What is a settlement statement in real estate?

The Seller’s Closing Statement, or Settlement Statement, is an itemized list of fees and credits that shows your net profits as the seller, and sums up the finances of the entire transaction. This is one of many closing documents for seller. Who prepares the settlement statement?

What is included in a HUD 1 settlement statement?

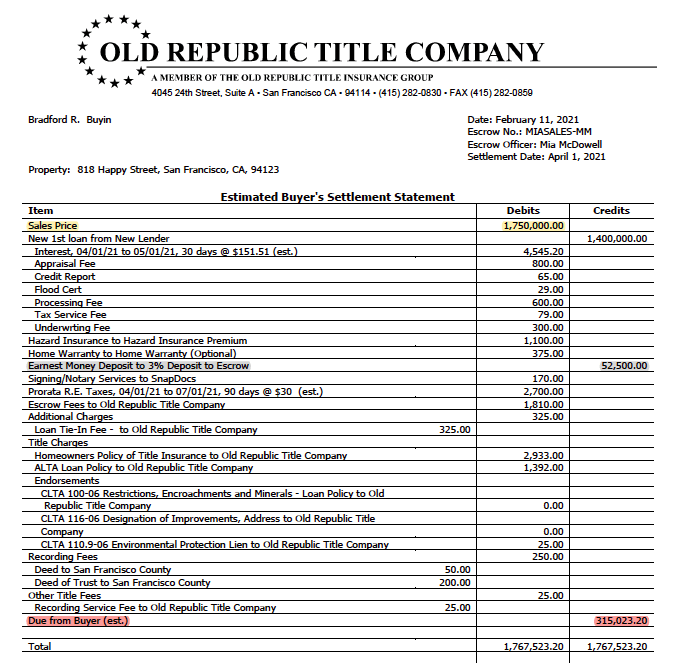

This document includes the sale price, your cash to close escrow, your loan amount, and all the other costs paid through escrow to settle the sale, including credits and prorations. This document is also known as the HUD 1 Settlement Statement.

Who prepares the settlement statement when closing?

Depending on what state you’re in, the settlement statement, a separate document, will be prepared by either an attorney, a title company, or an escrow firm, and the actual closing will be held at the offices of one of these three locations.

What should I do if I have a question about settlement statements?

If you have a question about your settlement statement, HomeLight always encourages you to reach out to your own advisor. It’s the moment when you can’t bear to see another piece of paper related to your home sale that you’ll receive the settlement statement — also known as a closing statement in real estate.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

Which document is the most important at closing?

It often includes a description of the property and signed by both parties. Deeds are the most important documents in your closing package because they contain the statement that the seller transfers all rights and stakes in the property to the buyer.

What do you need for settlement?

Bring to settlement:Photo ID such as driver's license.Another ID such as a credit card.A copy of your insurance policy.Your certified or cashier's check for the amount you need to bring made out to the Title Company or to you.A personal check for any balance. It won't be much.

What does it mean to settle on a house?

Settling is a term often used to describe a home's gradual sink into the ground over time. Settling occurs when the soil beneath the foundation begins to shift. Although settling is usually not something to worry about, sometimes it can lead to problematic foundation damage.

What not to do after closing on a house?

What Not To Do While Closing On a HouseAvoid Big Charges on a Credit Card. Do not rack up credit card debt. ... Be Careful with Trends. ... Do Not Neglect Your Neighbors. ... Don't Miss Tax Breaks. ... Keep Your Real Estate Agent Close. ... Save That Mail. ... Celebrate!

What do closing documents consist of?

At closing you'll need to review and sign some legal/financial documents, for example: The agreement between you and the seller transferring ownership of the property. The agreement between you and your lender regarding the terms and conditions of the mortgage.

What happens at a house settlement?

At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged. Your conveyancer or solicitor can check and negotiate the settlement period with the seller.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What should I do before settlement?

