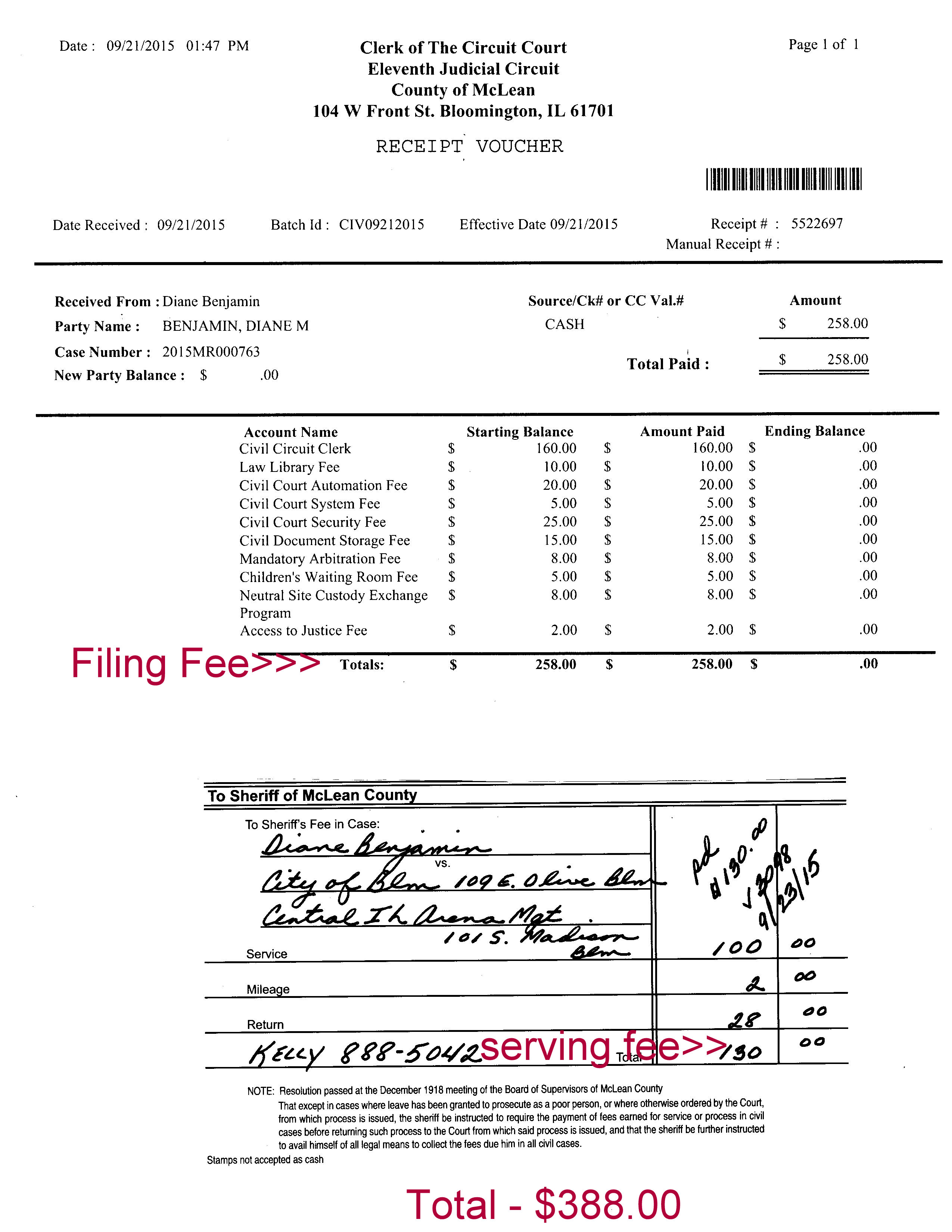

The settlement money will first be used to cover any expenses that were incurred in the lawsuit. In many cases, the law firm you are working with will cover common expenses like filing fees, court reporter fees, and expert expenses. Then, when you win your case or get a settlement, you will reimburse the law firm for those fees.

What happens when you get a structured settlement?

