The Local Government Finance

Public finance

Public finance is the study of the role of the government in the economy. It is the branch of economics which assesses the government revenue and government expenditure of the public authorities and the adjustment of one or the other to achieve desirable effects and avoid undesirable ones.

What is the 2022/23 local government finance settlement?

The Local Government Finance Settlement is the annual determination of funding to local government from central government. This briefing covers the provisional settlement for 2022/23. We expect the final 2022/23 settlement to be laid before the House of Commons, for its approval, in late January or early February 2022.

What is in the impact statement for the local government finance settlement?

This impact statement covers the government’s Local Government Finance Settlement for 2022/23. It focuses on the impact of proposals on people who share protected characteristics. Explanation of the measures announced in the settlement can be found in the following documents:

When are core funding allocations announced for local authorities?

Each year local authorities’ core funding allocations for the forthcoming financial year are announced by Government in the provisional local government finance settlement, usually in December. Following consultation, allocations are confirmed in the final settlement, usually in February.

What does the government’s new funding for local authorities mean for councils?

This settlement makes available an additional £3.7 billion to councils, including funding for adult social care reform. This is an increase in local authority funding for 2022/23 of over 4.5% in real terms, which will ensure councils across the country have the resources they need to deliver key services.

When is the final settlement vote?

What is the final settlement 2021-2022?

About this website

Why is local government finance important?

Why is Local Government Finance Important? The potential importance of local government finance is based on two main pillars. The core rationale is that local governments are well positioned to improve how public resources are used and the extent to which diverse citizen needs are satisfied.

What is the lower tier services grant?

Lower Tier Services Grant: Providing £111m to councils with responsibility for services such as homelessness, planning, recycling and refuse collection and leisure services. The funding floor has been updated so that no council will have less funding available in 2022/23 than this year.

Are Section 31 grant ring fenced?

The grant is a specific revenue grant for the 2022 to 2023 financial year only. It is not ring-fenced. The grant covers a single new burden: enforcement costs.

What is local authority general fund?

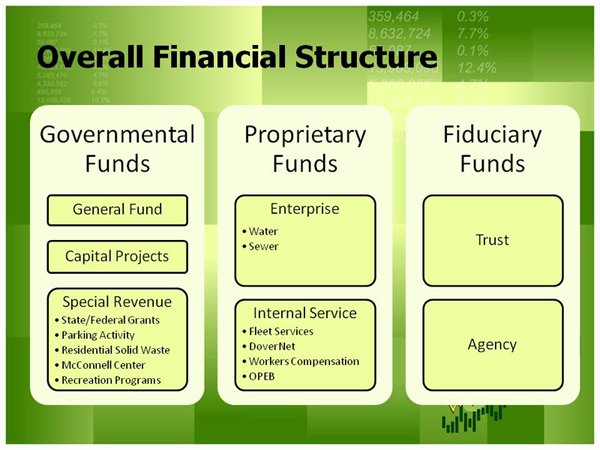

General Fund This is the main revenue account which summarises the cost of all services (except those related to Council Housing and Locally Managed Schools) provided by the Council.

How do I find local government grants?

To search or apply for grants, use the free, official website, Grants.gov. Commercial sites may charge a fee for grant information or application forms. Grants.gov centralizes information from more than 1,000 government grant programs. It's designed to help states and organizations find and apply for grants.

What does the government give money to?

Nearly 60 percent of mandatory spending in 2019 was for Social Security and other income support programs (figure 3). Most of the remainder paid for the two major government health programs, Medicare and Medicaid.

What do local authorities pay for?

Local authorities spend the majority of this on providing schools, social services and maintaining roads, but they also provide many other services. Local government spending pays for many different types of local authority.

What is an example of a general fund?

Examples are the purchase of supplies and meeting operating expenditures. An example of a specialized fund, on the other hand, is the capital projects fund that accounts for financial resources used for the acquisition or construction of major capital facilities.

What is included in a general fund?

As “America's Checkbook,” the General Fund of the Government consists of assets and liabilities used to finance the daily and long-term operations of the U.S. Government as a whole. It also includes accounts used in management of the budget of the U.S. Government.

What is the difference between general fund and capital fund?

