Settlement Agreement Letter Writing Tips

- The letter should specify the important details.

- The letter should also specify how the settlement can be tackled.

- The letter should specify the amount.

- The letter should be clear and simple.

- The letter should express the terms & conditions from the standpoint of both the parties.

Should I write a debt settlement offer letter?

What Your Settlement Letter Should Include

- The letter should be on company letterhead, regardless of whether you’re dealing with a collection agency or the original creditor. ...

- The letter should include a date so you know when the settlement offer was made.

- Make sure the correct account number is listed on the debt settlement letter. ...

How to write a simple disagreement letter?

How to Write a Disagreement Letter. by WriteExpress Staff Writers. Consider diffusing the situation by using love and humor. Clearly describe the disagreement and explain what you want done to resolve it. Avoid accusations and threats, particularly in a first letter. (Generally, the intent is to strive to resolve the problem, not simply disagree.)

How to write a good credit dispute letter?

When writing your letter to a credit bureau, please remember these simple guidelines:

- In most cases, it’s unnecessary to mention laws, procedures, court rulings, or threaten lawsuits, etc. ...

- Similarly, remember to be kind. ...

- Include copies of information that supports your claims, but remember, anything you send them can also be used against you. ...

- Make and send copies, but always keep the originals for your records.

How to settle debt on your own?

To settle debt on your own you will need to:

- Learn the steps to settle debt on your own – What to say when negotiating, what to send to creditors in writing, and the overall order of operations.

- Obtain debt settlement letter templates, negotiating letters, counteroffers, settlement acceptance letters and much more. ...

- Understand the pros and cons when settling debt on your own. ...

How do you write a full and final settlement letter?

The language can be as simple as: In order to settle this matter amicably, I offer you the sum of [amount] (inclusive of interests and costs) as the full and final settlement of the above [claim/debt].

How do I write a debt settlement agreement?

