How to settle tax debt step by step

- First, you apply for an Offer in Compromise (OIC) using Form 656.

- You must pay a $186 application fee to apply.

- You must also provide a full financial disclosure that details all your income, expenditures, assets and equity.

Full Answer

How often does IRS accept offer in compromise?

How often does IRS Accept offer in compromise? In general, IRS OIC acceptance rate is fairly low. In 2019, only 1 out of 3 were accepted by the IRS. In 2019, the IRS accepted 33% of all OICs. How hard is it to get an offer in compromise with the IRS? But statistically, the odds of getting an IRS offer in compromise are pretty low.

Does IRS offer in compromise really work?

The average Offer in Compromise Settlement takes between 6- 9 months (usually longer) to work by the IRS; The average Offer in Comprise settlement is 14 cents on a dollar; 38% of all offers in compromise are accepted by the IRS; All accepted Offers in Compromise Settlements are a matter of public record;

Will I have to pay tax on my settlement?

You will have to pay your attorney’s fees and any court costs in most cases, on top of using the settlement to pay for your medical bills, lost wages, and other damages. Finding out you also have to pay taxes on your settlement could really make the glow of victory dim. Luckily, personal injury settlements are largely tax-free.

Can the IRS tax your settlement?

The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion from taxable income with respect to lawsuits ...

See more

How much will the IRS usually settle for?

Each year, the Internal Revenue Service (IRS) approves countless Offers in Compromise with taxpayers regarding their past-due tax payments. Basically, the IRS decreases the tax obligation debt owed by a taxpayer in exchange for a lump-sum settlement. The average Offer in Compromise the IRS approved in 2020 was $16,176.

Can I negotiate a settlement with the IRS?

Apply With the New Form 656 An offer in compromise allows you to settle your tax debt for less than the full amount you owe. It may be a legitimate option if you can't pay your full tax liability or doing so creates a financial hardship. We consider your unique set of facts and circumstances: Ability to pay.

How do I make a successful offer in compromise with the IRS?

You must provide a written statement explaining why the tax debt or portion of the tax debt is incorrect. In addition, you must provide supporting documentation or evidence that will help the IRS identify the reason(s) you doubt the accuracy of the tax debt.

How likely is the IRS to accept an offer in compromise?

A rarity: IRS OIC applications and acceptances for 2010-2019 In 2019, the IRS accepted 33% of all OICs. There are two main reasons that the IRS may not accept your doubt as to collectibility OIC: You don't qualify. You can't pay the calculated offer amount.

How long does it take to settle with IRS?

Processing times vary, but you can expect the IRS to take at least six months to decide whether to accept or reject your Offer in Compromise (OIC).

What if I owe the IRS more than 50000?

If you owe more than $50,000, you may still qualify for an installment agreement, but you will need to complete a Collection Information Statement, Form 433-A. The IRS offers various electronic payment options to make a full or partial payment with your tax return.

Can you negotiate with the IRS without a lawyer?

You don't have to hire a law firm or other tax professional to make an OIC. If your offer is rejected, you can appeal within 30 days using Request for Appeal of Offer in Compromise, Form 13711 (PDF).

Can I do an offer in compromise myself?

Often, people who do have an Offer in Compromise accepted through their own work ended up offering the IRS way too much money. There is a reason the IRS jumps at certain offers. The IRS benefits all too often when taxpayers don't have a good legal team behind them.

How much does an offer in compromise cost?

OIC Process Submitting an offer to the IRS is a formal process -- you can't simply call the IRS and say "Let's make a deal." You start by completing IRS Form 656, Offer in Compromise. There is a $186 application fee for filing an OIC, which you must attach to Form 656.

Who qualifies for IRS offer in compromise?

To qualify for an OIC, the taxpayer must have filed all tax returns, have received a bill for at least one tax debt included on the offer, made all required estimated tax payments for the current year, and if the taxpayer is a business owner with employees, the taxpayer must have made all required federal tax deposits ...

