An Analysis Fee is the total of any transaction fees that have accumulated during the month on a business checking account. It is assessed on the last day of the month. Because business accounts typically have larger and more frequent transactions than personal accounts, business accounts are subject to transaction fees.

What is an analysis service charge for my business checking account?

What is an analysis service charge for my business checking account? An analysis service charge is a fee based on your business banking transactions and activities from the previous month.

What is an analysis fee?

The checking account is analyzed at the end of the month and any assessed fees are debited from the account at that time in one lump sum, known as an Analysis Fee. For a list of business account fees, see our Business Rates & Fees section.

What is an account analysis?

What is an Account Analysis? Account Analysis is a monthly statement outlining the banking services provided to your business. The statement is usually comprised of the company’s average daily balance and the charges that the company incurs from the bank.

How do I understand the sections of my account analysis statement?

Use this guide as a reference to understand the sections of your Account Analysis Statement and enjoy the convenience of having comprehensive account information at your fingertips. Balance Summary ➊ Average Ledger Balance The sum of the daily ledger balance divided by the number of days in the statement period. ➋ Average Float

How do I avoid an analysis service charge US bank?

How To Avoid US Bank Monthly Maintenance FeesKeep a Minimum Balance in Your Account.Use US Bank Credit Products.Combine Qualifying Deposits With Credit Balances.Meet Age Requirements.Use Mobile Banking.Take Advantage of Overdraft Protection.

What does account analysis mean?

What is an Account Analysis? Account Analysis is a monthly statement outlining the banking services provided to your business. The statement is usually comprised of the company's average daily balance and the charges that the company incurs from the bank.

What is an account analysis fee Suntrust?

An Analysis Fee is the total of any transaction fees that have accumulated during the month on a business checking account. It is assessed on the last day of the month.

How does account analysis work?

Account analysis is a process in which detailed line items in a financial transaction or statement are carefully examined for a given account, often by a trained auditor or accountant. An account analysis can help identify trends or give an indication of how a particular account is performing.

What is an analysis statement from a bank?

Bank statement analysis gives an overview of one's liabilities, recurring transactions, and monthly dues as well, which helps banks and financial institutions decide how much money they can afford lending to borrowers.

What does it mean to analyze a transaction?

