Trade Settlement is the process of transferring securities to a buyer’s account and cash to a seller’s account. Trade settlement is a two-way process in the final transaction stage relating to trading stocks, bonds, futures, or other financial assets. The transaction date is the date on which the official deal takes place.

How long does it take for my trade to settle?

The settlement date for stocks and bonds is three business days after the trade was executed. For government securities, options and mutual funds the settlement date is the next business day. These settlement times apply to trades made in the United States markets and may be different in markets in other parts of the world.

What is the difference between clearing and settlement?

What is the difference between clearing and settlement? Settlement is the actual exchange of money, or some other value, for the securities. Clearing is the process of updating the accounts of the trading parties and arranging for the transfer of money and securities. Central clearing uses a third-party — usually a clearinghouse — to clear ...

What is the 3 day trade rule?

The three-day settlement rule The Securities and Exchange Commission (SEC) requires trades to be settled within a three-business day time period, also known as T+3. When you buy stocks, the...

When do stock trades settle?

When does settlement occur? For most stock trades, settlement occurs two business days after the day the order executes, or T+2 (trade date plus two days). For example, if you were to execute an order on Monday, it would typically settle on Wednesday.

What are the types of trade settlement?

The important settlement types are as follows:Normal segment (N)Trade for trade Surveillance (W)Retail Debt Market (D)Limited Physical market (O)Non cleared TT deals (Z)Auction normal (A)

What is trading and settlement process?

Trade Settlement is the process of transferring securities to a buyer's account and cash to a seller's account. Trade settlement is a two-way process in the final transaction stage relating to trading stocks, bonds, futures, or other financial assets.

Who is responsible for trade settlement?

The responsibility for clearing and settlement of trade executed at the stock exchange lies on the National Securities Clearing Corporation Limited (NSCCL). It is also in charge of risk management and is obligated for meeting all settlement regardless of the member defaults.

How long do trades take to settle?

two business daysFor most stock trades, settlement occurs two business days after the day the order executes, or T+2 (trade date plus two days). For example, if you were to execute an order on Monday, it would typically settle on Wednesday. For some products, such as mutual funds, settlement occurs on a different timeline.

What is settlement process?

Settlement can be defined as the process of transferring of funds through a central agency, from payer to payee, through participation of their respective banks or custodians of funds.

Can I sell share before settlement?

The Indian capital markets follow a T+2 settlement cycle. This means that if you buy a stock on Monday, it gets delivered to your demat account on Wednesday. However, you can sell your stock even before you receive it in your demat account.

What is settlement period?

At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged. Your conveyancer or solicitor can check and negotiate the settlement period with the seller.

Why does it take 2 days to settle a trade?

The rationale for the delayed settlement is to give time for the seller to get documents to the settlement and for the purchaser to clear the funds required for settlement. T+2 is the standard settlement period for normal trades on a stock exchange, and any other conditions need to be handled on an "off-market" basis.

What is trade process?

Abstract. The trade process is a stochastic process of transactions interspersed with periods of inactivity. The realizations of this process are a source of information to market participants. They cause prices to move as they affect the market maker's beliefs about the value of the stock.

What happens during trade settlement?

When shares of stock, or other securities, are bought or sold, both buyer and seller must fulfill their obligations to complete the transaction. During the settlement period, the buyer must pay for the shares, and the seller must deliver the shares.

What is the difference between trade date and settlement date?

The first is the trade date, which marks the day an investor places the buy order in the market or on an exchange. The second is the settlement date, which marks the date and time the legal transfer of shares is actually executed between the buyer and seller.

What is trading procedure in stock exchange?

The steps in trading procedure on stock exchange are as follows : (i) Selection of a broker: The first step is to select a registered broker prior to purchase /sale of securities that assist investors to execute trade transactions in secondary markets.

Q1. What is meant by trade settlement date?

The settlement date is when a transaction is complete, and the buyer must pay the seller while the seller will transfer the assets to the buyer.

Q2. Can I sell my stock before the date of settlement?

Settled funds are defined as cash or the sale proceeds of fully paid for securities. Since no effort was made to deposit extra cash into the accoun...

Q3. Who are the participants that are involved in the process of settlement?

The participants are involved in clearing corporations, clearing members, custodians, depositors, clearing banks, and professional clearing members.

Q4. What constitutes a poor delivery?

A poor delivery occurs when a share transfer is not completed due to a violation of the exchange's rules.

Q5. What are the terms "pay-in" and "pay-out"?

The buyer provides money to the stock exchange, and the seller sends the securities on the pay-in day. The stock exchange delivers the money to the...

What is the difference between a trade date and a settlement date?

The date an order is filled is the trade date, whereas the security and cash are transferred on the settlement date. The three-day stock settlement period is represented by

Why is the settlement date important?

The settlement date is important for deciding who receives a stock dividend. The dividend goes to the owners of the stock at the end of the dividend record date, which is set by the stock issuer, usually quarterly. Since stocks must settle in order for ownership to transfer, the settlement date for a trade must be no later than ...

How long does it take for a stock to settle?

In the U.S., it normally takes three days for stocks to settle.

What is freeriding in trading?

Settlement date also is important for determining whether a trader is freeriding -- a violation of trading regulations in which a cash-account trader sells a security before buying it. A cash account doesn't have access to loans from the broker, as would be the case in a margin account.

What is trade settlement?