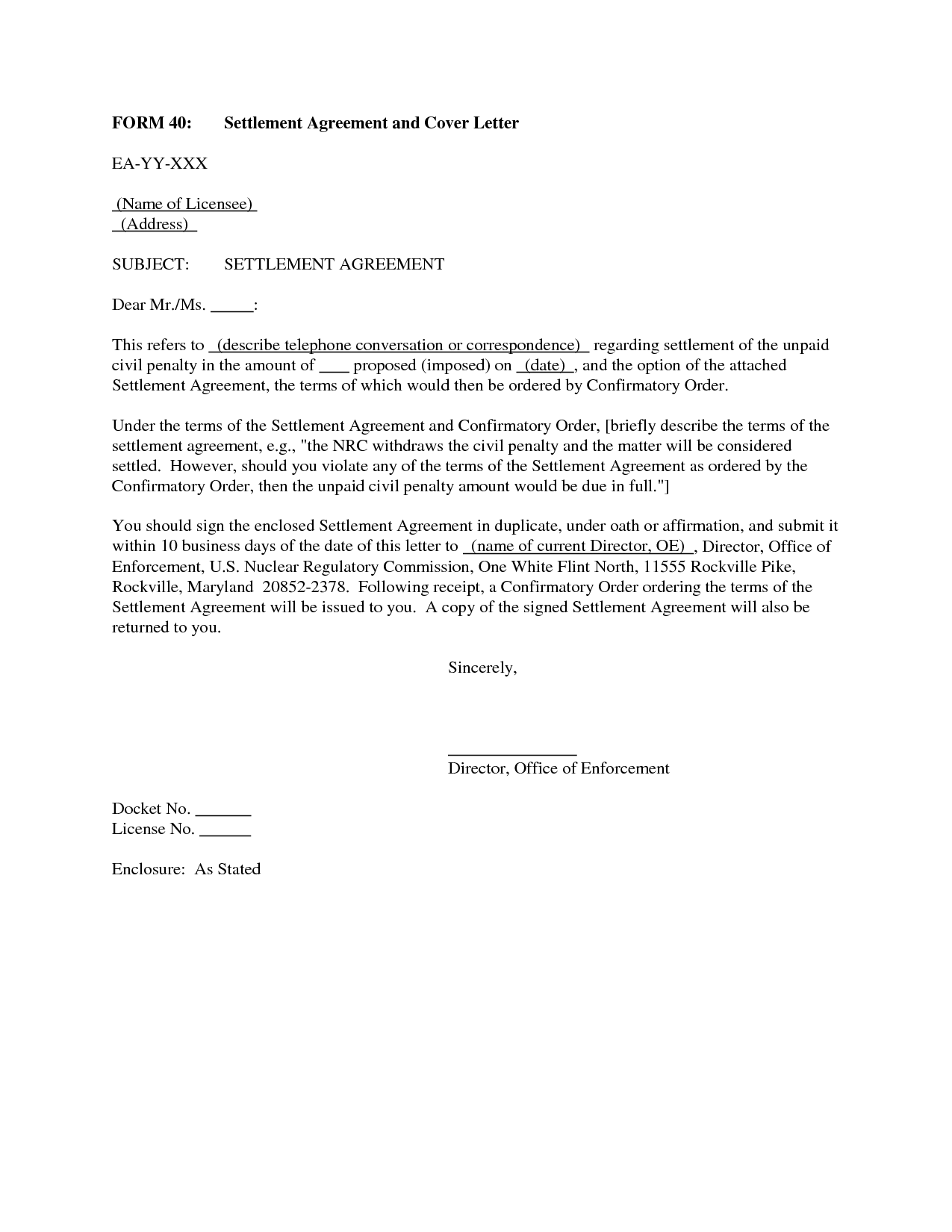

The following terms and conditions should be included in a settlement.Original creditor and collection agent's company name.Date the letter was written.Your name.Your account number.Outstanding balance owed on the account (optional)Amount agreed to as settlement.More items...

What is a settled letter?

A settlement letter is a written offer from a creditor to settle a debt, and serves as legal documentation of this arrangement. A settlement letter is a legally binding agreement on both you and the creditor, and technically replaces your original contract with them.

How do I write a final payment letter?

Dear Sir/Madam [or “To Whom It May Concern”], I am attaching my final payment for the account referenced above. I request a written confirmation from you that this account is [paid in full/settled in full] according to the terms of our agreement on [insert date of agreement].

How do you negotiate a full and final settlement?

What percentage should I offer a full and final settlement? It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

How do I ask for a final settlement?

Dear Sir, I had resigned from my position of (Designation) in the company on (Date). Before the last date of service and notice period, I had completed all the handing over formalities duly. I was told that I would get a full and final settlement amount of ___________ towards the pending salary and other dues.

How do you make a settlement?

A 6-step DIY debt settlement planAssess your situation. ... Research your creditors. ... Start a settlement fund. ... Make the creditor an offer. ... Review a written settlement agreement. ... Pay the agreed-upon settlement amount.

What is a settlement note?

Put simply, a settlement note is a formal letter that asks your creditors if they would be willing to accept a debt settlement on your account. It specifies the amount of money that you can offer them as a settlement and explains why you cannot pay your debt in full.

What percentage should I offer to settle a debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

What is a debt settlement agreement?

Debt settlement is a means of reducing or eliminating unsecured debt by negotiating an agreed upon payoff amount with creditors. This usually does not occur if a debt is secured, since the lender will have the right to take the property that secures the loan in lieu of payment.

What is calculated in your debt to income ratio?

To calculate your DTI, you add up all your monthly debt payments and divide them by your gross monthly income. Your gross monthly income is generally the amount of money you have earned before your taxes and other deductions are taken out.

How can a debt lawsuit be dismissed?

In a motion to dismiss, you can ask the judge to throw out any or all of the claims in the lawsuit. The judge will review your claims and issue a ruling. Use SoloSuit to respond to a debt collection lawsuit and win your case.

What is the most important part of a debt settlement letter?

One of the most important components of your debt settlement letter is a single number: the amount you decide to offer. You’ll base that number on your assessment of two considerations. Affordability. Never offer more than you can afford to pay.

What is the purpose of the settlement paragraph?

You’ll use this paragraph to present the details of your settlement offer. This will include the dollar amount you’re proposing to pay.

Why do you need to sign a letter?

Your Signature. Your letter will require your signature because you’ll be offering the creditor a contract, which is settlement of the debt. If you fail to sign your letter, the creditor may interpret that as an indication you’re not completely serious.

What to do if you can't pay your debt?

If you decide to try to settle your debts, you’ll start the process by writing a debt settlement letter. You’ll use the letter to propose settling the debt for a reduced amount.

What should be the opening paragraph of a letter?

First Paragraph. Your opening paragraph should quickly state the purpose of your letter, which is a proposal to settle the account for less than the full amount. In the next sentence, you’ll explain why you can’t pay the full amount.

What happens if you fail to sign a letter?

If you fail to sign your letter, the creditor may interpret that as an indication you’re not completely serious.

What should I say in the last sentence?

In the last sentence, you should provide a reason why you won’t be able to pay the full amount. It should be a circumstance beyond your control. I’ve listed several within the parentheses, but feel free to include whatever situation may be preventing you from making full payment. You don’t need to be long-winded here.

What is a settlement offer letter?