What is a good offer in compromise?

An offer in compromise (with doubt as to collectability) to the IRS should be equal to, or greater than what the IRS calculates as the taxpayer's reasonable collection potential.

Can you win against the IRS?

Taxpayers are entitled to a fair and impartial administrative appeal of most IRS decisions, including many penalties, and have the right to receive a written response regarding the Office of Appeals' decision. Taxpayers generally have the right to take their cases to court.

Do you need a lawyer to negotiate with the IRS?

You have the legal right to represent yourself before the IRS, but most taxpayers have determined that professional help, such as specialized attorneys, accountants, or tax specialists who are experienced in helping taxpayers resolve unpaid tax debts can significantly impact your odds of reaching an acceptable ...

Can you negotiate with the IRS without a lawyer?

You don't have to hire a law firm or other tax professional to make an OIC. If your offer is rejected, you can appeal within 30 days using Request for Appeal of Offer in Compromise, Form 13711 (PDF).

Can you negotiate with IRS to remove penalties and interest?

First, you should know that it is possible to negotiate for an abatement of penalties and interest, but it is at the discretion of the IRS agent with whom you are working. Second, it takes time, sometimes a year or two, to negotiate with the IRS for a reduction of interest or penalties.

How can I avoid paying taxes on debt settlement?

According to the IRS, if a debt is canceled, forgiven or discharged, you must include the canceled amount in your gross income, and pay taxes on that “income,” unless you qualify for an exclusion or exception. Creditors who forgive $600 or more are required to file Form 1099-C with the IRS.

Make Sure You Are Eligible

Before we can consider your offer, you must be current with all filing and payment requirements. You are not eligible if you are in an open bankrup...

If Your Offer Is Accepted

1. You must meet all the Offer Terms listed in Section 8 of Form 656, including filing all required tax returns and making all payments; 2. Any ref...

If Your Offer Is Rejected

1. You may appeal a rejection within 30 days using Request for Appeal of Offer in Compromise, Form 13711 (PDF). 2. The online self-help tool may pr...

What happens if you accept a tax offer?

You must meet all the Offer Terms listed in Section 7 of Form 656, including filing all required tax returns and making all payments; Any refunds due within the calendar year in which your offer is accepted will be applied to your tax debt;

How long does it take for an IRS offer to be accepted?

Your offer is automatically accepted if the IRS does not make a determination within two years of the IRS receipt date.

What is an offer in compromise?

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. It may be a legitimate option if you can't pay your full tax liability, or doing so creates a financial hardship. We consider your unique set of facts and circumstances: Asset equity.

Do you have to pay the application fee for low income certification?

If accepted, continue to pay monthly until it is paid in full. If you meet the Low Income Certification guidelines, you do not have to send the application fee or the initial payment and you will not need to make monthly installments during the evaluation of your offer. See your application package for details.

Does the IRS return an OIC?

The IRS will return any newly filed Offer in Compromise (OIC) application if you have not filed all required tax returns and have not made any required estimated payments. Any application fee included with the OIC will also be returned. Any initial payment required with the returned application will be applied to reduce your balance due. This policy does not apply to current year tax returns if there is a valid extension on file.

What to do if you owe IRS money?

If you owe the IRS money, you may be able to negotiate a settlement in order to resolve the debt. This can be a tricky process, so you want to consider hiring a professional to handle the offer in compromise.

When neither a payment plan nor an offer in compromise is in the cards, what is your best bet?

When neither a payment plan nor an offer in compromise is in the cards, your best bet might be to just focus on fighting back against the IRS’s collection actions, until you can get back on your feet.

What happens when you have proof of wrongfully charged?

When a taxpayer has definitive proof that they’ve been wrongfully charged, such as having the paperwork to back up a deduction the IRS rescinded, they may be able to negotiate a reduced or completely pardoned debt.

