How long does it take to get a settlement check from lawyer?

Once your lawyer receives the check, they usually hold it in a trust or escrow account until it clears. This process takes around 5-7 days for larger settlement checks. Once the check clears, your lawyer deducts their share to cover the cost of their legal services. They also pay any outstanding liens or bills for you.

How do settlement checks work in a personal injury case?

In most personal injury cases that involve a settlement check, the defendant’s insurance company writes a check to your attorney. Your lawyer receives the check and then deducts the percentage of money agreed upon before sending you the balance in the form of another check. What Happens When the Settlement Check Arrives at Your Lawyer’s Office?

When does an insurance company have to write a settlement check?

This insurance company has a legal obligation to write the check as soon as it receives your release, but internal issues may slow this process. Some states have deadlines for when the defendant must provide the settlement funds after receiving the release form.

How are settlement funds handled at a law firm?

Certain types of funds require special handling, and settlement funds fall into this category. Settlement funds are always deposited directly into your law firm’s trust account and are paid to parties of the settlement from the trust account. A settlement check is never directly deposited into your firm’s operating account.

How can I protect my settlement money?

Keep Your Settlement Separate Rather than depositing the settlement check directly into your standard bank account, keep the settlement money in its own separate account. This can help you keep it safe from creditors that may try to garnish your wages by taking the money you owe directly out of your bank account.

How long do banks hold settlement checks?

Cashing in Your Settlement Check With Your Bank Generally, a bank can hold funds: For up to two business days for checks against an account at the same institution. For up to five additional days for other banks (totaling seven days)

How does the settlement process work?

A settlement agreement works by the parties coming to terms on a resolution of the case. The parties agree on exactly what the outcome is going to be. They put the agreement in writing, and both parties sign it. Then, the settlement agreement has the same effect as though the jury decided the case with that outcome.

How can I cash a settlement check without a bank account?

Cash a Check without a Bank AccountCash it at the issuing bank (this is the bank name that is pre-printed on the check)Cash a check at a retailer that cashes checks (discount department store, grocery stores, etc.)Cash the check at a check-cashing store.More items...

How long does it take for a $30000 check to clear?

Most checks take two business days to clear. Checks may take longer to clear based on the amount of the check, your relationship with the bank, or if it's not a regular deposit. A receipt from the teller or ATM tells you when the funds become available.

What happens when you deposit over $10000 check?

Depositing a big amount of cash that is $10,000 or more means your bank or credit union will report it to the federal government. The $10,000 threshold was created as part of the Bank Secrecy Act, passed by Congress in 1970, and adjusted with the Patriot Act in 2002.

Can my lawyer cash my settlement check?

While your lawyer cannot release your settlement check until they resolve liens and bills associated with your case, it's usually best to be patient so you don't end up paying more than necessary.

How long after settlement will I get my money?

If your matter settles electronically, the funds should appear in your nominated account within a couple of hours after settlement. However, PEXA does recommend allowing a maximum of 24 hours just in case banking delays occur.

How long does it take to get paid after a settlement?

While rough estimates usually put the amount of time to receive settlement money around four to six weeks after a case it settled, the amount of time leading up to settlement will also vary. There are multiple factors to consider when asking how long it takes to get a settlement check.

What to do with a $100000 settlement?

What to Do with a $100,000 Settlement?Sort Out Tax Implications.Find a Financial Advisor.Pay Off the Debts.Invest in a Retirement Home.Start a Business or Help Friends and Family.Donate the Money to the Needy.Final Words.

What is the largest check a bank will cash?

Banks don't place restrictions on how large of a check you can cash. However, it's helpful to call ahead to ensure the bank will have enough cash on hand to endorse it. In addition, banks are required to report transactions over $10,000 to the Internal Revenue Service.

How long does a 50 000 check take to clear?

Usually within two business days for personal checks; up to seven for some accounts. Usually one business day for government and cashier's checks and checks from the same bank that holds your account.

How long does a bank hold a check over $10000?

Essentially, any transaction you make exceeding $10,000 requires your bank or credit union to report it to the government within 15 days of receiving it -- not because they're necessarily wary of you, but because large amounts of money changing hands could indicate possible illegal activity.

How long will bank hold large check?

According to banking regulations, reasonable periods of time include an extension of up to five business days for most checks. Under certain circumstances, the bank may be able to impose a longer hold if it can establish that the longer hold is reasonable.

How long does it take for a large check to clear?

Large deposits (those greater than $5,000) can be held for a “reasonable period of time,” between two and seven business days, depending on the type of check.

Why do banks hold checks for 7 days?

