What to expect from a settlement?

- For minor injuries, they often settle for 1 to 2 times the medical bills.

- For more serious injuries, your case could settle for 10 times or more of the medical bills.

- But in most cases, it is likely that your case will settle for somewhere between 1 1/2 to 4 times your medical bills.

What is a good settlement amount?

What is a good settlement amount? Very roughly, if you think that you have a 50% chance of winning at trial, and that a jury is likely to award you something in the vicinity of $100,000, you might want to try to settle the case for about $50,000.

What is included in settlement?

What Is Included in a Personal Injury Settlement? A personal injury settlement is an amount of money awarded to an injured victim (plaintiff) by an insurance company to make the victim whole again. A victim may achieve a settlement by proving the policyholder’s fault for the accident and injury in question.

What are settlement charges to a seller?

Closing costs for sellers of real estate vary according to where you live, but as the seller you can expect to pay anywhere from 6% to 10% of the home’s sales price in closing costs at settlement.

What fees can increase at settlement?

Others may change, but only by 10% or less. Some other closing costs can increase without limit....These include:Prepaid interest.Prepaid property taxes.Prepaid homeowners insurance premiums.Initial escrow account deposits.Real estate-related fees.

What's the term for a charge that either party has to pay at closing?

Closing costs are fees due at the closing of a real estate transaction in addition to the property's purchase price. Both buyers and sellers may be subject to closing costs.

Who pays for title search in Florida?

the seller'sThe cost of a title search in Florida is typically the seller's responsibility and ranges anywhere from $150 to $1500, depending if it's a residential or complex commercial title search and examination.

What is a settlement cost booklet?

The GFE is a three page form designed to encourage you to shop for a. mortgage loan and settlement services so you can determine which mortgage is best. for you. It shows the loan terms and the settlement charges you will pay if you.

What if I can't afford closing costs?

Apply for a Closing Cost Assistance Grant One of the most common ways to pay for closing costs is to apply for a grant with a HUD-approved state or local housing agency or commission. These agencies set aside a certain amount of funds for closing cost grants for low-to-moderate income borrowers.

Who pays closing cost?

Closing costs are split up between buyer and seller. While the buyer typically pays for more of the closing costs, the seller will usually have to cover their end of local taxes and municipal fees. There's a lot to learn for first time home sellers.

How much are closing costs on a 250k home in Florida?

Seller Closing Costs in Florida Sellers can expect to pay from 7-9% of the home's purchase price in closing costs (this includes the commission fees given to the agents). For the average $225,000 home, this equates to a range of $15,750 to $20,250.

Who pays transfer taxes in Florida?

sellerThere are some jurisdictions that dictate who pays the tax, but for the most part, there is no mandate and it's up to the buyer and seller to negotiate who makes the payment. In Florida, the seller traditionally pays the transfer tax or documentary stamp.

Who pays property taxes at closing in Florida?

Closing Costs the Seller Traditionally Covers Property Taxes – In Florida, these are paid in arrears, which is to say, one year behind. To address this, buyers are credited with the amount of tax for which the seller would otherwise be responsible in the current year.

Are settlement charges tax deductible?

Can you deduct these closing costs on your federal income taxes? In most cases, the answer is “no.” The only mortgage closing costs you can claim on your tax return for the tax year in which you buy a home are any points you pay to reduce your interest rate and the real estate taxes you might pay upfront.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

Are settlement charges included in basis?

Settlement costs. Your basis includes the settlement fees and closing costs for buying property. You can't include in your basis the fees and costs for getting a loan on property.

What is escrow demand fee?

Homeowners' association (HOA) demand fees are the outstanding debts required to be paid before a homeowner can sell their home. When a buyer initially purchases an HOA home, he or she agrees to pay the assessments (dues, fines, and fees) as stipulated in the community association's CC&Rs and other governing documents.

Which costs are paid by the loan application fee?