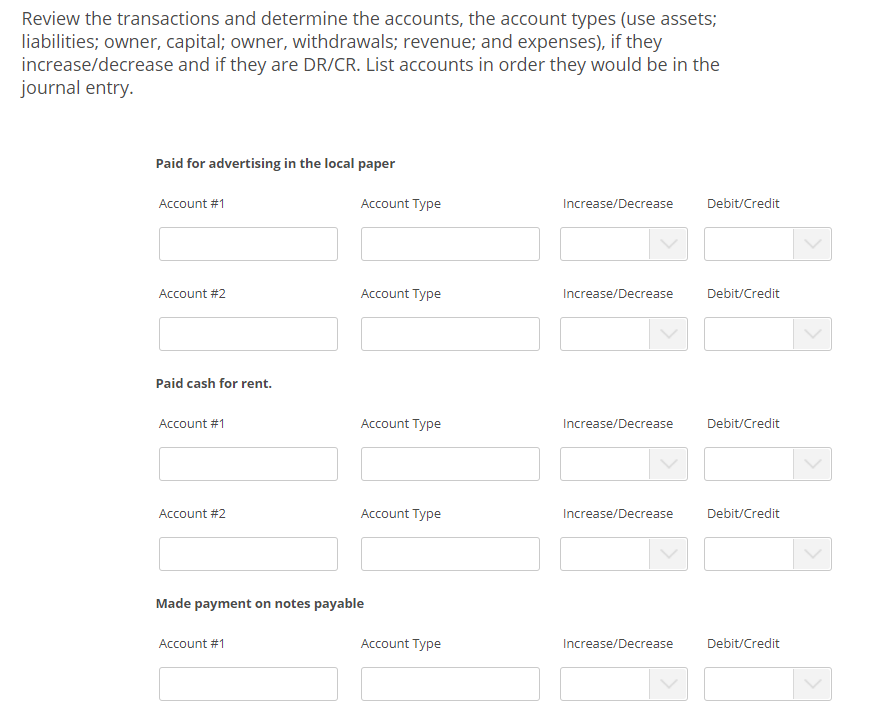

Transaction analysis is the act of examining a transaction to decide how it affects the accounting equation. It's also the first step in the accounting cycle. In order to properly analyze a transaction, you must know and understand a few key things.

Why did SunTrust charge me a maintenance fee?

If you have to use another bank's ATM to check your balance or make a withdrawal, SunTrust Bank will charge you a fee. Unfortunately: You'll pay $3 for each transaction at another bank's ATM if you're in the US.

Is Truist a good bank?

Overall bank rating Truist was formed in 2019 through a merger of two banks, BB&T and SunTrust. Today, Truist Bank is among the top 10 largest banks in the U.S. Truist has a good basic checking account but its savings rates are generally low, and some fees, including overdraft fees, are high and hard to avoid.

How much does Truist charge to cash a check?

Truist Bank: Truist will cash any Truist checks. There's no fee if the value of the check is less than $50. If it's greater than $50, you'll pay $8.

How account analysis is used in cost estimation?

Account Analysis Answer: This approach requires that an experienced employee or group of employees review the appropriate accounts and determine whether the costs in each account are fixed or variable. Totaling all costs identified as fixed provides the estimate of total fixed costs.

Why is analysis important in accounting?

Accountants use data analytics to help businesses uncover valuable insights within their financials, identify process improvements that can increase efficiency, and better manage risk.

What are the types of financial analysis?

Types of Financial AnalysisVertical.Horizontal.Leverage.Growth.Profitability.Liquidity.Efficiency.Cash Flow.More items...•

Why is analysis important in accounting?

Accountants use data analytics to help businesses uncover valuable insights within their financials, identify process improvements that can increase efficiency, and better manage risk.

How do you analyze accounting?

Six Steps of Accounting Transaction AnalysisDetermine if the event is an accounting transaction. ... Identify what accounts it affects. ... Determine what type of accounts they are. ... Determine which accounts are going up or down. ... Apply the rules of debits and credits to these accounts.More items...•

How account analysis is used in cost estimation?

Account Analysis Answer: This approach requires that an experienced employee or group of employees review the appropriate accounts and determine whether the costs in each account are fixed or variable. Totaling all costs identified as fixed provides the estimate of total fixed costs.

What is in a financial analysis?

Financial analysis is the process of evaluating businesses, projects, budgets, and other finance-related transactions to determine their performance and suitability. Typically, financial analysis is used to analyze whether an entity is stable, solvent, liquid, or profitable enough to warrant a monetary investment.

When is a checking account analyzed?

The checking account is analyzed at the end of the month and any assessed fees are debited from the account at that time in one lump sum, known as an Analysis Fee.

Why are business accounts subject to transaction fees?

Because business accounts typically have larger and more frequent transactions than personal accounts, business accounts are subject to transaction fees.

What Is Account Analysis?

Account analysis is a process in which detailed line items in a financial transaction or statement are carefully examined for a given account, often by a trained auditor or accountant. An account analysis can help identify trends or give an indication of how a particular account is performing.

What is cost accounting?

In cost accounting, this is a way for an accountant to analyze and measure the cost behavior of a firm. The process involves examining cost drivers and classifying them as either fixed or variable costs. The cost accountant then uses the company's data to figure out the estimated variable cost per cost-driver unit or fixed cost per period.

What is an Account Analysis?