A Settlement Offer Letter is a communication between two parties in a dispute. The dispute does not have to be in a court of law, although most of the time, it is. One party sends the other party this Settlement Offer Letter, with the proposed terms for a complete settlement between the parties. Rather than a formal legal document, this letter can ...

What information is entered in a settlement agreement?

The parties' identifying details and contact information will be entered, as well as the proposed settlement terms.

What happens if a dispute is not litigated?

If the dispute is not being litigated, details of the incident at the heart of the parties' dispute will be entered.

Is a settlement agreement a legal document?

Although the terms listed in this letter will generally become the terms of the Settlement Agreement, this letter does not create a legally binding contract.

Is a settlement offer letter legal?

Although settlement agreements can be governed by both state and federal law, this Settlement Offer Letter is not a legal document, so it is simply a best practice to give the recipient of the letter as much information as possible about the terms of the proposed settlement.

What is a Settlement Demand Letter?

The settlement demand letter is a document written when asking for compensation due to persona injury. This letter is usually addressed to the plaintiff who has already sent you a demand letter asking for payment for the sustained injuries or any other damages suffered. In this settlement demand letter, a counteroffer is usually included to persuade the defendant to settle instead of this matter proceeding to court.

What to write after a personal injury?

After suffering a personal injury, claimants often write a demand letter asking for compensation from the responsible party for their injuries and other damages. If you’re the defendant, the right thing to do would be to write them a settlement demand letter . With this formal letter, you’ll be able to fight against the accusations being placed upon you. If you didn’t know how to write this document, highlighted above is everything you need to know about the settlement demand letter .

What is a summary of legal standards?

A summary of all the appropriate legal standards applicable to the issue.

When did Meadow Selgado get her letter?

Dear Mrs. Meadow Selgado, I got your letter, dated May 10, 2021, where you detailed an account of the vehicle accident you were involved in on March 14, 2021, plus demanded payment summing up to $1500 for injuries suffered due to the incident.

Should you include a deadline for a settlement?

You should include a clear deadline within when a reply should be made. It’s advisable you provide enough time but ensuring it doesn’t exceed a certain duration. Moreover, make sure to observe a tight timeline for your settlement to be considered seriously.

What is a settlement demand letter?

A settlement demand letter is a letter in which the writer expresses their willingness to settle a case out of court and offers a settlement. You might write a settlement demand letter if you have received a claimant’s demand letter and wish to respond with a settlement counteroffer. This letter is a written response to ...

How to negotiate a settlement offer?

Discuss the Terms of Your Offer. Clearly outline the terms of your settlement offer. Often settlements require confidentiality agreements and a stipulation that both parties will release any legal claims arising from the incident. Include a time frame for the claimant to accept the offer. Be sure to include the date the offer expires in your letter.

Why Offer a Settlement?

Settling a case out of court can save you money, time, and stress. Because a court case can be long-term and expensive , you might decide to settle even if you disagree with the claimant’s version of the incident that caused their loss. A settlement demand letter allows you to express your disagreement and offer a lower settlement amount.

What to do when a claimant sends a demand letter?

Offer a Reasonable Settlement. When a claimant sends a demand letter, they ask for a larger amount of money than they expect to receive. Their demand letter opens negotiation. Your settlement demand letter continues that negotiation. Offer a smaller amount than the claimant demands but large enough to tempt the claimant to settle out of court.

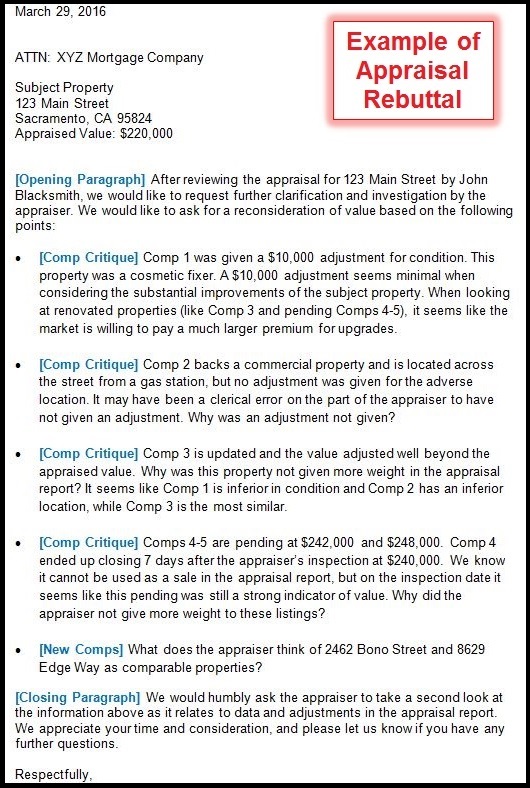

How to dispute a claim in a letter?