Types of Loan Fees Loan application fees are just one type of fee lenders can charge on a loan. Other fees may include an origination fee and monthly service fees. 1 In general, fees help a lender cover costs associated with underwriting and processing a loan.

Which of the following fees must be included in the calculation of finance charges?

Interest is the most obvious example and most common finance charge. Other charges that always qualify include, but are not limited to: Loan origination fees. Mortgage broker fees.

Which of the following would be treated as a credit on the seller's closing statement?

Which of the following would be treated as a credit on the seller's closing statement? prepaid taxes. If a seller has already paid for a period of property tax that must be reimbursed by the buyer, it would be a credit on the seller's closing statement.

What is settlement fee?

Definition of Settlement Fee. When you're buying a home with a mortgage, it's important to understand the type of fees you might incur. Most people are familiar with the term closing costs, or the genuine third-party costs that are associated with the closing of a real estate transaction, and expect to pay these expenses when they purchase ...

How Do You Calculate Settlement Costs?

Right at the beginning of your loan application, you'll get a good faith estimate. This document outlines all the fees you should expect to pay for your mortgage such as the loan application fee, appraiser's fees, points, title insurance, mortgage insurance and accrued mortgage interest from the closing date until the end of the month. It's an estimate of the total cost of buying the property and it's provided to help you compare the cost of different mortgage providers.

What are closing costs when buying a home?

Most people are familiar with the term closing costs, or the genuine third-party costs that are associated with the closing of a real estate transaction, and expect to pay these expenses when they purchase a property.

What are closing costs?

Closing costs are the legitimate third-party expenses you incur when you buy a property. These are expenses that you would never get back even if you sold the home a day after you closed on it. Examples include the loan application fee, points, title search fees, appraisal fee, home inspection fees, escrow fees, credit reports, courier fees, ...

What is the HUD-1 settlement statement?

This looks a bit like the good faith estimate, only now it shows the true closing costs, including the final cost of items that could only be estimated before.

What happens when you combine closing costs?

If you combine all these various sums together and add them to the genuine closing costs, you get a complete account of everything you need to purchase the property. This total amount is what real estate professionals are referring to when they talk about "settlement costs," "settlement expenses" or "settlement fees."

Is autoplay a closing cost?

Autoplay. Brought to you by Sapling. Brought to you by Sapling. These costs are not technically "closing costs" because they're associated with your future home ownership and not the closing of the loan. You would get some or all of these costs back if you sold the home tomorrow.

What is title company settlement fee?

What is a Title Company Settlement Fee? The settlement fee is sometimes referred to the closing fee, and it covers costs associated with closing operations.

What are the costs associated with closing a home?

When you are buying a home, there are plenty of costs associated with closing that have nothing to do with the actual cost of the home. These costs are generally associated with insuring, reviewing, and modifying the title of that property. The costs can be broadly called “title fees”.

What is Scott Title?

For over two decades, the Scott Title team has maintained a commitment to delivering the highest quality of service in the title insurance industry . We provide our clients with an attention to detail they won’t find anywhere else when it comes to title insurance services including property title searches, settlement services, and real estate paralegal services. Buying a home is usually the single largest investment most people make in their lifetime, and our experienced team will make sure you are fully prepared for a smooth and successful closing. Contact us today to learn more about our services.

Does Scott Title Services work with real estate?

Settlement experts from Scott Title Services will seamlessly integrate into your real estate team by working with your lender, real estate agent and yourself to guarantee that the transaction is both successful and as stress free as possible. We coordinate everything to ensure that your interests and rights are protected during the entire closing process and beyond.

What is debt settlement?

Debt Settlement empowers you to take control of your debt, and part of that is knowing exactly where your money is going. Before the debt settlement, your money was being eaten up by interest rates and penalty fees. With debt settlement, your money goes directly toward paying down your debt and pays for essential services that may help you move toward a future beyond debt.

How to find out if debt settlement is right for you?

Contact a Certified Debt Specialist to find out if debt settlement is right for you.