Why is it important to work with a professional when drafting a first offer?

It is a good idea to work with a professional when drafting your first offer, especially because the IRS continues to calculate and add interest to your debt while deliberating your offer.

What happens if you owe back taxes to the IRS?

When you owe back taxes to the IRS, you’re indebted to the government itself – and there are very few ways out of that debt. In some cases, taxpayers can argue that the debt they’re facing isn’t valid and argue doubt as to their own liability.

Why do you offer in compromise?

An offer in compromise can be an effective way to reduce what you owe, and help you get back into good standing with the IRS. But offers in compromise are not always necessary, when there are other, potentially easier alternatives.

Can you negotiate with the IRS about debt?

There are very few ways around a debt with the IRS. The government expects you to pay them one way or another, and even in the most desperate cases, your best bet is to negotiate for a reduced debt rather than a full pardon. Working with experienced tax professionals is key, as the IRS can be particularly picky about tax debt settlements and won’t accept just any offer.

The IRS Debt Settlement Options

The IRS offers a few different debt settlement options for unpaid taxes. They include:

How a Tax Debt Settlement Attorney Can Help

A tax lawyer has extensive education and experience representing their clients in tax matters concerning the IRS and state taxing authorities. They’re trained to negotiate with the IRS in order to achieve an equitable settlement on behalf of their client.

Retaining a Tax Attorney Means Your Personal Information is Kept Confidential

After you retain a tax attorney to represent you in your IRS back tax settlement process, all of your communications with your lawyer become privileged. That is, the IRS cannot break the confidential communications between you and your lawyer. The purpose of attorney-client privilege is to give you, the client, someone you can confide in.

Contact Our Experienced Tax Attorney Today for Help with Your Tax Debt Issues

If you owe the IRS and need relief from their efforts to collect back taxes from you, call Attorney Jerry E. Smith for help with an IRS back tax settlement. Jerry Smith is an attorney and CPA with extensive experience representing clients and getting them an appropriate IRS debt settlement.

How Does a Tax Settlement Work?

You determine which type of settlement you want and submit the application forms to the IRS. The IRS reviews your application and requests more information if needed. If the IRS does not accept your settlement offer, you need to make alternative arrangements. Otherwise, collection activity will resume. If the IRS accepts your settlement offer, you just make the payments as arranged.

How to settle taxes owed?

These are the basic steps you need to follow if you want to settle taxes owed. File Back Taxes —The IRS only accepts settlement offers if you have filed all your required tax returns. If you have unfiled returns, make sure to file those returns before applying.

What is a tax settlement?

A tax settlement is when you pay less than you owe and the IRS erases the rest of your tax amount owed. If you don’t have enough money to pay in full or make payments, the IRS may let you settle. The IRS also reverses penalties for qualifying taxpayers.

How long do you have to pay back taxes?

If you personally owe less than $100,000 or if your business owes less than $25,000, it is relatively easy to get an installment agreement. As of 2017, the IRS gives taxpayers up to 84 months (7 years) to complete their payment plans.

What is partial payment installment agreement?

A partial payment installment agreement allows you to make monthly payments on your tax liability. You make payments over several years, but you don’t pay all of the taxes owed. As you make payments, some of the taxes owed expire. That happens on the collection statute expiration date.

What happens if you default on a settlement offer?

At that point, you are in good standing with the IRS, but if you default on the terms of the agreement, the IRS may revoke the settlement offer . To explain, imagine you owe the IRS $20,000, and the IRS agrees to accept a $5,000 settlement.

Why do you settle taxes if you don't qualify?

If you don’t qualify for a tax settlement for less money, then it will ensure you are paying back a lower amount of taxes and penalties that are due.

How Much Should I Offer in Compromise to the IRS?