Settlement Day ChecklistConfirm the important details. ... Prepare the money required for settlement. ... Check the registration fee. ... Approve the settlement statement. ... Check your solicitor's tax invoice. ... Check the adjustment for local council rates. ... Adjust your water and sewer charges. ... Follow up on the registration of your title.More items...•

How much house settlement is normal?

Settling cracks will be vertical, between two and six inches long, and 1/16 of an inch in width. If the cracks you're seeing are horizontal or wider than 1/16 of an inch, that could indicate improper settling.

How long does it take to get money after house settlement?

The timeframe in which it takes for mortgage funds to be released does vary between lenders, however, it is common for funds to be released within between 3 and 7 days.

How long does it take for a house to settle?

Generally, it might take around two years internally before the building stabilizes. In most cases, a house should finish “settling” after a year. Usually, it goes through seasons of different humidity: hot weather, cold weather, wet weather, etc.

What is the most important document in real estate?

1) The Sale Deed The Sale Deed is an essential legal document which contains evidence of the sale and the transfer of property from the builder to the individual. Many-a-time, years after buying a home, the individual may want to sell the house[PK1] [WU2] for some reason, in which case, this document is essential.

What is the final step in the closing process of a home?

The last step of the closing process is the actual legal transfer of the home from the seller to you. The mortgage and other documents are signed, payments are exchanged, and finally, the waiting is over: you get the keys.

What is a closing statement?

A closing statement is a form used in a real estate transaction that includes an itemized list of all the buying or selling costs associated with that transaction. It's a standard element of home sales, especially those that involve mortgages, and refinancings.

What is signed at closing?

At the closing, you will sign a number of documents, transfer funds, and then the seller will publicly transfer the property to you.

Buying

If you are a new homeowner, it would be wise to retain a copy of the agreement between you and the real estate agent who represented you when you purchased your home. This is a contract that spells out the responsibilities and obligations of each party and the terms of your relationship.

Selling

Due to the plethora of real estate fraud that has taken place over the years, sellers are required to verify their own identity via state-issued photo identification cards, passports or any other government issued photo document.

Maintaining

Any recurring contracts for service staff that maintain your home should be retained not just for your needs but for future buyers of the property as well. Continuity of service is a good idea, especially if you are happy with the service and pricing of your current gardener, housekeeper, nanny, plumber, electrician, or HVAC service companies.

Renovating

In our experience, renovation contracts have been the most imperative documents to retain as new renovations often require some type of adjustment period, especially when the renovated room is placed into actual service.

Monetizing

A Lease Agreement is a detailed contact agreement with all of the necessary tenets between the tenant or lessee and landlord or lessor for rental of real property.

Enjoying

An agreement between a catering client and the catering provider or business will make sure that expectations are met with respect to menu options, service level, payment details, cancellation policies, health and hygiene compliance and insurance requirements.

How to Store Your Legal Documents

A basic, inexpensive method of retaining documentation is to scan all signed and fully executed contracts, deeds, and other legal commitments and email them to an email address specifically set up as a repository, such as documents@ [email-provider].com.

What is a document on the way to closing?

Documents on the Way to Closing. Addendums, amendments, or riders include anything that alters or amends the terms of your original purchase contract. These types of document might clarify the names on title or the spelling of the seller's or buyer's name. They might correct a street address.

What is included in closing disclosure?

Other inspections and work-related documents could include contractor invoices and permits. The closing disclosure includes all the final costs for your mortgage, laid out in a manner that you might not understand even though the government tries to make it simple for you.

What is seller disclosure?

Seller disclosures include material facts about things like lead-based paint. They might include a transfer disclosure statement, and other written warranties, guarantees, or disclosures that the seller provides. These documents are often the basis for future lawsuits against sellers when they fail to disclose an issue that becomes apparent later. 4

What is escrow instructions?

Escrow instructions often supersede the purchase contract and spell out the financial terms and conditions of the agreement between buyers and sellers. They authorize an escrow agent to perform specific acts on behalf of the parties involved.

