Full Answer

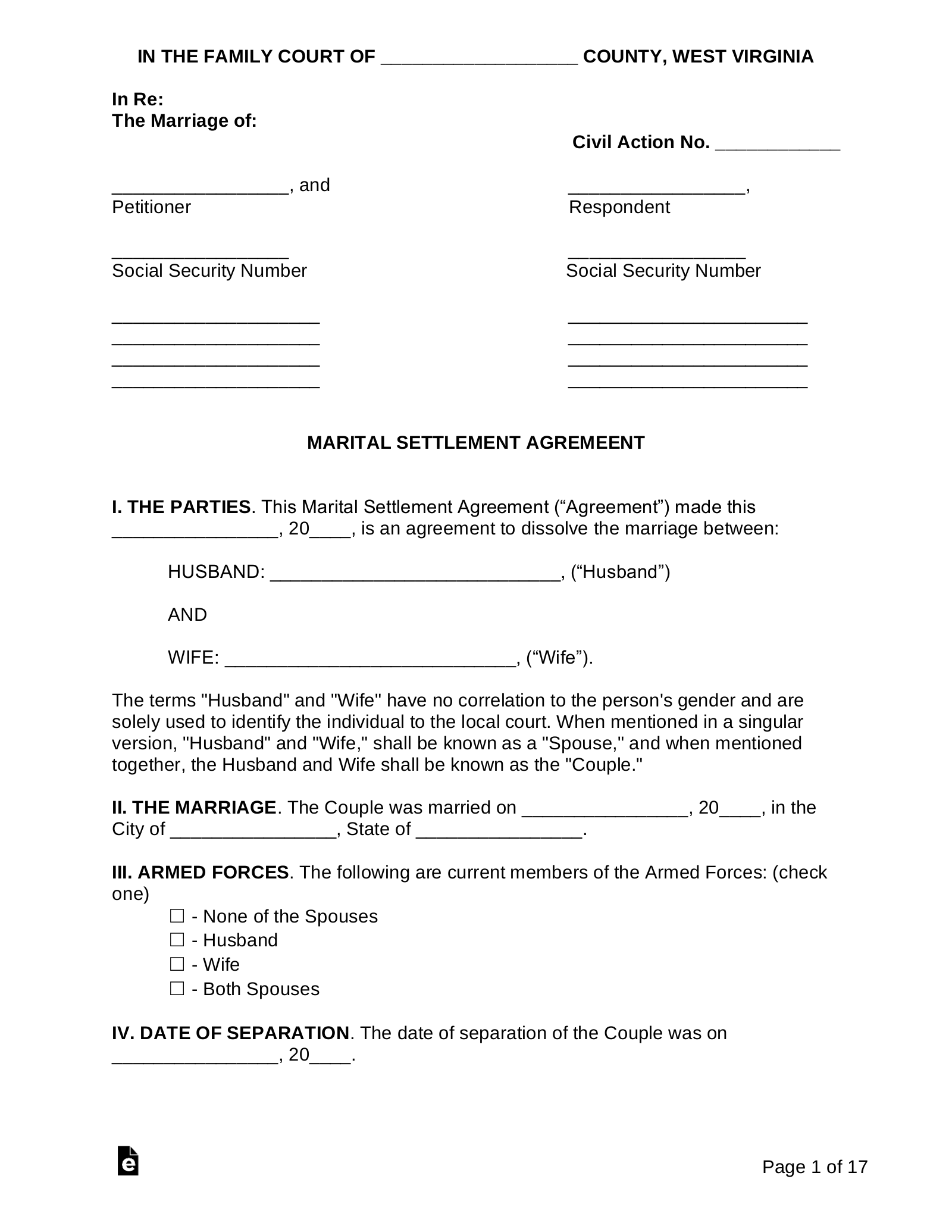

What is a marital settlement agreement in a divorce?

A Marital Settlement Agreement is a contract between the divorcing spouses that provides for the division of marital property and marital debt, child support, child custody, visitation rights, and maintenance payments. Once the agreement has been executed by both parties.

What is marital debt in a community property state?

In other words, in a community property state marital debt is considered joint debt -- debt that you are both responsible for. A creditor can come after you for payment of debt you did not create. To help protect yourself if you live in these states, full financial disclosure is important during settlement negotiations.

