Are legal malpractice settlements taxable?

This means your lawyer needs to convince the IRS that the settlement is not taxable or that the tax should be based on the least taxable method. The analysis depends, in part, on the underlying basis for the legal malpractice settlement. The analysis also depends on different provisions of the IRS Code. Forbes provides the following examples:

Are settlements taxed like income?

Settlements themselves are not taxed because the CRA does not consider a personal injury settlement to be “income.” Your settlement is considered “compensation” for expenses incurred by another person’s negligence. Indeed, personal injury settlements rarely function as any kind of windfall.

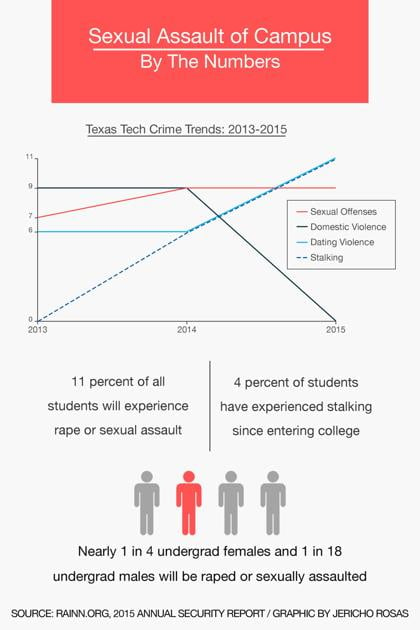

What is the average sexual harassment settlement?

When the sexual harassment was not extremely severe and pervasive, an employee may obtain a settlement of around $50,000 or so. Those individuals who take their sexual harassment cases to court may be able to receive a more significant award averaging over $200,000.

Are lawsuit payouts taxable?

The general rule of taxability for amounts received from the settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61, which states that all income is taxable “unless a specific exception exists from whatever source derived unless exempted by another section of the code.”

Is a sexual abuse lawsuit taxable?

Sexual assault and abuse agreements are not taxable. Under IRC 104a2, a long-standing tax law, you are not required to report or even include personal injury compensation information on your tax return. Therefore, you do not need to pay federal or state income tax on your settlement.

What types of settlements are taxable?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Is money awarded in a lawsuit taxable?

The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code.

Are personal injury settlements taxable IRS?

The majority of personal injury settlements are tax-free. This means that unless you qualify for an exception, you will not need to pay taxes on your settlement check as you would regular income. The State of California does not impose any additional taxes on top of those from the IRS.

How can I avoid paying taxes on a settlement?

How to Avoid Paying Taxes on a Lawsuit SettlementPhysical injury or sickness. ... Emotional distress may be taxable. ... Medical expenses. ... Punitive damages are taxable. ... Contingency fees may be taxable. ... Negotiate the amount of the 1099 income before you finalize the settlement. ... Allocate damages to reduce taxes.More items...•

Can the IRS take my settlement money?

If you have back taxes, yes—the IRS MIGHT take a portion of your personal injury settlement. If the IRS already has a lien on your personal property, it could potentially take your settlement as payment for your unpaid taxes behind that federal tax lien if you deposit the compensation into your bank account.

Do you pay tax on settlement agreement?

Usually a settlement agreement will say that you will be paid as normal up to the termination date. These wages are due to you as part of your earnings and so they will be taxed in the normal way.

Do settlement payments require a 1099?

Consequently, defendants issuing a settlement payment, or insurance companies issuing a settlement payment on behalf of the defendant, are required to issue a 1099 to the plaintiff unless the settlement qualifies for one of the tax exceptions.

Are settlements tax deductible?

Generally, if a claim arises from acts performed by a taxpayer in the ordinary course of its business operations, settlement payments and payments made pursuant to court judgments related to the claim are deductible under section 162.

Is an emotional distress settlement taxable?

Pain and suffering, along with emotional distress directly caused by a physical injury or ailment from an accident, are not taxable in a California or New York settlement for personal injuries.

How is settlement money divided?

The percentage of the settlement or judgment that attorneys charge does vary slightly, usually between 25% to 50%, depending on the type of case being handled.

What is the difference between punitive and compensatory damages?

Compensatory And Punitive Damages The compensatory damages awarded to plaintiffs are designed to give justice to them after being wronged. Punitive damages are designed to prevent others from being hurt by the same or similar actions.

Do you pay tax on settlement agreement?

Usually a settlement agreement will say that you will be paid as normal up to the termination date. These wages are due to you as part of your earnings and so they will be taxed in the normal way.

Are legal settlements tax deductible?

Generally, if a claim arises from acts performed by a taxpayer in the ordinary course of its business operations, settlement payments and payments made pursuant to court judgments related to the claim are deductible under section 162.

Are 1099 required for settlement payments?

Consequently, defendants issuing a settlement payment, or insurance companies issuing a settlement payment on behalf of the defendant, are required to issue a 1099 to the plaintiff unless the settlement qualifies for one of the tax exceptions.

What happens if you don't save enough from a settlement?

If you haven’t saved enough from your settlement to handle the tax dispute, it can be downright devastating. If you do have to pay tax, there’s a double whammy. You might assume if you have a contingent fee lawyer that the lawyer’s share isn’t income to you.

Is the tax rule black and white?