It has all liabilities and assets as on the date of the preparation of the balance sheet by the organization. The excess of assets over the liabilities is termed as Capital Fund or the General Fund.

What are the 5 types of governmental funds?

Governmental funds are classified into five fund types: general, special revenue, capital projects, debt service, and permanent funds.

Final local government finance settlement: England, 2022 to 2023

We use some essential cookies to make this website work. We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

Provisional local government finance settlement 2022 to 2023: draft ...

1. Brief outline of policy proposal. This draft policy impact statement covers the government’s proposals for the provisional local government finance settlement for 2022/23.

When is the final settlement vote?

The final settlement debate and vote was held in the House of Commons on 10 February 2021. This year has clearly been defined by the COVID-19 pandemic and the settlement should be seen alongside the Covid support we are providing local government. The government also launched a consultation on the future of New Homes Bonus for 2022 ...

What is the final settlement 2021-2022?

Final settlement 2021 to 2022: supporting documents. Core spending power 2021 to 2022. Other documents related to the 2021 to 2022 final settlement. The local government finance settlement is the annual determination of funding to local government. It needs to be approved by the House of Commons.

When are local government finance settlements announced?

Each year local authorities’ core funding allocations for the forthcoming financial year are announced by Government in the provisional local government finance settlement, usually in December. Following consultation, allocations are confirmed in the final settlement, usually in February.

What is the LGA?

The LGA is involved in responding to every stage of the annual settlement process including responding to technical consultations and the provisional settlement, producing on-the-day briefings and briefing parliamentarians ahead of the parliamentary debate on the settlement.

What is local government finance settlement?

The local government finance settlement is the annual determination of funding to local government. It needs to be approved by the House of Commons. This collection covers the provisional local government finance settlement for 2021 to 2022. The final 2021 to 2022 settlement will be laid before the House of Commons in early 2021.

When is the provisional local government settlement?

This collection brings together all documents relating to the provisional local government finance settlement, 2021 to 2022.

When will the 2021 settlement be laid?

The final 2021 to 2022 settlement will be laid before the House of Commons in early 2021. This year has clearly been defined by the COVID-19 pandemic, and this year’s settlement should be seen alongside the Covid support we are providing local government.

When is the provisional settlement 2021-22?

This section contains the press release for the provisional settlement 2021-22 and the ministerial statement made in Parliament by the Rt Hon Robert Jenrick MP on 17 December 2020. Government announces new funding boost for councils. 17 December 2020. Press release.

When will the Core Spending Power of Local Authorities be published?

Core spending power of local authorities 2021 to 2022. Other documents related to the provisional settlement 2021 to 2022. On 4 February 2021 the final local government finance settlement: England, 2021 to 2022 was published.

When is the final settlement vote?

The final settlement debate and vote was held in the House of Commons on 10 February 2021. This year has clearly been defined by the COVID-19 pandemic and the settlement should be seen alongside the Covid support we are providing local government. The government also launched a consultation on the future of New Homes Bonus for 2022 ...

What is the final settlement 2021-2022?

Final settlement 2021 to 2022: supporting documents. Core spending power 2021 to 2022. Other documents related to the 2021 to 2022 final settlement. The local government finance settlement is the annual determination of funding to local government. It needs to be approved by the House of Commons.

Brief Outline of Policy Proposal

- This impact statement covers the government’s Local Government Finance Settlement for 2022/23. It focuses on the impact of proposals on people who share protected characteristics. Explanation of the measures announced in the settlement can be found in the following documents: 1. Local Government Finance Report 2. Council Tax Referendum Principles R...

in Light of This Analysis, What Is Recommended and Why?

- The Government has not identified any compelling evidence that the 2022/23 settlement will have a “substantial” impact on those who share protected characteristics. The extent of the impact will also depend on the decisions made by authorities in response to a number of central and local policies. As noted in section 2 above, each local authority has a duty to assess the equalities im…

Where Impacts Are Or Could Be Significant, When and How Will They Be reviewed?

- Since the Department has not identified any specific impacts of these policies on those who share protected characteristics, there are no active plans in place to review their impact. However, the Government is publishing this statement in draft alongside the provisional local government finance settlement consultation, and actively welcomes the input of interested parties. Represent…