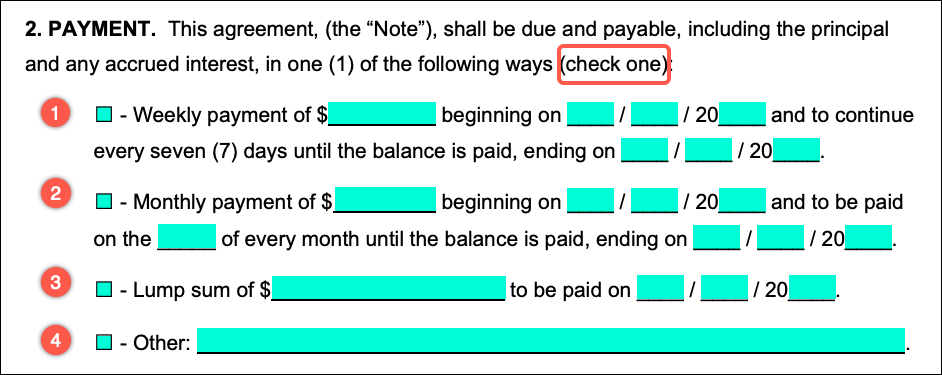

It is common for settlement agreements to include a payment provision from one party to another, which could include terms not dissimilar to that of loan agreements such as a payment of the settlement sum by installments, and a default clause that accelerates payment.

Full Answer

What is a settlement agreement in law?

A settlement agreement on the other hand typically refers to an agreement between parties to resolve an ongoing dispute. Such a dispute could potentially have arisen from a loan agreement in which parties are engaged in litigation over. Parties often enter into such settlement agreements to avoid further legal proceedings which can be costly.

What is the personal loan settlement process?

Personal loan settlement process, also known as personal loan defaulter settlement refers to an agreement between a lender and a borrower wherein the loan is ‘settled’ by repaying only a part of the loan. The lender may forgive a part of the debt in order to help the borrower repay the loan at least partially.

What is a payment provision in a settlement agreement?

It is common for settlement agreements to include a payment provision from one party to another, which could include terms not dissimilar to that of loan agreements such as a payment of the settlement sum by installments, and a default clause that accelerates payment.

What is a settlement in a credit facility?

With reference to a credit facility, a settlement is an official agreement between creditor and debtor to resolve over dues. This status signifies that there was a mutual agreement between the borrower and lending institution. As part of this arrangement, a part of the outstanding on a loan is waived to close the account

What is a loan settlement agreement?

Debt settlement is an agreement between a lender and a borrower to pay back a portion of a loan balance, while the remainder of the debt is forgiven. You may need a significant amount of cash at one time to settle your debt. Be careful of debt professionals who claim to be able to negotiate a better deal than you.

What is a reasonable offer to settle a debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

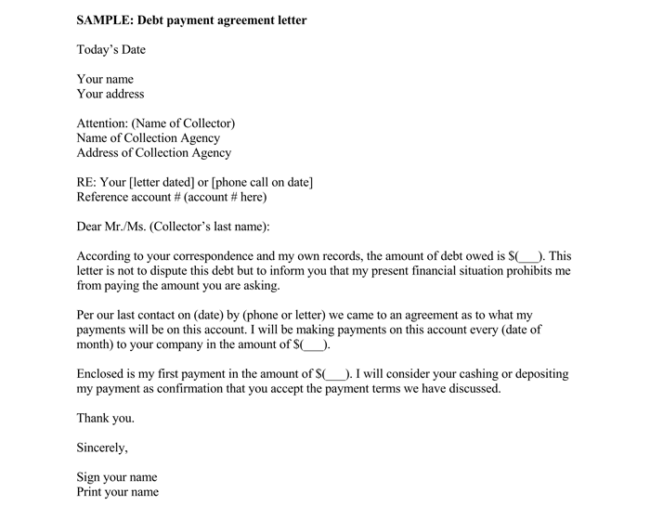

How do I write a debt settlement agreement?

The following terms and conditions should be included in a settlement.Original creditor and collection agent's company name.Date the letter was written.Your name.Your account number.Outstanding balance owed on the account (optional)Amount agreed to as settlement.More items...

What is a full settlement agreement?

A settlement agreement is a legal contract that resolves the disputes among all parties by coming to an agreement. It is a legal document where all parties in a court case, in civil law, agree to an outcome of any judgment being made in advance.

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

How much should I offer as a full and final settlement?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

How do I write a final settlement letter?