What happens to medical debt after a divorce?

This goes for medical debt involving a child’s illness, birth or emergency as well. In community property states, medical debt incurred during marriage is split 50-50. If an ex-spouse files for bankruptcy after a divorce, it could affect you. Since divorce doesn’t overrule a loan agreement, any joint credit is still your responsibility.

What happens if you owe money before a divorce?

You could petition the court and demand that terms of the divorce agreement be followed, perhaps causing the spouse to face fines or even jail time. The best strategy is to pay off debt your debt before finalizing your divorce. That’s often not possible, however, so the obligations are split.

How is debt settled in a divorce?

As part of the divorce judgment, the court will divide the couple's debts and assets. The court will indicate which party is responsible for paying which bills while dividing property and money. Generally, the court tries to divide assets and debts equally; however, they can also be used to balance one another.

What is considered joint debt?

Debt Incurred During a Marriage Some debts are joint debts incurred by both spouses. When a couple buys a house together, they jointly agree to be responsible for the mortgage. When they buy a car, both spouses are responsible for payments. Joint credit cards are also considered shared debts.

Does your spouse's debt become yours after marriage?

Debts you and your spouse incurred before marriage remain your own individual obligations—but you'll share responsibility for debts you take on together after the wedding.

Does your spouse's debt become yours after divorce?

When you get a divorce, you are still responsible for any debt in your name. That means that if you and your spouse had a joint credit card, you are just as liable for that debt as your spouse.

How do I protect myself from my husband's debt?

Keep Things Separate Keep separate bank accounts, take out car and other loans in one name only and title property to one person or the other. Doing so limits your vulnerability to your spouse's creditors, who can only take items that belong solely to her or her share in jointly owned property.

Is my husbands debt my debt?

When someone dies with an unpaid debt, it's generally paid with the money or property left in the estate. If your spouse dies, you're generally not responsible for their debt, unless it's a shared debt, or you are responsible under state law.

What is financial infidelity in a marriage?

Financial infidelity is when couples with combined finances lie to each other about money. Examples of financial infidelity can include hiding existing debts, excessive expenditures without notifying the other partner, and lying about the use of money.

When I get married will my husband's debt become mine?

No. Even in community property states, debts incurred before the marriage remain the sole responsibility of the individual. So if your spouse is still paying off student loans, for instance, you shouldn't worry that you'll become liable for their debt after you get married.

Should I pay off my debt before divorce?

Pay Off Debt before Finalizing Your Divorce They just want to be paid. If your name is on the account, you are on the hook regardless of what your divorce decree says. The best solution to avoid issues with dividing debt during a divorce is to dissolve joint accounts before going to court.

Can I be liable for ex husbands debt?

If you signed on a loan as the borrower or if you cosigned a loan for your spouse, you are legally liable for the debt that accompanies it. Any late fees charged due to a spouse's delinquent payments will also legally be your responsibility — even if they tell you that they'll take care of it.

Who is responsible for debt after separation?

If one spouse is continuing to incur matrimonial debt in their own name after a separation, in most circumstances, both parties will still be jointly responsible for this debt.

Can a joint debt be split?

Unlike credit cards, joint debts cannot be split. Whatever level of debt you have jointly incurred, each party listed in the financial agreement will be liable for the full amount, even if your relationship status or financial circumstances change.

How do I get out of a joint line of credit?

If only one person incurred the debt on the joint account and is willing to take responsibility, you can ask your creditor or lending institution if one person can qualify for the debt on their own merit. The person responsible for the debt can then apply for a new loan under their own name to pay off the joint debt.

How long does a charging order stay on your property?

12 yearsDoes a charging order expire after 12 years? The charging order on your home is recorded on the Land Registry until you pay the debt in full. It can then be removed by applying to the Land Registry.

What is the rule if there are several debtors or creditors?

Simply put, if the obligation involves numerous debtors, and it is a joint one, each debtor can only be held liable for a specific portion of the debt/obligation.

What is a divorce settlement agreement?