If you have a structured settlement, you and the defendant (with the help of your attorney) will ultimately decide how long you will receive payments and how much they will be. Once the structured settlement is set up and payments begin, you should not have to do anything else to get the payments based on your established schedule. Many structured settlements even use direct deposit to be sure you get payments on time, as promised.

How long does it take to get a medical lien payment?

It depends. In some cases, the final payout can be very quick if you receive a lump sum—a few days. In other cases, it can take a few months to be sure that all of your medical liens and other expenses are paid properly.

What does it mean when a medical provider is a lien?

That lien on your legal case means that you are required by law to pay those medical expenses once you get any funds out of the lawsuit. Sometimes medical providers will reduce their lien or make other adjustments if you request it.

What does it mean to pay taxes on a $100,000 case?

In a $100,000 case, that means paying tax on $100,000, even if $40,000 goes to the lawyer. The new law generally does not impact physical injury cases with no punitive damages. It also should not impact plaintiffs suing their employers, although there are new wrinkles in sexual harassment cases. Here are five rules to know.

Can you sue a building contractor for damages to your condo?

But if you sue for damage to your condo by a negligent building contractor, your damages may not be income. You may be able to treat the recovery as a reduction in your purchase price of the condo. The rules are full of exceptions and nuances, so be careful, how settlement awards are taxed, especially post-tax reform. 2.

Is there a deduction for legal fees?

How about deducting the legal fees? In 2004, Congress enacted an above the line deduction for legal fees in employment claims and certain whistleblower claims. That deduction still remains, but outside these two areas, there's big trouble. in the big tax bill passed at the end of 2017, there's a new tax on litigation settlements, no deduction for legal fees. No tax deduction for legal fees comes as a bizarre and unpleasant surprise. Tax advice early, before the case settles and the settlement agreement is signed, is essential.

Is attorney fees taxable?

4. Attorney fees are a tax trap. If you are the plaintiff and use a contingent fee lawyer, you’ll usually be treated (for tax purposes) as receiving 100% of the money recovered by you and your attorney, even if the defendant pays your lawyer directly his contingent fee cut. If your case is fully nontaxable (say an auto accident in which you’re injured), that shouldn't cause any tax problems. But if your recovery is taxable, watch out. Say you settle a suit for intentional infliction of emotional distress against your neighbor for $100,000, and your lawyer keeps $40,000. You might think you’d have $60,000 of income. Instead, you’ll have $100,000 of income. In 2005, the U.S. Supreme Court held in Commissioner v. Banks, that plaintiffs generally have income equal to 100% of their recoveries. even if their lawyers take a share.

Is punitive damages taxable?

Tax advice early, before the case settles and the settlement agreement is signed, is essential. 5. Punitive damages and interest are always taxable. If you are injured in a car crash and get $50,000 in compensatory damages and $5 million in punitive damages, the former is tax-free.

Do you have to pay taxes on a lawsuit?

Many plaintiffs win or settle a lawsuit and are surprised they have to pay taxes. Some don't realize it until tax time the following year when IRS Forms 1099 arrive in the mail. A little tax planning, especially before you settle, goes a long way. It's even more important now with higher taxes on lawsuit settlements under the recently passed tax reform law . Many plaintiffs are taxed on their attorney fees too, even if their lawyer takes 40% off the top. In a $100,000 case, that means paying tax on $100,000, even if $40,000 goes to the lawyer. The new law generally does not impact physical injury cases with no punitive damages. It also should not impact plaintiffs suing their employers, although there are new wrinkles in sexual harassment cases. Here are five rules to know.

Who pays for court recovered compensation?

Court recovered compensation, is paid by the person or a company -- who is found to be responsible for the incident, or by their insurance company.

Why do people settle out of court?

There are a number of strong incentives to settle on an award amount out of court, the greatest of which is often a need to keep down legal costs. Attorney's fees, expert witnesses, lost time from work, travel expenses and court costs are all much higher when a lawsuit must proceed to court . For this reason, a settlement offer is often made early in litigation. If this settlement amount does not work for both parties, a settlement conference may be scheduled so each party can discuss their needs and reach an agreeable amount. Some courts even require this before a case will be heard by a judge.

What are the three types of damages awarded in a civil tort case?

There are three common types of damages awarded in a civil tort or wrongful death case: economic, non-economic and punitive ( Harvard Law ).

