What is a FX settlement?

Foreign exchange (FX) settlement risk is the risk of loss when a bank in a foreign exchange transaction pays the currency it sold but does not receive the currency it bought. FX settlement failures can arise from counterparty default, operational problems, market liquidity constraints and other factors.

What does settlement period mean in forex trading?

The settlement period is the time between the trade date and the settlement date. The SEC created rules to govern the trading process, which includes outlines for the settlement date.

Is there a settlement period for Forex trading?

There is no settlement period in Forex like there is in stocks/shares. But there is a margin requirement on each trade which keeps a certain amount of your trading account “tied up” while the trade is open. Each broker has their own margin requirement and you need to be aware of the rules.

What is foreign exchange settlement?

The so-called compulsory foreign exchange settlement means that all the foreign exchange income of the enterprise or individual must be sold to the foreign exchange designated bank without reservation. It is called compulsory foreign exchange settlement if you cannot establish your own account to retain foreign exchange income.

How long does it take for forex to settle?

2 business daysStandard settlement periods for most currencies is 2 business days, with some pairs such as CAD/USD settling next business day. In order for a date to be a valid settlement date for an FX transaction, the central banks for both currencies must be open for settlements.

How are FX options settled?

For those traders who want to take their contract to expiration, there are two ways an FX contract can be settled: cash settlement or physical delivery of the currency. For many FX futures, the last trading day is generally the second business day prior to the third Wednesday of the contract month.

What is FX settlement risk?

Foreign exchange (FX) settlement risk is the risk of loss when a bank in a foreign exchange transaction pays the currency it sold but does not receive the currency it bought. FX settlement failures can arise from counterparty default, operational problems, market liquidity constraints and other factors.

What is settlement limit?

Settlement Limit means the maximum amount the Company will pay to or for each passenger stated in the Limits of Liability section of this endorsement.

Are currency options cash settled?

What is the settlement mechanism for USD-INR options? USD-INR options contracts are cash settled in Indian Rupee. Which day is the expiry/last trading day? The expiry / last trading day for the options contract is two working days prior to the last working day of the expiry month.

Are FX forwards physically settled?

FX Forwards are defined in Article 27 of the EU Margin Regulation as “physically settled OTC derivative contracts that solely involve the exchange of two different currencies on a specific future date at a fixed rate agreed on the trade date of the contract covering the exchange.”

How are FX options Priced?

An FX option is an insurance policy on an exchange rate. Its pricing is determined by factors including time to expiry, strike rate, and volatility of the underlying currency pair.

How are FX options quoted?

The FX spot rate, St = FOR-DOM, represents the number of units of domestic currency needed to buy one unit of foreign currency at time t. For example, EURUSD = 1.3900 means that one EUR is worth 1.3900 USD. In this case, EUR is the foreign currency and USD is the domestic one.

Why does Forex exist?

Forex exists so that large amounts of one currency can be exchanged for the equivalent value in another currency at the current market rate.

What is forex market?

Key Takeaways. Forex (FX) market is a global electronic network for currency trading. Formerly limited to governments and financial institutions, individuals can now directly buy and sell currencies on forex. In the forex market, a profit or loss results from the difference in the price at which the trader bought and sold a currency pair.

How many lots can you trade in a forex account?

When trading in the electronic forex market, trades take place in blocks of currency, and they can be traded in any volume desired, within the limits allowed by the individual trading account balance. For example, you can trade seven micro lots (7,000) or three mini lots (30,000), or 75 standard lots (7,500,000).

Why do we use forex?

Understanding Forex. Forex exists so that large amounts of one currency can be exchanged for the equivalent value in another currency at the current market rate. Some of these trades occur because financial institutions, companies, or individuals have a business need to exchange one currency for another.

What currency pairs are traded?

Currencies being traded are listed in pairs, such as USD/CAD, EUR/USD, or USD/JPY. These represent the U.S. dollar (USD) versus the Canadian dollar (CAD), the Euro (EUR) versus the USD, and the USD versus the Japanese Yen (JPY).

