- Know your purpose in writing the settlement statement. You should have a goal in mind as to why you are writing a settlement statement. ...

- Review all the details of your transaction. Make sure you remember what both parties have agreed upon.

- Carefully lay down the points needed to be discussed in the settlement statement. This includes all terms, conditions, standards, and all important details regarding your transaction.

- Write in an understandable manner. You need to write clearly. Use simple words, phrases, and language. Specify all the things that need to be specified.

- Be honest. You need the other party to trust you until the last moment, so be honest in writing all the contents of your settlement statement.

- Make it short. Do not include unnecessary information which would make your settlement statement unnecessarily long.

- Go over your settlement statement many times before sending it to the other party. You first need to check if all the information you included are accurate. ...

...

Those requirements include:

- An offer. This is what one party proposes to do, pay, etc.

- Acceptance. ...

- Valid consideration. ...

- Mutual assent. ...

- A legal purpose.

- A settlement agreement must also not be "unconscionable." This means that it cannot be illegal, fraudulent, or criminal.

What is settlement and examples of settlement?

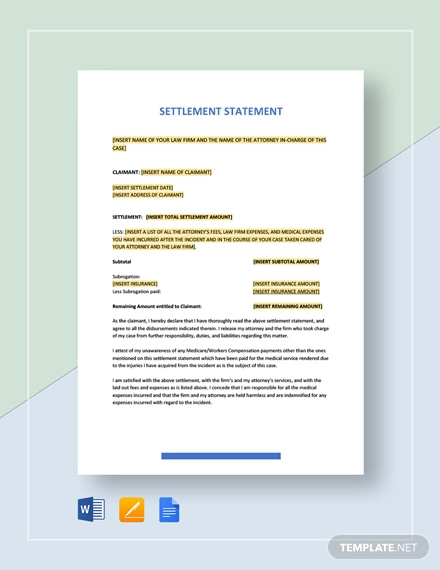

Settlement statement defines the document which discloses the summary writing of the transaction between the service provider and the client. For example, a seller sends the buyer a settlement statement containing the summed up costs with regards to the buyer’s purchase. Or a lender sends a settlement statement to a borrower containing all ...

What is a HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

How do you write a letter of settlement?

Settlement Agreement Letter Writing Tips. The letter should specify the important details. The letter should also specify how the settlement can be tackled. The letter should specify the amount. The letter should be clear and simple. The letter should express the terms & conditions from the standpoint of both the parties.

What is a HUD settlement statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction.

How do I write a settlement agreement?

First, give the document a title that describes the settlement. Next, write a paragraph that identifies all parties involved in the lawsuit and indicates their roles. This should also include their addresses and note that they have the authority and capacity to sign the agreement.

What should be included in a settlement?

9 Things to Include in a Settlement AgreementA Legal Purpose.An Offer.Acceptance of the Terms.Valid Consideration on Both Sides.Mutual Assent.Waiver of Unknown Claims.Resignation.Confidentiality Clause.More items...•

What is final settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

How do you draft a settlement proposal?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

What is a reasonable settlement agreement?

By Ben Power 8 April 2022. A settlement agreement is a contract between two parties, usually (but not always) an employer and an employee, which settles the employee's claims against their employer.

Does a settlement agreement need to be in writing?

A Settlement Agreement can be proposed by either an employer or employee; however, it is usually the employer who makes the first approach. To be legally valid, a Settlement Agreement must: be in writing.

What is a settlement letter?

A settlement letter is a letter that provides a quote for the amount you need to pay in order to settle your vehicle finance account in full.

Is a settlement statement the same as a closing disclosure?

When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

What is estimated settlement statement?

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss). Think of it as your detailed receipt that details information from various places on one page.

How do I write a final settlement letter?

Dear Sir, I had resigned from my position of (Designation) in the company on (Date). Before the last date of service and notice period, I had completed all the handing over formalities duly. I was told that I would get a full and final settlement amount of ___________ towards the pending salary and other dues.

How much should I offer as a full and final settlement?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

How do I write a legal letter to a settlement?

Here are ten strategies for writing a settlement demand letter:Stay Focused. ... Do Not Threaten. ... Make Your Case Stand Out. ... Understand Policy Limits Before Writing. ... Support Your Claim. ... Include All of Your Damages. ... Do Not Make a Specific Demand. ... Do Not Offer a Recorded Statement.More items...

What should I ask for in a settlement agreement?

8 Questions to Ask if You've Been Offered a Settlement AgreementIs the price right? ... How much will I pay for legal advice? ... Have I been offered a reference? ... How much time would legal action take? ... Are there any restrictive covenants in your agreement? ... Do I have to pay tax on my agreement?More items...

