SWIFT, today, is the largest and most streamlined method for international payments and settlements. SWIFT works by assigning each member institution a unique ID code (a BIC

ISO 9362

ISO 9362 defines a standard format of Business Identifier Codes (also known as SWIFT-BIC, BIC code, SWIFT ID or SWIFT code) approved by the International Organization for Standardization (ISO). It is a unique identification code for both financial and non-financial institutions. The acronym SWIFT stands for the Society for Worldwide Interbank Financial Telecommunication.

How does the SWIFT payment system work?

The SWIFT payment system does this by carrying payment information from the sender’s bank to the beneficiary’s bank, acting as a communication channel between the two. To do so, it identifies each bank by its unique ID code that corresponds with its bank name, country, city, and branch.

What is swift settlement and reconciliation messaging?

SWIFT’s settlement and reconciliation messaging solution uses globally-recognised communication standards to connect you to your counterparties, intermediaries and market infrastructures.

What is a swift code?

When you use SWIFT, you are not actually sending a money transfer. Instead, it is referred to as a “payment order” between two banks. This is done using a SWIFT code. It was the SWIFT network that standardized the formats for IBAN (international bank account numbers) and BIC ( bank identifier codes).

What is a swift transaction?

Inside a SWIFT Transaction. SWIFT is a messaging network that financial institutions use to securely transmit information and instructions through a standardized system of codes.

What is the meaning of SWIFT payment?

the Society for Worldwide Interbank Financial TelecommunicationWhat is SWIFT? SWIFT, or the Society for Worldwide Interbank Financial Telecommunication, is a secure global messaging network that banks use to make cross-border payments. The network facilitates financial institutions to wire money to each other, helping ensure that global trade carries on smoothly.

How do I receive swift payments?

Here's how it works: when a person transfers money individually, they will go to their bank with the recipient's banking SWIFT code and an international account number (more on that later). The local bank will then send a SWIFT message to the recipient's bank to accept the transfer.

Who owns SWIFT payment?

SWIFT is a cooperative company under Belgian law and is owned and controlled by its shareholders (financial institutions) representing approximately 2,400 Shareholders from across the world.

How are international SWIFT wire transfer settled?

With real-time gross settlement, money is transferred instantaneously from one financial institution to another. Each transaction is settled on an individual basis without netting of incoming and outgoing payments. Once completed, the payment is final and irrevocable.

How long does a SWIFT payment take?

1-4 working daysA SWIFT payment generally takes 1-4 working days. The time taken varies based on the destination, time zones and different banking procedures. SWIFT transfers aren't instant. Before your funds are credited to the recipient, they will undergo anti-fraud and anti-money laundering checks, which takes time.

What is SWIFT and how does it work?

SWIFT, today, is the largest and most streamlined method for international payments and settlements. SWIFT works by assigning each member institution a unique ID code (a BIC number) that identifies not only the bank name but the country, city, and branch.

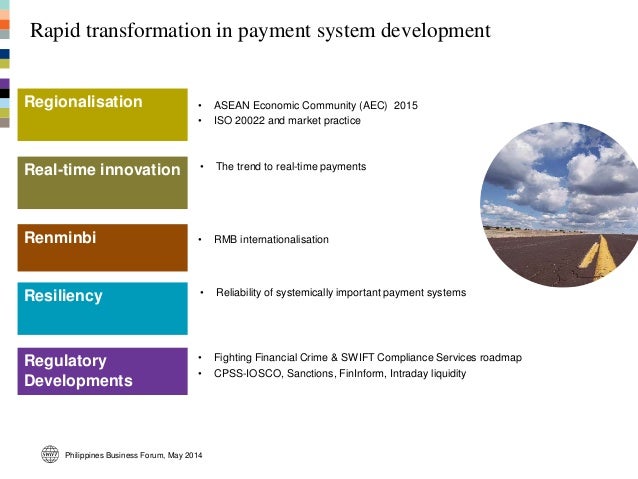

Is Russia in SWIFT?

SWIFT is used by thousands of financial institutions in more than 200 countries, including Russia, and provides a secure messaging system to facilitate cross-border money transfers.

Does China use SWIFT?

China, despite having concern about its reliance on Western financial infrastructure, continues to use SWIFT when messaging payment instructions across borders, even to its own foreign bank branches and subsidiaries.

What does Russia use instead of SWIFT?

SPFS (Russian: Система передачи финансовых сообщений (СПФС), romanized: Sistema peredachi finansovykh soobscheniy, lit. 'System for Transfer of Financial Messages') is a Russian equivalent of the SWIFT financial transfer system, developed by the Central Bank of Russia.

How does settlement work in SWIFT?

For international wire transfers, the Society for World Interbank Transactions (SWIFT) delivers payment instructions which a clearing or settlement system then settles. Together, CHIPS and Fedwire handle the approving and settling of wire transfers in US dollars.

What's the difference between wire transfer and SWIFT transfer?

Telegraphic transfer is now used as a catch-all term for methods of moving money between accounts, both locally and internationally, while SWIFT payments - or international wire transfers - are specifically those money transfers which use the SWIFT network, to move money between accounts based in different countries.

What happens if you wire transfer more than 10000?

