To add insult to injury, the IRS does not follow divorce decree arrangements. Meaning they will still go after both spouses for the entire amount due, even if your divorce judgement or agreement allocates tax liability to one spouse entirely. Even some lawyers fail to understand that family court rulings do not supersede the tax code.

Does a divorce decree affect my tax debt?

While your divorce decree may state who will pay your tax debt to the IRS, the IRS is not bound by the divorce decree and will continue to try to collect the tax liability from both of you. Fortunately, in some cases, innocent spouse relief can remove the tax liability from your name.

Is a divorce settlement taxable?

As if a divorce is not complicated enough, it is challenging to understand what part of a settlement is taxable. A divorce lawyer may be able to answer common tax questions.

Will divorcing couples owe back taxes?

Divorcing couples must also understand how their tax debt will be considered, and the effect of separation on their tax filing status. In this post, we cover these two topics. Take a look. Tax Attorney Patrick Walter guest blogs on the challenges faced by divorcing couples who owe back taxes.

How does a judge divide tax debts in a divorce?

Not every state gives judges such broad discretion when dividing debts, but in many cases, a judge will consider each party’s ability to pay when apportioning tax debts. It is important to understand the limits of a judge’s authority to assign tax debt to one or both parties through a divorce. The judge’s authority extends only to the parties.

What happens to IRS debt when you divorce?

If you filed tax returns jointly when married, both spouses are liable to the IRS. That means they can collect 100% of the debt (tax, penalties, and interest) from either spouse. This is true after divorce, even if the spouse that is obligated per the divorce decree, fails to pay.

Does a divorce decree override the IRS?

The IRS no longer accepts a copy of a divorce decree to show who has the right to claim a child as a dependent if the decree was executed after December 31, 2008.

Is spouse responsible for IRS debt?

Joint and several liability means that each taxpayer is legally responsible for the entire liability. Thus, both spouses on a married filing jointly return are generally held responsible for all the tax due even if one spouse earned all the income or claimed improper deductions or credits.

Does the IRS usually settle?

The IRS will typically only settle for what it deems you can feasibly pay. To determine this, it will take into account your assets (home, car, etc.), your income, your monthly expenses (rent, utilities, child care, etc.), your savings, and more. The average settlement on an OIC is around $5,240.

What is the IRS innocent spouse rule?

By requesting innocent spouse relief, you can be relieved of responsibility for paying tax, interest, and penalties if your spouse (or former spouse) improperly reported items or omitted items on your tax return.

Does court order supersede IRS?

Regardless of what the custody orders the court has issued, federal law determines your federal tax status. Therefore, the IRS requirements supersede a county or state court order.

Does IRS forgive tax debt after 10 years?

In general, the Internal Revenue Service (IRS) has 10 years to collect unpaid tax debt. After that, the debt is wiped clean from its books and the IRS writes it off. This is called the 10 Year Statute of Limitations.

How do I protect myself from my husband's debt?

Keep Things Separate Keep separate bank accounts, take out car and other loans in one name only and title property to one person or the other. Doing so limits your vulnerability to your spouse's creditors, who can only take items that belong solely to her or her share in jointly owned property.

Does the IRS forgive debt?

The IRS rarely forgives tax debts. Form 656 is the application for an “offer in compromise” to settle your tax liability for less than what you owe. Such deals are only given to people experiencing true financial hardship.

How much will the IRS usually settle for?

Each year, the Internal Revenue Service (IRS) approves countless Offers in Compromise with taxpayers regarding their past-due tax payments. Basically, the IRS decreases the tax obligation debt owed by a taxpayer in exchange for a lump-sum settlement. The average Offer in Compromise the IRS approved in 2020 was $16,176.

What happens if you owe the IRS more than $50000?

If you owe more than $50,000, you may still qualify for an installment agreement, but you will need to complete a Collection Information Statement, Form 433-A. The IRS offers various electronic payment options to make a full or partial payment with your tax return.

How likely is the IRS to accept an offer in compromise?

A rarity: IRS OIC applications and acceptances for 2010-2019 In 2019, the IRS accepted 33% of all OICs. There are two main reasons that the IRS may not accept your doubt as to collectibility OIC: You don't qualify. You can't pay the calculated offer amount.

Can my ex demand my tax return?

