How to properly record a HUD settlement?

- Deposit made by the buyer

- The loan amounts

- The amount owed by the seller to the buying party is a credit entry and must record. ...

- Property tax and assessment pro-ration credits from seller to the buyer of the HUD Settlement Statement

- Lastly, any additional credits to the buyer will be entered here from any source, if not from the seller

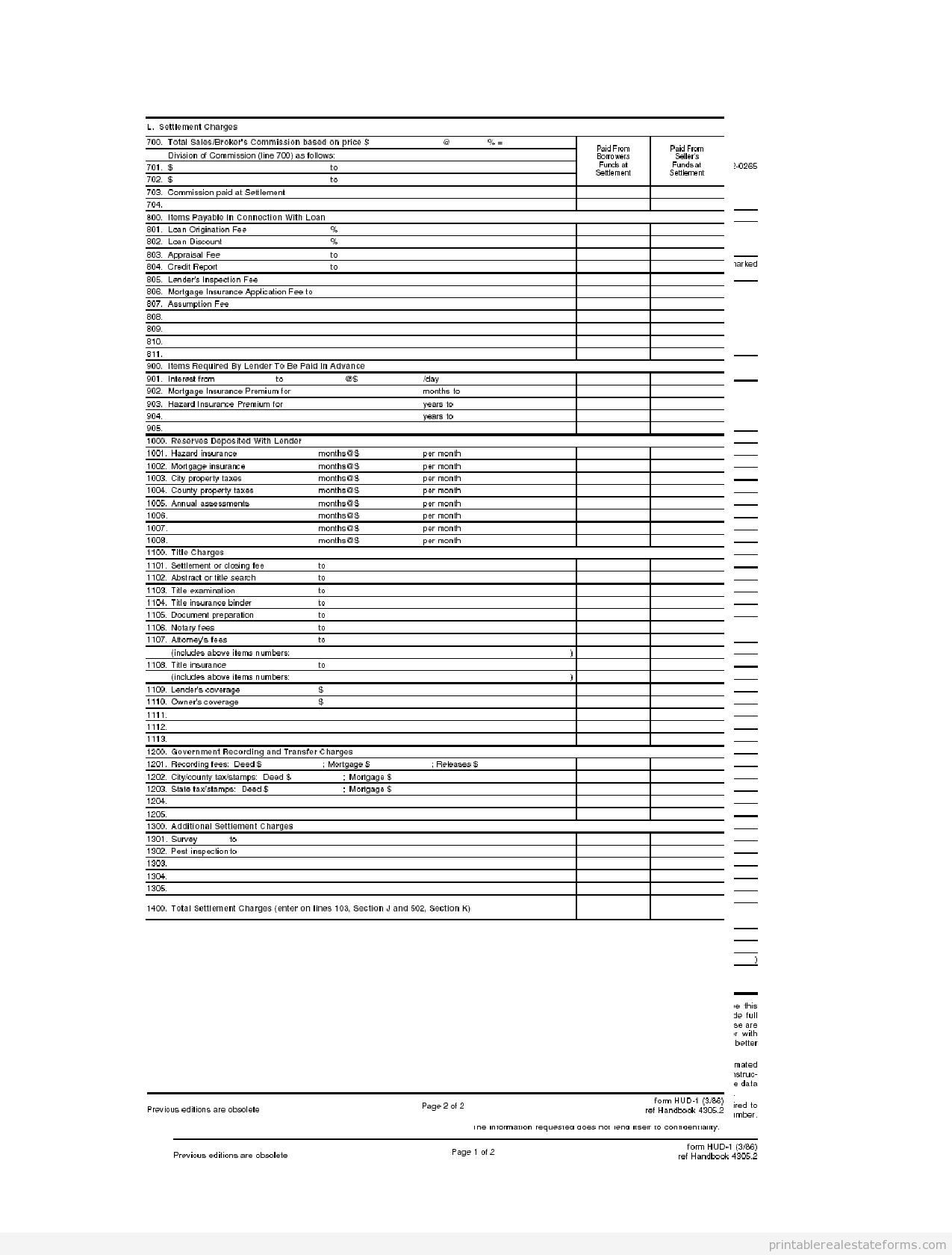

What does a HUD statement look like?

What does a HUD-1 look like? The statement is divided into two columns. The left lists all charges to the borrower and the right all those to the seller. The breakdown of the pages is as follows: Page One

What in my settlement statement is deductible?

The settlement statement gives both parties a full picture of the expenses attached to the transaction. Some of the more common examples of deductible expenses include loan origination fees, mortgage insurance premiums, and real estate tax payments.

