Deposit a Settlement Check

- NOTE: You can only deposit a settlement check once the settlement offer has been accepted.

- Go to the Settlement Tab in the open case.

- Locate the offer you want to deposit a check on.

- Click the arrow at the end of the settlement offer row.

- Select “deposit check” from the drop down menu.

- A pop-up window will appear.

- Enter the check information.

Can a Bank refuse to deposit a check?

Normally yes, but that would be governed by the language in your depositor's agreement. Most banks reserve the right to refuse any check for deposit. First published on BankersOnline.com 10/3/11. print email share.

Where to cash large check?

Where Can I Cash a Cashier’s Check?

- The bank that issued the cashier’s check. This is the first and best place to look to cash the check. ...

- Try your personal bank. The bank where you have an account is another place that can get you the money. ...

- A check cashing service. This may have an added fee, but it’s still a good option in many cases.

- Large retail stores. ...

- Try any bank. ...

Do banks hold large deposits?

Yes. Your bank may hold the funds according to its funds availability policy. Or it may have placed an exception hold on the deposit. If the bank has placed a hold on the deposit, the bank generally should provide you with ] How long can the bank place a hold on government checks (for example, Social Security and U.S. Treasury checks)?

Can I cash or deposit an unsigned check?

What happens if you deposit an unsigned check? Banks are not obligated to accept unsigned checks. The added writing tells the bank that if the payer doesn't honor the check or her bank account can't cover it, the bank can debit the payee's account for the deposited or cashed check.

Can I deposit a large settlement check?

You will be free to deposit that settlement check anywhere that you choose. If the check is a large sum of money, you can speak to a personal financial planner to decide how you want to disburse the check to yourself.

Can I cash a settlement check at the issuing bank?

If the issuing bank operates a local branch, you can cash the settlement check at the issuing bank. You must present two forms of identification that can include a driver's license or a state-issued identification card.

What is the best way to cash a settlement check?

Check-cashing and payday loan stores can be a good option for those who do not possess a bank account or where the check is too large to be cashed in at a retailer. Photo ID will be required. Check-cashing stores can charge considerable fees, often based on a percentage of the amount cashed in.

How can I cash a large settlement check without a bank account?

Cash a Check without a Bank AccountCash it at the issuing bank (this is the bank name that is pre-printed on the check)Cash a check at a retailer that cashes checks (discount department store, grocery stores, etc.)Cash the check at a check-cashing store.More items...

How long does it take for a $30000 check to clear?

Most checks take two business days to clear. Checks may take longer to clear based on the amount of the check, your relationship with the bank, or if it's not a regular deposit. A receipt from the teller or ATM tells you when the funds become available.

What is the largest check a bank will cash?

Banks don't place restrictions on how large of a check you can cash. However, it's helpful to call ahead to ensure the bank will have enough cash on hand to endorse it. In addition, banks are required to report transactions over $10,000 to the Internal Revenue Service.

What to do with a $100000 settlement?

What to Do with a $100,000 Settlement?Sort Out Tax Implications.Find a Financial Advisor.Pay Off the Debts.Invest in a Retirement Home.Start a Business or Help Friends and Family.Donate the Money to the Needy.Final Words.

Can my lawyer cash my settlement check?

While your lawyer cannot release your settlement check until they resolve liens and bills associated with your case, it's usually best to be patient so you don't end up paying more than necessary.

What do I do if I have a large settlement?

– What do I do with a large settlement check?Pay off any debt: If you have any debt, this can be a great way to pay off all or as much of your debt as you want.Create an emergency fund: If you don't have an emergency fund, using some of your settlement money to create one is a great idea.More items...•

How long does a bank hold a check over $10000?

Essentially, any transaction you make exceeding $10,000 requires your bank or credit union to report it to the government within 15 days of receiving it -- not because they're necessarily wary of you, but because large amounts of money changing hands could indicate possible illegal activity.

How do I cash a 50000 check?

How To Cash A $50,000 Check? Checks of $ 50,000 or more should be cashed with caution as it is a large sum of money. The most important thing is to try to cash it in the same bank from which the check was issued, as this will give you more security to access the funds.

Can I cash a settlement check at an ATM?

This can be done from an ATM at many banks and credit unions. Not every person has ready access to a bank account, or a bank deposit may simply not be an option. This leaves the matter of cashing a settlement check. Keep in mind that a bank is unlikely to cash a check for an account that exceeds funds availability.

Can my lawyer cash my settlement check?

While your lawyer cannot release your settlement check until they resolve liens and bills associated with your case, it's usually best to be patient so you don't end up paying more than necessary.

What to do with a $100000 settlement?

What to Do with a $100,000 Settlement?Sort Out Tax Implications.Find a Financial Advisor.Pay Off the Debts.Invest in a Retirement Home.Start a Business or Help Friends and Family.Donate the Money to the Needy.Final Words.

How long does it take to get paid after a settlement?

While rough estimates usually put the amount of time to receive settlement money around four to six weeks after a case it settled, the amount of time leading up to settlement will also vary. There are multiple factors to consider when asking how long it takes to get a settlement check.