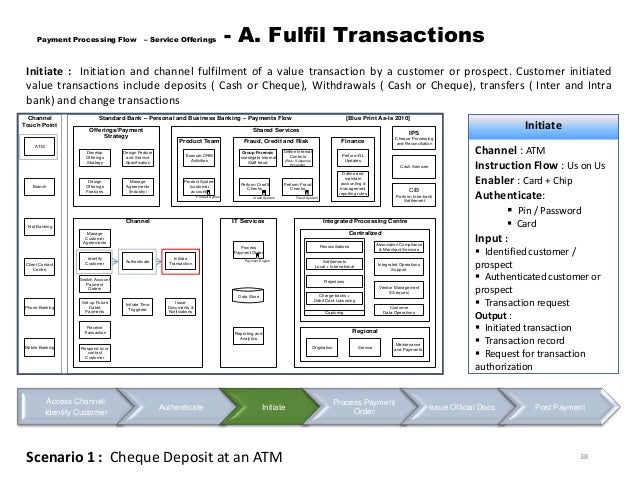

Trade settlement is one of the key processes of back office operation.

Why is a trade settlement team important?

Hence the trade settlement team plays a vital role in a trade life cycle and is the most important control point to avoid any risks and penalties.

What happens if the counterparty instructs your trades?

the counterparty has instructed your trades will get matched.

What do you need to do on a trade date?

a) On Trade Date you need to work on all unmatched trades or trades stuck in error

When should a failed trade settle?

Failed trade should settle as soon as possible otherwise you have to pay fail cost if you are delivering share or charge cpty if receiving shares or if it was exchange trade then a Buy-in might be executed.

What is SBL loan?

SBL or Stock loan ( Securities lending and Borrowing )

Examples of Settlement Payment in a sentence

At the request of Defendants’ counsel, the Settlement Administration Account Agent or its designee shall apply for any tax refund owed on the Settlement Payment and return the proceeds, after deduction of any expenses incurred in connection with such application (s) for refund, in accordance with the written direction of Defendants’ counsel.

More Definitions of Settlement Payment

Settlement Payment means an Up Settlement Payment or a Down Settlement Payment, as applicable.

What is the settlement period?

The settlement period is the time between the trade date and the settlement date. The SEC created rules to govern the trading process, which includes outlines for the settlement date. In March 2017, the SEC issued a new mandate that shortened the trade settlement period.

What is the settlement period in securities?

In the securities industry, the trade settlement period refers to the time between the trade date —month, day, and year that an order is executed in the market— and the settlement date —when a trade is considered final. When shares of stock, or other securities, are bought or sold, both buyer and seller must fulfill their obligations to complete ...

How long is the T+3 settlement period?

Then in 1993, the SEC changed the settlement period for most securities transactions from five to three business days —which is known as T+3.

Who pays for shares in a security settlement?

During the settlement period, the buyer must pay for the shares, and the seller must deliver the shares. On the last day of the settlement period, the buyer becomes the holder of record of the security.

Do you have to have a settlement period before buying stock?

Now, most online brokers require traders to have sufficient funds in their accounts before buying stock. Also, the industry no longer issues paper stock certificates to represent ownership. Although some stock certificates still exist from the past, securities transactions today are recorded almost exclusively electronically using a process known as book-entry; and electronic trades are backed up by account statements.

What Is a Settlement Date?

The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer. The settlement date for stocks and bonds is usually two business days after the execution date (T+2). For government securities and options, it's the next business day (T+1). In spot foreign exchange (FX), the date is two business days after the transaction date. Options contracts and other derivatives also have settlement dates for trades in addition to a contract's expiration dates .

What causes the time between transaction and settlement dates to increase substantially?

Weekends and holidays can cause the time between transaction and settlement dates to increase substantially, especially during holiday seasons (e.g., Christmas, Easter, etc.). Foreign exchange market practice requires that the settlement date be a valid business day in both countries.

How far back can a forward exchange settle?

Forward foreign exchange transactions settle on any business day that is beyond the spot value date. There is no absolute limit in the market to restrict how far in the future a forward exchange transaction can settle, but credit lines are often limited to one year.

How long does it take for a stock to settle?

Most stocks and bonds settle within two business days after the transaction date . This two-day window is called the T+2. Government bills, bonds, and options settle the next business day. Spot foreign exchange transactions usually settle two business days after the execution date.

How long does it take to settle a stock trade?

Historically, a stock trade could take as many as five business days (T+5) to settle a trade. With the advent of technology, this has been reduced first to T=3 and now to just T+2.

Why is there credit risk in forward foreign exchange?

Credit risk is especially significant in forward foreign exchange transactions, due to the length of time that can pass and the volatility in the market. There is also settlement risk because the currencies are not paid and received simultaneously. Furthermore, time zone differences increase that risk.

What is Stock Market Trading, Clearing and Settlement?

Foremost, for intraday trading in the secondary market, you have to open a trading account online with a broker or sub-broker. Once your trading account is active, you can start your intraday trading. You can buy and sell securities as per your choice.

What are the Different Types of Trading Settlement Processes?

About intraday trading meaning, there are two types of stock market trading settlement processes:

Conclusion

Overall, the trading settlement process is a complex process that involves various participants, including clearing corporations, clearing members, custodians, clearing banks, depositories, and professional clearing members. Understanding the stock market trading concept can help you better plan your intraday trading activities.