What are settlement documents?

A settlement statement is a document that summarizes the terms and conditions of a settlement agreement between parties. Commonly used for loan agreements, a settlement statement details the terms and conditions of the loan and all costs owed by or credits due to the buyer or seller.

What is the plaintiff typically giving up in a settlement of a lawsuit?

Through settlement, the plaintiff (the person filing the lawsuit) agrees to give up the right to pursue any further legal action in connection with the accident or injury, in exchange for payment of an agreed-upon sum of money from the defendant or an insurance company.

What areas must be investigated before a settlement offer is made?

List areas that must be investigated before a settlement offer is made. 2: a preliminary assessment of the client's present health, and the client's medical history. 3: You may also be required to calculate the damages in the case.

How to resolve a claim in a settlement agreement?

Negotiate the scope of the release. You must negotiate the scope of the release in the agreement to determine which claims will be resolved, and whether any future claims are also resolved by this settlement agreement. You can negotiate a provision stating that the settlement agreement applies to all claims arising out of the dispute, whether they are current or not yet realized, or the settlement may resolve just one aspect of a suit or a single claim. This will depend on your needs.

What should be hammered out before writing a settlement agreement?

For example, payment arrangements and logistics should be hammered out before you write the settlement agreement.

How to settle a dispute between two parties?

1. Decide whether you have the need for a settlement agreement. A settlement agreement is a legally enforceable contract. They can be used in a variety of situations where two parties are in dispute about something and they wish to compromise on how that dispute will be resolved.

What is a settlement agreement?

A settlement agreement is a legally binding contract meant to resolve a dispute between yourself and another party so you do not have to go through the judicial process (or extend the judicial process if you are already in court).

How to settle a dispute with a mediator?

1. Agree on a statement of the dispute. Both parties are likely to have a differing view of the dispute. Before writing your settlement agreement, you must come to an agreement of the factual terms of the dispute. A mediator may be helpful in determining this.

What are the situations where a settlement agreement is used?

Some of the most common situations in which a settlement agreement is utilized include: disputes over damaged property; employment disputes between employers and employees; marriage disputes; and medical malpractice disputes.

What does "unconscionable" mean in a settlement agreement?

A settlement agreement must also not be "unconscionable.". This means that it cannot be illegal, fraudulent, or criminal. For example, you could not agree to settle a lawsuit in exchange for six pounds of cocaine, because the sale of cocaine is illegal in the United States. [11]

What is a Settlement Statement?

The settlement statement, also known as the closing statement, is a legal document that outlines what a buyer needs to pay to the seller or vendor on settlement. The statement also has a good faith estimate. The settlement statement lists all charges and credits to both the buyer and the seller in a property or real estate settlement.

Meet some of our Real Estate Lawyers

Possesses extensive experience in the areas of civil and transactional law, as well as commercial litigation and have been in practice since 1998. I addition I have done numerous blue sky and SEC exempt stock sales, mergers, conversions from corporations to limited liability company, and asset purchases.

What Is a Settlement Statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest. Different types of loans can have varying requirements for settlement statement documentation. Generally, loan settlement statements can also be referred to as closing statements .

When are settlement statements created?

Beyond just loans, settlement statements can also be created whenever a large settlement has taken place, such as with a large business transaction or potentially in the legal, insurance, banking, and trading industries.

What is debt settlement?

Debt settlement: A debt settlement statement can provide a summary of debts written off, reduced, or otherwise amended after a debt settlement has completed. Lawyers and debt settlement companies work on behalf of borrowers with overwhelming amounts of debt, in order to help them reduce some or all of their obligations.

What is a settlement statement in stock trading?

Trading: In financial market trading, settlement statements provide proof of a security’s ownership transfer. Typically, stocks are transferred with a T+2 settlement date meaning ownership is achieved two days after the transaction is made.

What is insurance settlement?

Insurance settlement: An insurance settlement is most commonly documentation of the amount an insurer agrees to pay after reviewing an insurance claim. Banking: In the banking industry, settlement statements are produced on a regular basis for internal banking operations.

Does a reverse mortgage require a HUD-1 settlement statement?

RESPA requires a HUD-1 settlement statement for borrowers involved in a reverse mortgage. For all other types of mortgage loans, RESPA requires the mortgage closing disclosure. Both the HUD-1 and mortgage closing disclosure are standardized forms.

How to close a settlement letter?

Close the letter by reiterating that you are not able to pay off the debt, and that this settlement proposal represents your best effort to give the creditor something.

What does it mean to request a debt settlement?