A Marital Settlement Agreement is a contract between the divorcing spouses that provides for the division of marital property and marital debt, child support, child custody, visitation rights, and maintenance payments. Once the agreement has been executed by both parties. The court will adopt the marital settlement agreement as its dissolution order in lieu of a trial subject to two limitations: 1 The court may modify any provisions relating to child support,child custody, and visitation, based on the best interests of thechildren involved; and 2 The court will not enter the agreement as an order if it is"unconscionable."A marital settlement agreement will be held to be unconscionable if either:

How can a court vacate a divorce judgment?

If the court enters the Marital Settlement Agreement as a divorce judgment, either party can vacate the judgment by showing "clear and convincing evidence" that the agreement was unconscionable.

What is the role of a divorce attorney in Illinois?

One of the primary responsibilities of a good divorce attorney is to attempt to settle the major issues in a divorce case prior to trial. If this can be accomplished, both sides will save on attorney fees,and there will be more marital assets remaining for division among the parties. If the parties are unable to resolve all of the major issuesin their divorce, the outstanding issues will be resolved through a trial, and the judge will issue an order of dissolution setting forth his or her rulings on these issues. The alternative to a trial is a Marital Settlement Agreement.

What does it mean when a court does not enter an agreement as an order?

The court will not enter the agreement as an order if it is"unconscionable."A marital settlement agreement will be held to be unconscionable if either: It is unreasonably unfair to one party; or. The agreement was made under conditions under which one party didnot have a meaningful choice.

What is the job of a divorce attorney?

One of the primary responsibilities of a good divorce attorney is to attempt to settle the major issues in a divorce case prior to trial.If this can be accomplished, both sides will save on attorney fees,and there will be more marital assets remaining for division among the parties. If the parties are unable to resolve all ...

How does a divorce decree enforce a MSA?

If the divorce decree simply references the terms of the MSA, then the terms are only enforceable through breach of contract proceedings. Posted. November 16, 2020.

Can a court enter an unconscionable settlement agreement?

The court will not enter the agreement as an order if it is"unconscionable."A marital settlement agreement will be held to be unconscionable if either:

What is a Marital Settlement Agreement?

A marital settlement agreement (MSA) is a written and legally binding contract that divorcing spouses create to resolve the issues related to their divorce. It spells out the terms, in detail, of issues such as a division of assets, alimony, child custody and support (as part of a separate parenting plan), and many others.

What to do if you don't understand a settlement agreement?

If you don’t understand something, be sure to consult an attorney.

What is an MSA divorce?

An MSA may go by slightly different names depending on where you live, sometimes being referred to as a divorce settlement agreement, separation agreement, stipulated judgment, or something similar.

What is the final divorce decree?

After the court reviews your paperwork and approves it, a final divorce decree will be entered. This legally ends your marriage and you are officially divorced.

How long does it take to get divorced?

Depending on court backlogs, state laws regarding waiting periods, and the availability of judges, your divorce could be finalized in a matter of a few weeks, although it may take three months or longer in some cases .

Is a divorce decree the same as a marital settlement?

They sound similar and they are sometimes confused with each other, but a marital settlement agreement and a divorce decree are different.

Can you negotiate a divorce agreement?

But when you can find common ground, it’s possible to create a marital settlement agreement that works well for both sides.

What is a final decree of divorce?

A final decree of divorce is nothing more than a promise on a piece of paper. Just because a judge signs it and your ex is ordered to follow it doesn’t mean he will. What you have to do is think of all the possibilities and how to protect yourself in any situation that may arise once you are divorced. To do so you must:

What is the language in a divorce decree?

Make sure that there is language in your final decree of divorce that states the property is to be refinanced and the time period in which he is to complete the refinance. There should also be language in your divorce decree that states the consequences to your ex if he does not follow through with refinancing the property.

Can you be held responsible for a spouse's debt?

If you live in a community property state, you can be held responsible for debt incurred by your spouse even if you were unaware of the debt and did not sign an agreement with a creditor. In other words, in a community property state marital debt is considered joint debt -- debt that you are both responsible for.

Can marital debt be split during divorce?

We all know that marital debt, just like marital assets, are split during divorce. Something not discussed though is the fact that a contract you have with a debtor doesn’t change regardless of who is ordered to pay which debt.

What happens when a spouse gets more property?