A: The answer is “maybe” and the first thing to review would be your existing court order. If it calls for production of tax returns, etc., then that is the controlling order. If not, she has no per se right to your financial documents, and the court rules state that a party has to ask to open post-trial discovery.

Can you file single if you are divorced?

Filing status Couples who are splitting up but not yet divorced before the end of the year have the option of filing a joint return. The alternative is to file as married filing separately. It's the year when your divorce decree becomes final that you lose the option to file as married joint or married separate.

How can I avoid paying taxes on a divorce settlement?

Primary Residence If you sell your residence as part of the divorce, you may still be able to avoid taxes on the first $500,000 of gain, as long as you meet a two-year ownership-and-use test. To claim this full exclusion, you should make sure to close on the sale before you finalize the divorce.

What happens if both divorced parents claim child on taxes?

If you do not file a joint return with your child's other parent, then only one of you can claim the child as a dependent. When both parents claim the child, the IRS will usually allow the claim for the parent that the child lived with the most during the year.

What changes to the tax law affect alimony?

These payments are made after a divorce or separation. The Tax Cuts and Jobs Act changed the rules around them, which will affect certain taxpayers when they file their 2019 tax returns next year.

Is alimony deductible for 2019?

Beginning January 1, 2019, alimony or separate maintenance payments are not deductible from the income of the payer spouse, or includable in the income of the receiving spouse, if made under a divorce or separation agreement executed after December 31, 2018.

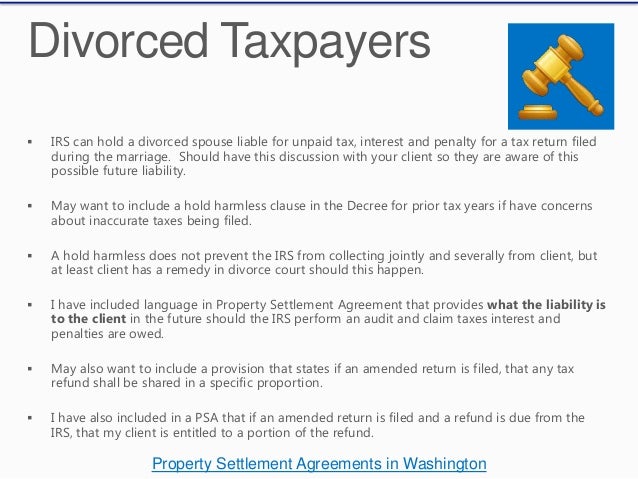

Joint and Several Liability for Taxes Between Divorced Spouses

When a taxpayer files separately, it is clear who will bear the burden of any tax liability assessed by the IRS. However, it may not be as intuitive when a tax return is filed on behalf of two taxpayers. If a joint return is filed, the liabilities linked to this return are held joint and several between both taxpayers.

BECOME AN INSIDER

Our best stuff: secrets, tax saving tools, and tax defense strategies from the braintrust at Brotman Law.

What to do with tax debt after divorce?

Innocent spouse, separation of liability and equitable relief can be a necessary and helpful next step to deal with the tax debt after divorce. If you have gone through a divorce or are going through a divorce and you have joint tax liability with your ex-spouse, it can be invaluable to explore your innocent spouse relief options ...

How to file an innocent spouse tax return?

To qualify for innocent spouse relief, you must meet the following criteria: 1 You filed a joint return; 2 There was an understatement of tax on the return due to errors made by your spouse; 3 When you signed the joint return you did not know (and had no reason to know) that the understatement existed; 4 Less than two years have passed since the IRS first attempted to collect the tax; and 5 Taking into account all facts and circumstances it would be unfair to hold you liable for the understated tax. Fairness is determined by several factors including whether you received a significant benefit from the understatement.

What happens when a couple files a joint return with a balance that goes unpaid?

Commonly this occurs when a couple files a joint return with a balance that goes unpaid. If you are granted equitable relief, the IRS will separate the unpaid liability between you and your spouse according to the proportion of income and the amount of payments each of you made that year.

Why was there an understatement on my tax return?

There was an understatement of tax on the return due to errors made by your spouse; When you signed the joint return you did not know (and had no reason to know) that the understatement existed; Less than two years have passed since the IRS first attempted to collect the tax; and.

Can a non-involved spouse file for innocent spouse relief?