What do I do if I have a large settlement?

– What do I do with a large settlement check?Pay off any debt: If you have any debt, this can be a great way to pay off all or as much of your debt as you want.Create an emergency fund: If you don't have an emergency fund, using some of your settlement money to create one is a great idea.More items...•

What are the Steps in the Settlement Check Process?

While the time it takes to receive your check will vary, settlement checks undergo a specific process before your funds are ready to deposit. This process proceeds as follows”

How to Deposit Your Personal Injury Settlement Check

You can deposit your settlement check like any other check you receive. Most personal injury firms, including ours, still issue paper checks to clients. The bank teller may bring over a manager to authorize the transaction, but other than that you should be good to go.

Speak with a Personal Injury Attorney Near You!

If you or a loved one would like to know more about filing personal injury claims and recovering compensation for your injuries, you can contact The Advocates by phone at 1-888-565-5277 or use our online form fill here. Don’t wait. You deserve an Advocate.

Why do people get settlement checks?

People across the U.S. receive settlement checks from insurance companies for a variety of reasons, including payouts connected to car accidents and storm damage. Most settlement checks are payable to the insured and a third party involved in the case, such as an automobile repair shop or attorney. Banks cannot cash checks payable ...

Why are settlement checks returned unpaid?

Very often settlement checks issued by insurance companies are returned unpaid because the issuers require endorsements to match the payee line. Omitting a middle initial or suffix or abbreviating a name could cause the drawee bank to reject the item for improper endorsement.

How to cash a check with a Patriot Act check?

When you arrive at the branch, give the teller your two forms of ID. You will probably be required to provide a thumb print sample somewhere on the check. Due to the amount of the check, the teller will call the drawer or the drawee bank (if you are not at the drawee bank) and verify the legitimacy of the check before cashing it. The teller may ask you some additional questions about the source of the funds. The Patriot Act requires banks to maintain information on people conducting certain large dollar transactions. Having established your identity, the teller will cash the check. Request a bag to conceal the money in as you leave the bank. The bank may charge a check cashing fee of between $5 and $10.

Why won't my bank cash a check that exceeds my average balance?

Your bank will not cash a check that exceeds your average balance because the drawee could return the check unpaid at a later date, in which case the bank would incur a loss.

How to find drawee bank on insurance check?

On the front of the check, usually under the numeric dollar amount , you will see the name of the drawee bank. Some insurance checks feature the names of two banks: a drawee bank and a bank through which the check is payable. If negotiating your check involves just one bank, look the bank up online and locate a nearby branch. Because of the high dollar amount, you may need two forms of identification.

Why won't my bank cash my check?

The bank may refuse to cash the check, because federal laws do not require banks to negotiate checks for non-customers and banks do not keep excess cash on hand. If the representative agrees to cash the item, she will probably require you to wait two or three days for the bank to make a special cash shipment order.

What to do if a check is large?

If the check is large, you must contact the bank ahead of time to schedule your visit. Branches do not always have sufficient cash on hand to provide to customers with large checks.

How long does it take to get a settlement check?

Once you have signed the completed release, it generally takes about six weeks to receive a settlement check; however, it can also take much longer. The timing depends on the defendant’s policy, the type of personal injury case involved, and other circumstances.

Who pays for a settlement?

Typically, as part of the settlement, the defendant must pay the plaintiff compensation for resulting losses. However, the parties may have very different perspectives on the case. They may disagree about issues of fault or the amount of compensation warranted.

What Is a Legal Settlement?

According to the Bureau of Justice, only 4 percent of personal injury cases go to trial. The majority settle out of court, by mutual agreement between the parties. This resolution is called a settlement.

What are the advantages and disadvantages of settling a case?

For both parties, there are potential advantages and disadvantages to settling the case. By settling, both parties know the terms of the agreement and avoid the unpredictability of a trial. Settlement allows both parties to resolve the matter more quickly. The settlement is not final until the plaintiff or the plaintiff’s attorney receives the check, and it clears.

What is the most important settlement document?

The most important settlement document is the release . This document absolves the other party of any further liability. The attorney for the defendant prepares a release form, which should clearly and accurately outline the terms and conditions of the settlement.

What is settlement in litigation?

A settlement is an agreement that ends a dispute and results in the voluntary dismissal of any related litigation. It may happen during the early stages of litigation, or in some cases, even before the injured person files a lawsuit. Settlements usually happen when the defendant and the plaintiff agree to the plaintiff’s claims rather than going to trial.

What happens before a trial?

Before a trial begins, there are investigations, pre-trial motions, insurance claims, medical evaluations, and more. Many accidents result in significant injuries, expenses, and lost wages, so victims often feel anxious about when they can expect to receive a settlement check for financial losses.

How long does it take to get a settlement check?

