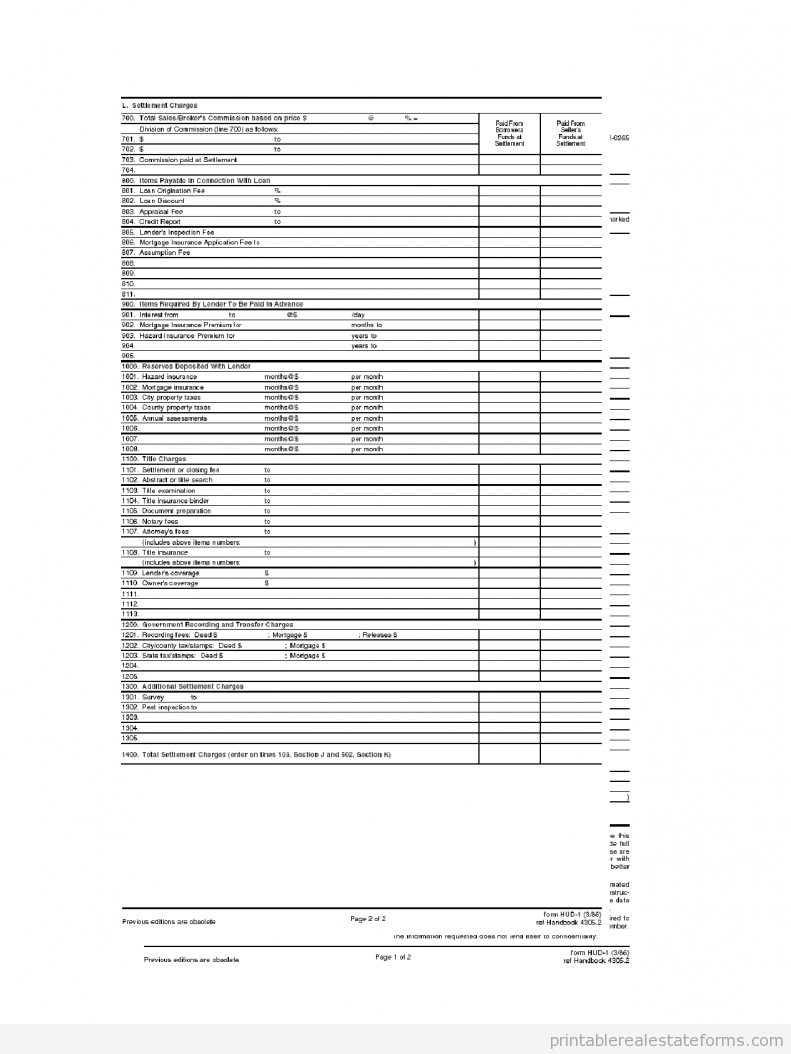

How do I fill out a HUD 1 settlement statement? Completing Part B of HUD-1Fill in the property location and the name and address for the borrower, seller and lender. The settlement agent, date and location also are needed.

Full Answer

What is HUD 1 settlement statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What is a HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

What is form HUD 1?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

What is a HUD 1 form?

The HUD-1 form is a three-page mortgage document required in certain cases. This document contains an itemized list of every fee charged for the loan. This form is also commonly referred to as a settlement statement because it’s one of the final pieces of paperwork that comes before the transaction officially closes, or “settles.”

What is typically required to be included on the closing statement HUD-1?

A HUD-1 settlement statement, also referred to simply as a settlement statement, details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

Who fills out HUD-1?

The settlement agentThe settlement agent shall complete the HUD-1 to itemize all charges imposed upon the Borrower and the Seller by the loan originator and all sales commissions, whether to be paid at settlement or outside of settlement, and any other charges which either the Borrower or the Seller will pay at settlement.

Who prepares the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

What is the difference between HUD-1 and settlement statement?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

What happened to the HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

What are some of the transactions recorded on the HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What is the HUD-1 now called?