Dear Sir, I had resigned from my position of (Designation) in the company on (Date). Before the last date of service and notice period, I had completed all the handing over formalities duly. I was told that I would get a full and final settlement amount of ___________ towards the pending salary and other dues.

What is a settlement proposal?

Settlement proposal means a proposal for effecting settlement of a contract terminated in whole or in part, submitted by a contractor or subcontractor in the form, and supported by the data, required by this part.

What should I ask for in a settlement agreement?

8 Questions to Ask if You've Been Offered a Settlement AgreementIs the price right? ... How much will I pay for legal advice? ... Have I been offered a reference? ... How much time would legal action take? ... Are there any restrictive covenants in your agreement? ... Do I have to pay tax on my agreement?More items...

What should be included in a settlement agreement?

A settlement agreement always includes monetary and/or non-monetary consideration provided to the claimant to settle known claims against the business....Waiver of Certain Claims.Earned wages.Business expense reimbursement.Unemployment insurance.COBRA.Workers' compensation insurance.

What must be in a settlement agreement?

What should the settlement agreement contain? The standard terms of the settlement agreement are the following: The outstanding balance of the salary, bonuses, commission and holiday pay of the employee; A termination payment that will be paid by the employer to the employee for agreeing to terminate the contract.

What percentage will a collection agency settle for?

Some want 75%–80% of what you owe. Others will take 50%, while others might settle for one-third or less. Proposing a lump-sum settlement is generally the best option—and the one most collectors will readily agree to—if you can afford it.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

Is it good to pay settlement offers?

While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative. Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account.

What percentage should I ask a creditor to settle for after a Judgement?

If you decide to try to settle your unsecured debts, aim to pay 50% or less. It might take some time to get to this point, but most unsecured creditors will agree to take around 30% to 50% of the debt. So, start with a lower offer—about 15%—and negotiate from there.

What is a settlement ?

With reference to a credit facility, a settlement is an official agreement between creditor and debtor to resolve over dues. This status signifies that there was a mutual agreement between the borrower and lending institution. As part of this arrangement, a part of the outstanding on a loan is waived to close the account

Disadvantages of a settlement

Credit bureau gets updated with a settlement flag (‘S’), which makes lenders wary of lending to such borrowers

What is the term of a loan contract?

Terms of the loan contract and which state or federal laws govern the performance obligations required by both parties, will differ depending upon the loan type. Most loan contracts define clearly how the proceeds will be used. There is no distinction made in law as to the type of loan made for a new home, a car, how to pay off new or old debt, ...

What are the terms and conditions of a loan agreement?

Most of the terms and conditions are standard fare – amount of money borrowed, interest charged, repayment plan, collateral, late fees, penalties for default – but there are other reasons that loan agreements are useful.

How is the length of a loan determined?

The length of a loan contract is determined by a lender’s reliance upon an amortization schedule. Once the lender and the borrower have determined the amount of money needed, the lender will use the amortization table to calculate what the monthly payment will be by dividing the number of payments to be made and adding the interest onto the monthly payment.

What happens if a loan is paid off late?

The borrower can be liable for a myriad of potential legal damages to compensate the lender for any losses suffered .

Why is it important to pay back a loan as quickly as possible?

Unless there are certain loan conditions that penalize the borrower for early loan payment, it is in the best interest of the borrower to pay back the loan as quickly as possible. The faster the loan debt is retired the less money it costs the borrower.

How are demand loans repaid?

The notification requirement is usually spelled out in the loan agreement. Demand loans with friends and family member might be a written agreement, but it might not be legally enforceable. Banks demand loans are legally enforceable. A check overdraft facility is one example of a bank demand loan – if you don’t have the money in your account to cover a check, the bank will loan you the money and pay the check, but you are expected to repay the bank quickly, usually with a penalty fee.

How is interest rate determined?

The interest rate depends on the type of loan, the borrower’s credit score and if the loan is secured or unsecured.

What is debt settlement?

Key Takeaways. Debt settlement is an agreement between a lender and a borrower to pay back a portion of a loan balance, while the remainder of the debt is forgiven. You may need a significant amount of cash at one time to settle your debt. Be careful of debt professionals who claim to be able to negotiate a better deal than you.

What are the downsides of debt settlement?

The Downsides of Debt Settlement. Although a debt settlement has some serious advantages, such as shrinking your current debt load , there are a few downsides to consider. Failing to take these into account can potentially put you in a more stressful situation than before.

What is a credit card unsecured loan?

Credit cards are unsecured loans, which means that there is no collateral your credit card company—or a debt collector —can seize to repay an unpaid balance.