In the body of your letter, dispute the claim and offer your perspective of the incident. Backup your viewpoint with evidence, such as a police report. Enclose a copy of any evidence you discuss in your letter.

Why do you settle out of court?

Note: You might decide to settle out of court because you are not required to admit guilt to offer a settlement. You can deny responsibility for the incident and still offer to settle. Offering to settle might be preferable to a court case in which a jury determines your guilt or innocence.

What Is a Debt Settlement Letter?

If you’re unable or unsure about negotiating a debt settlement over the telephone, negotiating by letter is a reasonable option. It’s not much different negotiating with your creditor by telephone, but it might take longer. There are several ways to prepare a settlement letter, including hiring an attorney to write it for you or going online to download a template to use as a starting point. There are also several sample letters you can look at to get an idea of what your completed letter should look like.

What is the first step in a debt settlement?

The first step in a debt settlement negotiation with a bank, credit card company, or collection agency is to confirm the debt belongs to you. Some debts pass through multiple collection agencies once they leave the original creditor. During that time, mix-ups can occur or debts can become so old they are past the statute of limitations and legally uncollectible .

How does debt settlement work?

Luckily, there are many debt relief options. Debt settlement is one of the most advertised and for good reason. It’s often used for credit card debts and allows borrowers with unmanageable debt to pay off one or more debts for less than the full amount. The creditor then forgives the remaining debt. This may sound too good to be true, but it’s not. How well it works for you will depend on your financial situation and whether you choose to hire a debt settlement company to help you or do the debt settlement process yourself. This article will explain how to handle debt settlement on your own and how to write the best debt settlement letter possible.

How long do you have to be behind on your debt to get a creditor to accept your debt?

To increase your chances of getting a creditor to accept your debt, you need to be at least 90 days behind on your payments with that creditor. And during the negotiation process, you’ll need to continue not making any payments. This will hurt your credit score and the extra fees and interest may increase your overall debt. But it’s easier to convince a creditor that you can’t fully pay off your debt when you haven’t made any payments for several months. Remember, a creditor is willing to settle a debt for less than what you owe because they fear your financial situation is so uncertain that they won’t recover any money from you in the near future.

How to reach out to your creditor?

Now it’s time to reach out to your creditor. You can do this by telephone or by letter. Either way, you’ll need to have some cash saved up beforehand. Most debts get settled after the borrower makes a one-time lump-sum payment of the outstanding debt. In other cases, you’ll need to pay two or three large payments over a short period of time instead. Creditors rarely agree to let borrowers use a payment plan with monthly payments to settle their debts.

How long does it take to settle a debt?

Another major advantage is that the DIY debt settlement process tends to be faster, perhaps six months or less. In contrast, using a debt settlement company can easily take several years. Not only does this extra time mean it takes longer to get debt relief, but that’s more time for your debt to accrue interest and penalties.

What is the second step in negotiating a debt?

The second step is deciding what terms you’ll agree to. During negotiations, the biggest item to discuss will be how much of the debt you need to pay. But don’t overlook another important term: how the debt will show up on your credit report.

How to write a settlement letter?

This is a formal letter that should include: 1 A summary of the original incident with any factual disputes highlighted 2 Evidence to support the version of events provided in the Settlement Demand Letter 3 An outline of any relevant legal standards that apply to the matter 4 A settlement offer and terms/timeline for acceptance

What is a settlement demand letter?

A Settlement Demand Letter is a written offer addressed to a claimant in a dispute. Typically, the claimant has previously sent a demand letter requesting payment for injury or other damages. In the Settlement Demand Letter, a counteroffer is made to try to induce settlement before the matter ends up in court.

What to include when offering a settlement?

Be specific when offering a settlement. Clearly indicate financial terms , the timeline for acceptance, and any conditions for this offer.

How to properly review a claim?

Remember that the claimant is responsible for establishing facts and law – even if the version of events detailed is correct, it does not necessarily follow that the monetary claims are supported by the law. Scrutinize the evidence and all relevant legal standards.

Why is money needed in a final settlement agreement?

Industries are set up for the production of certain goods. They face a problem with funds in hand because most of the money is used and is blocked.

What is final settlement draft?

A final settlement draft is written for finally making it as an agreement which includes the reason of coming to a peaceful mutual settlement, and both parties should agree to all the terms and the legal implications and clauses and sign the draft letter to make it binding and real.

What happens when there is no hope of receiving any payment?

In such a case where there is no hope of receiving any payment, the banks/ financial institute at one time want to recover at least their capital investment from the company who had taken a loan against some property. In such cases, the financial companies want a one-time settlement, by waving the interest thereof.