This sounds like a silly question. Surely the answer is no! Yet the question comes up frequently, the tax rules aren’t black and white, and the stakes can be huge. If you’ve been through an ordeal, make a legal claim and eventually get a settlement or judgment, the last thing you want is uncertainty about taxes.

Do you have to pay taxes if you don't have to?

If you’ve been through an ordeal, make a legal claim and eventually get a settlement or judgment, the last thing you want is uncertainty about taxes. You don’t want to pay taxes if you don’t have to. But you also don’t want to face claims by the IRS or state tax authorities several years down the line.

Can you deduct legal fees?

Because of tax deduction rules, you may not be able to deduct all of the legal fees. The most surprising tax trap on fees is the Alternative Minimum Tax. See 10 Things To Know About Taxes On Damages. Under the tax code, damages for personal physical injuries or physical sickness are tax free.

What is a settlement or payment related to sexual harassment?

any settlement or payment related to sexual harassment or sexual abuse if such settlement or payment is subject to a nondisclosure agreement, or. attorney's fees related to such a settlement or payment. The implications of this change in law are significant, perhaps even for individual taxpayers. (Unlike many of the changes to individual tax in ...

What are revocable trusts?

Revocable trusts and the grantor’s death: Planning and pitfalls 1 any settlement or payment related to sexual harassment or sexual abuse if such settlement or payment is subject to a nondisclosure agreement, or 2 attorney's fees related to such a settlement or payment.

Can you deduct attorneys fees above the line?

It remains clear that if the lawsuit is a qualified personal injury case and if no interest and punitive damages were paid, then attorneys' fees can be deducted above the line. Also, if a claim is brought against an employer that affects his or her trade or business, then, generally, the attorneys' fees may be deducted above the line. However, the limitation on the deductibility of legal expenses applies when the case has anything to do with sexual harassment and contains a nondisclosure agreement. As a rule, any settlement that involves punitive damages is taxed on 100% of the recoveries. The tricky part to this is how these recoveries are taxed.

Can you deduct sexual harassment awards?

Employers who paid awards in sexual harassment lawsuits generally could deduct the awards paid and attorneys’ fee’s incurred in the lawsuits as ordinary and necessary business expenses. Current law. Sec. 162(q), which addresses the tax deductibility of expenses related to sexual harassment settlements, states: ...

Will there be an increase in settlements without nondisclosure agreements?

Only time will tell how this will play out, but it is highly likely that an increase in settlements without nondisclosure agreements will cause more victims of sexual harassment to come into the public light when they hear other encouraging voices not silenced by nondisclosure agreements.

3 attorney answers

You can exclude it to the extent the settlement is for personal physical injury under 104 (a) (2) and for pain and suffering. More

Zaher Fallahi

It depends on how the settlement is characterized. To the extent any of the settlement was for economic damages (like lost wages), then that's taxable. If there is a confidentiality provision in the settlement agreement, the IRS takes the position that that part is taxable (that issue can get kind of dicey).

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

Is emotional distress excludable from gross income?

96-65 - Under current Section 104 (a) (2) of the Code, back pay and damages for emotional distress received to satisfy a claim for disparate treatment employment discrimination under Title VII of the 1964 Civil Rights Act are not excludable from gross income . Under former Section 104 (a) (2), back pay received to satisfy such a claim was not excludable from gross income, but damages received for emotional distress are excludable. Rev. Rul. 72-342, 84-92, and 93-88 obsoleted. Notice 95-45 superseded. Rev. Proc. 96-3 modified.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

Is mental distress a gross income?

As a result of the amendment in 1996, mental and emotional distress arising from non-physical injuries are only excludible from gross income under IRC Section104 (a) (2) only if received on account of physical injury or physical sickness. Punitive damages are not excludable from gross income, with one exception.

Is emotional distress taxable?

Damages received for non-physical injury such as emotional distress, defamation and humiliation, although generally includable in gross income, are not subject to Federal employment taxes. Emotional distress recovery must be on account of (attributed to) personal physical injuries or sickness unless the amount is for reimbursement ...

Is a judgment based on sexual harassment taxable?

If you sue an employer for sexual harassment and you are awarded a judgment, the amount isn’ t taxable to the recipient. That’s provided the award was not based on compensation. For instance, let’s say that you sue your employer because you were sexually harassed. You went to human resources, and they brushed you off.

Do you get a 1099 for back pay?

At tax time, you will receive a Form 1099 for the back pay. If you receive an award for a car accident, slip and fall, or any other nonsense like that, typically the amount isn’t taxable unless part of the award is based on the pay that you lost out on when you were recovering.

Is a judgment taxable if you sue a company?

If you sue the company and win a judgment — unless a portion of the judgment is for back pay or compensation — it is not taxable to the recipient. My advice is if you plan to sue, make sure that your tax accountant and attorney have a conversation about how the judgment will be issued.

Is alimony taxable in divorce?

Under the new tax law, the Tax Cuts and Jobs Act, alimony in a divorce is no longer deductible to the person that pays it and no longer taxable to the receipient. Most legal settlements are structured settlements, meaning you receive the amount over time.

Is a 1099 taxable if you don't receive it?

The question is whether the full amount would be taxable even though you didn’t receive the money. Most individuals are cash basis taxpayers, meaning that when they receive the income it is taxable. With a structured settlement you have received the 1099, so the IRS thinks it’s taxable.