What is a confidential settlement statement?

Confidential Settlement Statement Example. johnawest.com. The purpose of including confidentiality clauses in settlement agreements is to keep both parties away from sharing the details with the World. This Confidential Settlement Statement Example is a well-drafted confidentiality agreement that can settles most potential litigation nightmares.

Is a settlement statement the same as a HUD?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

Who prepares the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

What is the purpose of a settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What happened to the HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

How do I get my HUD payoff statement?

Requests for payoff statements, subordinations, releases, and other documentation specific to these programs can be submitted to:Payoff Requests: [email protected] Requests: [email protected] Requests: [email protected] Partial Claim document submittal: [email protected] items...

Is a HUD statement the same as a closing disclosure?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

Is the settlement statement and closing disclosure the same thing?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

What is HUD statement called now?

If you applied for a mortgage after October 3, 2015, for most kinds of mortgage loans you receive a form called the Closing Disclosure instead of a HUD-1.

What does HUD statement mean?

The HUD-1 (or a similar variant called the HUD-1A) is used primarily for reverse mortgages and mortgage refinance transactions. The reference to 'HUD' in the form's name refers to the Department of Housing and Urban Development.

How do you read a HUD statement?

Look at the first page of the HUD statement. Look over the basic details in Part B, such as your name, the seller's name and the property address. Read sections J and K, which give a summary of the total amounts owed from or due to the borrower or seller.

Is a HUD statement the same as a closing disclosure?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

Is closing disclosure same as settlement statement?

Closing Disclosure When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

What are the responsibilities of the closing agent?

A closing agent is a real estate professional who helps the buyer, seller, and lender to complete a property sale. Your primary job duties in this career include drawing up the appropriate paperwork, delivering documents to all the interested parties, ensuring that they sign the documents, and filing them properly.

What is a closing statement?

A closing statement is a form used in a real estate transaction that includes an itemized list of all the buying or selling costs associated with that transaction. It's a standard element of home sales, especially those that involve mortgages, and refinancings.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What is HUD-1 form?

The statutes of the Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federally related mortgage loans. 2.

When Is a HUD-1 Used in 2020?

The HUD-1 settlement statement is still used in 2020 for reverse mortgages. These types of mortgages are very popular with sellers over the age of 62 who want to pull equity out of their homes. 4

When Is the HUD-1 Distributed?

Before October 3, 2015, RESPA stated that borrowers should be given a copy of the HUD-1 at least one day prior to settlement. 5 However, entries could easily still be coming in, right up until a few hours before closing.

What is the 701 and 702 section?

This section deals with the commissions paid to real estate agencies. Lines 701 and 702 show how the commissions are split between two participating agencies. 6

What is tabulated before being brought forward to page 1 in Section L or page 2?

Many entries are tabulated before being brought forward to page 1 in Section L or page 2. Columns contain charges that are paid from either the borrower's or the seller's funds. Your closing statement probably won't have entries in all these lines.

Who studied the statement of sale?

Most buyers and sellers studied the statement on their own, with the assistance of their real estate agent and the settlement agent. The idea was that the more people who reviewed it, the more likely it became that errors would be detected.

What Is HUD Settlement Statement?

The HUD Settlement Statement is a document that shows all buyer and seller fees and credits in a real estate transaction or all fees that are charged by the lender for refinancing a mortgage.

What Is Included In A HUD Settlement Statement?

As unusual as it may sound, the HUD statement was supposed to be analyzed reverse side first. The back side of the statement had two columns: the column on the left displayed the borrower’s costs and the column on the right displayed the seller’s costs.

HUD Settlement Statement Vs. Closing Disclosure

Before October 2015, different federal agencies required different documents from the borrower. This can be confusing for the borrower as the information in the documents can be inconsistent.

What is a HUD-1 settlement statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement , details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

How long do you have to give a closing disclosure?

In contrast, lenders must give you a closing disclosure three days before closing. Everyone taking out a HELOC, reverse mortgage or manufactured home loan should ask their lender for the HUD-1 document at least a day before closing to allow time to review the contents, fix errors and raise questions with the lender.

What is section 300?

No. 5 (Section 300): Cash at settlement from/to borrower. This section explains if you need to bring cash to the settlement. In most cases, the closing costs for a reverse mortgage refinance or HELOC will be subtracted from the loan, so you don’t need to bring funds to the closing.

How many sections are there in a settlement statement?