In this scenario, the non-involved spouse may have a good case for innocent spouse relief.

Does the IRS have to pay taxes after divorce?

While your divorce decree may state who will pay your tax debt to the IRS, the IRS is not bound by the divorce decree and will continue to try to collect the tax liability from both of you. Fortunately, in some cases, innocent spouse relief can remove the tax liability from your name.

Can you file a separation of liability if you are not married?

However, while innocent spouse relief can be granted to anyone who filed a joint return, separation of liability relief can only be granted if you are no longer married, are legally separated or have not lived in the same household as your spouse for the past year.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is an interview with a taxpayer?

Interview the taxpayer to determine whether the taxpayer provided any type of settlement payment to any of their employees (past or present).

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

Is emotional distress excludable from gross income?

96-65 - Under current Section 104 (a) (2) of the Code, back pay and damages for emotional distress received to satisfy a claim for disparate treatment employment discrimination under Title VII of the 1964 Civil Rights Act are not excludable from gross income . Under former Section 104 (a) (2), back pay received to satisfy such a claim was not excludable from gross income, but damages received for emotional distress are excludable. Rev. Rul. 72-342, 84-92, and 93-88 obsoleted. Notice 95-45 superseded. Rev. Proc. 96-3 modified.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

Is mental distress a gross income?

As a result of the amendment in 1996, mental and emotional distress arising from non-physical injuries are only excludible from gross income under IRC Section104 (a) (2) only if received on account of physical injury or physical sickness. Punitive damages are not excludable from gross income, with one exception.

How to deal with unpaid taxes after divorce?

Consulting with a tax relief attorney or innocent spouse relief lawyer should be your first step when creating a plan of action to address unpaid tax liabilities resulting from divorce. An attorney can help you understand the potential risks and dangers involved, represent you in IRS negotiations, and keep the process moving efficiently. It is in your best interests to examine your legal options with the guidance of a dually licensed attorney-CPA. For a reduced-rate consultation concerning divorce-related tax issues in Northern or Southern California, contact the Tax Law Office of David W. Klasing online or call us today at (800) 681-1295.

Can you petition for modification of alimony?

One of you successfully petitions the family court for a modification of your existing alimony and/or child support order

Does the sale of a home have tax consequences?

Because of these and other factors, the sale of your home has major tax ramifications. In this particular situation, the Avvo user’s spouse did not account for these ramifications, which – as evidenced by his attempts to reduce payments owed – resulted in burdensome financial consequences. These consequences could have been anticipated and mitigated through careful tax planning.

Can the IRS collect taxes from divorce?

This becomes especially critical in cases where the tax liability is associated with a jointly filed tax return. In such scenarios, the IRS can (and likely will) pursue the taxpayer aggressively, engaging in a host of tax debt collection actions, regardless of the divorce agreement’s contents. Be advised that, when attempting to collect a delinquent tax debt, the IRS may utilize tax liens, levies, and garnishments to secure the unpaid amount – plus interest.

Does divorce trigger tax issues?

Divorce can trigger numerous tax issues, guidelines for which are established through a combination of IRS rules and dissolution agreements. Both parties to a divorce can assume tax liabilities, depending on factors such as:

Does the IRS have to honor the dissolution agreement?

However, the Internal Revenue Service (IRS) is under no obligation to honor these provisions – a fact which often startles divorcees.

Can I Become Liable for Taxes Because of My Divorce?

On May 29, 2018, an anonymous user writing from Los Angeles posted the following tax question to Avvo.com:

What is the recapture rule in divorce?

For instance, if a divorce decree orders the husband to pay his wife a large amount of alimony for one year with a lower amount to follow, the IRS uses the “recapture rule.”. This requires the paying party to “recapture” some of the money as taxable income. As if a divorce is not complicated enough, it is challenging to understand what part ...

Do you have to live separately to exchange money?

To begin, the exchange must be in cash or an equivalent, payment must be made under a court order, the parties must live separately, there are no requirements of payment after the receiving party dies and each party files tax returns separately.

Is it better to give one party a lump sum settlement?

For instance, when the couple has a home with a mortgage, it is common for one party to keep the house and pay the other spouse the equity as a property settlement. No taxable gain or loss is recognized.

Is child support deductible in divorce?