If a spouse is awarded more property, for example, that decision might be accompanied by more debt obligations for that spouse. Each state has its own laws for dividing debts and assets. Some states consider the assets and debts each spouse brought into the marriage. Other states consider everything to be owned equally.

Who gets mortgage debt?

Typically, mortgage debt is assigned to the spouse who makes significantly more than the other spouse. Or it goes to the spouse who is awarded full custody of the children. In those cases, one party will be required to buy out the other’s equity in the home.

What happens when a divorce is divided?

As part of the divorce judgment, the court divides the couple’s debts and assets, while deciding who is responsible for paying specific bills. Equality is the goal, but the division of assets could change that ratio. If a spouse is awarded more property, for example, that decision might be accompanied by more debt obligations for that spouse.

What to do if you have both parties on a mortgage?

If both parties are on the mortgage, the cleanest solution is to sell the house and split the money. Even if you’re advised to keep it in place for the good of the children, selling and splitting is usually the best strategy because it allows for a clean getaway. While you wait for the home to sell, you need to work out an agreement with your ex. ...

Can you ignore a divorce debt?

The ugly truth is if one spouse is made responsible for paying a debt following a divorce — including joint debts, such as auto loans — the payments could be ignored. And if the other spouse is part of the loan — as a borrower or co-signer — they are on the hook for any default, late fees or collection costs.

Is joint credit card debt considered marital debt?

Joint Credit Card Debt. The responsibility of joint credit card debt can vary, but most states consider marital debt to be any debt accumulated during the partnership, regardless of whose name appears on the account .

Does a divorce agreement supersede a loan agreement?

It’s also important to know that a divorce agreement does not supersede the terms of a loan agreement.

What happens if a spouse is obligated to pay a divorce debt?

If a spouse is obligated to pay a divorce-related debt, the indemnification language would make it near irrefutable that the non-filing spouse has legal standing to challenge the treatment and classification and dischargeability of a debt included in the filing spouse’s bankruptcy.

How to determine if a divorce debt is dischargeable?

The primary question that needs to be asked when determining whether a divorce-related debt is dischargeable is if the debt is a Domestic Support Obligation (DSO). The Bankruptcy Code defines the domestic support obligation at 11 U.S. Code § 101 (14A). The simple version is any child support, alimony, or any other payment that is “in the nature of alimony, maintenance, or support” will be a DSO. The Bankruptcy Court will look to federal law to make this determination, and will look past any labels that may have been used in the divorce agreement or order. The determination is a case-specific determination of whether the intent of the parties or the divorce court was for the obligation to be the nature of support.

What is a hold harmless debt?

Hold-Harmless Debts. When an order or agreement contains language that orders Spouse A to hold harmless or indemnify the Spouse B for a debt that Spouse A is to pay, the Court is creating a potentially non-dischargeable debt – the indemnification debt from Spouse A to Spouse B.

Why was Giddens' debt not dischargeable?

The court denied some of the grounds but ultimately, agreed that Giddens debt was not dischargeable because it was procured through fraud. More specifically, the court found that at the time Giddens entered into the marital settlement agreement, he had no intention of living up to his obligation to pay and transfer property to Morales.

What to consider when drafting a divorce agreement?

Protecting the Non-Filing Spouse in a Chapter 13. There are several items that should be considered when drafting a divorce agreement or judgment and trying to avoid issues and protect the non-filing spouse in case of a Chapter 13 filing.

How to protect a client in a divorce agreement?

Another way to protect a client in a divorce agreement or order is to reserve the issue of alimony for failure to abide by the orders of the court, including payment of the debts.

What is the purpose of filing bankruptcy?

When an individual files a bankruptcy, the most basic reason is to eliminate debts by receiving a discharge. In a Chapter 7, the individual eliminates unsecured debts (such as medical and credit card debt) and keeps property that is exempt. In a Chapter 13, the debtor proposes a plan to pay back certain types of debt over a three to five year period, can catch up delinquent loans on secured property, and can keep non-exempt property. In either a Chapter 7 or 13, the debtor receives an order at the conclusion of a successful case that discharges (eliminates) any remaining debt. However, some debts may be non-dischargeable, and high among the non-dischargeable debts are debts related to divorce.