What is closing statement?

The closing statement is the final estimate of all charges and credits for buying the home. This document includes the sale price, your cash to close escrow, your loan amount, and all the other costs paid through escrow to settle the sale, including credits and prorations. This document is also known as the HUD 1 Settlement Statement. The Consumer Financial Protection Bureau replaced it with the closing disclosure in 2015. 7

What is a repair addendum?

A repair addendum specifies the particular type of work to be completed.

What is a purchase agreement?

The purchase agreement is your contract to buy the home, setting forth all the terms and conditions required for closing. It's the document you and the seller signed when you agreed to buy the property, and both parties are legally obligated to abide by its terms.

How many documents should a homeowner keep?

Six documents every homeowner should keep. As a homeowner, you may find yourself with a lot of paperwork. While you don’t have to keep all of it, it is a good idea to keep certain files for tax or mortgage purposes.

How long do you keep mortgage insurance statements?

5. Private or primary mortgage insurance statements and cancelled checks: Keep these for three years after the tax year in which you’ve claimed this deduction. This payment is part of your monthly mortgage payment.

How long do you keep property tax payments?

6. Property tax payment: Keep your tax bill and statements showing payment for three years after you’ve made the payment.

What is a house deed?

1. House deed: A house deed is a document that transfers ownership of a house from one party to another. Keep this for as long as you own a property, to have proof that you own it.

What is a settlement statement?

The settlement statement is an important document, especially if you received the First Time Homebuyer Credit when it was in place. The statement lists actual costs, including fees and charges for the seller and buyer during the final stages of a home sale transaction. The settlement statement is also called the HUD-1, and it is administered through the U.S. Department of Housing and Urban Development. Other details included in the statement are the purchase price, points incurred by the buyer at the time of purchase and the amount of the buyer's mortgage loan.

What is the IRS form 1098?

IRS Form 1098. Homeowners with mortgages are usually eligible for the Home Mortgage Interest Deduction. Form 1098 includes important information from the lender about the amount of money the owner has paid out in interest. Interest paid on first and second mortgages, home equity and home improvement loans may qualify for deductions.

How long do you keep home improvement receipts?

The IRS recommends that taxpayers keep income-related documents and home improvement receipts in their files for at least three years and property-related documents for as long as they own the property.

Can you deduct points on a home loan?

Points can be deducted under the Home Mortgage Interest Deduction.

Do you have to report all income for a year?

The law requires you to report all income for the year. Additionally, some states offer tax credits for lower- and middle-income families who pay higher property taxes. Other homeowner credits and deductions are determined based on your income depending on the state where you live. 00:00. 00:04 09:16.

Do you need to keep income tax documents?

From the initial purchase to upkeep and everything in between, many documents are created that tell your home's story both legally and financially. A number of these documents are needed when you file your taxes and may be required later if the IRS has questions about your return. The IRS recommends that taxpayers keep income-related documents ...

What is HUD-1 settlement statement?

The HUD-1 settlement statement outlines your exact mortgage payments, a loan’s terms (such as the interest rate and term) and additional fees you’ll pay, called closing costs (which total anywhere from 2% to 7% of your home’s price). Compare your HUD-1 to the good-faith estimate your lender gave you at the outset; make sure they’re similar and ask your lender to explain any discrepancies.

How long before closing do you get your HUD-1?

Thanks to new regulations put in effect in October 2015 known as TRID (which stands for TILA-RESPA Integrated Disclosure), you will receive your HUD-1 three days before closing so that you have plenty of time to check it over. (Before TRID, home buyers received this form only 24 hours ahead of time, which resulted in a lot more last-minute surprises and holdups.)

How long before closing can you walk through a home?

Do a final walk-through: A buyer’s contract usually allows for a walk-through of the home 24 hours before closing. First and foremost, you’re making sure the previous owner has vacated (unless you’ve allowed a rent-back arrangement where they can stick around for a period of time before moving). Second, make sure the home is in the condition agreed upon in the contract. If you’d had a home inspection done earlier and it had revealed problems that the sellers had agreed to fix, make sure those repairs were made.