Why do traders take positions in currency?

In the world of electronic markets, traders are usually taking a position in a specific currency with the hope that there will be some upward movement and strength in the currency they're buying (or weakness if they're selling) so that they can make a profit.

When is the forex market closed?

Since the forex market is closed on Saturday and Sunday, the interest rate credit or debit from these days is applied on Wednesday. Therefore, holding a position at 5 p.m. on Wednesday will result in being credited or debited triple the usual amount.

What is settlement risk in forex?

FX settlement risk - the risk of their bank in the foreign exchange transaction paying the currency without receiving the currency in return.

How to manage FX settlement?

Corporate treasury departments have four options for managing FX settlement: 1 ignore it; 2 settle most of their trades with their principal cash management bank where there is no settlement risk; 3 use the Continuous Linked Settlement (CLS) System; or 4 use bilateral settlement.

Is there a risk of defaulting on a deal in the US$5 trillion/day FX market?

After the credit/liquidity crunch, there is even more risk of the bank defaulting on a deal in the US$5+ trillion/day FX market. For many banks, FX transaction settlement risk is typically higher than credit risk, often three times as high. No wonder the central banks continue to be concerned about FX settlement risk.

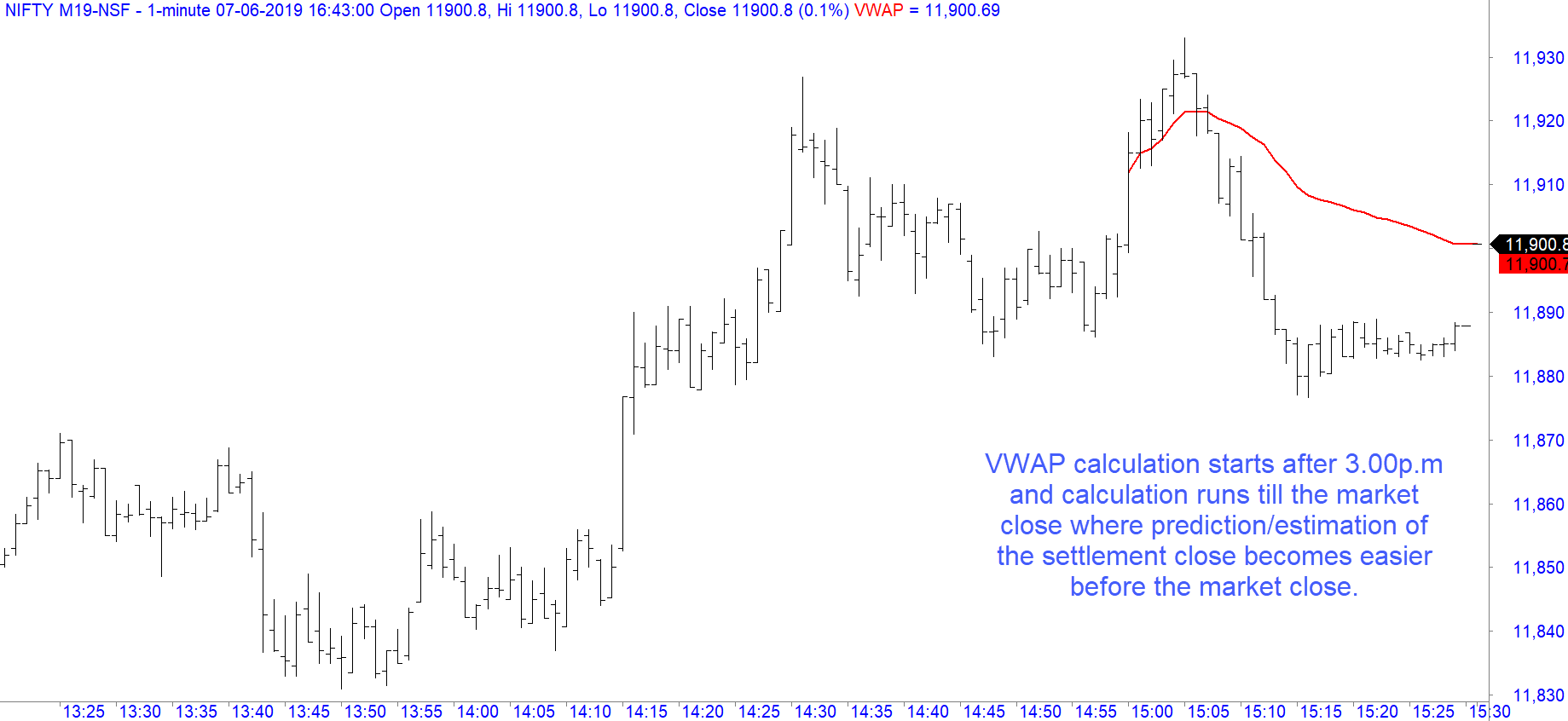

Is CLS settlement transparent?

The CLS settlement process, shown in figure above, is fully automated and transparent, participants have a global view of their FX positions in real time, so they know exactly what their FX and same day funding requirements will be. Also CLS is easier to use because it provides post trade and pre-settlement matching, generally within 30 minutes of trading, i.e. once the trade is matched the corporate treasury department can be sure the trade will settle. Compliance with Sarbanes Oxley and other process regulations are also improved as the whole settlement process is fully automated and transparent.

What Is the Forex Market?

The foreign exchange market is where currencies are traded. Currencies are important because they enable purchase of goods and services locally and across borders. International currencies need to be exchanged to conduct foreign trade and business.

How much is forex trading?

According to a 2019 triennial report from the Bank for International Settlements (a global bank for national central banks), the daily trading volume for forex reached $6.6 trillion in April 2019. 1.

