Do you pay taxes on pain and suffering settlements?

The amount of pain and suffering compensation you will receive depends on the scope and severity of your accident injuries. Since pain and suffering damages stem from physical injuries, the IRS does not classify this compensation as taxable. In the same way as compensation for medical bills, compensation for pain and suffering is not taxable.

Do you have to pay taxes on a settlement?

Whether you need to pay taxes on a lawsuit settlement is dependent on the circumstances of the case. You’ll have to determine the nature of the claim and whether it was paid to you. If it was a settlement of an accident, it’ll be treated as ordinary income. Its value will be taxable if the plaintiff made it whole and won’t receive tax breaks.

Will I have to pay taxes on my settlement?

While there are times that you are not required to pay tax on your settlement, there are also cases in which you will be required to fork over a percentage. As long as you know your way around the law, you can minimize how much you have to pay in the end. In Court for Personal Injury?

Do I need to pay taxes on an injury settlement?

The agency has ruled that these injuries must be observable, such as cuts or bruises, to qualify as physical. The IRS also specifies that taxes do need to be paid on a portion of the settlement for medical expenses, if you deducted those medical expenses in prior years.

What settlements are not taxable?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Do I have to report personal injury settlement to IRS?

The compensation you receive for your physical pain and suffering arising from your physical injuries is not considered to be taxable and does not need to be reported to the IRS or the State of California.

Is emotional distress settlement taxable?

“Emotional Distress Damages Are Not Taxable.” Only if the emotional distress emanates from physical injuries or physical sickness are the damages tax free. That's why you might commonly see the phrase “physical injuries, physical sickness and emotional distress therefrom” in settlement agreements.

How do I report settlement income on my taxes?

If you receive a taxable court settlement, you might receive Form 1099-MISC. This form is used to report all kinds of miscellaneous income: royalty payments, fishing boat proceeds, and, of course, legal settlements. Your settlement income would be reported in box 3, for "other income."

Can the IRS take my settlement money?

If you have back taxes, yes—the IRS MIGHT take a portion of your personal injury settlement. If the IRS already has a lien on your personal property, it could potentially take your settlement as payment for your unpaid taxes behind that federal tax lien if you deposit the compensation into your bank account.

Are settlements tax deductible?

Generally, if a claim arises from acts performed by a taxpayer in the ordinary course of its business operations, settlement payments and payments made pursuant to court judgments related to the claim are deductible under section 162.

Is a mental anguish due to anxiety disorder settlement taxable income?

Settlement agreements are not binding on the IRS, but they do warrant attention. One payment may be allocable to physical injuries or physical sickness and, therefore, be non-taxable while other damages may be allocated to the emotional distress, which would be taxable.

Are damages for PTSD taxable?

Emotional Distress: Symptoms of emotional distress are not considered to be physical injuries. Therefore, the damages received for emotional distress can be taxed. However, in cases of PTSD, if you can prove the condition caused by material changes to the brain, your damages may be tax-free.

Is a settlement agreement taxable?

Settlement agreements (or compromise agreements as they used to be called), usually involve a payment from the employer to the employee. Such payments can attract income tax or national insurance contributions – but they can also sometimes rightly be paid tax free.

How can I avoid paying taxes on debt settlement?

According to the IRS, if a debt is canceled, forgiven or discharged, you must include the canceled amount in your gross income, and pay taxes on that “income,” unless you qualify for an exclusion or exception. Creditors who forgive $600 or more are required to file Form 1099-C with the IRS.

Is a lump sum payment in a divorce settlement taxable?

Generally, lump-sum divorce settlements are not taxable for the recipient. If the lump-sum payment is an alimony payment, it is not deductible for the person who makes the payment and is not considered income for the recipient.

Why is a W 9 required for settlement?

The Form W-9 is a means to ensure that the payee of the settlement is reporting its full income. Attorneys are frequently asked to supply their own Taxpayer Identification Numbers and other information to the liability carrier paying a settlement.

Do insurance claims count as income?

Would an insurance claim payment count as income or need to be included in my tax return somewhere? No. Insurance claim payments restore you to how you were before and are not income. However, insurance claim payments reduce deductions for medical expenses, casualty and theft losses.

Do you get a 1099 for insurance claims?

If you do have to pay taxes on an insurance claim, you'll receive a 1099 form to help you file.

How do I report a 1099 MISC settlement?

The W2 portion reports the amount of the settlement that was back wages and the associated taxes that were also paid and withheld on your behalf. You should treat this as any other Form W2 you would receive. The proceeds of the settlement that are not subject to payroll taxes are reported on Form 1099-MISC.