The settlement statement lists charges in three sections. The first section shows charges that cannot change. The next section outlines charges that cannot change by more than 10%, while the final section outlines charges that may change.

Do you need to review a HUD-1 settlement statement before closing?

If you’re getting ready to close on a mortgage, you’ll typically review a closing disclosure. However, if you’re taking out a home equity line of credit (HELOC), a mortgage for a manufactured home that is not attached to real estate or a reverse mortgage, you’ll need to review a HUD-1 settlement statement before you head to the closing table.

Is HUD 1 settlement exempt?

Some home equity products are now exempt from using the HUD-1 settlement form, such as open-ended lines of credit. Your lender will let you know whether a HUD-1 settlement statement is involved, or if you’ll receive a Truth-in-Lending disclosure instead.

What information is provided on a HUD-1 Settlement Statement?

Aside from the basic details of the involved parties, consisting of the buyer and seller , the lender , property details and settlement agent details, unsurprisingly the majority of the settlement statement consists of figures. Lots of figures.

What is HUD-1 form?

The HUD-1 form, often also referred to as a “ Settlement Statement ”, a “ Closing Statement ”, “ Settlement Sheet ”, combination of the terms or even just “ HUD ” is a document used when a borrower is lent funds to purchase real estate. Another acronym used in relation to the HUD form is GFE, which means ‘ Good Faith Estimate ’.

Where is my closing credit?

Usually this credit will be given on the first page of the respa, buyers side, indicating that the amount being credited is being added to the amount the Buyer has to use, therefore, a check will not be given to the Buyer at the time of the closing.

Why are the values between the GFE and final HUD figures different?

Many times the GFE and the final HUD figures do indeed differ from each other. The GFE figures are presented by a lender within 3 days of applying for ta loan. In many instances, these figures may increase or decrease. Many of these GFE disclosures cannot exceed a 10% tolerance given by the bank. Unless they are figures that can be shopped for, any tolerance of over 10% must be reduced by the Lender to adhere to the 10% tolerance level.

What is a RESPA?

Another term linked with the HUD is RESPA. RESPA is an acronym for Real Estate Settlement Procedures Act and represents a set of legislative statutes relating to real estate transactions put in place by the government to enforce disclosure of charges and fees to the consumer.

What is HUD 1?

HUD is an acronym for Housing and Urban Development, and represents the arm of the U.S. government department responsible for legislation relating to home ownership and property development within the United States of America. The HUD-1 form, often also referred to as a “ Settlement Statement ”, a “ Closing Statement ”, “ Settlement Sheet ”, ...

What is an adjustment for items paid in advance?

Adjustments for items paid in advance by the seller primarily calculated from taxes paid. Amounts paid for by or in behalf of the borrow, and reductions in the amount due to the seller. Adjustments for items unpaid by the seller. Cash at settlement due from or to the buyer and seller.

What does a HUD-1 look like?

The statement is divided into two columns. The left lists all charges to the borrower and the right all those to the seller.

What is HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a government form that was used widely before 2015 when buying, selling, and refinancing real estate. It lists all the charges and credits to the buyer and seller in a real estate settlement or a mortgage refinance. You will also hear people refer to it as a settlement or closing statement.

What is page 3 of HUD?

Page 3 relates to the figure in the Good Faith Estimate (GFE) which has been replaced by the Loan Estimate. The lender would have supplied GFE estimate figure to the settlement agent upon application of the loan. The HUD figures are listed side by side with the GFE so that a comparison can be made and discrepancies highlighted. The standard loan terms shown here will include the origination fee, interest rate, term, and payment.

What is the second page of a transaction?

The second page details the associated fees and charges involved in the transaction. There are again two columns with charges that the buyer and seller pay. This page features the following:

Can you search for unlisted properties on Marketproof?

With Marketproof New Development, you can easily search both publicly listed properties and unlisted off-market properties not available on popular listing sites. Marketproof can increase the inventory you see by 9-10x what you may see on other sites. Create an account today and get a 7-day free trial.

What is a HUD-1 statement?

When you refinance or purchase a home, one of the first things that your lender is going to provide you with is a HUD-1 Settlement Statement. This particular statement contains all the fees and costs that incurred with the financing of your home. In order to ensure that it is 100% accurate, it is important for both the seller and buyer to fully comprehend this document and to review it as it contains a handful of details that are important for both parties. The Real Estate Settlement Procedures Act (RESPA) requires that the HUD-1 statement is utilized in every federally regulated mortgage loan.

Who is responsible for reviewing HUD-1?