What to do if you find an issue during a walk through?

If you find an issue during your walk-through, bring it up with the sellers as soon as possible. There’s no need to panic; at worst you can simply delay the closing until you resolve it.

Do you need a title clearance before you can own a home?

Title clearance: Before you can own or “take title” to a home, most lenders will require a title search of public property records to make sure there aren’t any liens or issues with transferring the property into your name (which is rare, but if something does crop up, it’s better to know that upfront).

Does realtor.com make commissions?

The realtor.com ® editorial team highlights a curated selection of product recommendations for your consideration; clicking a link to the retailer that sells the product may earn us a commission.

What are disclosures for sellers?

Seller disclosures. Sellers are required by law to disclose certain problems with the home, both present and past, that they’re aware of that could affect its value. While laws vary by state, these disclosures might include lead-based paint, pest infestations, and renovations done without a permit.

How long do you have to keep a closing disclosure?

6. Closing disclosure. Mortgage lenders must provide borrowers with a closing disclosure (also called a CD) at least three business days before settlement.

What happens when you take title and become the sole owner of the property?

When you take title and become the sole owner of the property, you’ll receive a deed —a legal document that confirms or conveys the ownership rights to the home, says Anne Rizzo, associate vice president of Detroit-based title insurance company Amrock.

What is title insurance?

Title insurance offers protection against any competing claims to a home. As part of the process, the insurer will run a title search of public records, seeking loose ends such as liens against the property or fraudulent signatures on ownership documents.

What is a purchase agreement?

Every home sale starts with a real estate purchase agreement —a legally binding contract signed by home buyers and sellers that confirms that they agree upon a certain purchase price, closing date, and other terms. Why you should keep it: The provisions stated in this contract must be followed to the letter.

What is a buyer's agent agreement?

When you choose a real estate agent, you sign a buyer’s agent agreement —a contract between you and the brokerage, stating that the agent represents you in the purchase of your home. This agreement outlines the terms of the relationship with your agent—including who pays the agent’s commission (in most cases, ...

Does realtor.com make commissions?

The realtor.com ® editorial team highlights a curated selection of product recommendations for your consideration; clicking a link to the retailer that sells the product may earn us a commission.

Who prepares settlement statements?

Depending on what state you’re in, the settlement statement – a separate document – will be prepared by either an attorney, a title company, or an escrow firm, and the actual closing will be held at one of these three offices.

What is settlement statement cash?

Settlement Statement Cash – This version is used for liquid cash transactions for property sales.

What fees would a seller pay?

Another cost that buyers and sellers may both have to pay is their portion of the commission for the real estate agents. This would be listed in your seller’s disclosure statement. You might also pay your prorated portion of the property taxes, or homeowners insurance for the period you’re still living in the home.

How long does it take to get a closing disclosure?

Since the subprime lending crisis of the 2000s, the Consumer Financial Protection Bureau requires that buyers receive the Closing Disclosure no later than 3 days before closing. It outlines loan costs among other fees and information pertinent to the borrower,

What is the net sheet of a home sale?

A net sheet is a document that can be provided throughout the sale process to give the seller an estimate on what they can expect to make.

What is a closing statement?

The Seller’s Closing Statement, or Settlement Statement, is an itemized list of fees and credits that shows your net profits as the seller, and sums up the finances of the entire transaction. Everything from the sale price, loan amounts, school taxes, and other important information is contained in this document. Sellers can expect to pay between 6-10% of the final sale price in commissions and closing costs. So, it’s good to see exactly where that money is going.

What is due when closing a mortgage?

The Big Stuff. Anything you owe on the mortgage is due when you close the sale. That’s the first big thing to think about from a seller’s perspective. Another cost that buyers and sellers may both have to pay is their portion of the commission for the real estate agents.