What Do Your Program Fees Pay Cover?

Our fees are used to cover our services. During enrollment, we help you set up your Dedicated Account and provide budget counseling, which includes a full review of all your finances to determine a monthly deposit amount that is affordable for you. During the program, we also field all your creditor calls* and give access to a client portal so you can monitor your progress. Most importantly, we handle negotiations with your creditors and use our expertise to get you a fair settlement that may save you money.

Do you pay fees on enrolled debt?

You won’t pay any fees on each of your enrolled debts until you get successful settlements. However, when you qualify for debt settlement, you also qualify for a flat-rate fee based on your enrolled debt. So you’ll know upfront exactly how much the program fees may be. Our program fees are success-based, which means you won’t pay any fees on any of your enrolled debts until we successfully reach a settlement agreement with your creditor, you agree to that settlement and make at least one payment toward the settlement.

What is a mortgage settlement?

Mortgage settlement--sometimes called mortgage closing--can be confusing. A settlement may involve several people and many documents and fees. This information will help you understand all that is involved. Although the focus of this guide is on settlements for home purchases, much of it will also be useful if you are refinancing a mortgage.

What is origination fee?

The origination fee (also called underwriting fee, administrative fee, or processing fee) is charged for the lender's work in evaluating and preparing your mortgage loan. This fee can cover the lender's attorney's fees, document preparation costs, notary fees, and so forth.

What are the fees for FHA mortgage insurance?

As with Private MI, insurance premium payments will stop when you acquire 22% equity in your home. FHA fees are about 1.5% of the loan amount. VA guarantee fees range from 1.25% to 2% of the loan amount, depending on the size of your down payment (the higher your down payment, the lower the fee percentage). RHS fees are 1.75% of the loan amount.

What is appraisal fee?

Appraisal fee. Lenders want to be sure that the property is worth at least as much as the loan amount. This fee pays for an appraisal of the home you want to purchase or refinance. Some lenders and brokers include the appraisal fee as part of the application fee; you can ask the lender for a copy of your appraisal.

How long does it take to get a good faith estimate of closing costs?

The Real Estate Settlement Procedures Act (RESPA) requires your mortgage lender to give you a good faith estimate of all your closing costs within 3 business days of submitting your application for a loan, whether you are purchasing or refinancing the home. This is a good faith estimate, but the actual expenses at closing may be somewhat different. If you are purchasing the home, you will also get an information booklet, Buying Your Home: Settlement Costs and Helpful Information.

How much is prepay for a mortgage?

Estimated cost: 0.5% to 1.5% of the loan amount to pre-pay for the first year

How much does a 142,500 loan cost?

Estimated cost: Depends on loan amount, interest rate, and the number of days that must be paid for (a $120,000 loan at 6% for 15 days, about $300; a $142, 500 loan at 6% for 15 days, about $356).

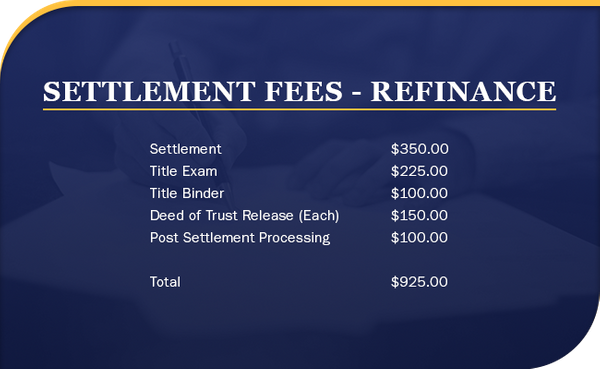

What is settlement fee?

Sometimes referred to the Closing Fee, the Settlement Fee covers costs associated with closing operations. Some title companies list out each cost, and some bucket them all in one place, so be sure you know exactly what you’re paying for. Costs bundled under the Settlement Fee may include the cost of escrow, survey fees, notary fees, deed prep fees, and search abstract fees.

What is title fee?