An offer in compromise is a settlement agreement between a taxpayer and the IRS that allows taxpayers with financial hardship to resolve their tax debts for less than the full amount owed. The Offer In Compromise program becomes an option when other collection efforts have proven unsuccessful and allow you to settle your tax debt for less than what you owe. Here are some questions and answers about OICs…

What happens after I send my offer in compromise?

After submitting an offer in compromise, it will take several weeks to receive a response from the IRS. If the IRS rejects your offer, they should provide detailed information about why it was rejected. In some cases, you may need to submit additional documentation or information to support your reason for filing an OIC. For example, if you are seeking an OIC based on being unable to pay because of financial hardship due to unemployment, generally this requires the submission of a letter from your state unemployment agency.

When should I consider an OIC?

If you cannot pay your tax debt by installment payments or through an installment agreement, you may qualify for an OIC. There are circumstances where the IRS will not accept your offer, so it’s important to review all of the information about OICs on this page before deciding whether or not to submit one.

What Should I Do If I’m Not Sure If I Qualify for an OIC?

If you are considering an offer in compromise, the IRS offers a pre-qualifier tool to help you determine if you are eligible. The pre-qualifier tool asks a series of questions about your individual tax situation and provides an estimate of the chance that the IRS will accept your offer.

Does the IRS Really Settle for Less?

Is this true? Does the IRS Really Settle for Less? In the real world, however, it’s not so very easy to get the IRS to work out a tax financial obligation for pennies on the dollar. It does take place…

What options do I have for settling my IRS debt?

There are several routes you can take to settle your tax debts with the IRS. The only sure-fire way to reduce your total balance, though, is through an Offer in Compromise. Unfortunately, this tends to be challenging to come by.

How much does the IRS settle for OIC?

The average settlement on an OIC is around $5,240.

What happens to your IRS if your financial situation improves?

If the agency finds that your financial situation has improved, it can increase your payment or begin taking other measures to collect on the original debt.

What happens if you ignore your taxes?

Taxpayers who ignore tax debts can face serious penalties. For one, it increases the overall costs of your taxes by adding fees and extra interest to your balance. Late fees start at 0.5% of the tax debt, while interest comes in at the federal short-term rate, plus 3%.

What do you need to do before you can get a PPIA?

Before you can be eligible for a PPIA, you’ll need to use all assets to try and repay your debt. The IRS can also ask that you use the equity in those assets (like your home equity, for example) to pay off the balance.

How to apply for PPIA?

To apply for a PPIA, you’ll need a Collection Information Statement and a Form 9465, and like with OICs, you’ll need to have your returns filed and any estimated payments made. You will also need to agree to financial reviews every two years.

How long does it take to pay off a mortgage?

The first option must be paid off within five months and the second in six to 24 months. Offers in Compromise evaluations typically take around six to seven months to process and, unfortunately, come with low success rates.

What is IRS offer in compromise?

An IRS Offer in Compromise is an IRS program that allows a taxpayer to make an offer for less than the total amount owed. If the IRS accepts the offer, you pay less than you owe, and the IRS wipes clean the rest of the taxes owed. After your payment, you are in good standing, and you don’t owe anything else. However, you will need to stay in tax compliance for five years going forward.

Do you have to meet certain requirements to qualify for an offer in compromise?

You must meet certain requirements to qualify for an Offer in Compromise. Additionally, there are three main situations where you might qualify.

Can IRS accept an offer?

To take advantage of this program, you have to submit an offer. The IRS will only accept an offer if they feel that your offer is equal to or greater than the amount they would ever collect from you, even if they used enforced collection actions (garnishment, or levies).

Does each state have its own tax resolution solution?

Each state agency has its own tax resolution solutions. Some states offer a version of an offer in compromise program similar to the IRS while some do not offer at all. Below are some details on various states that do offer an offer in compromise program.

How much should I offer to settle my IRS debt?

