What does it mean to be a payee settlement entity?

payment settlement entity as used in this document means the banks and other organizations with contractual obligations to make payment to participating payees ( merchants) in settlement of payment cards, or third- party settlement organizations.

How do I pay the government with Telpay?

Simply select the government department you wish to pay, enter the payment amount and fill in the corresponding government form. Fund your payments by using an online bank transfer from your financial institution or have Telpay withdraw the funds from your account. Review, approve and transmit the payment information to Telpay.

How can Telpay help you grow your business?

Grow your business by managing your clients’ business payments with Canada’s most all-inclusive electronic payment system. Telpay provides electronic payment processing solutions. "Our average bill run now takes less than an hour and can be done remotely,” says McAuley.

How do I contact Telpay sales?

To learn more, email [email protected] or call 1-800-665-0302. Do I need a lead time to fund payments? Timing can be tricky, but with the help of our funding timeline, you can be sure to get your payments where they need to go on time.

Who is considered a payment settlement entity?

Payment settlement entities are the organizations responsible for reporting the payments made to participating payees. A payment settlement entity may be a domestic or foreign entity.

What is Telpay bill payment?

Telpay is best known as a bill payment service. We accept payment instructions from individuals and businesses by a variety of means – online, payment software systems, and other financial service providers. In short, any source that can provide accurate information in electronic form.

How do I receive a payment from Telpay?

Getting Paid FAQSign Up Customers for PADs. To debit your customer's account, your business must have authorization from the account holder as per Payments Canada's Rule H1 requirements. ... Set Up Debit Info. Enter the banking details and amount of withdrawal for each customer you are debiting. ... Receive Funds.

What are third party payment networks?

A third party payment network is any agreement or arrangement that provides for the following: A central organization establishes the accounts by a substantial number of providers of goods or services who are unrelated to the organization and who have agreed to settle transactions.

Does Telpay work with QuickBooks?

Telpay provides a simple direct deposit solution that integrates with QuickBooks software.

Does Telpay work with QuickBooks online?

Telpay now integrates with QuickBooks Online with our newly released integration tool, Telpay Connect. It's an online tool that allows QuickBooks Online users to securely download a payroll file to a format compatible for importing into Telpay for Business desktop software.

How do I pay my employees direct deposit?

The most common way to pay employees, direct deposit, allows an employee's pay to be deposited directly into their bank account, usually within days of processing. Setting up direct deposit is simple—you just need your employees' bank account information, signed approval, and a service to help facilitate.

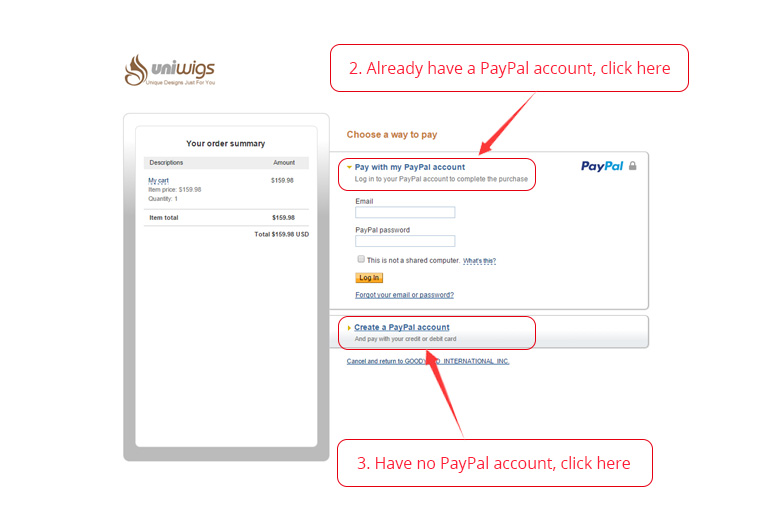

What is an example of a third party payment?

PayPal is one good example of an online payment portal that acts as a third party in a retail transaction. A seller offers a good or service, and a buyer uses a credit card entered through the PayPal payment service. The payment is run through PayPal and is thus a third-party transaction.

Is venmo a third party payment processor?

Third-party payment networks like Venmo, CashApp or Zelle are now required to report if you receive payments totaling $600 or more for goods and services. This is different than in the past, when the threshold was $20,000, and there had to be more than 200 transactions in a year.

Is Google pay a third party payment processor?

The Reserve Bank of India (RBI) has told the Delhi High Court that Google Pay is a third party app provider (TPAP) and does not operate any payment systems.

What is an example of a third-party sender?

As this post has described, a third-party sender sits in the flow of money. In payments, we sometimes call this type of business a processor. Accounts Payable software providers are also third-party senders. An example of a third-party service provider would be Modern Treasury.

What is a 3rd party service provider?

A third-party service provider is generally defined as an external person or company who provides a service or technology as part of a contract.

How to direct deposit payroll?

How does Payroll Direct Deposit work? 1 Calculate Payroll#N#Simply calculate your payroll using any payroll solution or CRA’s free payroll calculator and import the net payroll information and/or enter any new employee banking details directly into Telpay for Business. 2 Send Payroll Information and Funds#N#Transmit your payment file to Telpay and fund the Telpay trust account by either using an online banking transfer from your financial institution or have Telpay withdraw the funds from your account. 3 Deposit Made#N#Once Telpay has received your funds; your employees will be paid via direct deposit.