What happens if you settle for punitive damages?

If a significant portion of your settlement is awarded for punitive damages, you can expect to have a high tax liability that can drastically alter the final payout.

When is compensation tax free?

When a person experiences pain, suffering, and emotional distress from physical injuries or illness caused by another party’s negligence, that compensation is tax-free.

What to do before accepting a settlement after an accident?

Before accepting any settlement after your accident, always seek trusted legal counsel. It’s in your best interest to ensure that you’re not overlooking critical details that could alter your final payment outcome. A knowledgeable attorney can be of immense value to help you understand the different damages you are being offered and the taxation related to each category. In a poorly structured settlement, you could stand to lose thousands of dollars. The IRS won’t accept the fact that you were unaware should you fail to include the taxable amounts in your yearly tax return.

What is financial reimbursement?

Financial reimbursement, known as compensatory damages, are intended to relieve a person for direct costs related to an injury. These damages include compensation for losses related to: Compensatory damages are not taxed by the State of California nor by the Internal Revenue Service (IRS).

What is punitive damages?

Punitive damages are awarded by a judge or jury as a punishment when the defendant’s actions were especially heinous or showed complete and utter disregard for human life. An example of a case where a judge may award punitive damages would involve a drunk driver.

How long does it take to get compensation for an accident?

If you were hurt in an accident caused by another party’s negligence, the legal process could often take months or years before a settlement or payout can be reached. When you receive financial reimbursement for all the expenses and costs you sustained since the accident, it’s exciting and comes as a relief to many.

Will a lawsuit be taxed if there are no injuries?

However, if there were no physical injuries, and the foundation of the lawsuit is related solely to the harm being mental or emotional distress—those damages will likely be taxed both by the state and the IRS.

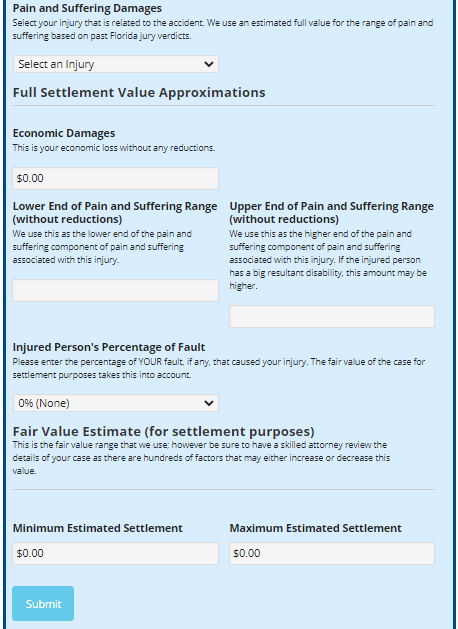

How Is Pain and Suffering Settlement Calculated?

However, once you receive a settlement offer from the insurance company, your attorney can help you determine whether the pain and suffering compensation offered is fair.

Do You Need a Lawyer to Win a Fair Settlement for Pain and Suffering?

You can estimate your pain and suffering damages as shown above or wait for the insurance company to quantify the amount for you. However, the downside of taking this option is that you might end up leaving money on the table.

How long does it take to get a settlement for pain and suffering?

First, it depends on how badly you are injured. All things equal, if you’re badly injured the case will settle faster.

How can you find see examples of a particular adjusters’ settlements for pain and suffering?

At least one state (Florida) lets you look up civil remedy notices (CRN) that were filed against a particular insurance company. Basically, someone (usually a lawyer) filed a notice complaining that an insurance company failed to properly handle a claim. Most often, the attorney’s complaint is that insurance company refused to pay the uninsured motorist insurance policy limits.

Does surgery lead to a bigger pain and suffering Payout?

In my larger settlements, the claimant usually had surgery. Here is the actual data:

Are pain and suffering damages bigger in certain counties?

Yes. In certain areas, juries are known to award bigger verdicts in personal injury cases.

Is there a cap of pain and suffering?

In some states there are maximum amounts that a jury may not legally exceed in awarding pain and suffering damages. For example, Florida used to have pain and suffering caps in medical malpractice cases.

Do insurers use r ecent jury verdicts and settlements to calculate pain and suffering?

Yes. However, the recent trend is taht I look at past jury verdicts to get the full settlement value of the pain and suffering component in a personal injury case. I then adjust the full value as necessary.

Does more medical treatment get you more money for pain and suffering?