Request, in exchange for a debt settlement, that the creditor remove mention of the debt in your credit report and make a good effort to improve your credit rating.

What is a settlement proposal?

A settlement proposal most commonly refers to an attempt by a person in debt to reduce or eliminate their debt by proposing an alternative to paying the full debt to the creditor. Proposing a settlement is a good idea for someone who is considering bankruptcy or who feels like they can pay some, but not all, of a debt.

How to settle a debt that is overdue?

Steps. Collect all information on your debts and sort it by date. Decide which debt you want to settle and the amount you can pay. You should choose a debt that is long overdue and which the creditor might reasonably expect will not be paid back. Decide on a figure for your settlement.

Why are creditors open to settlement?

Creditors are often open to settlement proposals as they offer an alternative to settling a debt that might otherwise go unpaid. The steps below will guide you on how to write a settlement proposal and seek good terms for a partial or full debt reduction.

What is a request for a creditor to respond to a proposal?

Request that the creditor respond in writing to your proposal, indicating their acceptance, refusal, or request for new terms.

How much should a debt settlement be?

In general, a debt settlement should be about half of the total amount owed. ...

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

How long before closing do you have to give closing disclosure?

In the wake of the subprime crisis, the Consumer Financial Protection Bureau requires that buyers receive the Closing Disclosure, outlining loan costs among other fees and information pertinent to the borrower, no later than 3 days before closing for review.

Does the seller get a closing statement?

Buyers tend to sign the bulk of the paperwork at closing, making some sellers wonder if they will even receive a settlement statement.

What does a well-researched and cogent statement tell the judge?

A well-researched and cogent statement tells the judge you’ve thought about—and care about—your case. Your thought and care promotes theirs

What did panelists draw on their experiences and observations from the bench and practice on enhancing pre-settlement?

Panelists drew on their experiences and observations from the bench and practice on enhancing pre-settlement conference position papers, as well as tips and suggestions for more successful settlement conferences.

Should you talk to a settlement conference judge?

With notice to the other side, talk with the settlement conference judge beforehand about aspects of your case that you’re uncomfortable disclosing ( e. g., difficult client) or intricate details the judge to may need to delve into beforehand to get perspective they’ll need. Oftentimes judges aren’t prepared to “rule” on the case, and if a litigant wants the judge to understand a particular aspect, they should tell the judge in advance. This technique often proves especially useful for nuances, awkward facets, and explaining why a defendant really can’t go above a maximum they’ve set

Is it too early to file a settlement?

Judge Finnegan replied that yes, sometimes it’s too early for a settlement conference, but she generally encourages litigants to prepare for a conference before filing a motion for summary judgment.

Should litigants jointly memorialize their principal settlement terms?

If the litigants successfully reach a settlement, to avoid later confusion and dispute, they should jointly memorialize their principal settlement terms in detail before anyone leaves

How to explain why you need to settle your debt?

Explain your predicament. Avoid getting emotional about the problems in your life, but you should explain your reason for needing to settle your debt. It will help your case if you can refer to a particular cause, such as an accident, divorce, or something else that is not likely to repeat. If you've simply overspent, the company will be less inclined to settle, because they have no assurance that your spending habits will change in the future.

What does "in full settlement" mean?

An offer of this type could say something like, “I am able to make an immediate payment of $4,000 in full settlement of my outstanding credit card debt.” Be sure to use the phrase “in full settlement,” so it is clear that you mean this as a full and final payment and not as part of a payment plan.

What to do if you owe more on credit card?

If you owe more on a credit card than you can afford to pay, you may wish to negotiate a settlement with the card company. In a settlement you agree to pay some lesser amount, and the company agrees to accept that amount. You both avoid the trouble and expense of going to court, and you can protect your credit rating at the same time.

How to settle credit card debt?

Decide what you can offer to pay. Before trying to settle your credit card debt, you need to decide what you can afford. Review all of your outstanding debts, and compare these to your regular income and any other funds you have available.

How to send a letter to a credit card company?

Address the letter to the proper office. Find out which office of the credit card company handles settlement offers. You can usually discover this by looking up the company online or calling the customer-service number on the back of the card itself. When you reach someone at the company, say that you would like to make an offer to settle your debt, and ask what address you should use for sending a letter.

How long does it take to respond to a letter from a company?

Provide a date for a response. At the end of your letter, ask the company to respond to you by a particular date. You should allow at least two weeks for the response. However, even if you do not receive a reply by that date, do not assume that your offer has been rejected.

How to state account number in letter?

Clearly identify the account that you are discussing. At the top of your letter, below the address, you should state the account number . Especially if you have more than one account with the institution, it is important to state clearly which account you are trying to settle.