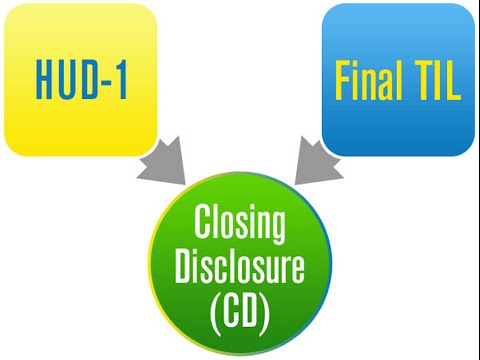

Closing DisclosureThe Current Closing Disclosure The Consumer Financial Protection Bureau (CFPB) took over administration from HUD and replaced the HUD-1 with the Closing Disclosure in October of 2015.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

How do I read a HUD statement?

Look at the first page of the HUD statement. Look over the basic details in Part B, such as your name, the seller's name and the property address. Read sections J and K, which give a summary of the total amounts owed from or due to the borrower or seller.

Is a closing disclosure the same as a HUD statement?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

Is closing disclosure the same as closing statement?

A closing statement or credit agreement is provided with any type of loan, often with the application itself. A seller's Closing Disclosure is prepared by a settlement agent and lists all commissions and costs in addition to the net total to be paid to the seller.

How do I get my HUD payoff statement?

Requests for payoff statements, subordinations, releases, and other documentation specific to these programs can be submitted to:Payoff Requests: [email protected] Requests: [email protected] Requests: [email protected] Partial Claim document submittal: [email protected] items...

What are the responsibilities of the closing agent?

A closing agent is a real estate professional who helps the buyer, seller, and lender to complete a property sale. Your primary job duties in this career include drawing up the appropriate paperwork, delivering documents to all the interested parties, ensuring that they sign the documents, and filing them properly.

What is a HUD closing disclosure?

The Closing Disclosure (CD - formerly the HUD-1 Uniform Settlement Statement) is a three-page, government-mandated form that details the costs associated with a real estate transaction. The borrower should receive a copy of the CD at least one day prior to the closing.

What is a closing statement?

5 days agoA closing statement is a form used in a real estate transaction that includes an itemized list of all the buying or selling costs associated with that transaction. It's a standard element of home sales, especially those that involve mortgages, and refinancings.

What is a HUD-1 settlement statement?

Upon the closing of a real estate transaction, a HUD-1 Settlement Statement must be issued to the buyer (called the "borrower") and the seller. This outlines the financial responsibility of each party, usually showing the buyer how much money is needed to complete the deal and outlining the funds received by the seller.

How to fill out HUD-1?

How to Fill Out a HUD-1 Form. Working in a mortgage, title, escrow or settlement company requires you to complete many forms for clients who are buying and selling their homes. Upon the closing of a real estate transaction, a HUD-1 Settlement Statement must be issued to the buyer (called the "borrower") and the seller.

What is section 700 in real estate?

Part L, Section 700, details the real estate commissions paid . Using the good-faith estimate to complete sections 800 to 1300, make any changes where necessary according to the sales agreement. Place prorated hazard insurance, private mortgage insurance and property tax costs in Section 1000, and use Section 1100 for charges related to title search and insurance. Carefully place the amounts for which the buyer and seller are responsible in the appropriate columns.

What line to put 700 through 1305?

Total lines 700 through 1305 and place the amounts on line 1400 under the column for each party. These will be transferred to borrower's line 103 and seller's line 502, so that the calculation in sections J and K may be completed. Add lines starting with "2" for the borrower and "5" for the seller and put the amounts on lines 220 and 520, respectively. Place the amount from line 120 on line 301 for the borrower, and put the total from line 520 on line 602 for the seller.

What is a HUD-1 settlement statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement , details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

How long do you have to give a closing disclosure?