Is Telpay a payee?

Telpay is listed as a Biller (Payee) with virtually all financial institutions in Canada. Simply login into your online banking, select the bill payment option, add Telpay as a payee (Biller) and enter your Telpay access number as your account number.

Do I need a lead time to fund payments?

Timing can be tricky, but with the help of our funding timeline, you can be sure to get your payments where they need to go on time. Click here to visit our funding timelines page.

How much do third party settlement organizations have to report?

Third-party settlement organizations must report the gross amounts of reportable transactions of any payee for whom they settle payments using their network provided that a payee’s reportable transactions exceed $20,000 and the aggregate number of those transactions exceeds 200.

Who must report the gross amount of reportable transactions?

Merchant acquiring entities must report the gross amount of reportable transactions of any payee for whom they settle payment card transactions. A reportable payment card transaction is any payment in which a payment card or any indicia thereof (such as a credit card number) is accepted as payment.

What is a payment settlement entity?

payment settlement entity as used in this document means the banks and other organizations with contractual obligations to make payment to participating payees ( merchants) in settlement of payment cards, or third- party settlement organizations.

What is daily settlement price?

Daily Settlement Price means the settlement price for a Swap calculated each Business Day by or on behalf of BSEF. The Daily Settlement Price can be expressed in currency, spread, yield or any other appropriate measure commonly used in swap markets.

What is a qualified settlement fund?

Qualified Settlement Fund or “Settlement Fund” means the interest-bearing, settlement fund account to be established and maintained by the Escrow Agent in accordance with Article 5 herein and referred to as the Qualified Settlement Fund (within the meaning of Treas. Reg. § 1.468B-1).

What is default settlement method?

Default Settlement Method means Combination Settlement with a Specified Dollar Amount of $1,000 per $1,000 principal amount of Notes; provided, however, that the Company may, from time to time, change the Default Settlement Method by sending notice of the new Default Settlement Method to the Holders, the Trustee and the Conversion Agent.

What is net settlement amount?

Net Settlement Amount means the Gross Settlement Amount minus: (a) all Attorneys’ Fees and Costs paid to Class Counsel; (b) all Class Representatives’ Compensation as authorized by the Court; (c) all Administrative Expenses; and

What is the settlement date of a note?

Settlement Date means, with respect to the Called Principal of any Note, the date on which such Called Principal is to be prepaid pursuant to Section 8.2 or has become or is declared to be immediately due and payable pursuant to Section 12.1, as the context requires.

What is Scheduled Settlement Date?

Scheduled Settlement Date means a date on which a payment or delivery is to be made under Section 2 (a) (i) with respect to a Transaction.

What is a third party settlement organization?

The term third party settlement organization means the central organization that has the contractual obligation to make payments to participating payees (as defined in paragraph (a) (5) (i) (B) of this section) of third party network transactions.

What is a participating payee?

In general, the term participating payee means any person, including any governmental unit (and any agency or instrumentality thereof), who: (A) In the case of a payment card transaction, accepts a payment card (as defined in paragraph (b) (3) of this section) as payment; and.

What is X account payable?

X is a “shared-service” organization that performs accounts payable services for numerous purchasers that are unrelated to X. A substantial number of providers of goods and services have established accounts with X and have agreed to accept payment from X in settlement of their transactions with purchasers. The provider agreement with X includes standards and mechanisms for settling the transactions and guarantees payment to the providers, and the arrangement enables purchasers to transfer funds to providers. Under paragraph (c) (3) of this section, X's accounts payable services constitute a third party payment network, of which X is the third party settlement organization (as defined in paragraph (c) (2) of this section). For each payee, X must file the annual information return required under paragraph (a) (1) of this section to report payments made by X in settlement of accounts payable to that payee if X's aggregate payments to that payee exceed $20,000 and the aggregate number of transactions with that payee exceeds 200 (as provided in paragraph (c) (4) of this section).

What is merchant acquiring entity?

The term merchant acquiring entity means the bank or other organization that has the contractual obligation to make payment to participating payees (as defined in paragraph (a) (5) (i) (A) of this section) in settlement of payment card transactions.

Is a check accepted as a payment card?

The acceptance of a check issued in connection with a payment card account by a merchant or other payee is not a payment card transaction under paragraph (b) (1) of this section because the check is accepted and processed through the banking system in the same manner as a traditional check, not as a payment card.

Who receives payment from Bank X?

Corporation A, acting on behalf of A's independently-owned franchise stores, receives payment from Bank X for credit card sales effectuated at these franchise stores. X, the payment settlement entity (as defined in paragraph (a) (4) (i) of this section), is required under paragraph (d) (1) (i) of this section to report the gross amount of the reportable payment transactions distributed to A (notwithstanding the fact that A does not accept payment cards and would not otherwise be treated as a participating payee). In turn, under paragraph (d) (1) (ii) of this section, A is required to report the gross amount of the reportable payment transactions allocable to each franchise store. X has no reporting obligation under this section with respect to payments made by A to its franchise stores.

Is a mall card a payment card?

Under paragraph (b) (3) of this section, the mall card is a payment card because the card is accepted as payment by a network of persons who are unrelated to the issuer of the card and to the other merchants who have agreed to accept the card as payment.