1 Sometimes there are circumstances that cause a check deposit to be placed on a temporary hold of up to seven business days. We place the hold to protect you from fraud, overdrafts, or fees that may occur if we were to make funds available immediately and the check is returned to you.

What Factors Delay My Settlement Check?

Depending on the details of your case or your settlement agreement, the actual time it takes for your check to be delivered varies. While many sett...

How Can I Speed Up the Delivery of My Settlement Check?

If you need your settlement check as soon as possible, there are a few ways to speed up the process. Once you get close to a settlement, start draf...

Should I Get a Settlement Advance?

A lawsuit loan, also known as pre-settlement funding, is a cash advance given to a plaintiff in exchange for a portion of their settlement. Unlike...

What to Do During the Process of Receiving a Settlement Check

There’s no greater relief than finding out a long, drawn-out lawsuit is coming to a close. Even better, you discover you’re about to receive your highly anticipated settlement check.

2. Distribution of Funds

Since it takes several days for funds from a deposited check to clear within a bank account, the process of receiving settlement funds won’t be overnight.

3. Processing Time

While the entire process may only take a few days, there are instances where it can take longer.

Related Posts

It's 2022 and there are more ways to build wealth today than ever before. From traditional methods like saving and buying real estate, to non-traditional methods like buying the latest cryptocurrency,…

How to settle a case?

To settle a case, you’ll generally need to sign a settlement agreement and release so the defendant or insurance company makes a deposit in your attorney’s escrow account who will then need to pay you in return

What happens when a person files a lawsuit for personal injury?

For example, when a person files a lawsuit for personal injury claiming damages, the case may eventually settle where the defendant (or insurance company) agrees to pay a certain amount of money to prevent further litigation.

What is settlement check?

A settlement check refers to an amount of money that you expect to receive in the form of a check following the resolution of a lawsuit.

Why does a defendant accept to pay the plaintiff?

The reason why a defendant (or party to a lawsuit) accepts to pay the plaintiff (or the injured party) a sum of money compensating it for damages and , in return, gets the plaintiff to dismiss the lawsuit.

When a claim is filed against an insurance company, can you expect to receive a check for the settlement?

When a claim is filed against an insurance company, you can also expect to receive a check for the settlement of the claim.

What is the next step in a settlement?

Once both parties have reached a settlement, the next step is to submit the settlement to the court and obtain a settlement order.

What is the first step to get a settlement check?

For you to receive a settlement check, you must first be in a legal proceeding of some form such as a motor vehicle accident claim lawsuit, personal injury lawsuit, medical malpractice lawsuit, defective product lawsuit, or any other type of legal action.

How long does it take to settle a liens claim?

It’s usually easy to settle liens, unless the government has a lien against your settlement. If you have any liens from a government-funded program like Medicare or Medicaid, it takes months to resolve them. Your lawyer also uses your settlement check to resolve any bills related to your lawsuit.

How long does it take for a check to clear?

Once your lawyer receives the check, they usually hold it in a trust or escrow account until it clears. This process takes around 5-7 days for larger settlement checks. Once the check clears, your lawyer deducts their share to cover the cost of their legal services.

What is structured settlement?

Unlike a regular settlement that pays the settlement amount in full, a structured settlement is when a defendant pays the settlement amount over time. These types of settlements usually occur when the case involves a minor or if there was a catastrophic injury that requires extensive ongoing medical care.

What happens when you get a settlement check?

When you finally reach a settlement, there are a few more things you and your lawyer need to do before the defendant gives your lawyer the check. Even so, once the check reaches your lawyer, there are a few obligations they must attend to before they give you the final balance.

How long does it take for a settlement check to be delivered?

While many settlements finalize within six weeks, some settlements may take several months to resolve.

What form do you sign to get a settlement?

The first form you have to sign to get your settlement is a release form. This form is a legally binding agreement stating that you will not pursue further legal action against the defendant for your specific case. Most defendants or insurance companies won’t give you a settlement check unless you sign the release form. However, if you have concurrent lawsuits against the same defendant for a different matter, you don’t have to stop pursuing those claims.

How to speed up the delivery of a settlement check?

Once you get close to a settlement, start drafting a release form ahead of time so it’s ready once you reach an agreement.

The Settlement Check

After settling a case, you can expect to receive compensation from the opposing party, or their insurer, in the form of a settlement check. The amount of settlement check is however much you and your attorney were able to negotiate for, ideally enough to cover all your damages, including past and future medical expenses and other costs.

How Long Does it Take to Get Paid After a Settlement?

Getting to a settlement is itself a long and often arduous process. It is natural that once you’ve finally agreed to a settlement, you want to know how quickly you will get your check. Usually, the insurance company forwards the settlement check to your attorney.