How to negotiate a credit card?

Start by calling the main phone number for your credit card’s customer service department and asking to speak to someone, preferably a manager, in the “debt settlements department.”. Explain how dire your situation is.

Is debt settlement good for you?

Although a debt settlement has some serious advantages, such as shrinking your current debt load, there are a few downsides to consider. Failing to take these into account can potentially put you in a more stressful situation than before.

Who Helps With Settlement And Release Agreements?

Lawyers with backgrounds working on settlement and release agreements work with clients to help. Do you need help with an settlement and release agreement?

When was the Xenacare settlement agreement signed?

This Settlement and Release Agreement (the “Agreement”) is entered into this 5th day of November 2008 by and between Xenacare Holdings, Inc., (“XCH” or “Debtor”) and MOMEMTUM MARKETING, INC., a creditor of the Company (Creditor”).

How long does it take for XHI to pay creditors?

NOW, THEREFORE, in exchange of the execution of this Agreement, and in full satisfaction of the Advances, Debtor will pay to Creditor and or its assigns within five (5) business days following the parties mutual execution and exchange of this Agreement, XHI will issue to MOMEMTUM MARKETING, INC., 3,165,974 shares of XHI Common stock (the “Settlement Shares”). The Settlement Shares will contain the appropriate restrictive legends representing that the Settlement Shares have not been registered under the Securities Act of 1933, as amended. The Parties herewith agree as follows

What fees are prevailing parties entitled to?

Should it become necessary for any party to institute legal action, whether at law or in equity, to enforce any provision of this Agreement, the prevailing party shall be entitled to recover all costs and reasonable attorney’s fees, including but not limited to, fees for collection, mediation, arbitrations, trials, appeals, bankruptcy or any other legal proceedings.

Who has sought the assistance of competent legal and other professional advice before executing this Agreement?

Every party has sought the assistance of competent legal and other professional advice before executing this Agreement and agrees to be bound by the terms set forth in this Agreement.

Is this agreement and any related instrument construed more strictly against any party?

This Agreement and any related instrument shall not be construed more strictly against any party regardless of who was more responsible for its preparation, and being recognized that this Agreement and any related instrument are the product of extensive negotiations between the parties hereto and that all of the parties have contributed substantially and materially to the final preparation of this Agreement and other related instruments.

What is a loan settlement statement?

A loan settlement statement is the document that describes the amount of a loan, typically for a mortgage, given to the borrower once the loan has been settled. In addition to the amount, the settlement statement will also contain the frequency of installments expected from the lender in regards to repayment.

Is there any downside to settling a loan early?

On the surface, paying off your loan before the terms agreed to seems like an obvious decision. If you're looking at a mortgage, it's likely that this is going to be the largest debt that you encounter in your lifetime, and the faster you settle your debt, the less interest you'll pay. Seems like a clear-cut decision, right?

Is a loan settlement statement different from a normal settlement statement?

Quick answer: yes. It's not uncommon to mix the two up, though, because a "settlement statement" is another document that's involved in buying a home. So how do you keep track of which one is which?

What is a settlement for student loans?

In a student loan settlement, you (the borrower) and your student loan lender agree that you can satisfy a student loan for less than you owe. This requires you to pay a lump sum of a large percentage of the principal balance and accrued interest.

What is a student loan settlement?

A student loan settlement is when the loan holder agrees to accept less money than you currently owe after you've missed payments for several months.

Can you settle student loans in good standing?

You cannot settle federal student loans or private student loans that are in good standing. With both federal and private loans, a student loan settlement doesn't become an option until you enter loan default — and that can take up to 270 days.

Does settling student loan debt hurt your credit?

Settling student loan debt may hurt your credit and FICO score. Lenders understand that settlements happen after delinquency and default, and the settlement will be on your credit history for years to come.

How much money will I save by settling my student loan?

Savings for private student loan settlements vary greatly depending on the lender. Some lenders will accept 40% of the current principal and interest. Other lenders will demand 75%.

Who can help you negotiate student loans?

Negotiate yourself. There's no law against you going the DIY route and contacting the debt collection agency that has your student debt to offer a settlement. However, be careful about resetting the clock on old private student loan debt by agreeing you owe the loans and setting up payment. Federal student loans never go away, so you don't have to worry about restarting the statute of limitations.

What to expect after settling?

After you make your payment and fulfill the terms of the settlement, you will receive a debt clearance letter. This letter will serve as proof that you are no longer financially responsible for the particular student loan.