When a divorcing couple has children, child support is often part of the settlement. This money is not deductible. Besides alimony, divorce usually contains a property settlement as well. Many times, it is not recommended for a couple to equally divide marital assets.

Is alimony settlement taxable?

Is Divorce Settlement Money Taxable? After a divorce is final, assets change hands. It is important to understand what part of the settlement is taxable and to what party. In the case of alimony, the amount is taxable to the person who receives the support. In return, the person paying the money receives a tax deduction.

What happens if you don't pay your spouse's tax bill?

A debt to IRS is like a debt to any other creditor. So, the court has the authority to order you and your spouse to pay debts any way it wants to order the payment. What a court cannot do is obligate the creditor to only go after one or the other of you for not paying your bill. So, even if the court split the obligation equally, if your spouse does not pay you still owe the creditor the entire amount of the obligation.#N#Talk to your lawyer about this because it applies to all your creditors, not just the IRS.

Can you split liability?

The liability can't be split where each of you would only be responsible for 50% each. Since you both sign the returns, the IRS can come after you, her or both for 100%. A divorce order or settlement that says each of you are only 50% responsible each is not binding on the IRS.

Can the IRS collect joint taxes?

As far as the IRS is concerned, they can collect all or an portion of the joint taxes due from one or both spouses. How you and your spouse want to divide up the debt is a state / contract / marital dissolution matter. If you obtain an order splitting the obligation, that will have no effect on the IRS. If your spouse does not live up to their obligation, you would still be liable to the IRS and have to go back to court to...

What happens if a husband doesn't pay taxes after divorce?

In other words, if the husband fails to pay the marital tax debt after the divorce, the wife may bring the husband to court for failure to comply with the divorce order. The husband’s non-compliance with the divorce judgment will not prevent the IRS or state tax collector from seeking back taxes from the wife.

What happens if you get divorced on the date of the judgment of divorce?

Upon the entry of Judgment of Divorce Nisi, all rights and obligations set forth in the separation agreement ( child support, custody, division of assets, etc.) become immediately enforceable. In almost every meaningful way, the parties are divorced on the date that Judgment of Divorce Nisi enters.

How does a divorce end?

Most divorces end through settlement, not trial. A typical divorce agreement will include a provision addressing how the parties will pay for any back taxes (as well as any joint tax liability that is only discovered after the divorce is complete). Each party’s obligation to contribute to the joint tax debt is enforceable in the state or county court where the divorce agreement was entered. However, the IRS and state tax authority are not bound by a divorce agreement, and it is important for divorcing spouses to understand what the IRS and state authorities are seeking from each spouse. A well-drawn divorce agreement will seek to apportion payment for back taxes in manner that is fair and reasonable for the parties, while simultaneously striving to satisfy the requirements of state and federal authorities, such that compliance with the divorce agreement will also result in compliance with the demands of the IRS and state tax collectors.

What is marital debt?

A marital debt represents an obligation to pay in the future. The principle of “equal division” sounds good on paper, but judges must consider whether a spouse will have the ability to pay his or her share of a marital debt in the future. In a state like Massachusetts, judges have broad discretion to disproportionately assign assets or debts in favor of one party based on more than a dozen statutory factors. Not every state gives judges such broad discretion when dividing debts, but in many cases, a judge will consider each party’s ability to pay when apportioning tax debts.

How long is the divorce period in Massachusetts?

Of course, Massachusetts poses special opportunities and challenges for former spouses due to the state’s anachronistic “nisi period”, which holds that the marital status of divorcing couples continues to remain “married” for a 90-day or 120-day period after the initial “Judgment of Divorce Nisi” enters.

What happens if you divorce a rough spouse?

A rough divorce can cause considerable stress and trauma, leaving both the spouses scarred for years. Divorcing couples have too much on their plate and must split property, divide debts, and resolve custody issues. Additionally, to avoid tax problems with divorce, couples who have been filing taxes jointly must decide their respective tax ...

How much of a spouse's premarital debt can a judge assign to a less wealthy spouse?

For example, in Massachusetts, if spouses are only married for one year, a judge is unlikely to provide assign 50% of a wealthy spouse’s premarital assets or debts to the less wealthy spouse. Instead, the judge may assign 5% of wealthy spouse’s assets/debts – or even none at all.