Steps Toward Getting Your Settlement Check

Once you reach an agreement to settle with another party, one of the attorneys must draft the settlement agreement with the terms you agreed on. The drafting attorney then forwards the draft agreement to the other party’s attorney. If the other attorney has changes, they discuss the changes with the drafting attorney.

After You Receive Your Settlement Check

Once you receive your settlement check, it is yours to spend to cover your expenses.

Injuries that Could Become Permanent Disabilities

Car accidents, slip and fall incidents, dog bites, and several other accidents could cause catastrophic injuries. These injuries are those that often lead to permanent disabilities, leading to life-long expenses your settlement should take into account.

Recovering Damages After an Accident

Your settlement check should cover all of your expenses and impacts, beyond mere medical expenses. You can collect two types of compensatory damages after an accident, including economic damages and non-economic damages.

What Is a Legal Settlement?

The vast majority of personal injury cases settle outside of a courtroom. Both parties reach an agreement that is worked out between the attorneys representing each party.

When Is a Check Issued After a Legal Settlement?

As part of a settlement agreement, the defendant is legally liable to compensate the plaintiff for the costs associated with a personal injury incident. Although the plaintiff agrees to compensate the defendant, it takes negotiations to bridge the gap between the legal issue of fault and the amount of compensation the plaintiff should receive.

What Happens When the Settlement Check Arrives at Your Lawyer’s Office?

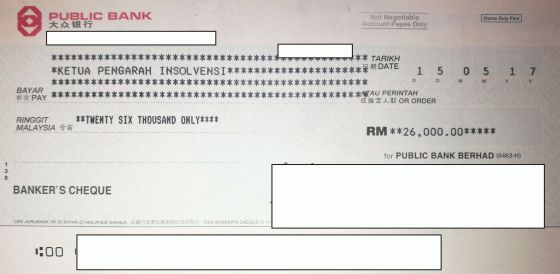

After the settlement check from the insurance company arrives at your lawyer’s office, your personal injury attorney places the funds into an escrow account. Putting the settlement check funds into an escrow account ensures the insurance company has enough money in its account to cover the settlement check. When the settlement check clears, your lawyer can then begin to distribute money out of the escrow account.

What Is Just Compensation?

You will hear a lot about the term “just compensation.” What exactly does that mean?

How Do I Track My Settlement Check?

Tracking the status of your settlement check starts by determining how long the defendant’s insurance company has to submit the release form. Your lawyer will contact the defendant’s insurance company to discover whether the company has submitted the proper paperwork.

What to do if playback doesn't begin?

If playback doesn't begin shortly, try restarting your device.

Who invited the attorneys to talk to him about your case?

The trial judge invite d the attorneys to talk to him about your case.

How long does it take to get a settlement check?

Remember, the settlement check must get deposited into your trust account and the funds need to be available to withdraw. This may take two to three days, depending on your bank’s deposit rules and the amount of the check being deposited. Trust accounting has rules that need to be followed.

What should a contingent fee agreement explain?

In the case when a settlement is not reached and there is no settlement check for the client, the fee agreement should also explain what expenses or fees the client will be responsible for paying, if any. As an example, below is a sample of text that may be used in a contingent fee agreement.

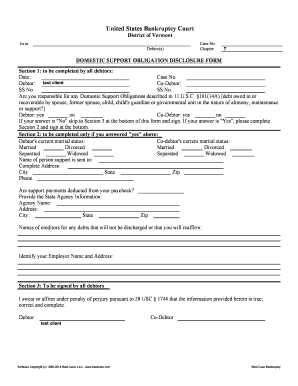

What is settlement statement?

The settlement statement is your audit trail and it should be reviewed and signed by both the client and the lawyer. It defines the proposed disposition of the settlement fund check and should include the following:

What do you write on a trust check?

On the check, write the case number, client name and case description. (This is good risk management if you ever need to re-create your trust accounting records.)

What is the best practice for handling settlement funds?

Best practices for handling settlement funds starts with a properly written and executed contingent fee agreement. This document should clearly communicate to the client how funds from a settlement check will be disbursed. In the case when a settlement is not reached and there is no settlement check for the client, the fee agreement should also explain what expenses or fees the client will be responsible for paying, if any.

Where are settlement funds deposited?

Settlement funds are always deposited directly into your law firm’s trust account and are paid to parties of the settlement from the trust account. A settlement check is never directly deposited into your firm’s operating account.

Can you deposit a settlement check into a trust account?

A settlement check is never directly deposited into your firm’s operating account. Depositing into the trust account serves as notice to the world that this money is not for you to use for regular business operations. Here is an example illustrating a basic settlement statement.