Purpose of A Loan Agreement

Other Reasons For Using Loan Agreements

- Borrowing money is a huge financial commitment, which is why a formal process is in place to produce positive results on both sides. Most of the terms and conditions are standard fare – amount of money borrowed, interest charged, repayment plan, collateral, late fees, penalties for default – but there are other reasons that loan agreements are useful. A loan agreement is proo…

on Demand vs. Fixed Repayment Loans

- Loans use two sorts of repayment: on demand and fixed payment. Demand notes are usually used for short-term borrowing and are often used when people borrow from friends or family members. Sometimes banks will offer demand loans to customers with whom they have an established relationship. These loans typically don’t require collateral and are for small amounts…

Legal Terms to Consider

- All loan agreements must specify general terms that define the legal obligations of each party. For instance, the terms regarding repayment schedule, default or contract breach, interest rate, loan security, as well as collateral offered must be clearly outlined. There are some standard legal terms involved in loan agreements that all sides should be aware of, regardless of whether the c…

Interest Rate Determination

- Many borrowers in their first experience securing a loan for a new home, automobile or credit card are unfamiliar with loan interest rates and how they are determined. The interest rate depends on the type of loan, the borrower’s credit score and if the loan is secured or unsecured. In some cases, a lender will request that the loan interest be tied to material assets like a car title or prop…

Contract Length & Amortization

- The length of a loan contract is determined by a lender’s reliance upon an amortization schedule. Once the lender and the borrower have determined the amount of money needed, the lender will use the amortization table to calculate what the monthly payment will be by dividing the number of payments to be made and adding the interest onto the monthly payment. Unless there are certai…

Pre-Payment Fees and Penalties

- While the goal to pay back a loan quickly is a financially sound practice, there are certain loans that penalize the borrower with pre-paid fees and penalties for doing so. Prepayment penalties are typically found in automobile loansor in mortgage subprime loans. They also can occur when borrowers choose to refinance a home or auto loan. Pre-payment penalties are applied to protec…

Breach Or Default

- If a loan contract is paid off late, the loan is considered in default. The borrower can be liable for a myriad of potential legal damages to compensate the lender for any losses suffered. The breached or defaulted lender can pursue litigation and have a court hold the borrower liable for legal costs, liquidated damages and even have assets and property attached or sold for repaym…

Mandatory Arbitration

- Mandatory arbitration is an increasingly popular provision in loan agreements that requires parties to resolve disputes through an arbitrator, rather than the court system. More than 50% of lending institutions include mandatory arbitration as part of their loan contracts because it is supposed to be faster and cheaper than going to court. Arbitration puts the final decision in the hands of one …

Usury and Predatory Protections

- Several federal and state consumer protection lawsprotect consumers against predatory and usury loan tactics used by lenders. The Truth In Lending Act, Real Estate Settlement Act and the Home Owners Protection Act federally protect borrowers against predatory lenders. Many states enacted companion consumer predatory and usury protection acts to protect borrowers. Both pa…

The Basics of Debt Settlement

The Downsides of Debt Settlement

- Although a debt settlement has some serious advantages, such as shrinking your current debt load, there are a few downsides to consider. Failing to take these into account can potentially put you in a more stressful situation than before. First, debt settlement generally requires you to come up with a substantial amount of cashat one time. This is what makes the debt settlement attracti…

Should You Do It Yourself?

- If you decide that a debt settlement is the right move, the next step is to choose between doing it yourself or hiring a professional debt negotiator. Keep in mind that your credit card company is obligated to deal with you and that a debt professional may not be able to negotiate a better deal than you can. Furthermore, the debt settlement industry has its fair share of con artists, ripoffs, a…

Appearances Matter

- Whether you use a professional or not, one of the key points in negotiations is to make it clear that you’re in a bad position financially. If your lender firmly believes that you’re between a rock and a hard place, the fear of losing out will make it less likely that they reject your offer. If your last few months of card statementsshow numerous trips to five-star restaurants or designer-boutique sho…

The Negotiating Process

- Start by calling the main phone number for your credit card’s customer service department and asking to speak to someone, preferably a manager, in the “debt settlements department.” Explain how dire your situation is. Highlight the fact that you’ve scraped a little bit of cash together and are hoping to settle one of your accounts before the money gets used up elsewhere. By mentioning …

The Bottom Line

- While the possibility of negotiating a settlement should encourage everyone to try, there’s a good chance you’ll hear a “no” somewhere along the way. If so, don’t just hang up the phone and walk away. Instead, ask your credit card company if it can lower your card’s annual percentage rate(APR), reduce your monthly payment, or provide an alternative payment plan. Often your cre…