What are the types of damages?

3 Types of Damages Explained 1 Perhaps the most common of all types of damages is compensation to cover the cost of medical treatment stemming from the accident. Even with minor injuries, medical bills from testing and emergency department treatment can quickly add up. When injuries are severe, they often require extensive hospital stays, surgical treatment, critical care, and extended rehabilitation periods. If the injury leads to a permanent disability, the injured party may need ongoing treatment, special adaptive devices and lifelong nursing care. 2 Determining damages to cover medical costs, the plaintiff's attorney will collect documentation of every expense related to the accident, and may use medical experts to predict the cost of future needs.

What is the purpose of civil litigation compensation?

Lawsuit compensation in a civil litigation is designed to redress the wrongdoing done to the plaintiff by way of financial help from the defendant. This compensation is the legal right of anyone who has suffered monetary losses or injury due to another person's actions.

How are medical costs and lost wages calculated?

Both medical costs and lost wages can be calculated through receipts and a history of income. Determining how damages should be awarded for emotional distress is more complicated. Even so, these damages can play a major role in a personal injury suit. In some cases, the amount of damages recovered for pain and suffering dwarf the economic damages recovered.

What happens if someone is negligent?

If someones negligent or intentional actions resulted in your injury, loss or the death of a loved one, you have a legal right to pursue maximum compensation under the law. Depending on the circumstances a civil lawsuit may be filed by the victim, the victim's family, estate or heirs.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

Does gross income include damages?

IRC Section 104 explains that gross income does not include damages received on account of personal physical injuries and physical injuries.

Is dismissal pay a federal tax?

As a general rule, dismissal pay, severance pay, or other payments for involuntary termination of employment are wages for federal employment tax purposes.

Is punitive damages a gross income?

Punitive damages are not excludable from gross income, with one exception. The exception applies to damages awarded for wrongful death, where under state law, the state statue provides only for punitive damages in wrongful death claims. In these cases, refer to IRC Section 104 (c) which allows the exclusion of punitive damages. Burford v. United States, 642 F. Supp. 635 (N.D. Ala. 1986).

What is a lawsuit against insurance companies?

Lawsuits against insurance companies, finance companies, etc., for negligence, fraud, breach of contract, etc., can include a variety of claims, and therefore can produce a variety of types of awards/settlements.

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example, lost wages, business income, and benefits, are not excludable from gross income unless a personal physical injury caused such loss

What is discrimination suit?

Discrimination suits usually are brought alleging infringements in the areas of age, race, gender, religion or disability. These types of cases can generate compensatory, contractual and punitive awards, none of which are excludable under IRC § 104(a)(2).

What is punitive damages?

Generally, punitive damages are not awarded for simple breach of contract or negligent tort. They are added to any compensatory damages where the defendant acted recklessly, with malice or deceit, or in any other manner that would justify penalizing the wrongdoer or making an example to others.

What is damages intended to compensate the taxpayer for a loss?

Damages intended to compensate the taxpayer for a loss, i.e., payment to compensate the injured party for the injury sustained, and nothing more. This loss may be purely economic, for example, arising out of a contract, or personal, for example, sustained by virtue of a physical injury.

Can you find a settlement on a 1099?

You may have discovered a lawsuit award or settlement while performing a bank deposit analysis, in your Accurint report, through the 1099 MISC, as a related return pick up from the examination of an attorney or in the interview. Based on the facts and circumstances as well as how the award/settlement was reflected on the return, you may have an issue.

Can you deduct attorneys fees?

Generally, individuals, as cash basis taxpayers, may deduct attorneys‟ fees in the year they are paid, assuming the attorneys‟ fees otherwise qualify as deductible. In the majority of such cases, the attorneys‟ fees are paid pursuant to a contingent fee arrangement once damages have been recovered. Where the ultimate recovery is excludable from gross income, either in whole or in part, the payment of contingent attorneys‟ fees allocable to exempt income are not deductible. IRC § 265(a)(1). The question of the timing and deductibility of attorneys‟ fees paid prior to resolution of the lawsuit on a noncontingent fee basis requires additional analysis that is not practical to provide in this guide. Examiners should consult with the appropriate Technical Advisor.