Why was forex trading so difficult?

Most currency traders were large multinational corporations , hedge funds, or high-net-worth individuals because forex trading required a lot of capital. With help from the Internet, a retail market aimed at individual traders has emerged, providing easy access to the foreign exchange markets through either the banks themselves or brokers making a secondary market. Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance.

What is forex 2021?

Updated Feb 19, 2021. Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or tourism. According to a 2019 triennial report from the Bank for International Settlements ...

How much can you trade in a mini forex account?

Mini forex accounts: Accounts that allow you to trade up to $10,000 worth of currencies in one lot. Standard forex accounts: Accounts that allow you to trade up to $100,000 worth of currencies in one lot. Remember that the trading limit for each lot includes margin money used for leverage.

Why is forex the largest asset market?

Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world.

What is a finalized deal?

It is a bilateral transaction in which one party delivers an agreed-upon currency amount to the counter party and receives a specified amount of another currency at the agreed-upon exchange rate value. After a position is closed, the settlement is in cash.

How is the final settlement price determined?

For cash-settled FX futures, the process is much simpler. The final settlement price is determined by the clearinghouse. Any profit or loss is calculated by taking the difference between the final settlement price and the previous day’s mark-to-market

What happens before a FX contract expires?

Prior to expiration, traders have a number of options to either close out or extend their open positions without holding the trade to expiration. For those traders who want to take their contract to expiration, there are two ways an FX contract can be settled: cash settlement or physical delivery of the currency.

When is CME settlement day?

The two banks agree to these terms per CME Group arrangement and cash versus currency are exchanged over the bank wire. All of this is completed by 10:00 a.m. CT on the settlement day, which is the third Wednesday of the contract month, two business days after last trading day.

Can you roll forward a futures contract?

Like any other futures contract, a trader with an open position they may decide to offset or roll forward their position to avoid expiration and delivery. However, if they decide to go to expiration, they should understand the final settlement procedures for the specific contract they are trading.