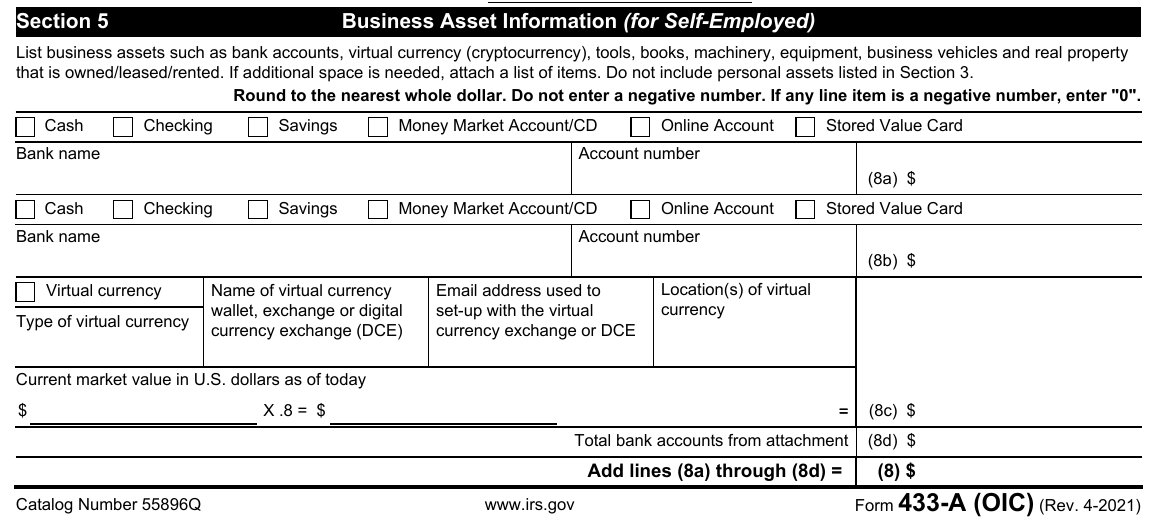

The IRS’s Form 433-A also offers guidance on an appropriate offer, meaning one you can not only afford but that the government will find acceptable for recouping their money.

How can I settle my IRS debt for less than I owe?

It’s not easy, but it is possible to pay less than you actually owe. The federal government considers an offer in compromise (OIC) a last resort if you can’t pay what you owe in taxes. The qualifications are fairly murky, though. Generally, the IRS might let you pay less than you owe if they think that’s the most money they can expect to collect from you in a reasonable period of time. That time is likely the full 10 years they have to collect on the debt.

How do I know if I qualify for an offer in compromise?

The IRS will consider a variety of factors when deciding to accept an application for an offer in compromise, including your ability to pay, your income, your expenses and your asset equity. To find out if you qualify, you can fill out an online questionnaire. Filing all your relevant tax returns is one requirement to be considered. Another is making your estimated tax payments, if applicable. You are also ineligible if you are currently in a bankruptcy proceeding.

What happens if you don't pay your taxes?

If you don’t pay your taxes when you file, you’ll receive a bill for the unpaid balance. The unpaid balance is subject to interest as well as a monthly late payment penalty. But that doesn’t mean you shouldn’t file if you don’t have the money to pay all your taxes.

How much is the failure to file fee?

The IRS also charges a failure-to-file fee that is equal to 5% of the unpaid balance per month, which can acc rue to as much as 25% of unpaid tax. If you aren’t going to pay your whole bill at the time of filing, you should immediately get in touch with the IRS to figure out a plan. Your tax bill has an expiration date, but it’s not short.

What happens if you don't qualify for an offer in compromise?

If you don’t qualify for an offer in compromise, you can still ask to be put on an installment plan to pay off what you owe.

What happens if you leave your taxes unpaid?

If left unpaid, your tax bill can balloon and cause a huge financial headache, one that might be difficult to get rid of. But what many people don’t know is that they have options when it comes to dealing with their tax debt. Here’s how to settle IRS debt by yourself.