In contrast, lenders must give you a closing disclosure three days before closing. Everyone taking out a HELOC, reverse mortgage or manufactured home loan should ask their lender for the HUD-1 document at least a day before closing to allow time to review the contents, fix errors and raise questions with the lender.

What is section 300?

No. 5 (Section 300): Cash at settlement from/to borrower. This section explains if you need to bring cash to the settlement. In most cases, the closing costs for a reverse mortgage refinance or HELOC will be subtracted from the loan, so you don’t need to bring funds to the closing.

How long does it take to pay down a HELOC?

You can borrow as much as you need up to your maximum loan amount, then pay it down to zero as many times as necessary during a set draw period that usually ends after 10 years.

What is section 200 in mortgage?

No. 4 (Section 200): Amount paid by or on behalf of borrower. This section details any credits you receive toward costs you’ve already paid or that the seller is paying. Line 201 shows the money you’ve already paid, such as an earnest money deposit, while Line 202 reflects the principal amount of the new loan.

How many sections are there in a settlement statement?

The settlement statement lists charges in three sections. The first section shows charges that cannot change. The next section outlines charges that cannot change by more than 10%, while the final section outlines charges that may change.

What is a HUD-1 Settlement Statement?

We can define the HUD-1 statement, also known as the HUD-1 form, as a settlement form that itemizes and reconciles all the charges that the buyer and seller pay in purchasing real estate. These charges include a loan origination fee and discount points.

Meet some of our Real Estate Lawyers

Mr. LaRocco's focus is business law, corporate structuring, and contracts. He has a depth of experience working with entrepreneurs and startups, including some small public companies.

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.

What is a HUD 1 settlement statement?

This form is to be used as a statement of actual charges and adjustments paid by the borrower and the seller, to be given to the parties in connection with the settlement. The instructions for completion of the HUD–1 are primarily for the benefit of the settlement agents who prepare the statements and need not be transmitted to the parties as an integral part of the HUD–1. There is no objection to the use of the HUD–1 in transactions in which its use is not legally required. Refer to the definitions section of the regulations (12 CFR 1024.2) for specific definitions of many of the terms that are used in these instructions.

Who completes HUD-1?

The settlement agent shall complete the HUD–1 to itemize all charges imposed upon the Borrower and the Seller by the loan originator and all sales commissions, whether to be paid at settlement or outside of settlement, and any other charges which either the Borrower or the Seller will pay at settlement.

What is line 101 in a mortgage?

Line 101 is for the contract sales price of the property being sold, excluding the price of any items of tangible personal property if Borrower and Seller have agreed to a separate price for such items.

Where to find charges on HUD?

As a general rule, charges that are paid for by the seller must be shown in the seller's column on page 2 of the HUD–1 (unless paid outside closing), and charges that are paid for by the borrower must be shown in the borrower's column (unless paid outside closing). However, in order to promote comparability between the charges on the GFE and the charges on the HUD–1, if a seller pays for a charge that was included on the GFE, the charge should be listed in the borrower's column on page 2 of the HUD–1. That charge should also be offset by listing a credit in that amount to the borrower on lines 204–209 on page 1 of the HUD–1, and by a charge to the seller in lines 506–509 on page 1 of the HUD–1. If a loan originator (other than for no-cost loans), real estate agent, other settlement service provider, or other person pays for a charge that was included on the GFE, the charge should be listed in the borrower's column on page 2 of the HUD–1, with an offsetting credit reported on page 1 of the HUD–1, identifying the party paying the charge.

When to use line 503?

Line 503 is used if the Borrower is assuming or taking title subject to existing liens which are to be deducted from sales price.

What to do if there is no street address?

If there is no street address, a brief legal description or other location of the property should be inserted . In all cases give the zip code of the property. Section H. Fill in name, address, zip code and telephone number of settlement agent, and address and zip code of “place of settlement.”.

Which lines and columns in section J are left blank on the copy of the HUD–1?

Lines and columns in section K which relate to the Seller's transaction may be left blank on the copy of the HUD–1 which will be furnished to the Borrower.