Generally speaking, the longer that you treat with a doctor, the higher the full value of pain and suffering. Different injuries have different values for pain and suffering. The amount is usually a range (e.g. $25,000 to $50,000). The higher end of the range is if you have a larger resultant disability. In other words, if you have serious limitations as a result of the injury.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is a 1.104-1 C?

Section 1.104-1 (c) defines damages received on account of personal physical injuries or physical sickness to mean an amount received (other than workers' compensation) through prosecution of a legal suit or action, or through a settlement agreement entered into in lieu of prosecution.

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

What is Publication 4345?

Publication 4345, Settlements – Taxability PDF This publication will be used to educate taxpayers of tax implications when they receive a settlement check (award) from a class action lawsuit.

Is emotional distress excludable from gross income?

96-65 - Under current Section 104 (a) (2) of the Code, back pay and damages for emotional distress received to satisfy a claim for disparate treatment employment discrimination under Title VII of the 1964 Civil Rights Act are not excludable from gross income . Under former Section 104 (a) (2), back pay received to satisfy such a claim was not excludable from gross income, but damages received for emotional distress are excludable. Rev. Rul. 72-342, 84-92, and 93-88 obsoleted. Notice 95-45 superseded. Rev. Proc. 96-3 modified.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

Is physical pain taxable?

2)"Physical" is still the pivotal word when it comes to damages for emotional issues. If your pain and suffering is the result of injury or illness that gave rise to your lawsuit, the damages aren’t taxable.

Is car insurance taxable?

Car accident insurance settlements are generally not taxable, although there are certain exceptions, according to the Internal Revenue Service (IRS). Car insurance settlement for pain and suffering: taxes vary. If your pain and suffering is the result of a physical injury, your award is not taxable. However, if your pain and suffering is classified ...

Is a settlement for physical injury taxable?

If you receive a settlement for personal physical injuries or physical sickness and did not take an itemized deduction for medical expenses related to the injury or sickness in prior years, the full amount is non-taxable. Do not include the settlement proceeds in your income.

Is anxiety compensation taxable?

If, for example, you were not injured in an auto accident, but you developed a fear of driving as a result, compensation for your anxiety disorder would be taxable. However, compensation for emotional distress resulting from a physical injury is tax-exempt.

Is pain and suffering taxable?

If your pain and suffering is the result of a physical injury, your award is not taxable. However, if your pain and suffering is classified as emotional distress, it is taxable, and you must pay taxes on the amount paid to your attorney.

Is a settlement for a lawsuit included in your income?

If your lawsuit was for “personal physical injuries or physical sickness,”then generally the settlement proceeds are not included in your income. An exception applies when some of the proceeds are paid to reimburse you for medical expenses that you deducted on your tax return.

Is a settlement taxable?

If you received a settlement related to a medical condition, injury, or illness and you have not taken an itemized deduction for medical expenses in previous years, then your settlement is non-taxable. However, if you have paid out expenses for injury or illness over the course of more than one year, and in past years you did take a deduction for medical expenses, you do have to include that portion of your settlement in your taxable income.

Is emotional distress taxable?

If you have received money for emotional distress, it is treated the same as it would be for physical injury. It is non-taxable as long as you have not taken an itemized deduction for medical expenses in the past. However, if the emotional distress is unrelated to physical injury or illness, then the award is taxable.

Is loss in value of property taxable?

If the compensation you receive is less than that value, it is not taxable. If it exceeds the value, then it is taxable.

Is personal injury taxable?

Personal injury awards are not taxable when they relate to obvious illness or injury. Money that does not relate to physical injuries, such as unlawful discrimination or breach of contract, is considered taxable income. Attorney's fees also may be taxable, so it is a good idea to clarify this with an accountant.

Is a settlement for physical injury taxable?

If you receive a settlement for personal physical injuries or physical sickness and did not take an itemized deduction for medical expenses related to the injury or sickness in prior years, the full amount is non-taxable. Do not include the settlement proceeds in your income.

Is severance pay taxable?

If you receive a settlement in an employment-related lawsuit; for example, for unlawful discrimination or involuntary termination, the portion of the proceeds that is for lost wages (i.e., severance pay, back pay, front pay) is taxable wages and subject to the social security wage base and social security and Medicare tax rates in effect in the year paid. These proceeds are subject to employment tax withholding by the payor and should be reported by you as ‘Wages, salaries, tips, etc.” on line 1 of Form 1040.

Do you have to report a settlement on your taxes?

Property settlements for loss in value of property that are less than the adjusted basis of your property are nottaxable and generally do not need to be reported on your tax return. However, you must reduce your basis in theproperty by the amount of the settlement.