Account Analysis is a monthly statement outlining the banking services provided to your business. The statement is usually comprised of the company’s average daily balance and the charges that the company incurs from the bank. You can think about account analysis statements being similar to an invoice from a company; an invoice lists out the goods or services that you received from that company. Similarly, the bank sends an account analysis statement that lists out activities or services that you have received or utilized on your commercial checking account. Activities or services may include the number of checks paid, number of deposits, number of items deposited, a monthly account maintenance fee, remote deposit capture, ACH origination, wire transfers, etc. It's good news that business accounts that are in an analyzed checking account each receive an “earnings credit,” also known as a monthly credit allowance, to help reduce or eliminate account fees. Banks use the business' average daily balance in the account to help determine how much credit that particular account will receive. The general formula for calculating the earnings credit allowance that your particular account will receive is the following:

Why do businesses get monthly credit allowances?

It's good news that business accounts that are in an analyzed checking account each receive an “earnings credit,” also known as a monthly credit allowance, to help reduce or eliminate account fees. Banks use the business's average daily balance in the account to help determine how much credit that particular account will receive.

Can banks analyze your balance?

Most banks have someone that can analyze your current activity and see what average balances would be necessary in order to not be assessed a fee or to receive a smaller fee than you currently are on your existing account.

What is an account settlement?

An account settlement, or settlement of accounts, is the action of paying off any outstanding balances to bring an account balance to zero.

What is settlement date accounting?

With settlement date accounting, enter the transactions into your general ledger when the transaction happens. This method ensures that everything on your general ledger has actually happened with the exact amount recorded. You settle the account at the time you record the transaction.

What happens to the clearing account balance after employees deposit their checks?

After the employees deposit their checks and you remit the taxes, the clearing account balance is zero. So, you settled the account.

What is an example of an outstanding balance?

For example, you have one outstanding balance in an account. Customer A owes the entirety of the balance because of Invoice A. When Customer A pays the invoice, the account is now settled.

Why do you settle your accounts?

When you settle your accounts, you are typically doing so because you recorded transactions in anticipation of receiving funds or making payments. However, settlement date accounting is a method you can use to enter the information in your books only when you fulfill the transaction.

Can you hold multiple payments in a clearing account?

You may choose to hold multiple payments in the clearing account until you receive the total balance due on an invoice.

Is a settlement an account payable?

If you record payments you owe to a lender or other business until you pay off the fund s you owe, the account you settle is an account payable ( i.e., a liability account).

What is the sum of the Negative Collected Balance?

The sum of the Negative Collected Balance (ledger balance minus float) divided by the number of days in the statement period.

How does interest on excess balances work?

Interest on excess balances works for you by allowing: • The ability to earn traditional earnings credit on your balances to offset your eligible charges • Interest earned on excess balances to be paid the 6th business day of the following month • Interest to be calculated on the full relationship excess balance position and paid to the lead/billing account

What is valuation rate?

The valuation rate used to determine explicit charges associated with Negative Collected Balances.

What is service charge offset?

The total dollar amount of service charges that can be offset by an earnings allowance.

Can service charges be offset by Earnings Credit Allowance?

Service charges not eligible to be offset by Earnings Credit Allowance.

Is Account Analysis Statement available electronically?

Your Account Analysis Statement is available electronically though two channels – KeyNavigatorSMand direct transmission in EDI 822 format. If you prefer paper statements, your Account Analysis Statement is also available for delivery via U.S. Mail.* KeyNavigator puts strategic financial management at the heart of your business. Our advanced website offers a robust suite of functionality that streamlines your daily cash management activities, simplifies and integrates your banking needs, and offers you the security to make financial decisions quickly and easily.

What is a corporate checking statement?

Corporate checking customers will receive a monthly paper or electronic statement which provides a detailed explanation of their monthly billing. Depending on your account structure you may have a combined statement in addition to statements for each account. The combined analysis statement takes into consideration all accounts which are structured under the account analysis relationship.

What is a composite account number?

①Account Number: On a combinedstatement which includes multiple accounts, this refer s to the composite account number. The composite number is not an actual account number and is only used for internal bank purposes.