These costs are called “title fees,” because the “title” is a legal document that proves you own a property. Title fees can cover a wide range of costs, ...

What is lender title insurance?

Lender’s Title Insurance. Lender’s Title Insurance is required in nearly all refinance and purchase transactions. As the name suggests, this policy protects the lender against losses incurred due to title disputes.

Why are title fees called title fees?

These costs are called “title fees,” because the “title” is a legal document that proves you own a property. Title fees can cover a wide range of costs, so we’ve outlined a few of them below to help you know what to expect.

When is a deed prep fee required?

A Deed Prep Fee is applicable when a title is transferred, or an existing deed has to be modified as part of a transaction. When a home is purchased, for example, the deed must be transferred title from the seller to the buyer.

Who is Better Settlement Services?

Better Settlement Services, an affiliate of Better Mortgage, has answers. Contact us at [email protected] and we’d be happy to provide you with any information you need.

Who pays the premium on a refinance?

In a refinance transaction, the lender’s premium is typically paid by the borrower , but in some purchase transactions, the borrower may be responsible for the cost. The lender’s premium is dependent on the loan amount or purchase amount. So if either increase, the premium will likely follow suit.

What is title settlement fee?

The title settlement fee, or closing fee, is a charge from the title company to cover the administrative costs of closing. Title companies may or may not list out the individual costs of the fee.

What Are Title Fees?

Title is the right to own and use the property. Title fees are a group of fees associated with closing costs. These fees pay a title company to review, adjust and insure the title of the property.

How to find closing costs?

You can find title fees and overall closing costs on a couple documents: 1 Closing disclosure: Your closing disclosure will break down total closing costs, including title fees, in an itemized list. 2 Loan estimate: The loan estimate will list your total closing costs, along with title service fees, and tell you the cash you need to bring to close.

How much does a home buyer pay for closing costs?

Home buyers can typically expect to pay 2% – 5% of the loan amount in closing costs. One of the main costs is a title fee. Here we’ll cover what title fees are, who pays them and how much they cost.

How much does title fee vary?

Title fees change from company to company and from location to location. They can also change depending on what’s included. In general, closing costs, which title fees are a large part of, cost from 2% – 5% of the total loan amount.

How much does it cost to record a deed?

The national average for this charge is around $125.

What is abstract of title?

The abstract is the summary of the title search from the title company. It compiles the details of the search and the related official documents and communicates them in a concise manner. Abstract of title fees can range from $200 – $400 for an update to the abstract to $1000+ if a new abstract of title must be created.

Who pays settlement fee?

Settlement: This fee is paid to the settlement agent or escrow holder. Responsibility for payment of this fee can be negotiated between the seller and the buyer.

What is origination fee?

Origination: The fee the lender and any mortgage broker charges the borrower for making the mortgage loan. Origination services include taking and processing your loan application, underwriting and funding the loan, and other administrative services.

What is appraisal charge?

Appraisal: This charge pays for an appraisal report made by an appraiser.

What are points on a loan?

Points: Points are a percentage of a loan amount. For example, when a loan officer talks about one point on a $100,000 loan, this is 1 percent of the loan, which equals $1,000. Lenders offer different interest rates on loans with different points. You can make three main choices about points. You can decide you don’t want to pay or receive points at all. This is a zero-point loan. You can pay points at closing to receive a lower interest rate. Alternatively, you can choose to have points paid to you (also called lender credits) and use them to cover some of your closing costs.

What is document preparation fee?

Document Preparation: This fee covers the cost of preparation of final legal papers, such as a mortgage, deed of trust, note or deed.

What is flood determination?

Flood determination: This is paid to a third party to determine if the property is located in a flood zone. If the property is found to be located within a flood zone, you will need to buy flood insurance. The insurance is paid separately.

What is real estate commission?

Real estate commission: This is the total dollar amount of the real estate broker’s sales commission, which is usually paid by the seller. This commission is typically a percentage of the selling price of the home.