If a person receives multiple payments toward a single transaction or two or more related transactions, the person should file Form 8300 when the total amount paid exceeds $10,000. Each time payments aggregate more than $10,000, the person must file another Form 8300.

How do I open a SWIFT account?

Create your swift.com user account. ... Register your organisation. ... Start the formal application. ... Provide data and legal documents and familiarise yourself with the Customer Security Programme (CSP) ... Receive legal acceptance and have your BIC created.More items...

How do I track a SWIFT transfer?

You can track your company swift payment message instantly and enjoy full transparency over transfers status & fees deducted at any given moment. Once outgoing/incoming Swift transaction is performed you can track it through a link https://paytrack.qnbalahli.com will be sent to you.

What is a SWIFT bank account number?

A SWIFT code, also called a SWIFT number, is used to identify banks and financial institutions worldwide. The term Business Identifier Code (BIC) is used interchangeably with SWIFT code and means the same thing.

Is SWIFT a wire transfer?

SWIFT transfers offer a secure and convenient electronic global payment system. This process of international bank transfers is also more commonly known as 'wire' transfers, which have become one of the most popular ways to send money across borders.

What is SWIFT in banking?

SWIFT is a vast messaging network used by banks and other financial institutions to quickly, accurately, and securely send and receive information, such as money transfer instructions.

How Does SWIFT Make Money?

16 Members are categorized into classes based on share ownership. 17 All members pay a one-time joining fee plus annual support charges which vary by member classes.

Why Is SWIFT Dominant?

According to the London School of Economics, "support for a shared network...began to achieve institutional form...in the late 1960s, when the Société Financière Européenne (SFE, a consortium of six major banks based in Luxembourg and Paris, initiated a ‘message-switching project.'" 8

Why did Swift start?

In the beginning, SWIFT founders designed the network to facilitate communication about Treasury and correspondent transactions only . The robustness of the message format design allowed huge scalability through which SWIFT gradually expanded to provide services to the following:

How many transactions did SWIFT send in 2020?

More than 11,000 SWIFT member institutions sent over 35 million transactions per day through the network in 2020. The organization recorded an average of 42.5 million messages per day on a year-to-date (YTD) basis in March 2021. Traffic grew by 9.8% compared to the same period of the previous year. 1.

What is Swift used for?

While SWIFT primarily started for simple payment instructions, it now sends messages for a wide variety of actions, including security transactions, treasury transactions, trade transactions, and system transactions. Nearly 50% of SWIFT traffic is still for payment-based messages, 47% is for security transactions, ...

What is SWIFT network?

SWIFT is a messaging network that financial institutions use to securely transmit information and instructions through a standardized system of codes.

Wide variety

The settlement messages include repurchase agreements, portfolio transfers, internal account movements, collateral exchanges and corporate actions distribution.

Automated and standardised reporting

Improve visibility and transparency of your operations through each pre-settlement stage - and for all post-settlement reporting activity.

What is Swift Payment?

SWIFT Payment is the acronym of the Society for Worldwide Interbank Financial Telecommunication, an organization based in Brussels that has been around since the early 1970s . What are SWIFT payments and how do they work?

How does the higher the fees deducted from the payment affect the Swift message?

As you can appreciate, the more intermediary banks engaged in the transaction, the higher the fees deducted from the paid amount, the longer the payment will take to be credited to your account, and finally the higher the risk to have the SWIFT message lost.

What is the SWIFT network?

SWIFT was created to help banks communicate faster and more securely among themselves in relation to the processing of international payments.

What is Swift GPI?

SWIFT GPI aims to improve the transparency and traceability of cross-border payments. In other words, this means that if your bank is a member of the SWIFT network, they may check where a payment is at any given time of the day.

What is Swift communication?

Basically what SWIFT does is channel the message enclosing payment instructions from the issuing bank, i.e. the bank of the payor, all the way to the remitting bank, i.e. the bank of the beneficiary.

How many countries are part of SWIFT?

More than 10,000 financial institutions in more than 200 countries are members of the SWIFT network, making it the largest international payment network worldwide.

What are the sources of income for Swift?

Other sources of income for SWIFT are coming from additional services such as business intelligence, reference data, and compliance services.

How does the payments process work?

When a domestic payment is made, the initiating institution sends a message to the receiving institution, after which the transfer is settled electronically. As such, domestic payments can often be settled instantly or within 24 hours.

Why can payments sometimes take longer to process?

Delays can arise at a number of different points in the cross-border payments process, with common causes of friction including:

Straight-through processing

Straight-through processing (STP) is the term used to describe an automated payments process that can take place without the need for manual intervention. This eliminates the operational burden that can arise when banks need to repair payments, manually add data or adopt workarounds.

Remittance information

Another component of the payments process is the remittance information that accompanies a payment. Accurate remittance data is important because it enables the payment beneficiary to reconcile the payment with outstanding invoices, resulting in a more efficient reconciliation process.

Visibility over fees

Payments may also be subject to various types of transaction fees, including FX conversion costs and payment processing fees. However, where cross-border payments are concerned there is often a lack of transparency over the fees and deductions charged for different payments.

How is SWIFT helping?

Alongside our instant and frictionless payments strategy, a number of SWIFT initiatives are helping to streamline the payments process. SWIFT gpi enables banks to pass on remittance information with no loss of data, making it easy for end users to reconcile incoming payments with outstanding invoices.