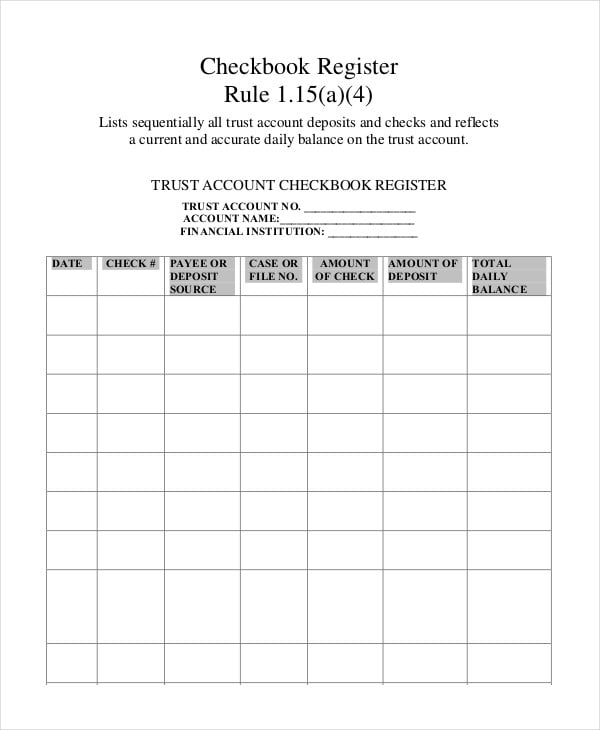

Remember, the settlement check must get deposited into your trust account and the funds need to be available to withdraw. This may take two to three days, depending on your bank’s deposit rules and the amount of the check being deposited. Trust accounting has rules that need to be followed.

Where are settlement funds deposited?

Settlement funds are always deposited directly into your law firm’s trust account and are paid to parties of the settlement from the trust account. A settlement check is never directly deposited into your firm’s operating account.

What should a contingent fee agreement explain?

In the case when a settlement is not reached and there is no settlement check for the client, the fee agreement should also explain what expenses or fees the client will be responsible for paying, if any. As an example, below is a sample of text that may be used in a contingent fee agreement.

What is settlement statement?

The settlement statement is your audit trail and it should be reviewed and signed by both the client and the lawyer. It defines the proposed disposition of the settlement fund check and should include the following:

What do you write on a trust check?

On the check, write the case number, client name and case description. (This is good risk management if you ever need to re-create your trust accounting records.)

What is the best practice for handling settlement funds?

Best practices for handling settlement funds starts with a properly written and executed contingent fee agreement. This document should clearly communicate to the client how funds from a settlement check will be disbursed. In the case when a settlement is not reached and there is no settlement check for the client, the fee agreement should also explain what expenses or fees the client will be responsible for paying, if any.

Can you write checks to all parties on a settlement?

Write checks and receive payments for your portion of the settlement. Once funds are available, you can write checks to all of the parties listed on the settlement statement. All funds get disbursed directly out of your trust bank account and recorded in the client’s trust account ledger.

What is required to receive a settlement check?

Of course, receiving a settlement check is going to require some signatures . Signatures required may include: Order of Settlement. Typically, the Order of Settlement consists of paperwork, with various types of boilerplate information, that must be completed by both sides.

Do you need signatures for settlement check?

Of course, receiving a settlement check is going to require some signatures. Signatures required may include:

What to do if you don't understand a settlement?

Conversely, if you truly don’t understand it or have concerns about the settlement itself you can contact the adjuster, if they don’t satisfy you ask for a manager or if all else fails speak with a lawyer (usually only worthwhile if the value of a claim is relatively high).

How long does it take to get a check?

This is the question everyone wants to know. As a rule of thumb, it would be reasonable to expect a check within 2-3 weeks.

What is the agreement with an insurance adjuster?

Agreeing and Documenting. At the end of the personal injury claims process you will (typically) verbally agree with your insurance adjuster on a settlement amount. Sometimes the adjuster will send you the compensation offer in the mail. These verbal agreements are usually contingent upon you signing a release form.

How long does it take to get a release from insurance?

In a week or two following your verbal agreement with the insurance company, you should receive a release form in the mail. Usually, the check is withheld until this release is signed.

Do you have to file another claim against insurance company?

You acknowledge that you do have any other claim against the insurance company for the related incident. This means that the settlement check you are receiving covers your damages and you are giving up the right to file another claim.

Can you claim a check from your own insurance company?

No, not if the check is from your own insurance company. If the check is from another party’s insurer (in the case of an auto accident where your claim is against the other driver’s insurer) and a release has been signed, yes, for all intents and purposes your accident claim is closed.

How long does it take for a check to clear?

Just deposit it like any normal check. It may take a week or so for the check to clear and have full access to the funds.

How long did the scammers record on my phone?

They are sure all that money is gone but are also worried because the scammers were recording them for 9 hours a day on the phone and also got all of the personal data (SSN, Driver's License no., etc.)

Can I deposit a large amount at the teller?

I would just go to the teller and deposit it. For that large amount they will probably bring over a manager for authorization but you will be fine. Like I mentioned above they will put a hold on it though.