Buyers and sellers are the ones who are responsible for reviewing their HUD-1 Settlement Statement form in order to ensure that it is accurate. Before the end of closing, every error found must be corrected. Until every question that relates to the HUD-1 Settlement Statement has been satisfactorily answered, no seller or buyer is obligated to complete a closing. Alongside his or her loan officer, the HUD-1 needs to be especially reviewed by the buyer before the closing of a home purchase or mortgage loan. Comparing the mortgage loan documents to the HUD-1 Settlement Statement will prevent the buyer from obligation to loan terms that are incorrect.

How many sections are there in HUD-1?

The HUD-1 Settlement Statement form contains twelve main sections, and a lot more subsections. You will notice that some sections on the form are specifically referred to the borrower’s costs and fees. Other sections on the form refer to the seller that’s in the transaction. One day prior to the closing, every party to the transaction is required to attain a copy of the HUD-1 Settlement Statement form. However, in a lot of cases, the form’s entries are still changing a couple of hours before the closing is conducted. A title agent, lender, or real estate professional can answer any question you may have that regard to the HUD-1 Settlement Statement form.

What is section L on HUD?

This section on the HUD-1 Settlement Statements details information on loan fees, costs that were paid to real estate professionals, items paid in advance such as homeowners insurance and interests, and several required escrow items. You will notice that additional subsections detail items such as home warranties, survey, home inspections, deed fees, and title fees. Section L subsections are 1400-Total Settlement Charges, 1300-Additional Settlement Charges, 1200-Government Recording and Transfer Charges, 1100-Title Charges, 1000-Reserves Deposited with Lender, 900-Items Required by Lender to be Paid in Advance, 700-Total Sales/Broker’s Commission on Price, and 800-Items Payable in Connection with Loan. Before signing any closing document, make sure to carefully review each of these items in this section. In order to make sure that you understood all the charges stated in this section, prior to closing, ask any questions. If you stop and think about it, it is better to prevent than lament.

What is section J in a mortgage?

This section contains details on the buyer’s amounts paid, amount due, and amount of cash that the borrower gets or pays at closing. The subsections in section J are 300-Cash at Settlement To/From Borrower, 200-Amounts Paid or in Behalf of Borrower, and 100-Gross Amount Due from Borrower. In order to determine what exactly the borrower will need to take or pay home from closing, it is important that this section is carefully reviewed.

Why was the HUD-1 Settlement Statement required in 2010?

The reason behind all of these amendments and changes was to create more transparency and progress in consumer protection, which leads us into the 1986 HUD-1 Form.

What is the real estate settlement procedure act?

1974: The Real Estate Settlement Procedures Act (RESPA) was created to help protect consumers from foul practices, forcing lending institutions to disclose settlement costs upfront. This act is enforced by the Consumer Financial Protection Bureau (CFPB) and includes all types of mortgages. RESPA requires different disclosures during different parts of the home closing process and also offers protection to consumers in areas including: 1 Limiting the amount put into escrow for real estate charges 2 Allowing buyers to use their own title company and title insurance 3 Prohibiting lenders from receiving a fee in exchange for a referral

What is RESPA disclosure?

RESPA requires different disclosures during different parts of the home closing process and also offers protection to consumers in areas including: Limiting the amount put into escrow for real estate charges. Allowing buyers to use their own title company and title insurance.

What is the difference between HUD-1 and HUD-1?

Another big distinction between the Closing Disclosure and the HUD-1 is where the HUD-1 listed all terms, charges and credits for both the buyer and the seller, the Closing Disclosure has a separate form for the buyer as it does for the seller. This provides for more consumer protection at the closing table. Another change that came up ...

How long does a loan estimate need to be in the hands of the buyer before closing?

These two documents must be in the hands of the buyer at least 3 days prior to the closing date in order to find any errors or issues before closing. If certain changes are made to the disclosure, the 3-day waiting period starts over. This is one big change with the new TRID rules.

What is HUD-1 form?

1986-2015: Prior to October 2015, the Settlement Statement was known as the HUD-1, which is a standard government form issued by the Closing Agent that lists all credits, charges and home loan terms for both the buyer and the seller in all real estate transactions that required a mortgage. The charges for both the borrower and seller were listed on the same form, with borrower charges on one side of the form and seller charges on the other.

When did the HUD-1 change to the closing disclosure?

The Consumer Financial Protection Bureau (CFPB) took over administration from HUD and replaced the HUD-1 with the Closing Disclosure in October of 2015. It is similar to the HUD-1 in that it details the loan terms and costs, including the interest rates, closing costs, taxes, monthly payments, and more.